Global Liquid Explosives Detector Market Size, Share, and COVID-19 Impact Analysis, By Technology (Infrared Spectroscopy, Raman Spectroscopy, Mass Spectrometry, Ion Mobility Spectrometry, and Others), By Application (Aviation Security, Public Safety, Border Security, and Others), By End-User (Airports, Military & Defense, Law Enforcement Agencies, and Others), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Liquid Explosives Detector Market Insights Forecasts to 2033

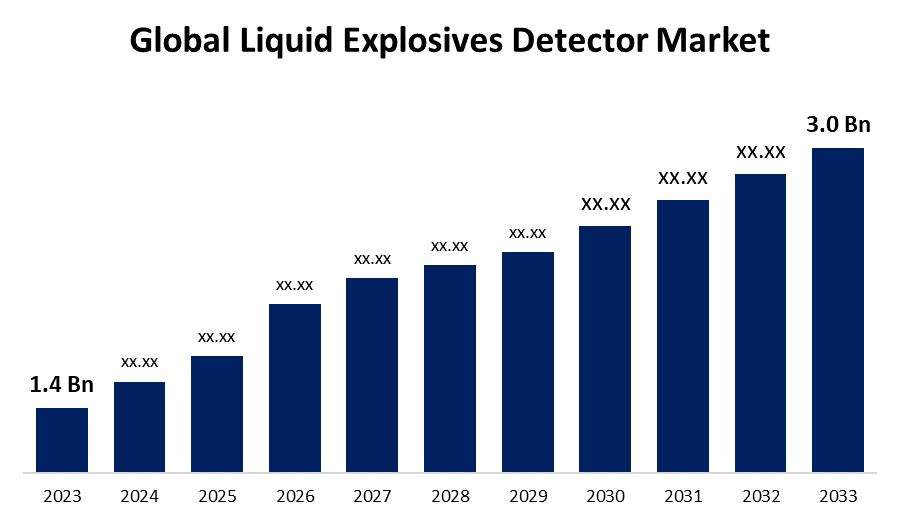

- The Global Liquid Explosives Detector Market Size was Valued at USD 1.4 Billion in 2023

- The Market Size is Growing at a CAGR of 7.92% from 2023 to 2033

- The Worldwide Liquid Explosives Detector Market Size is Expected to Reach USD 3.0 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Liquid Explosives Detector Market Size is Expected to Grow from 1.4 Billion in 2023 to USD 3.0 Billion by 2033, at a CAGR of 7.92% during the forecast period 2023-2033.

Market Overview

The liquid explosives detector market is the industry involved in developing, manufacturing, and deploying devices and systems capable of detecting liquids used as explosives. Liquid explosives detectors are mainly used in security-sensitive settings to identify and preclude the transport of hazardous liquids that could potentially harm public safety or infrastructure. Furthermore, market growth prospects for Liquid Explosives Detectors are expected to be high, especially with the issues of the increasingly growing global security concerns, improvement in the detection technologies and demanding regulatory mandates for public safety. Expanded usage in aeronautics, transportation, and critical infrastructure, along with increased investments in security systems, provides further impetus for demanding growth in the market. Moreover, the key players in this area are manufacturers of detection equipment, system integrators, and technology innovators in the analysis of liquids and explosives. The market also encompasses partnerships with government agencies and security organizations.

For instance, in July 2022, Teledyne FLIR Defense introduced a lightweight vehicle surveillance system with cutting-edge counter-drone capabilities. Moreover, Smiths Detection introduced the HI-SCAN 7555 DV, a dual-view X-ray scanner, for enhanced explosives detection, specifically targeting high-security areas like airports and border checkpoints. This device improves screening efficiency with automation and robust threat-detection capabilities.

Opportunities and Trends in the Global Liquid Explosives Detector Market:

The liquid explosives detector Market has huge growth opportunities in terms of adoption in aviation, critical infrastructure, and huge public events. The market trend includes AI for accuracy, portable, and lightweight systems for accommodation, multimodal systems for combining X-ray and trace analysis, regional expansion in Asia-Pacific, and strategic partnerships for innovation and market reach.

Report Coverage

This research report categorizes the global liquid explosives detector market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global liquid explosives detector market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global liquid explosives detector market.

Global Liquid Explosives Detector Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.92% |

| 2033 Value Projection: | USD 3.0 Billion |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 144 |

| Segments covered: | By Technology, By Application, By End-User, By Region |

| Companies covered:: | Smiths Detection, L3Harris Technologies, OSI Systems, Nuctech Company Limited, FLIR Systems, Chemring Group, Autoclear, Bruker Corporation, Leidos Holdings, Rapiscan Systems, Kromek Group, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The heightened security concerns all over the world, advancements in trace detection technology, increased use of improvised explosive devices by insurgent groups, and increased government funding for innovative research and deployment of new detection methods like Raman spectroscopy and laser-induced breakdown spectroscopy drive the liquid explosives detector market.

Governments in the U.S. and Europe support innovations in detection technology, such as standoff systems, to increase efficiency and safety in operations (College of Engineering, Lincoln Laboratory). Increasing security requirements for airports and other infrastructure boosts demand (Combating Terrorism Center, Lincoln Laboratory). Public-private partnerships, such as grants for research into lightweight detection technologies, are increasing the pace of innovation and market expansion.

