Global Lime Market Size, Share, and COVID-19 Impact Analysis, By Type (Hydrated Lime, Quick Lime, Calcined Lime, Dolomitic), By Application (Construction, Water Treatment, Iron and Steel, Agriculture, Chemical), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Lime Market Insights Forecasts to 2033

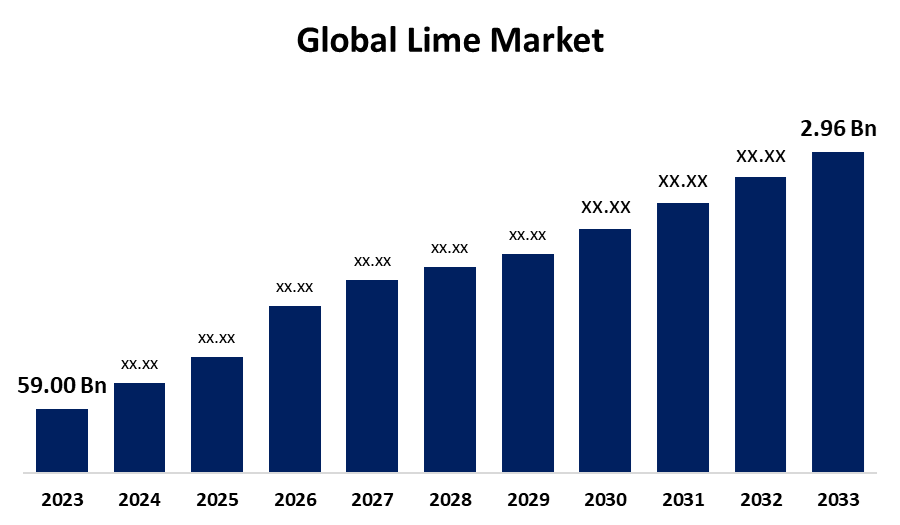

- The Global Lime Market Size was Valued at USD 44.08 Billion in 2023

- The Market Size is expected to grow at a CAGR of around 2.96% from 2023 to 2033

- The Worldwide Lime Market Size is Expected to Reach USD 59.00 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Lime Market size was valued at USD 44.08 billion in 2023 and is slated to cross USD 59.00 billion by 2033, growing at a CAGR of 2.96% from 2023 to 2033. The lime market is driven by growth in construction, water treatment, and agriculture. Environmental regulations, industrial growth, and sustainable trends are increasing demand and driving expansion in the market. Innovation, product development, and the rising global demand for lime-based solutions dominate the scope of the key players.

Market Overview

The lime market is about the production and consumption of lime. Lime is the product obtained through the calcination of limestone. Available in forms like quicklime and hydrated lime, it finds its usage widely in construction, environmental applications, agriculture, chemical processing, food, and beverages, driving the demand in several industries. Moreover, the drivers for the lime market include demand in construction for cement and mortar, environmental applications such as water treatment and carbon capture, and agriculture applications for soil management. Growth in industrial chemical processes and an increasing trend of urbanization also further drive lime consumption. Additionally, the sustainability trend toward carbon sequestration further adds to the growing market potential for lime. Furthermore, opportunities are found in the lime market with sustainable construction, green technologies, and waste management. Trends include increased use of eco-friendly materials, innovations in carbon capture, and increased demand in emerging markets for infrastructure development, driving further market expansion and investment.

For instance, in May 2023, Graymont announced an expansion of the Victoria, Australia, operations by delivering higher volume lime with low emission. The firm confirmed that the company is undertaking planning and detailed engineering for substantial expansion and diversification of southeastern Australia operations; to meet enhanced lime demand in the Victoria region and other nascent markets along eastern Australia.

Report Coverage

This research report categorizes the lime market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the lime market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the lime market.

Global Lime Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 44.08 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.96% |

| 2033 Value Projection: | USD 59.00 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Carmeuse, Graymont, Cheney Lime & Cement Company, Linwood Mining & Minerals Corporation, Pete Lien & Sons, Inc., Cape Lime (Pty) Ltd., Valley Minerals LLC, GP Group, Sigma Minerals Ltd., Lhoist, United States Lime & Minerals, Inc., Cornish Lime, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The critical driving factors of the lime market include rapid industrialization, especially in developing economies, because it affects the construction material demand scale. Another aspect is that increasing environmental sustainability will demand greater lime volumes in green technologies like carbon capture and waste management. Growing agricultural productivity along with awareness about soil health consistently stimulates market growth. Technological advancements in processing and lime's various applications present new opportunities within all sectors. For instance, in September 2023, Graymont Limited declared the expansion of business in Southeast Asia. The company acquired Compact Energy, which is a significant lime processing facility located in Malaysia, to achieve this end. From here, the company is likely to produce 600,000 tons of quicklime and 170,000 tons of hydrated lime per year.

In September 2023, Lohist Group announced its intention to increase its lime production capacity in Texas, U.S. The company decided to increase its production capacity with an aim to establish its business presence in the U.S. and maximize its revenue from the lime segment.

Restraints & Challenges

The lime market faces several issues, including unstable raw material prices, high energy consumption in production, and carbon emission concerns related to the environment. In addition, competition from alternative materials and economic downturns in the main industries will limit market growth.

Market Segmentation

The lime market share is classified into product type and application.

