Global Landfill Gas to Energy (LFGTE) Systems Market Size, Share, and COVID-19 Impact Analysis, By Application (Electricity Generation, Direct Use, Combined Heat and Power (CHP), and Vehicle Fuel), By Capacity (Small Scale (Below 500 kW), Medium Scale (500 kW - 5 MW), and Large Scale (Above 5 MW)), By End-User (Municipalities, Industrial Sector, Utilities, and Commercial Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Landfill Gas to Energy (LFGTE) Systems Market Insights Forecasts to 2033

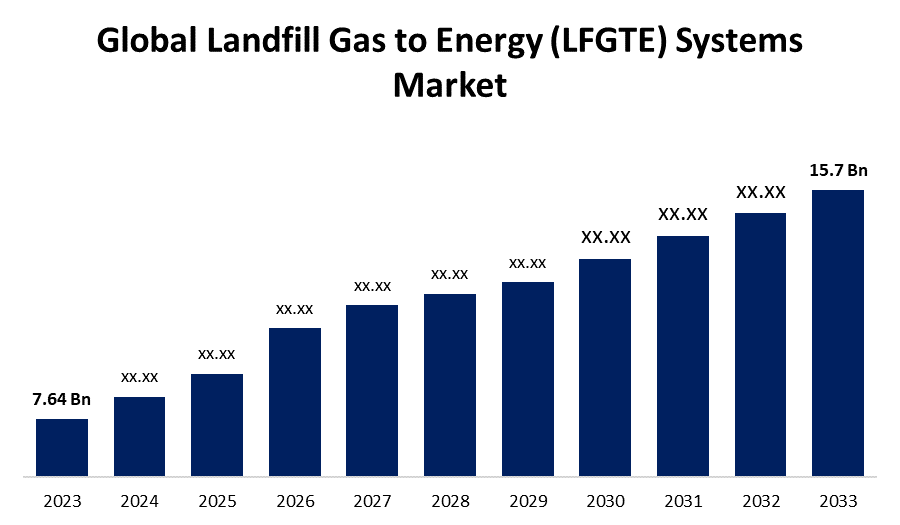

- The Global Landfill Gas to Energy (LFGTE) Systems Market Size was Valued at USD 7.64 Billion in 2023

- The Market Size is Growing at a CAGR of 7.47% from 2023 to 2033

- The Worldwide Landfill Gas to Energy (LFGTE) Systems Market Size is Expected to Reach USD 15.7 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Landfill Gas to Energy (LFGTE) Systems Market Size is Anticipated to Exceed USD 15.7 Billion by 2033, Growing at a CAGR of 7.47% from 2023 to 2033.

Market Overview

The economic ecology centered on the gathering, extraction, and use of gases created during the organic waste's natural decomposition in landfills is known as the "landfill gas to energy." Landfill gas, which is primarily made up of carbon dioxide and methane, presents benefits as well as concerns for the environment. By using technology to capture and transform these gases into energy, the market aims to realize the potential of these gases as a valuable resource.

This dynamic market is essential to tackling environmental issues associated with greenhouse gas emissions, especially methane, which is a powerful driver of climate change. The benefits of turning landfill gas into energy, heat, or useable fuel are becoming more widely acknowledged by governments, businesses, and private organizations. As a result, the market for landfill gas is defined by the intricate interactions of legal frameworks, technological advancements, and financial incentives that are designed to reduce environmental impact, support environmentally friendly waste management techniques, and aid in the world's shift to renewable energy sources.

According to the U.S. Environmental Protection Agency (EPA), Landfills that handle municipal solid waste (MSW) make up around 14.4% of all methane emissions attributable to human activity in the United States in 2022, making them the third-largest source. In 2022, the amount of methane released by MSW landfills was roughly equal to the annual greenhouse gas emissions from driving over 24.0 million gasoline-powered passenger cars or the annual carbon dioxide emissions from using more than 13.1 million residences for energy. However, methane emissions from MSW landfills are a wasted chance to seize and put to good use a substantial amount of energy.

Report Coverage

This research report categorizes the market for landfill gas to energy (LFGTE) systems based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the landfill gas to energy (LFGTE) systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the landfill gas to energy (LFGTE) systems market.

