Global LED Video Walls Market Size, Share, and COVID-19 Impact Analysis, By Type (Direct View LED Video, Indoor LED Video, Blended Projection LED Video), By Location (Outdoor, Indoor), By End-User Industry (Retail, Transportation, Media & Advertising, Sport & Entertainment, Auditorium, Commercial Buildings, Airports/Railways, Healthcare, Commercial Electronics, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Semiconductors & ElectronicsGlobal LED Video Walls Market Insights Forecasts to 2030

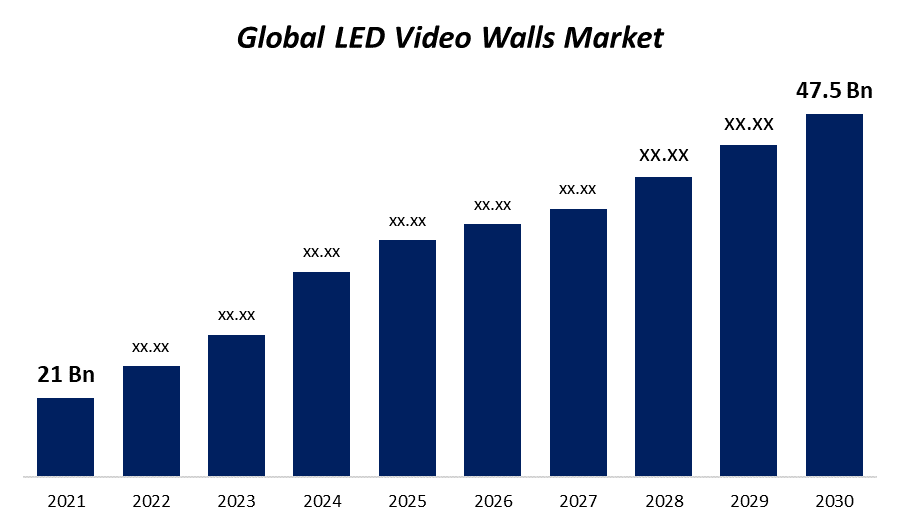

- The LED Video Walls Market size was valued at USD 21 billion in 2021

- The market is growing at a CAGR of 11.8% from 2022 to 2030

- The Global LED Video Walls Market is expected to reach USD 47.5 billion by 2030

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global LED Video Walls Market is expected to reach USD 47.5 billion by 2030, at a CAGR of 11.8% during the forecast period 2022 to 2030. Given the Covid-19 pandemic, there was a surge in the virtual world, with meetings and conferences taking place online. When regional and global peers must attend a meeting or conference but are unable to travel, video walls in conference rooms have proven to be effective. As a result of the pandemic, many cross-border training programs, concerts, and awards have begun to take place via key product categories, boosting market growth even further.

Market Overview

LED video walls typically combine several LED units into a single display screen. These video walls can be installed on mobile mounting systems or permanently wall-mounted. It also consists of numerous televisions, video projectors, or computer displays strategically angled or overlapped to release more light than signs made for commercial use. They don't get too hot and are extremely efficient, durable, and long-lasting. They require limited repairs and maintenance. They are primarily used for promotional purposes in the media and advertising industries. In commercial spaces, interactive video walls are used to engage customers.

Report Coverage

This research report categorizes the market for global LED video walls market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the LED video walls market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the LED video walls market.

Driving Factors

The rising popularity of energy-efficient display systems for promotional activities is a major driver of the global LED video wall market. This is primarily due to an increase in the number of political addresses, product launches, musical and sporting events, and the need to display critical information in control rooms and exhibitions. Additionally, elements fostering the rise include the benefits of using LED video walls, such as their durability, environmental friendliness, and efficiency in terms of energy use. Furthermore, the need to display information about various items in shopping malls, auditoriums, and other public places is expected to drive the demand for LED video walls over the forecasted period.

Global LED Video Walls Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 21 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 11.8% |

| 2030 Value Projection: | USD 47.5 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 201 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Type, By Location, By End-User Industry, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Samsung Electronics Co. Ltd., Panasonic Corporation, Christie Digital Systems Inc., Lighthouse Technologies Ltd., Toshiba Corporation, Delta Electronics Inc., NEC Display Solutions, ViewSonic Corporation, Koninklijke Philips N.V., AU Optronics Corporation, Unilumin, Sony Corp., Planar Systems Inc., Navori SA, Barco NV, NEC Display Solutions, Acer Inc., Prysm Inc., Mitsubishi Electric Corporation, Leyard Optoelectronic Co., Ltd., Cetech |

| Pitfalls & Challenges: | Due to the increasing number of COVID-19 cases |

Get more details on this report -

Restraining Factors

However, there are some limitations, such as the higher initial installation costs of these solutions and the growing popularity of LED video wall rental services. However, with larger dimensions, transportation becomes "non-standard," with increased costs and risk of damage. The LED panel, like all electronic devices, can fail due to manufacturing flaws or accidental impacts. Moreover, an LED panel is far more impact resistant than an LCD monitor, particularly the front-facing ones.

Market Segmentation

- In 2021, the direct view LED video segment is witnessing a higher growth rate over the forecast period.