- The hydrated lime segment accounted for the highest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the type, the lime market is divided into hydrated lime, quick lime, calcined lime, and dolomitic. Among these, the hydrated lime segment accounted for the highest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. This is mainly because of its versatile applications in different industries, such as water treatment, construction (for mortar and plaster), and environmental applications like air pollution control and soil stabilization. Hydrated lime's widespread use in these sectors, coupled with its efficiency and cost-effectiveness, makes it a dominant player in the lime market.

- The water treatment segment accounted for the greatest share in 2023 and is predicted to grow at a remarkable CAGR during the anticipated timeframe.

Based on the application, the lime market is divided into construction, water treatment, iron and steel, agriculture, and chemicals. Among these, the water treatment segment accounted for the greatest share in 2023 and is predicted to grow at a remarkable CAGR during the anticipated timeframe. Growing demand for clean water and the need for effective water and wastewater treatment solutions are driving this growth. pH regulation, coagulation, and flocculation in water treatment are all important functions of lime, meaning that the product has a growing usage base in municipal and industrial applications. Growing environmental regulations and increasing concerns over water scarcity are adding to the demand in this sector.

Regional Segment Analysis of the Lime Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

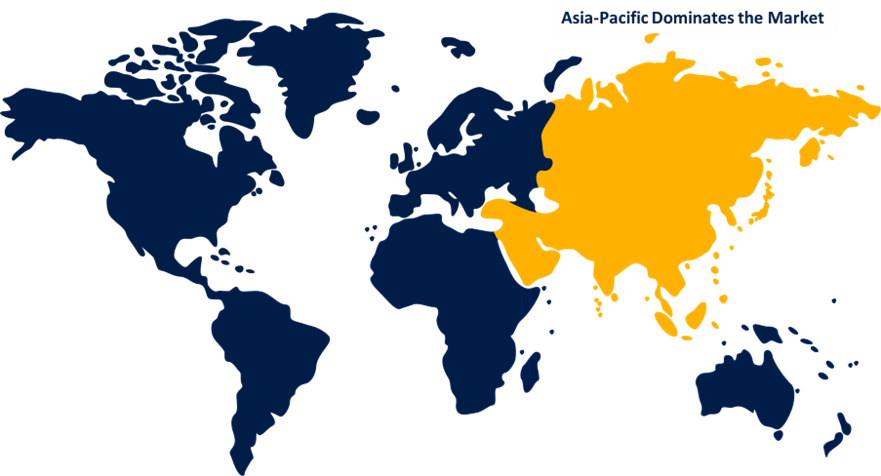

Asia Pacific is anticipated to hold the largest share of the lime market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the lime market over the predicted timeframe. The Asia-Pacific region, especially China and India, is rapidly industrializing, urbanizing, and building infrastructure, all of which hugely increase the demand for lime in construction, water treatment, and agriculture. Further, the focus on environmental regulations and sustainable practices in countries of the Asia-Pacific region further increases the demand for lime-based solutions, thus cementing the region's market leadership. For instance, Vietnam's National Assembly passed the Law on Water Resources to update processes to purify water for citizens. In addition, due to intensive industrialization and the establishment of manufacturing facilities in different areas, lime finds its applications in the chemicals, pulp paper, and sugar refining industries in the Asia Pacific region.

North America is expected to grow at a rapid CAGR of the lime market during the forecast period. This growth is induced by high demand from the industrial sectors, especially water treatment, construction, and steel production. Furthermore, this lime finds extensive application in carbon capture and pollution control due to the increased importance of sustainability and environmental regulations within the U.S. and Canada. Economic development and infrastructure build-up within this region further increase its market volume. For instance, Lohist North America has received approval from the Texas Commission on Environmental Quality to build a new lime kiln at its New Braunfels, Texas facility as energy-efficient. The regulatory approval will help support the company's cap.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the lime market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Carmeuse

- Graymont

- Cheney Lime & Cement Company

- Linwood Mining & Minerals Corporation

- Pete Lien & Sons, Inc.

- Cape Lime (Pty) Ltd.

- Valley Minerals LLC

- GP Group

- Sigma Minerals Ltd.

- Lhoist

- United States Lime & Minerals, Inc.

- Cornish Lime

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2022, HBM Holdings' company Mississippi Lime Company acquired the leading independent U.K. lime product supplier, Singleton Birch, which has its headquarters in St. Louis. This move is part of MLC's approach to drive growth, innovation, and sustainability through geographic expansion and new products and technologies that address proactively evolving customer needs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the lime market based on the below-mentioned segments:

Global Lime Market, By Type

- Hydrated Lime

- Quick Lime

- Calcined Lime

- Dolomitic

Global Lime Market, By Application

- Construction

- Water Treatment

- Iron and Steel

- Agriculture

- Chemical

Global Lime Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Lime market over the forecast period?The global Lime market size was valued at USD 44.08 billion in 2023 and is slated to cross USD 59.00 billion by 2033, growing at a CAGR of 2.96% from 2023 to 2033.

-

2. Which region holds the largest share of the Lime market?Asia Pacific is estimated to hold the largest share of the Lime market over the predicted timeframe.

-

3. Who are the top key players in the global lime market?Carmeuse, Graymont, Cheney Lime & Cement Company, Linwood Mining & Minerals Corporation, Pete Lien & Sons, Inc., Cape Lime (Pty) Ltd., Valley Minerals LLC, GP Group, Sigma Minerals Ltd., Lhoist, United States Lime & Minerals, Inc., Cornish Lime, and Others.

Need help to buy this report?