Restraints & Challenges

Difficulties in the liquid explosives detector market include high development costs, extensive integration with other security systems, and the likelihood of generating false alarms. Moreover, limited adoption in regions which can be sensitive to cost and the need for trained personnel to operate advanced systems also constrain growth.

Market Segmentation

The global liquid explosives detector market share is classified into technology, application and end-user.

• The infrared spectroscopy segment is expected to hold the largest share of the global liquid explosives detector market during the forecast period.

Based on technology, the global liquid explosives detector market is categorized as infrared spectroscopy, Raman spectroscopy, mass spectrometry, ion mobility spectrometry, and Others. Among these, the infrared spectroscopy segment is expected to hold the largest share of the global Liquid Explosives Detector market during the forecast period. This dominance comes with its widespread use in checking for liquid explosives through accurate and swift molecular analysis, which is crucial for security purposes in airports, borders, and other critical infrastructure. Besides, infrared spectroscopy provides high sensitivity and reliability, making it the preferred choice for meeting rigid security regulations worldwide for energy generation.

• The border security segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the global liquid explosives detector market is categorized as aviation security, public safety, border security, and others. Among these, the border security segment is expected to grow at the fastest CAGR during the forecast period. As governments become anxious over the terrorism scenario and the illegal transfer of explosives across their borders, they are spending more on developing advanced detection technologies for secure border control. These technologies are necessary for the identification of explosive material in cargo shipments, vehicles, and individuals moving about in potentially sensitive regions.

• The airports segment is expected to hold the largest share of the global liquid explosives detector market during the forecast period.

Based on end-user, the global liquid explosives detector market is categorized as airports, military & defense, law enforcement agencies, and others. Among these, the airports segment is expected to hold the largest share of the global liquid explosives detector market during the forecast period. This is driven by the critical role these detectors play in enhancing aviation security, ensuring compliance with aviation regulations, and preventing the transportation of liquid-based explosives through air travel. Further, growing investments in security infrastructure and heightened global terrorism concerns have increased the demand for advanced detection systems at airports.

Regional Segment Analysis of the Global Liquid Explosives Detector Market

• North America (U.S., Canada, Mexico)

• Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

• Asia Pacific (China, Japan, India, Rest of APAC)

• South America (Brazil and the Rest of South America)

• The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global liquid explosives detector market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global liquid explosives detector market over the forecast period. This is being driven by increased security concerns, stiff regulatory standards, as well as advancements in detection technologies within the aviation and transportation sectors. The U.S. is one of the biggest contributors, hence with a lot of investments through defence and public safety initiatives. More recently, the focus has been on developing multi-modal detection systems, which integrate several technologies that combine spectroscopy with mass spectrometry to enhance their sensitivity and reliability. In 2022, Smiths Detection launched its latest release, the HI-SCAN 7555 DV, a dual-view X-ray scanner for high-threat environments, such as airports.

Asia Pacific is expected to grow at the fastest CAGR growth of the global liquid explosives detector market during the forecast period. Growth within this region is driven by increasing security concerns, especially in the countries of India, China, and Japan. The APAC market is witnessing high investments in transportation infrastructure and border security and has been driven by rapid urbanization as well as the increasing threats from terrorism. The region is witnessing an increase in security measures by the governments, with notable initiatives through India and Australia countries, deploying advanced liquid explosives detectors in airports and at border checkposts. Advances in detection technologies, such as AI and multi-modal systems, are driving growth in demand for high-tech security solutions, increasing the competitive force in the APAC market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global liquid explosives detector market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smiths Detection

- L3Harris Technologies

- OSI Systems

- Nuctech Company Limited

- FLIR Systems

- Chemring Group

- Autoclear

- Bruker Corporation

- Leidos Holdings

- Rapiscan Systems

- Kromek Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In September 2022, Smiths Detection India inked an MOU with the Indian government's Bharat Electronics Limited to create high-energy X-ray screening technology in India.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global liquid explosives detector market based on the below-mentioned segments:

Global Liquid Explosives Detector Market, By Technology

- Infrared Spectroscopy

- Raman Spectroscopy

- Mass Spectrometry

- Ion Mobility Spectrometry

- Others

Global Liquid Explosives Detector Market, By Application

- Aviation Security

- Public Safety

- Border Security

- Others

Global Liquid Explosives Detector Market, By End-User

- Airports

- Military & Defense

- Law Enforcement Agencies

- Others

Global Liquid Explosives Detector Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global liquid explosives detector market over the forecast period?The global liquid explosives detector market size is expected to grow from USD 1.4 Billion in 2023 to USD 3.0 Billion by 2033, at a CAGR of 7.92% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global liquid explosives detector market?North America is projected to hold the largest share of the global liquid explosives detector market over the forecast period.

-

3. Who are the top key players in the global liquid explosives detector market?Smiths Detection, L3Harris Technologies, OSI Systems, Nuctech Company Limited, FLIR Systems, Chemring Group, Autoclear, Bruker Corporation, Leidos Holdings, Rapiscan Systems, Kromek Group and Others.

Need help to buy this report?