Global Liquid Biopsy Market Size, Share, and COVID-19 Impact Analysis, By Technology (NGS, PCR, FISH, and Others), By Workflow (Sample Preparation, Library Preparation, Sequencing, and Data Analysis), By Usage (RUO and Clinical), By Types of Sample (Blood, Urine, Saliva, and Cerebrospinal Fluid), By Circulating Biomarker (Circulating Tumor Cells, Cell-free DNA, Circulating Cell-Free RNA, Exosomes & Extracellular Vesicles, and Others), By Products (Test/Services, Kits & Consumable, and Instruments), By Indication Type (Lung Cancer, Breast Cancer, Prostate Cancer, Colorectal Cancer, Melanoma, and Others), By Clinical Application (Treatment Monitoring, Prognosis & Recurrence Monitoring, Treatment Selection, and Diagnosis & Screening), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2032.

Industry: HealthcareGlobal Liquid Biopsy Market Insights Forecasts to 2032

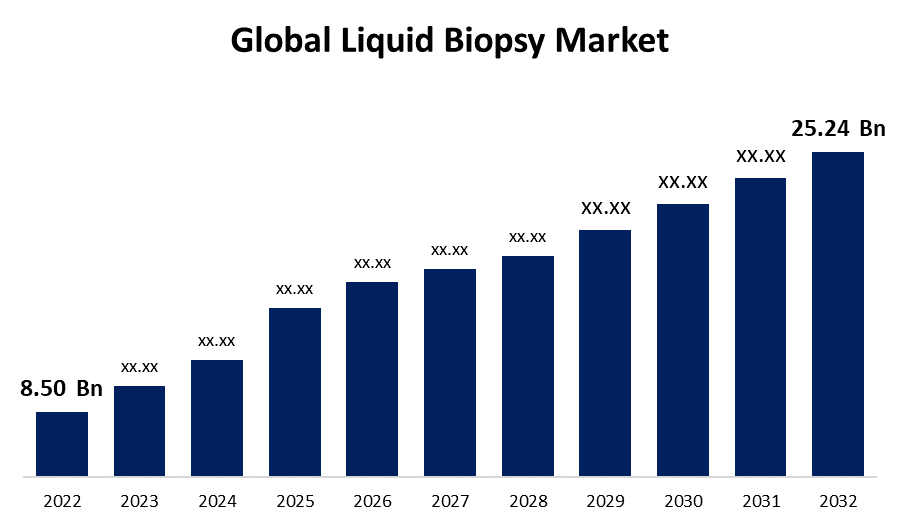

- The Liquid Biopsy Market Size was valued at USD 8.50 Billion in 2022.

- The Market Size is Growing at a CAGR of 11.5% from 2022 to 2032

- The Word wiled liquid biopsy market Size is expected to reach USD 25.24 Billion By 2032

- Asia-Pacific is expected to Grow fastest during the forecast period

Get more details on this report -

The Global Liquid Biopsy Market Size is expected to reach USD 25.24 Billion By 2032, at a CAGR of 11.5% during the forecast period 2022 to 2032.

Market Overview

Liquid biopsy is a revolutionary non-invasive medical technique that enables early cancer detection and monitoring through the analysis of various biomarkers present in a patient's blood or other body fluids. Unlike traditional tissue biopsies, which can be invasive and limited by tumor accessibility, liquid biopsy offers a less risky and more accessible means of obtaining crucial genetic and molecular information about tumors. This cutting-edge technology has the potential to transform cancer management, facilitating personalized treatment plans, tracking disease progression, and identifying early-stage cancers in asymptomatic individuals, ultimately improving patient outcomes and revolutionizing the field of oncology.

Report Coverage

This research report categorizes the market for liquid biopsy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the liquid biopsy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the liquid biopsy market.

Global Liquid Biopsy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 8.50 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 11.5% |

| 2032 Value Projection: | USD 25.24 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Technology, By Workflow, By Usage, By Types of Sample, By Circulating Biomarker, By Products , By Indication Type, By Clinical Application, By Region |

| Companies covered:: | Bio-Rad Laboratories, Biocept Inc., Guardant Health, Illumina, Inc., F. Hoffmann-La Roche Ltd., Johnson & Johnson, Laboratory Corporation of America Holdings, MDxHealth SA, QIAGEN N.V, Thermo Fisher Scientific Inc., and Other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The liquid biopsy market is driven by several key factors that have contributed to its rapid growth and adoption in the medical field, the increasing prevalence of cancer globally is a major driver. As cancer rates rise, there is a growing need for accurate and less invasive diagnostic methods, making liquid biopsy an attractive option. Advancements in technology and genomics have played a crucial role. The development of high-throughput sequencing techniques and sensitive molecular analysis tools has enabled the detection of minute amounts of circulating tumor DNA and other biomarkers in blood samples, enhancing the efficacy of liquid biopsy tests. The potential of liquid biopsy to aid in early cancer detection and monitoring treatment response has garnered significant interest from healthcare providers and patients alike. Early detection can lead to better treatment outcomes and improved survival rates, driving the demand for liquid biopsy tests. Moreover, the rising focus on personalized medicine and targeted therapies has boosted the market. Liquid biopsy provides a valuable means to identify specific genetic mutations and alterations in tumors, allowing clinicians to tailor treatment plans to individual patients. Additionally, the non-invasive nature of liquid biopsy compared to traditional tissue biopsies reduces patient discomfort and complications, making it a preferred option for both physicians and patients. Overall, collaborations between biotechnology and pharmaceutical companies to develop innovative liquid biopsy technologies have accelerated market growth.

