Global LEO Terminals Market Size, Share, and COVID-19 Impact Analysis, By Application (Satellite Communication, Internet of Things, Remote Sensing), By Terminal Type (Mobile Terminals, Fixed Terminals, Transportable Terminals), By Technology (Software Defined Networking, Cloud Computing, Artificial Intelligence), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal LEO Terminals Market Insights Forecasts to 2033

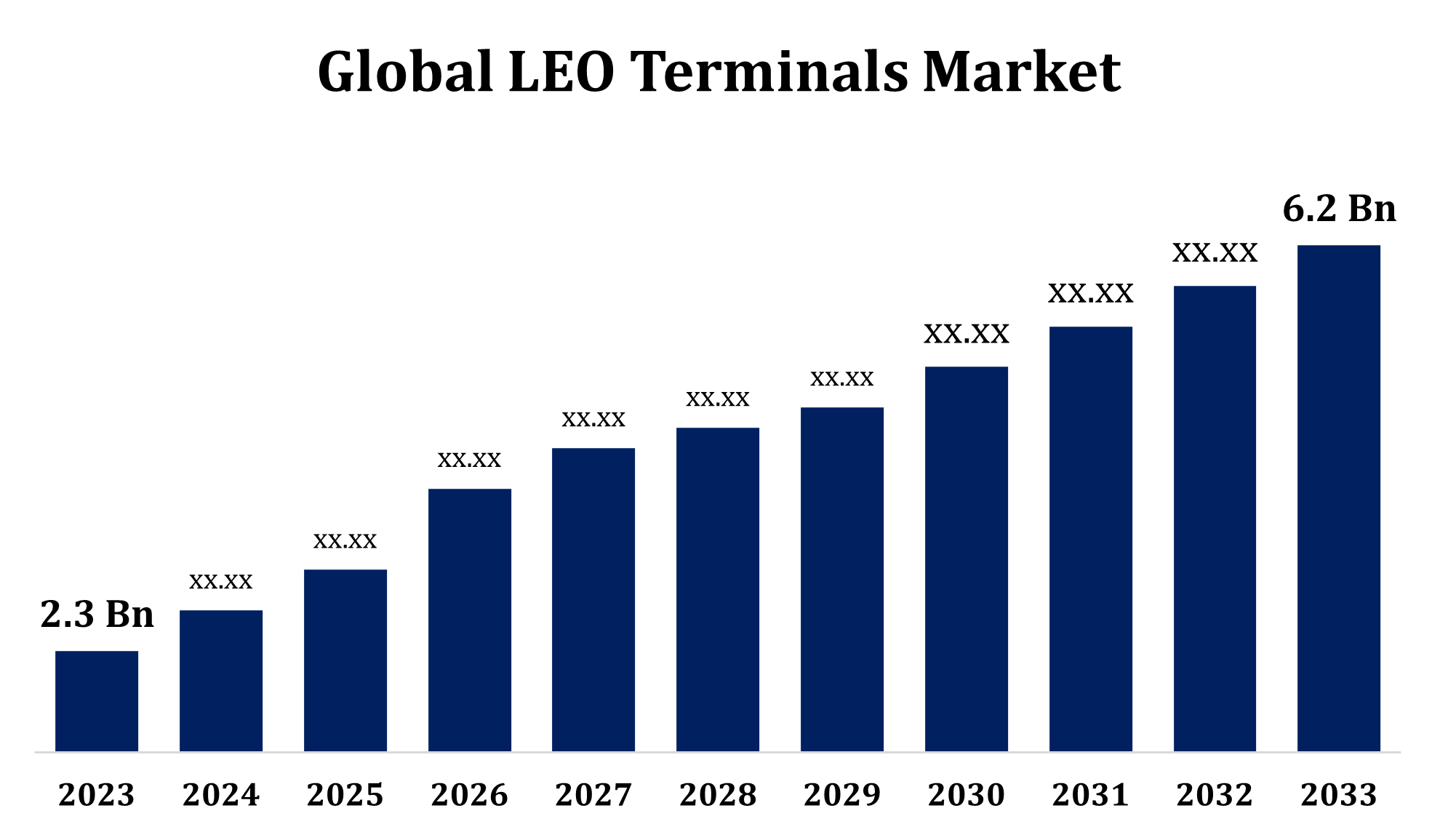

- The Global LEO Terminals Market Size was valued at USD 2.3 Billion in 2023.

- The Market is Growing at a CAGR of 10.42% from 2023 to 2033.

- The Worldwide LEO Terminals Market is expected to reach USD 6.2 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global LEO Terminals Market is Expected to reach USD 6.2 Billion by 2033, at a CAGR of 10.42% during the forecast period 2023 to 2033.

