Global Laser Cladding Market Size, Share, and COVID-19 Impact Analysis, By Type (Diode Lasers, Fiber Lasers, CO2 Lasers, and YAG Lasers), By Material (Cobalt Based Alloys, Nickel Based Alloys, Iron Based Alloys, Carbide & Carbide Blends, and Others), By End-Use (Aerospace & Defense, Oil & Gas, Automotive, Power Generation, Medical, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Advanced MaterialsGlobal Laser Cladding Market Insights Forecasts to 2033

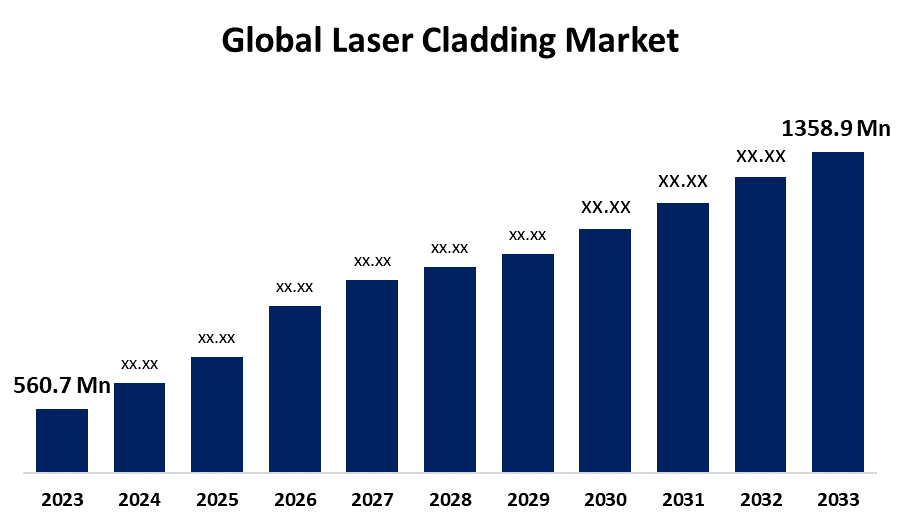

- The Global Laser Cladding Market Size was Valued at USD 560.7 Million in 2023

- The Market Size is Growing at a CAGR of 9.26% from 2023 to 2033

- The Worldwide Laser Cladding Market Size is Expected to Reach USD 1358.9 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Laser Cladding Market Size is Anticipated to Exceed USD 1358.9 Million by 2033, Growing at a CAGR of 9.26% from 2023 to 2033.

Market Overview

Laser cladding, also known as laser metal deposition, is a process for depositing one material into the surface of another. Laser cladding involves feeding a stream of metallic powder or wire into a melt pool formed by a laser beam as it scans across the target surface, resulting in a coating of the desired material. Laser cladding technology allows materials to be deposited precisely, selectively, and with minimal heat into the underlying substrate. The defense and military industries' increased reliance on laser cladding to repair and reinforce critical components in vehicles, aircraft, and weapon systems is driving market growth. Laser cladding increases durability, wear resistance, and performance while meeting the severe requirements of defense applications. As global defense budgets grow, the demand for laser cladding solutions in military maintenance and manufacturing operations is projected to rise. As compared to standard coating processes, laser cladding offers superior protection against wear, corrosion, and other forms of degradation. Furthermore, the increasing focus on sustainability and environmental responsibility has resulted in greater use of laser cladding as an eco-friendly alternative to classic surface treatment procedures such as hard chrome plating or thermal spraying.

Report Coverage

This research report categorizes the market for the laser cladding market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the laser cladding market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the laser cladding market.

Global Laser Cladding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 560.7 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.26% |

| 2033 Value Projection: | USD 1358.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Material, By End-Use, By Region |

| Companies covered:: | Lame Spray Technologies, Huffman, Hoganas, Lumibird, Laserline GmbH, Whitfield Welding Inc., Lumentum Operations, TRUMPF, OC Oerlikon Management AG, Swanson Industries, TLM Laser, Kondex Corporation, HAMUEL Maschinenbau, Coherent Corp, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The production industry is currently the larger market for fiber lasers, with a considerable portion of the activity operating at the kilowatt-class power level. The growing demand for wear- and corrosion-resistant materials, the expanding automotive sector, and the requirement for repairs and maintenance of existing parts and components are the primary drivers of the laser cladding market. Wear- and corrosion-resistant materials are in high demand because of the rising number of applications in the automotive, aerospace, and construction industries. The automotive industry is expanding rapidly as vehicle demand rises, as is the requirement for repairs and maintenance of current parts and components.

