Global LEO Satellite Market Size, Share, and COVID-19 Impact Analysis, By Satellite Type (Small, Medium, Large), Application (Communication, Earth Observation & Remote Sensing, Technology Development), End-User (Commercial, Military, Government), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal LEO Satellite Market Insights Forecasts to 2033

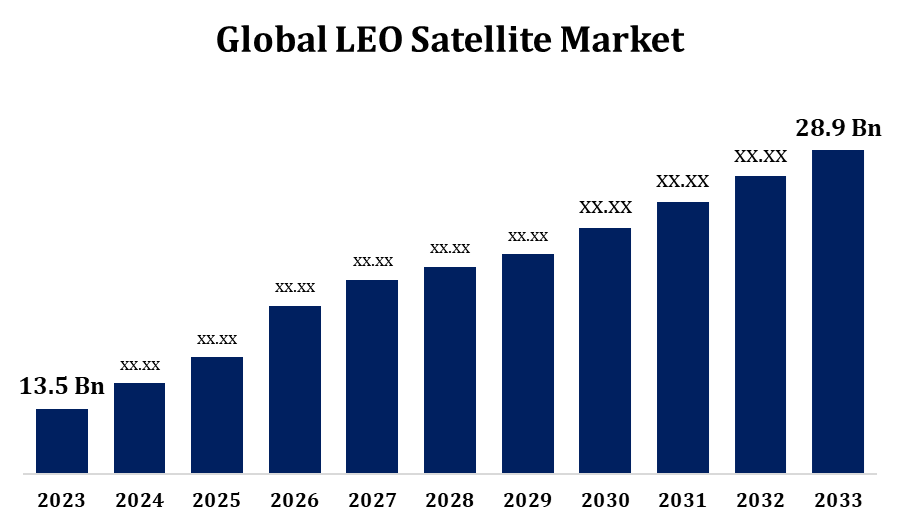

- The LEO Satellite Market was valued at USD 13.5 billion in 2023.

- The market is growing at a CAGR of 7.91% from 2023 to 2033.

- The global LEO Satellite Market is expected to reach USD 28.9 billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

Global LEO Satellite Market is expected to reach USD 28.9 billion by 2033, at a CAGR of 7.91% during the forecast period 2023 to 2033.

The Low Earth Orbit (LEO) satellite market is experiencing significant growth, driven by advancements in satellite technology and increasing demand for high-speed internet, remote sensing, and global communication services. Positioned at altitudes between 200 and 2,000 kilometers, LEO satellites offer reduced latency and enhanced coverage compared to geostationary satellites, making them ideal for applications like IoT, 5G, and disaster management. The market is fueled by investments from private players such as SpaceX, Amazon, and OneWeb, alongside governmental space initiatives. Key growth factors include the rising need for satellite-based solutions in defense, agriculture, and environmental monitoring. However, challenges like orbital debris and high deployment costs persist. Emerging trends include satellite miniaturization, advanced propulsion systems, and reusable rocket technology, fostering a competitive and dynamic market landscape.

LEO Satellite Market Value Chain Analysis

The LEO satellite market value chain comprises several interconnected stages, beginning with raw material suppliers providing components like sensors, solar panels, and propulsion systems. Satellite manufacturers integrate these into fully functional satellites, focusing on innovation and miniaturization to reduce costs and improve performance. Launch service providers, including SpaceX and Rocket Lab, play a crucial role, offering affordable and reusable launch systems to place satellites into orbit. Ground station operators manage communication, data reception, and satellite control. Service providers leverage LEO constellations for applications like broadband internet, Earth observation, and navigation. End-users span industries such as telecommunications, agriculture, defense, and disaster management. Additionally, regulatory bodies ensure orbital traffic management and compliance. The value chain is evolving with advancements in automation, AI-driven analytics, and sustainable space practices.

LEO Satellite Market Opportunity Analysis

The LEO satellite market presents significant growth opportunities, driven by the rising demand for global broadband connectivity, particularly in underserved regions. Initiatives like SpaceX’s Starlink and Amazon’s Project Kuiper aim to bridge the digital divide, creating avenues for socio-economic development. The adoption of LEO satellites in sectors like agriculture, logistics, and environmental monitoring is expanding, with applications in precision farming, supply chain optimization, and climate change mitigation. Defense and security sectors benefit from real-time intelligence and surveillance enabled by LEO constellations. Emerging markets in Asia-Pacific and Africa offer untapped potential for satellite-based solutions. Innovations in satellite miniaturization, reusable rocket technologies, and AI-driven analytics further enhance the scalability and affordability of LEO systems, opening doors for startups and SMEs to enter the competitive space economy.

