Global Land Military Laser Designator Market Size, Share And Global Trend By Type (Man-Portable & Vehicle-Mounted), By Application (Military And Defense & Homeland Security); By Region (U.S., Canada, Mexico, Rest Of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest Of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest Of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest Of Middle East & Africa, Brazil, Argentina, Rest Of Latin America) - Global Insights, Growth, Size, Comparative Analysis, Trends And Forecast, 2021-2030

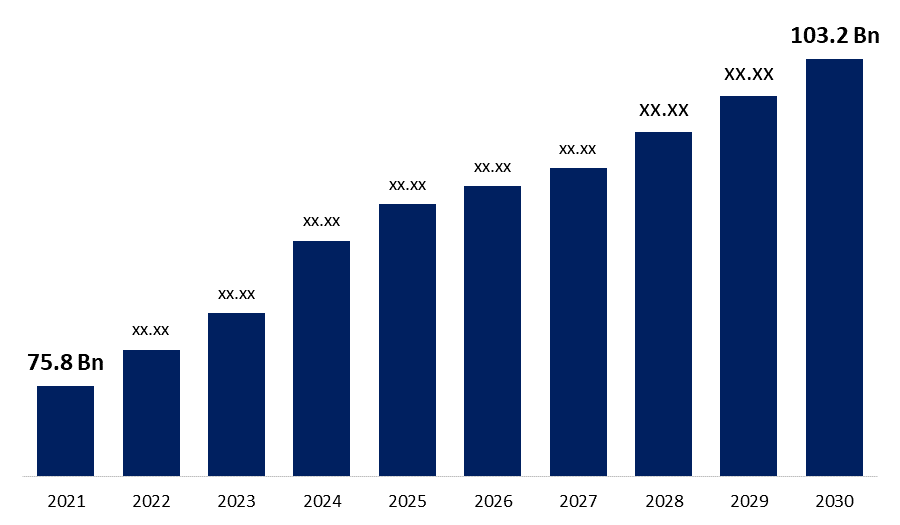

Industry: Aerospace & DefenseThe Global Land Military Laser Designator Market size was USD 75.8 Billion in 2021 and is projected to reach USD 103.2 Billion by 2030, exhibiting a CAGR of 4.7% during the forecast period. A military laser designator is a light source that emits a laser beam that is used to mark a target. Armed forces use laser designators to help them target laser-guided bombs, missiles, and precision artillery ammunition. The beam is invisible and does not glow continuously when a target is marked with a designator. Instead, a succession of coded laser light pulses are launched. The growing use of lasers by the military for target designation and ranging, defensive countermeasures, communications, and directed energy weapons is a major driver for the market. Furthermore, the military uses laser as an energy weapon for defensive countermeasures, target disorientation, target guidance, holographic weapon sight, and many other purposes. All of these factors are driving the market for land military laser designator market.

Get more details on this report -

Many governments have created particular departments or agencies devoted to creating new AI capabilities as well as planning, implementing, and integrating AI capabilities into current technology. The National Science and Technology Council in the United States, the Strategic Council for AI Technologies in Japan, and the AI Council in the United Kingdom are examples of such organisations. For example, the UK AI Council presented the UK Government with a roadmap in January 2021, recommending that it scale up and make sustainable public sector investment in AI, as well as invest in The Alan Turing Institute (UK), fostering development to gain strategic leadership for the UK in AI research.

Furthermore, when compared to normal manned aerial vehicles, the deployment of unmanned electronic warfare systems such as laser weapons helps to eliminate the hazards connected with the pilot or operator's lives, and the lengthy endurance duration allows significantly better coverage. Large UAVs such as hawk and the predator have successfully included laser designators. Unmanned aerial vehicles (UAVs) are in high demand all around the world. This is one of the major driving forces in the global military laser designator market. Unmanned aerial vehicles are employed in the public, commercial, and military sectors for a variety of purposes. The use of a laser designator in an electronic warfare system helps to reduce the chance of operators and pilots losing their lives. When compared to typical manned aerial vehicles, it also covers a wide range. The global land military laser designator market is expected to be driven by this factor in the approaching years.