Global Landfill Gas to Energy (LFGTE) Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.64 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.47% |

| 2033 Value Projection: | USD 15.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 217 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Capacity, By Region |

| Companies covered:: | Waste Management Inc., Veolia Environnement S.A., Covanta Holding Corporation, Republic Services Inc., BP plc, SUEZ Group, Waste Connections Inc., Dalkia Wastenergy (EDF Group), Ameresco Inc., Aria Energy, MicroPowers Ltd., INNIO, Jiangsu New Energy Development Co. Ltd., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Stricter environmental regulations, particularly around greenhouse gas emissions and waste management, are compelling landfill operators to capture and utilize the methane-rich landfill gas instead of flaring or venting it. The growing demand for renewable and clean energy sources, coupled with the need for sustainable waste management practices, is driving the adoption of LFGTE systems, which can generate electricity, heat, or fuel from the captured landfill gas. Government incentives, such as tax credits, renewable energy credits, and feed-in tariffs, are encouraging the development and deployment of LFGTE systems, making them more financially viable for landfill operators. Improvements in LFGTE system efficiency, reliability, and cost-effectiveness are further boosting market growth, as landfill operators can achieve better returns on their investments.

In November 2023, in order to promote a circular economy, the ACT (Australian Capital Territory) government is enhancing landfill gas capture at the Mugga Lane landfill. By doing this, emissions decreased, and dependable renewable energy that can annually power 10,800 houses be produced. This would be achieved by growing the collaboration with the renewable energy engineering business LGI Limited, which is owned and run in Australia and provides a landfill gas expansion project. The project, which is scheduled to be built over the next three years, would enhance the capacity to sequester harmful methane emissions from the Mugga Lane landfill and convert them into ACT-specific renewable energy.

Restraining Factors

The initial investment required to install LFGTE systems can be high, presenting a barrier for some landfill operators, especially smaller or resource-constrained facilities. The quantity and quality of landfill gas can vary significantly over time, depending on factors such as the age and composition of the landfill, as well as environmental conditions. This can make it challenging to maintain consistent energy generation and revenue streams. While advancements have been made, some LFGTE technologies still face limitations in terms of efficiency, reliability, and maintenance requirements, which can affect their overall viability. Changes in government policies, regulations, and incentive programs can create uncertainty and risk for LFGTE project developers, potentially slowing down market growth. The increasing competitiveness of other renewable energy technologies, such as solar and wind power, can pose a challenge for LFGTE systems in terms of market share and investment allocation.

Market Segmentation

The landfill gas to energy (LFGTE) systems market share is classified into application, capacity, and end users.

- The electricity generation is estimated to hold the highest market revenue share through the projected period.

Based on the application, the landfill gas to energy (LFGTE) systems market is classified into electricity generation, direct use, combined heat and power (CHP), and vehicle fuel. Among these, electricity generation is estimated to hold the highest market revenue share through the projected period. This is mostly because LFGTE systems the most well-known and often used application of landfill gas have been widely adopted for the generation of electricity. Electricity produced by generators, turbines, or engines running on landfill gas can be consumed on-site or sold to the grid. Many landfill operators find the power production segment to be a financially viable and appealing alternative due to its well-developed technology, acceptable regulatory frameworks, and ability to leverage existing infrastructure. The adoption of LFGTE systems for electricity generation is also being fueled by the growing demand for renewable energy sources and the need to reduce greenhouse gas emissions, which will further contribute to its dominant market share over the forecast period.

- The large scale (above 5 MW) segment is anticipated to hold the largest market share through the forecast period.

Based on the capacity, the landfill gas to energy (LFGTE) systems market is divided into small scale (below 500 kW), medium scale (500 kW – 5 MW), and large scale (above 5 MW). Among these, the large scale (above 5 MW) segment is anticipated to hold the largest market share through the forecast period. This is caused by the growing focus on utilizing larger landfills' potential for energy production, as these sites usually generate larger amounts of landfill gas. Greater economies of scale can be attained by larger LFGTE systems, increasing their total cost-effectiveness and drawing landfill operators to invest in them. Large-scale LFGTE initiatives can also more efficiently capture and utilize the significant landfill gas resources present at these locations since they frequently have access to more funding, technological know-how, and infrastructure support. Furthermore, throughout the projection period, it is anticipated that the adoption of large-scale LFGTE systems will be further bolstered by the demand for large-scale renewable energy projects, which is driven by the need to fulfill growing energy consumption and sustainability goals.

- The industrial sector segment dominates the market with the largest market share through the forecast period.