Global LEO Satellite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.5 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.91% |

| 2033 Value Projection: | USD 28.9 billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Satellite Type, Application and COVID-19 Impact Analysis |

| Companies covered:: | SpaceX, Airbus Defenses & Space, Lockheed Martin Corporation, Northrop Grumman Corporation, L3Harris Technologies Inc., Astrocast, China Aerospace Science & Technology Corporation (CASC), German Orbital Systems, Gomphacils, Nano Avionics, Planet Labs Inc., ROSCOSMOS, Space Exploration Technologies Corp., SpaceQuest Ltd., Thales Alenia Space, and other Key Players |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Market Dynamics

LEO Satellite Market Dynamics

The growing demand for enhanced Earth observation and remote sensing capabilities

The growing demand for enhanced Earth observation and remote sensing capabilities is a key driver of growth in the LEO satellite market. These satellites provide high-resolution imaging and real-time data, essential for applications in agriculture, disaster management, environmental monitoring, and urban planning. Governments and private sectors are increasingly leveraging LEO constellations for precision mapping, climate analysis, and resource management. Advancements in sensor technology and data analytics enhance the efficiency and accuracy of remote sensing, further expanding its applications. Additionally, the integration of AI and machine learning enables actionable insights from satellite data, supporting industries like defense and energy. As global challenges such as climate change and natural disasters escalate, the reliance on LEO satellites for timely and reliable Earth observation continues to accelerate market growth.

Restraints & Challenges

Orbital congestion is a pressing issue, with the increasing number of satellite launches raising concerns about collisions and space debris management. High deployment and maintenance costs remain a barrier, particularly for small and emerging companies. Regulatory complexities across different countries create hurdles for international collaboration and spectrum allocation. Additionally, limited lifespan and the need for frequent satellite replacements increase operational expenses. Environmental concerns related to space debris and atmospheric pollution during launches are drawing greater scrutiny. The reliance on advanced technologies demands significant R&D investment, which can deter smaller players. Furthermore, cybersecurity risks, including potential satellite hacking, pose threats to critical applications. Addressing these challenges is essential for ensuring the sustainable growth of the LEO satellite industry.

Regional Forecasts

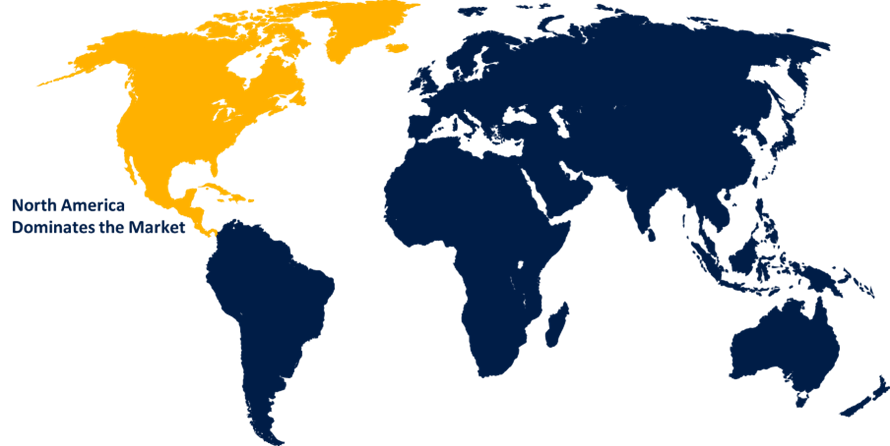

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the LEO Satellite Market from 2023 to 2033. The region benefits from robust governmental support through agencies like NASA and the U.S. Department of Defense, which prioritize satellite applications in communication, navigation, and surveillance. Rising demand for broadband connectivity in rural and underserved areas, coupled with advancements in 5G and IoT technologies, fuels market expansion. North America also leads in satellite launches, with innovative reusable rocket systems reducing costs and boosting deployment rates. The region faces challenges such as stringent regulatory frameworks and orbital congestion but continues to drive innovation in satellite miniaturization, AI-driven analytics, and space sustainability practices, maintaining its leadership in the LEO satellite market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, and South Korea are at the forefront, with substantial investments in satellite constellations for communication, Earth observation, and navigation. Government initiatives, such as India’s ISRO missions and China’s BeiDou expansion, are boosting regional capabilities. The demand for high-speed internet in remote and underserved areas and applications in agriculture, disaster management, and environmental monitoring fuel market growth. Private sector participation is also rising, with startups and collaborations advancing satellite miniaturization and cost-effective launches. Despite challenges like regulatory fragmentation and limited infrastructure, Asia-Pacific is poised to become a key contributor to the global LEO satellite market.