Land Military Laser Designator Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 75.8 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 4.7% |

| 2030 Value Projection: | USD 103.2 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | L3Harris Technologies, Inc, Leonardo, Northrop Grumman Corporation, Thales, UTC Aerospace Systems, ALPHA DESIGN TECHNOLOGIES PVT LTD, RPMC Lasers, Elbit Systems, Teledyne FLIR LLC, General Atomics. |

| Growth Drivers: | 1) The man-portable segment is expected to dominate the market share 2) The military and defense segment is expected to dominate the market share |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Type Outlook

The man-portable segment is expected to dominate the market share in 2020 of global land military laser designator market owing to rising usage of thermal lasers since it is a man-portable device that delivers laser identification while also weighing less (2-2.5kg). The mix of portability and energy output distinguishes these lasers from the rest. The battle-proven Type 163 laser target designator has been launched by Leonardo. It was designed specifically to meet all of today's special and conventional force Joint Terminal Attack Controller (JTAC) and JFO mission requirements for marking and terminally controlling Semi Active Air to Ground weapons accurately onto the target at ranges up to 10 kilometers.

Application Outlook

The military and defense segment is expected to dominate the market share in 2020 of global land military laser designator market due to highest military spending globally. The Department of Defense (DoD) planned to invest in military modernizing and technologies like as artificial intelligence, hypersonic missiles, 5G communications, and quantum computing.

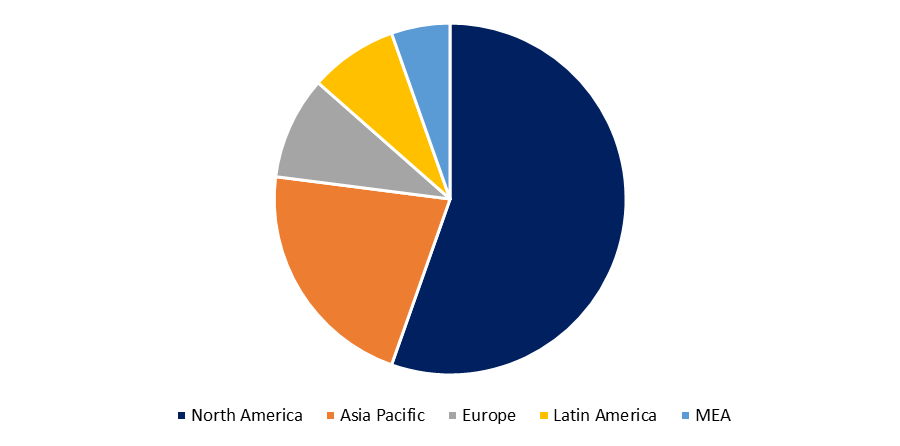

Regional Outlook

Europe is expected to dominate the market share in 2020 of global land military laser designator market. The regional market has benefited by the presence of countless airplane manufacturers, concentrating military laser designators in their new challenger jets. The advantages of laser designators are becoming more prevalent in planes and helicopters. Laser designators are increasingly being used in country defenses, while military laser designators are increasingly being used for warriors and forces. In addition, increased spending on innovative work exercises in the aviation and security sectors is likely to boost the market in Europe throughout the forecast period.

Get more details on this report -

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities. For instance, in February 2022, Leonardo Australia made a strategic move by making an agreement with Collins Aerospace Australia to supply Type 163 Laser Target Designators (LTDs) to the Australian Defence Force (ADF). In July 2019, Northrop Grumman Corporation has received a $17.6 million award from the U.S. Army to upgrade with high accuracy capability to modernize the Lightweight Laser Designator Rangefinder 2H (LLDR 2H) man-portable targeting system. In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market. For instance, in October 2020, L3Harris received an initial production order from the U.S. Army in July 2020 for more than 1,000 combat-ready laser rangefinder systems.

Market Segmentation of Global Land Military Laser Designator Market

By Type

- Man-portable

- Vehicle-mounted

By Application

- Military and Defense

- Homeland Security

Key Players

- L3Harris Technologies, Inc.

- Leonardo

- Northrop Grumman Corporation

- Thales

- UTC Aerospace Systems

- ALPHA DESIGN TECHNOLOGIES PVT LTD

- RPMC Lasers

- Elbit Systems

- Teledyne FLIR LLC

- General Atomics

Need help to buy this report?