The Low Earth Orbit (LEO) terminals market is growing rapidly, fueled by the increasing demand for fast, reliable, and low-latency satellite communication. LEO satellites, positioned closer to Earth, provide enhanced data transmission and global coverage, making them ideal for applications such as broadband internet, remote sensing, and maritime or aviation communications. Technological advancements have led to the development of compact and cost-effective terminals, driving adoption across various industries. The market is further propelled by rising investments from private companies and government initiatives aimed at bridging digital divides and enhancing connectivity in remote areas. Key sectors like defense, telecommunications, and transportation are leveraging LEO terminals for seamless communication. As satellite constellations expand, the market is expected to witness robust growth in the coming years.

LEO Terminals Market Value Chain Analysis

The value chain of the Low Earth Orbit (LEO) terminals market encompasses several key stages, from satellite and terminal manufacturing to service delivery. It begins with raw material suppliers providing essential components such as semiconductors, antennas, and advanced composites. Satellite and terminal manufacturers then design and produce LEO-specific hardware, focusing on compactness, durability, and high performance. Network integrators and ground station operators ensure connectivity between satellites and terminals, managing data transmission and network reliability. The final stage involves service providers, who deliver end-user applications, including broadband internet, IoT solutions, and communication services. Collaboration among stakeholders, including private companies, government agencies, and technology providers, plays a critical role in innovation and market expansion. Continuous R&D and infrastructure investments are vital for enhancing efficiency across this value chain.

LEO Terminals Market Opportunity Analysis

The Low Earth Orbit (LEO) terminals market presents significant growth opportunities driven by the rising demand for high-speed, low-latency connectivity worldwide. Expanding satellite constellations from companies like SpaceX, OneWeb, and Amazon’s Project Kuiper are creating a vast need for advanced, cost-effective terminals. The growing focus on bridging the digital divide, especially in remote and underserved regions, is a major driver for market expansion. Industries such as defense, maritime, aviation, and telecommunications are adopting LEO terminals for reliable global coverage and seamless communication. Additionally, the increasing integration of LEO terminals with IoT and smart applications opens doors to innovative use cases. Government initiatives and private investments in space technology further amplify opportunities, positioning the LEO terminals market for substantial growth in the coming years.

Global LEO Terminals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.3 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 10.42% |

| 023 – 2033 Value Projection: | USD 6.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 259 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Application, By Terminal Type, By Technology, By Regional Analysis |

| Companies covered:: | Hewlett Packard Enterprise, Rockwell Collins, Airbus Defence and Space, Inmarsat, SES S.A., Sawyer Aerospace, Orbit Communications Systems, Lockheed Martin, L3Harris Technologies, Northrop Grumman, Boeing, Ball Aerospace, Iridium Communications, Thales Group, Cubic Corporation, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

LEO Terminals Market Dynamics

Rising Need for High-Speed Internet Access

The growing need for high-speed internet access is a key driver of growth in the Low Earth Orbit (LEO) terminals market. LEO satellites, positioned closer to Earth, enable faster data transmission and lower latency compared to traditional geostationary systems, making them ideal for meeting increasing connectivity demands. This is especially critical for remote and underserved areas where terrestrial infrastructure is limited or non-existent. The expansion of global satellite constellations by companies like SpaceX and OneWeb has intensified the demand for efficient and cost-effective LEO terminals to support broadband services. Additionally, industries such as maritime, aviation, and defense rely on LEO terminals for seamless communication. As digital transformation accelerates and the reliance on internet connectivity grows, the LEO terminals market is poised for significant expansion.

Restraints & Challenges

One major issue is the high cost of developing and deploying advanced terminals, which can limit accessibility for budget-conscious markets. Technical complexities, including ensuring seamless connectivity with rapidly moving LEO satellites and minimizing signal interference, pose additional hurdles. Scalability is another concern, as the increasing number of satellites in orbit may lead to congestion and require robust network management solutions. Regulatory barriers, including spectrum allocation and international compliance, add complexity to market operations. Moreover, competition among satellite operators and terminal manufacturers creates pricing pressures, impacting profitability. Environmental concerns, such as space debris from expanding satellite constellations, also raise sustainability issues. Addressing these challenges is essential for unlocking the full potential of the LEO terminals market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the LEO Terminals Market from 2023 to 2033. The region is home to key players such as SpaceX, Amazon’s Project Kuiper, and OneWeb, which are actively expanding LEO satellite constellations. The growing adoption of LEO terminals in sectors like defense, aviation, maritime, and rural broadband services further accelerates market growth. Government initiatives, such as NASA and the U.S. Department of Defense projects, support advancements in LEO technologies. Additionally, the region’s emphasis on bridging the digital divide in underserved and remote areas fuels demand for LEO terminals. With robust innovation and strong private-public collaboration, North America continues to lead the LEO terminals market globally.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The growth is driven by increasing demand for high-speed internet connectivity in densely populated urban areas and underserved rural regions. Governments is investing heavily in satellite communication technologies to enhance digital infrastructure and address connectivity challenges. The rise of private players and collaborations with global LEO satellite operators, such as OneWeb and SpaceX, further boost the market. Key industries like maritime, agriculture, and defense are adopting LEO terminals for reliable and efficient communication. Additionally, initiatives to bridge the digital divide and support smart city developments are driving demand. With rapid economic growth and technological advancements, Asia-Pacific is poised to become a key player in the LEO terminals market.