Segmentation Analysis

Insights by Satellite Type

The small satellite segment accounted for the largest market share over the forecast period 2023 to 2033. These satellites, typically weighing less than 500 kilograms, are increasingly favored for their lower launch costs, faster development cycles, and scalability for large constellations. They cater to diverse applications such as Earth observation, communication, scientific research, and IoT. The rise of reusable launch vehicles, like SpaceX’s Falcon 9, has further reduced deployment expenses, making small satellites more accessible to startups and research institutions. Governments and private players are leveraging this segment for rapid data acquisition and enhanced connectivity in remote areas. As demand for real-time data and high-speed networks grows, the small satellite segment is expected to play a pivotal role in the LEO satellite market's expansion.

Insights by Application

The communication segment accounted for the largest market share over the forecast period 2023 to 2033. Unlike geostationary satellites, LEO satellites provide enhanced performance for broadband services, making them ideal for underserved and remote areas. Initiatives like SpaceX’s Starlink, Amazon’s Project Kuiper, and OneWeb aim to create expansive LEO constellations to address this need. Applications range from enabling 5G networks and IoT connectivity to supporting maritime, aviation, and military communication. The growing reliance on satellite internet for education, telemedicine, and business continuity has further accelerated demand. Advances in satellite technology, such as phased-array antennas and inter-satellite links, enhance communication capabilities. As digital transformation continues globally, the communication segment remains pivotal to LEO satellite market growth.

Insights by End User

The government segment accounted for the largest market share over the forecast period 2023 to 2033. Governments worldwide are deploying LEO satellites for applications like surveillance, reconnaissance, secure communication, and navigation. Countries such as the U.S., China, and India are developing LEO constellations for defense and intelligence purposes, while also enhancing Earth observation capabilities for disaster management and environmental monitoring. Collaborations with private companies are accelerating satellite deployment and reducing costs, making space solutions more accessible. Additionally, government-backed initiatives in space exploration and research fuel demand for advanced satellite technologies. The increasing emphasis on cybersecurity, space debris management, and international cooperation further propels government-driven LEO satellite growth, positioning it as a critical component of national security and economic development.

Recent Market Developments

- In January 2024, SpaceX achieved a major milestone by successfully launching its 1,000th operational Starlink satellite, advancing its mission to offer global broadband coverage.

Competitive Landscape

Major players in the market

- SpaceX

- Airbus Defenses & Space

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- L3Harris Technologies Inc.

- Astrocast

- China Aerospace Science & Technology Corporation (CASC)

- German Orbital Systems

- GomSpaceApS

- Nano Avionics

- Planet Labs Inc.

- ROSCOSMOS

- Space Exploration Technologies Corp.

- SpaceQuest Ltd.

- Thales Alenia Space

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

LEO Satellite Market, Satellite Type Analysis

- Small

- Medium

- Large

LEO Satellite Market, Application Analysis

- Communication

- Earth Observation & Remote Sensing

- Technology Development

LEO Satellite Market, End User Analysis

- Commercial

- Military

- Government

LEO Satellite Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the LEO Satellite Market?The global LEO Satellite Market is expected to grow from USD 13.5 billion in 2023 to USD 28.9 billion by 2033, at a CAGR of 7.91% during the forecast period 2023-2033.

-

2 Who are the key market players of the LEO Satellite Market?Some of the key market players of the market are SpaceX, Airbus Defenses & Space, Lockheed Martin Corporation, Northrop Grumman Corporation, L3Harris Technologies Inc., Astrocast, China Aerospace Science & Technology Corporation (CASC), German Orbital Systems, GomSpaceApS, Nano Avionics, Planet Labs Inc., ROSCOSMOS, Space Exploration Technologies Corp., SpaceQuest Ltd., Thales Alenia Space.

-

3. Which segment holds the largest market share?The government segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the LEO Satellite Market?North America dominates the LEO Satellite Market and has the highest market share.

Need help to buy this report?