Based on the end users, the landfill gas to energy (LFGTE) systems market is divided into municipalities, industrial sectors, utilities, and commercial enterprises. Among these, the industrial sector segment dominates the market with the largest market share through the forecast period. This is a result of the significant demand from industrial facilities, including factories, refineries, and processing centers, for affordable and renewable energy sources. These industrial facilities can gain a great deal by using the available landfill gas to produce fuel, electricity, or heat for their operations. These facilities frequently have substantial on-site energy requirements. Due to the potential for cost savings, increased energy security, and decreased environmental effects, the industrial sector favors LFGTE systems since landfill gas may serve as a dependable and renewable energy supply. An additional factor supporting the industrial sector segment's dominance in the LFGTE systems market during the forecast period is the favorable government regulations and incentives aimed at encouraging the industrial use of renewable energy technology.

Regional Segment Analysis of the Landfill Gas to Energy (LFGTE) Systems Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

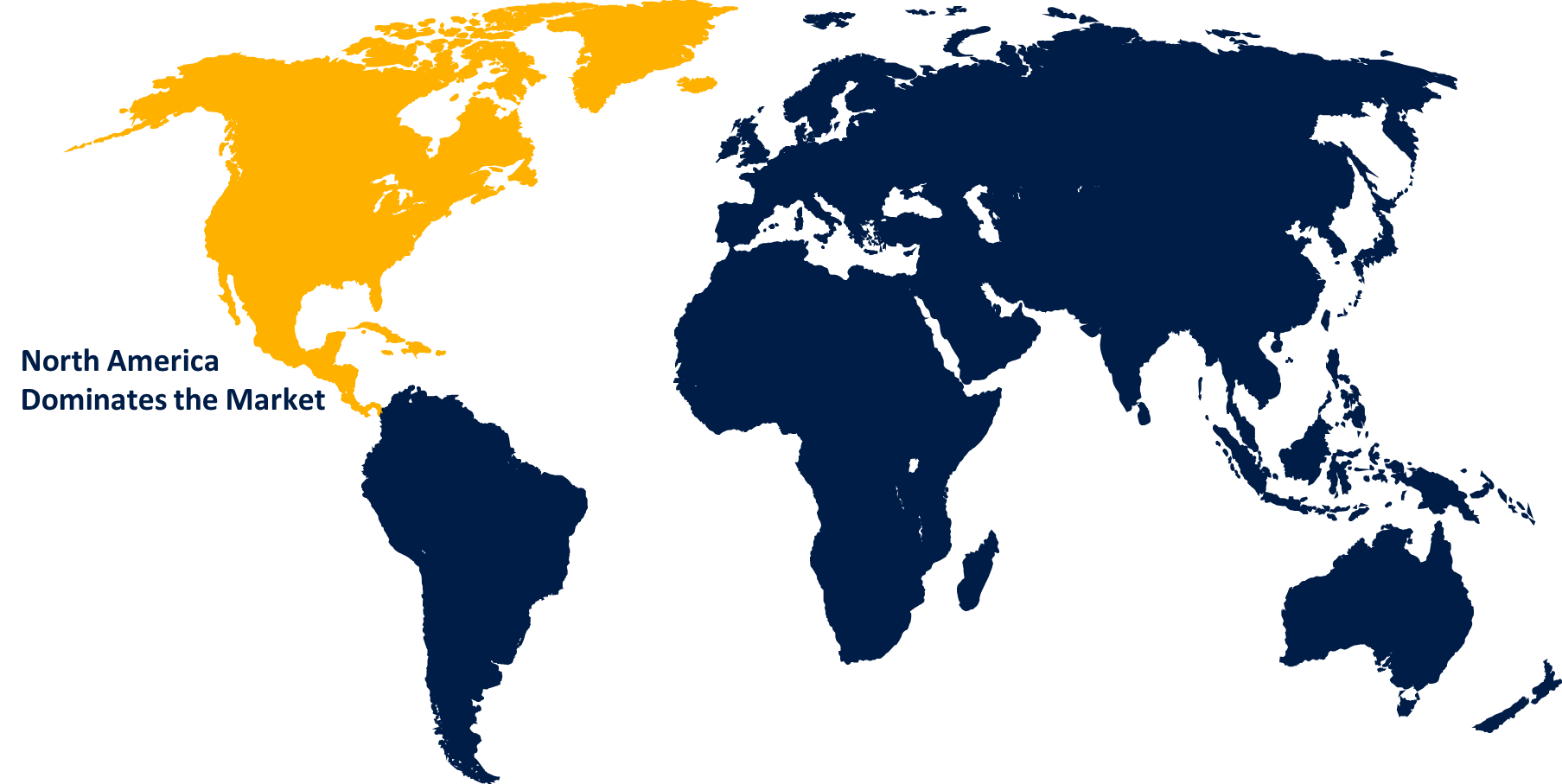

North America is anticipated to hold the largest share of the landfill gas to energy (LFGTE) systems market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the landfill gas to energy (LFGTE) systems market over the predicted timeframe. With many active landfills and a well-established waste management system, the region offers a substantial source of landfill gas that may be efficiently recovered and used to generate energy. Additionally, the availability of favorable government regulations, such as tax breaks, incentive plans, and mandates for renewable energy, has aided in the development and implementation of LFGTE systems throughout North America. The development of LFGTE technology has also been fueled by the region's thriving commercial and industrial sectors, which have a high demand for dependable and sustainable energy sources. North America's position as the leading market for LFGTE systems over the forecast period has been cemented by the presence of leading LFGTE technology providers and the region's robust research and development capabilities, which have further contributed to the advancement and cost-effectiveness of these systems.

Europe is expected to grow the fastest during the forecast period. This is supported by the region's strict environmental laws and policies that support renewable energy, lower greenhouse gas emissions, and move the economy in the direction of a circular economy. The ambitious energy and climate targets set by the European Union, such as the objective of becoming carbon neutral by 2050, have stimulated investment in and adoption of LFGTE technology in a variety of businesses and municipalities. The