Restraining Factors

Laser cladding is a newly developed technology, with some significant limitations. One of the main restrictions is the high cost of laser cladding equipment. Laser cladding equipment can cost hundreds of thousands of dollars, making it too expensive for many organizations.

Market Segmentation

The laser cladding Market share is classified into type, material, and end-use.

- The diode lasers segment accounted for the largest revenue share over the forecast period.

Based on the type, the laser cladding market is categorized into diode lasers, fiber lasers, CO2 lasers, and YAG lasers, and. Among these, the diode lasers segment accounted for the largest revenue share over the forecast period. High-power direct diode lasers (DDL) have grown increasingly common and are primarily utilized for heat processing applications. Diode lasers emit laser light through semiconductor diodes, making them suitable for applications that need precise regulated energy delivery.

- The cobalt based alloys segment holds the highest market share through the forecast period.

Based on the material, the laser cladding market is categorized into cobalt based alloys, nickel based alloys, iron based alloys, carbide & carbide blends, and others. Among these, the cobalt based alloys segment holds the highest market share through the forecast period. Cobalt based alloys have useful wear and corrosion resistance, high-temperature strength, and thermal conductivity, making them suitable for use in demanding working environments. As aerospace, automotive, and oil and gas industries continue to use laser cladding for surface protection and component repair, the demand for cobalt-based alloys as cladding materials will continue to rise.

- The aerospace & defense segment is anticipated to grow at the fastest CAGR during the forecast period.

Based on the end-use, the laser cladding market is categorized into aerospace & defense, oil & gas, automotive, power generation, medical, and others. Among these, the aerospace & defense segment is anticipated to grow at the fastest CAGR during the forecast period. The aerospace sector is one of the first to use laser cladding. Many critical components in an aviation engine are covered in laser cladding. In the aerospace industry, laser cladding is used to repair and improve vital parts including engine parts, turbine blades, and aircraft structures.

Regional Segment Analysis of the Laser Cladding Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the laser cladding market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the laser cladding market over the forecast period. This is due to the high demand for laser cladding in the aerospace, defense, and semiconductor industries in the surrounding countries, mainly the United States and Canada. North America's market is driven by the presence of significant aerospace and defense, automotive, and oil and gas industries. Aerospace, automotive, and energy companies in the region are increasingly using laser cladding to increase component performance, lower maintenance costs, and improve operational efficiency.

Asia Pacific is expected to grow at the fastest CAGR growth in the laser cladding market during the forecast period. When it comes to the usage of laser processing systems, APAC exceeds other areas. Numerous government and private-sector-funded firms have emerged in the region, all focused on the advancement of laser cladding applications. Notably, Hornet, a Chinese laser-based surface solutions company, provides cutting-edge laser cladding solutions such as EHLA cladding and wide beam cladding to industries including oil and gas, mining, and agriculture. The region's growth is accelerated by increased R&D spending in laser technologies, a growing manufacturing and electronics sector, and APAC's high population density.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the laser cladding market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lame Spray Technologies

- Huffman

- Hoganas

- Lumibird

- Laserline GmbH

- Whitfield Welding Inc.

- Lumentum Operations

- TRUMPF

- OC Oerlikon Management AG

- Swanson Industries

- TLM Laser

- Kondex Corporation

- HAMUEL Maschinenbau

- Coherent Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2022, TRUMPF, a German machine tool manufacturer, and the Fraunhofer Institute for Laser Technology (ILT) announced a collaborative agreement to transfer laser metal deposition technology from academics to industry. By combining their respective expertise in laser system technologies, the two companies will conduct research and development to improve customer productivity, materials, and laser material deposition processes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the laser cladding market based on the below-mentioned segments:

Global Laser Cladding Market, By Type

- Diode Lasers

- Fiber Lasers

- CO2 Lasers

- YAG Lasers

Global Laser Cladding Market, By Material

- Cobalt Based Alloys

- Nickel Based Alloys

- Iron Based Alloys

- Carbide & Carbide Blends

- Others

Global Laser Cladding Market, By End-Use

- Aerospace & Defense

- Oil & gas

- Automotive

- Power Generation

- Medical

- Others

Global Laser Cladding Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global laser cladding market?The global laser cladding market is projected to expand at 9.26% during the forecast period.

-

2. Who are the top key players in the global laser cladding market?The key players in the global laser cladding market are Lame Spray Technologies, Huffman, Hoganas, Lumibird, Laserline GmbH, Whitfield Welding Inc., Lumentum Operations, TRUMPF, OC Oerlikon Management AG, Swanson Industries, TLM Laser, Kondex Corporation, HAMUEL Maschinenbau, and Coherent Corp.

-

3. Which region is expected to hold the largest share of the global laser cladding market?The North America region is expected to hold the largest share of the global laser cladding market.

Need help to buy this report?