Segmentation Analysis

Insights by Application

The Satellite Communication segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing demand for global connectivity and high-speed internet services. LEO satellites, positioned closer to Earth, offer lower latency and faster data transmission compared to traditional geostationary satellites, making them ideal for real-time communications, especially in remote and rural areas. The rise of global satellite constellations from companies like SpaceX, OneWeb, and Amazon’s Project Kuiper is expanding network coverage and boosting adoption. Key applications, such as broadband internet, voice communication, and IoT services, are gaining traction across industries like telecommunications, aviation, and maritime. The growing focus on enhancing digital infrastructure and bridging the connectivity gap further propels the satellite communication segment, positioning it for sustained growth in the LEO terminals market.

Insights by Terminal Type

The mobile terminals segment accounted for the largest market share over the forecast period 2023 to 2033. LEO satellites, with their low latency and high-speed data transmission capabilities, are ideal for mobile communication applications, including mobile broadband and satellite-enabled services in remote or underserved areas. As mobile network providers seek alternatives to traditional terrestrial infrastructure, LEO terminals offer an effective solution for expanding coverage in hard-to-reach regions. The integration of LEO terminals in smartphones, vehicles, and wearable devices is enhancing mobile connectivity, supporting industries like automotive, aviation, and logistics. With advancements in satellite constellations from major players such as SpaceX and OneWeb, the mobile terminals segment is expected to see rapid growth, transforming global mobile communication landscapes.

Insights by Technology

The Software Defined Networking segment accounted for the largest market share over the forecast period 2023 to 2033. The Software Defined Networking (SDN) segment is experiencing notable growth in the Low Earth Orbit (LEO) terminals market, as it enables flexible, efficient, and scalable network management for satellite communication. SDN allows for the dynamic configuration and optimization of LEO satellite networks, improving the ability to manage traffic, enhance performance, and reduce latency. With the growing number of LEO satellite constellations, SDN provides a centralized approach to control network traffic, ensuring seamless integration and communication between satellites, ground stations, and terminals. This technology is particularly beneficial for handling the complex data flows in global networks. As demand for broadband services, IoT applications, and real-time communications rises, SDN is essential for optimizing satellite network operations and ensuring robust, reliable service. The SDN segment in LEO terminals is expected to expand rapidly as more advanced satellite constellations are deployed.

Recent Market Developments

- In August 2023, Hughes Network Systems, a subsidiary of EchoStar, has been awarded a five-year Indefinite Delivery Indefinite Quantity (IDIQ) contract by the US Space Force. This agreement enables the US Department of Defense, federal agencies, and international coalition partners to utilize Hughes’ fully managed, low-latency satellite services based on Low Earth Orbit (LEO) technology.

Competitive Landscape

Major players in the market

- Hewlett Packard Enterprise

- Rockwell Collins

- Airbus Defence and Space

- Inmarsat

- SES S.A.

- Sawyer Aerospace

- Orbit Communications Systems

- Lockheed Martin

- L3Harris Technologies

- Northrop Grumman

- Boeing

- Ball Aerospace

- Iridium Communications

- Thales Group

- Cubic Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

LEO Terminals Market, Application Analysis

- Satellite Communication

- Internet of Things

- Remote Sensing

LEO Terminals Market, Terminal Type Analysis

- Mobile Terminals

- Fixed Terminals

- Transportable Terminals

LEO Terminals Market, Technology Analysis

- Software Defined Networking

- Cloud Computing

- Artificial Intelligence

LEO Terminals Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the LEO Terminals Market?The global LEO Terminals Market is expected to grow from USD 2.3 billion in 2023 to USD 6.2 billion by 2033, at a CAGR of 10.42% during the forecast period 2023-2033.

-

2. Who are the key market players of the LEO Terminals Market?Some of the key market players of the market are Hewlett Packard Enterprise, Rockwell Collins, Airbus Defence and Space, Inmarsat, SES S.A., Sawyer Aerospace, Orbit Communications Systems, Lockheed Martin, L3Harris Technologies, Northrop Grumman, Boeing, Ball Aerospace, Iridium Communications, Thales Group, Cubic Corporation.

-

3. Which segment holds the largest market share?The Software Defined Networking segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the LEO Terminals Market?North America dominates the LEO Terminals Market and has the highest market share.

Need help to buy this report?