Restraining Factors

Despite the promising growth prospects, the liquid biopsy market faces several restraints that hinder its full potential, the high cost of liquid biopsy tests and related equipment poses a significant challenge, limiting their accessibility to a broader patient population. The regulatory hurdles and the need for extensive clinical validation can slow down the approval and adoption of liquid biopsy technologies. The complexity of analyzing and interpreting biomarker data from liquid biopsies may lead to false positives or negatives, affecting the reliability of results.

Market Segmentation

- In 2022, the NGS segment accounted for around 52.8% market share

On the basis of the technology, the global liquid biopsy market is segmented into NGS, PCR, FISH, and others. The NGS (Next-Generation Sequencing) segment has held the largest market share in the liquid biopsy market due to its exceptional capabilities in detecting and analyzing genetic mutations and alterations. NGS offers high-throughput sequencing of circulating tumor DNA and other biomarkers, providing precise and comprehensive insights into cancer profiles. Its ability to handle multiple samples simultaneously and rapidly generate large amounts of genomic data has made NGS the preferred choice for liquid biopsy testing. Additionally, continuous advancements in NGS technology, increased adoption in research and clinical settings, and declining sequencing costs have further propelled its dominance in the market.

- The blood segment held the largest market over the forecast period

Based on the sample type, the global liquid biopsy market is segmented into blood, urine, saliva, and cerebrospinal fluid. The blood segment dominated the liquid biopsy market over the forecast period primarily due to its non-invasive nature and ease of sample collection. Blood-based liquid biopsies offer a convenient and accessible method to detect and analyze circulating tumor cells (CTCs) and cell-free DNA (cfDNA), providing valuable information about cancer progression, treatment response, and genetic mutations. This has led to widespread adoption by healthcare providers and patients, making it the largest and preferred segment in the market for liquid biopsy testing during the projected period.

- The lung cancer segment held the largest revenue share of around 31.6% in 2022.

Based on the indication, the global liquid biopsy market is segmented into lung cancer, breast cancer, prostate cancer, colorectal cancer, melanoma, and others. The lung cancer segment held the largest share in the liquid biopsy market owing to the high incidence and prevalence of lung cancer globally. Liquid biopsy offers a non-invasive and repeatable method for early detection, monitoring, and assessment of treatment response in lung cancer patients. The ability to analyze circulating tumor DNA (ctDNA) and other biomarkers in blood samples has made liquid biopsy a valuable tool in lung cancer management, leading to its widespread adoption and prominence in this particular segment of the market.

- The cell-free DNA segment is expected to grow at a significant CAGR of around 11.6% during the forecast period

Based on the circulating biomarker, the global liquid biopsy market is segmented into circulating tumor cells, cell-free DNA, circulating cell-free RNA, exosomes & extracellular vesicles, and others. The cell-free DNA (cfDNA) segment is anticipated to witness substantial growth in the liquid biopsy market due to its remarkable potential in cancer diagnosis and monitoring. cfDNA-based liquid biopsies allow the detection of tumor-specific genetic mutations and alterations, offering a non-invasive and real-time approach to track cancer progression and treatment response. As technology continues to improve, enabling the detection of low-abundance cfDNA, and more research validates its clinical utility, the demand for cfDNA-based liquid biopsy tests is expected to increase, driving significant market growth.

Regional Segment Analysis of the Liquid Biopsy Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 47.3% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as a dominant player in the liquid biopsy market, holding the largest market share for several key reasons. The region benefits from a robust healthcare infrastructure and a high level of awareness about the importance of early cancer detection and personalized medicine. Significant investments in research and development, along with the presence of major biotechnology and pharmaceutical companies, have fostered the advancement of liquid biopsy technologies. Additionally, North America is home to numerous clinical trials and collaborations between academia and industry, driving innovation and commercialization of liquid biopsy products.

Asia-Pacific is expected to experience the fastest growth in the liquid biopsy market during the forecast period, due to the rising prevalence of cancer, along with an aging population, which creates a significant demand for early detection and accurate monitoring solutions. Increasing investments in healthcare infrastructure and research capabilities have facilitated the adoption of advanced medical technologies, including liquid biopsy.

Recent Developments

- In July 2022, Nanostics Inc. announced the start of its validation study for its ClarityDX diagnostic platform clinical research, which is a noninvasive liquid biopsy test for bladder cancer.

- In June 2021, Biocept Inc. and Quest Diagnostics cooperated to create a cutting-edge NGS diagnostic technique for lung cancer patients.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global liquid biopsy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Bio-Rad Laboratories

- Biocept Inc.

- Guardant Health

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson

- Laboratory Corporation of America Holdings

- MDxHealth SA

- QIAGEN N.V

- Thermo Fisher Scientific Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global liquid biopsy market based on the below-mentioned segments:

Liquid Biopsy Market, By Technology

- NGS

- PCR

- FISH

- Others

Liquid Biopsy Market, By Workflow

- Sample Preparation

- Library Preparation

- Sequencing

- Data Analysis

Liquid Biopsy Market, By Usage

- RUO

- Clinical

Liquid Biopsy Market, By Type of Sample

- Blood

- Urine

- Saliva

- Cerebrospinal Fluid

Liquid Biopsy Market, By Circulating Biomarker

- Circulating Tumor Cells

- Cell-free DNA

- Circulating Cell-Free RNA

- Exosomes & Extracellular Vesicles

- Others

Liquid Biopsy Market, By Products

- Test/Services

- Kits & Consumable

- Instruments

Liquid Biopsy Market, By Indication Type

- Lung Cancer

- Breast Cancer

- Prostate Cancer

- Colorectal Cancer

- Melanoma

- Others

Liquid Biopsy Market, By Clinical Application

- Treatment Monitoring

- Prognosis & Recurrence Monitoring

- Treatment Selection

- Diagnosis & Screening

Liquid Biopsy Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?