region's well-established waste management infrastructure, together with the availability of financing options and incentives for renewable energy initiatives, have also contributed to the development of a favorable climate in Europe for the market expansion of LFGTE systems. In addition, the region's technological know-how and inventiveness in the waste-to-energy industry, together with the rising need for sustainable energy solutions, are anticipated to fuel the LFGTE systems market's quick growth in Europe throughout the course of the projected period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the landfill gas to energy (LFGTE) systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Waste Management Inc.

- Veolia Environnement S.A.

- Covanta Holding Corporation

- Republic Services Inc.

- BP plc, SUEZ Group

- Waste Connections Inc.

- Dalkia Wastenergy (EDF Group)

- Ameresco Inc.

- Aria Energy

- MicroPowers Ltd.

- INNIO

- Jiangsu New Energy Development Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Vitol announces the formation of Vitol BioMethane (VBM) through the acquisition of BioMethane Partners, a sustainable energy company.

- In January 2024, a court ruling on January 12th Vermont Gas Systems procured methane generated at the Seneca Meadows Landfill in upstate New York for a period of 14.5 years.

- In January 2024, France-based Waga Energy signed a 20-year contract with Finest Way Disposal, Kalamazoo, Michigan, to generate renewable natural gas (RNG) at the Decatur Hills Landfill in Greensburg, Indiana.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the landfill gas to energy (LFGTE) systems market based on the below-mentioned segments:

Global Landfill Gas to Energy (LFGTE) Systems Market, By Application

- Electricity Generation

- Direct Use

- Combined Heat and Power (CHP)

- Vehicle Fuel

Global Landfill Gas to Energy (LFGTE) Systems Market, By Capacity

- Small Scale (Below 500 kW)

- Medium Scale (500 kW – 5 MW)

- Large Scale (Above 5 MW)

Global Landfill Gas to Energy (LFGTE) Systems Market, By End-User

- Municipalities

- Industrial Sector

- Utilities

- Commercial Enterprises

Global Landfill Gas to Energy (LFGTE) Systems Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Landfill Gas to Energy (LFGTE) Systems market over the forecast period?The Landfill Gas to Energy (LFGTE) Systems market is projected to expand at a CAGR of 7.47% during the forecast period.

-

2. What is the market size of the Landfill Gas to Energy (LFGTE) Systems market?The Global Landfill Gas to Energy (LFGTE) Systems Market Size is Expected to Grow from USD 7.64 Billion in 2023 to USD 15.7 Billion by 2033, at a CAGR of 7.47% during the forecast period.

-

3. Which region holds the largest share of the Landfill Gas to Energy (LFGTE) Systems market?North America is anticipated to hold the largest share of the Landfill Gas to Energy (LFGTE) Systems market over the predicted timeframe.

Need help to buy this report?