Based on type, the global LED video walls market is segmented into direct view LED video, indoor LED video and blended projection LED video. Among these, the direct view LED video segment witnessed a higher growth rate over the forecast period. Instead of an LCD panel, Direct View LED walls use a surface array of LEDs as the actual display pixels. This enables incredible contrast, vibrant colors, and brightness levels that are several times higher than those of LCDs. Most of these display systems were designed for outdoor use, but as times changed, they now provide superior pixel solutions for indoor displays.

- In 2021, the outdoor segment is witnessing significant CAGR growth over the forecast period.

On the basis of location, the global LED video walls market is segmented into outdoor and indoor. Among these, the outdoor segment is witnessing significant CAGR growth over the forecast period as a result of increased demand from various industries such as transportation and logistics, media and advertising, sport and entertainment, and others. Furthermore, the growing use of businesses to attract more customers through advertisement and displaying commercials as well as easily visible information will drive the outdoor LED video wall market.

- In 2021, the transportation segment is dominating the market with the largest market share of 40% over the forecast period.

Based on the end-use industry, the global LED video walls market is segmented into retail, transportation, media & advertising, sport & entertainment, auditorium, commercial buildings, airports/railways, healthcare, commercial electronics, and others. Among these, the transportation segment dominates the market with the largest market share of 40% over the forecast period. The growing demand for digital content and information relevant to travelers has resulted in interactive ads delivered via an LED video wall, which has contributed significantly to the rise in transportation media revenues. This has ultimately resulted in lower government costs, demonstrating the establishment's improved cost-effectiveness.

Retail and sports and entertainment are expected to grow steadily over the forecasted period due to their extensive use in advertising, brochures, live scores, news, videos, and other applications.

Regional Segment Analysis of the LED Video Walls Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

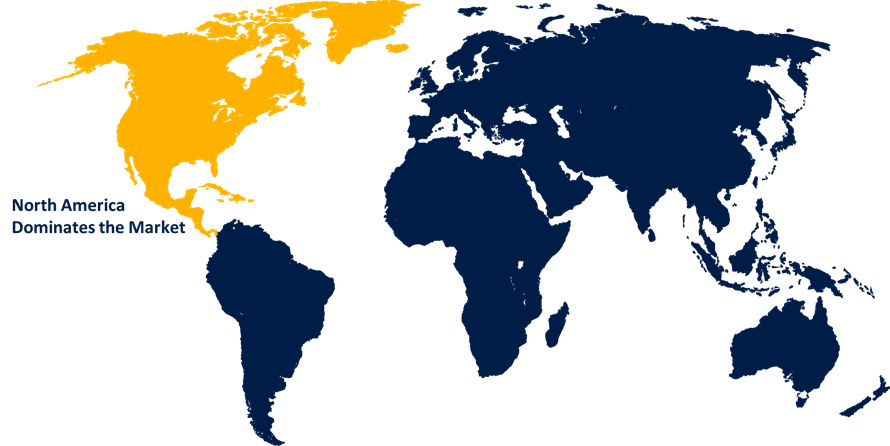

North America is dominating the market with the largest market share of 30%.

North America dominates the market with a 30% market share, owing to the region's largest revenue from LED video walls, which is expected to grow as the United States is a large market for digital advertising. One of the primary drivers of the expansion of LED video walls in the region is the emergence of newer display technologies. This trend is expected to continue as more industries, including retail, hospitality, media, and entertainment, adopt LED video walls.

The Asia-Pacific region is expected to have one of the fastest-growing markets as well as one of the most innovative markets, owing to changing consumer preferences and increased market innovation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global LED video walls market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players

- Samsung Electronics Co. Ltd.

- Panasonic Corporation

- Christie Digital Systems Inc.

- Lighthouse Technologies Ltd.

- Toshiba Corporation

- Delta Electronics Inc.

- NEC Display Solutions

- ViewSonic Corporation

- Koninklijke Philips N.V.

- AU Optronics Corporation

- Unilumin

- Sony Corp.

- Planar Systems Inc.

- Navori SA

- Barco NV

- NEC Display Solutions

- Acer Inc.

- Prysm Inc.

- Mitsubishi Electric Corporation

- Leyard Optoelectronic Co., Ltd.

- Cetech

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2022, Viewsonic launched the first 135-inch all-in-one, direct-view LED Display Solution Kit with a foldable screen, significantly lowering packaging size by nearly 50% over previous designs. Because it can fit into conventional freight and large passenger elevators, it is easier and less expensive to transport.

- In October 2021, LG Electronics and VA Corporation established a collaborative research center to create an LED wall optimized for in-camera visual effects. This innovative technology enables filmmakers to create multiple scenes and locations in the same studio at the lowest possible cost.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global LED video walls market based on the below-mentioned segments:

LED Video Walls Market, By Type

- Direct View LED Video

- Indoor LED Video

- Blended Projection LED Video

LED Video Walls Market, By Location

- Outdoor

- Indoor

LED Video Walls Market, By End-User Industry

- Retail

- Transportation

- Media & Advertising

- Sport & Entertainment

- Auditorium

- Commercial Buildings

- Airports/Railways

- Healthcare

- Commercial Electronics

- Others

LED Video Walls Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?