Global Lithium Cobalt Oxide Cathode Materials Market Size, Share, and COVID-19 Impact Analysis, By Type (4.35V LiCoO2 Material, 4.40V LiCoO2 Material), By Application (Laptops and Tablets, Smartphone), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Advanced MaterialsGlobal Lithium Cobalt Oxide Cathode Materials Market Insights Forecasts to 2033

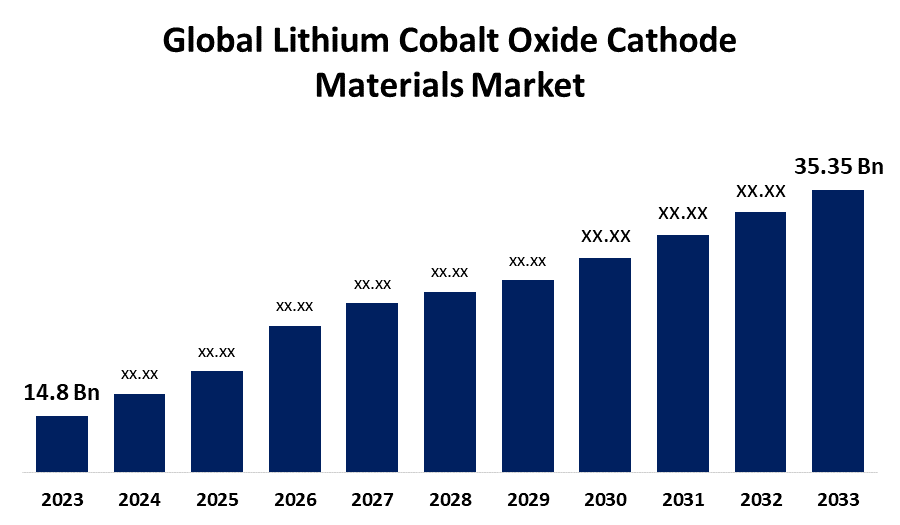

- The Global Lithium Cobalt Oxide Cathode Materials Market Size was Valued at USD 14.8 Billion in 2023

- The Market Size is Growing at a CAGR of 9.10% from 2023 to 2033

- The Worldwide Lithium Cobalt Oxide Cathode Materials Market Size is Expected to Reach USD 35.35 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Lithium Cobalt Oxide Cathode Materials Market Size is Anticipated to Exceed USD 35.35 Billion by 2033, Growing at a CAGR of 9.10% from 2023 to 2033.

Market Overview

A lithium cobalt oxide cathode material is a component used in lithium-ion batteries where lithium cobalt oxide serves as the active material. LCO is known for its high energy density, making it well-suited for applications requiring compact and lightweight batteries, such as in portable electronic devices like smartphones, laptops, and tablets. Cobalt in LCO cathodes provides high electrical conductivity and stability, which improves battery performance and durability. The material works by intercalating lithium ions between layers of cobalt oxide during charge and discharge cycles. For Instance, In August 2023, Altmin, a battery materials company, and ARCI, under the Union Ministry of Science and Technology, launched India's first 10 MW pilot facility for Cathode Active Material (CAM) production at the latter's site in Balapur, Hyderabad.

Report Coverage

This research report categorizes the market for lithium cobalt oxide cathode materials based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the lithium cobalt oxide cathode materials market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the lithium cobalt oxide cathode materials market.

Global Lithium Cobalt Oxide Cathode Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.10% |

| 2033 Value Projection: | USD 35.35 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 217 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Type, By Application, and By Region |

| Companies covered:: | XTC New Energy Materials (Xiamen) Co., Ltd., Ningbo Shanshan Co., Ltd., Greatpower Technology Co., Ltd., Golden Dragon Capital Limited, Zhejiang Huayou Cobalt, Beijing Easpring Material Technology, Hunan Changyuan Lico Co Ltd., Pulead Technology Industry Co., Ltd., BTR New Material Group Co., Ltd., Umicore, Advanced Lithium Electrochemistry, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand for high-energy-density batteries in electric vehicles and consumer electronics drives the lithium cobalt oxide (LCO) cathode materials market. Advances in battery technology, coupled with supportive government policies and incentives for EV adoption and renewable energy storage, further boost market growth. The availability and cost of raw materials, particularly cobalt, play a crucial role in shaping the market. Additionally, environmental concerns and the push for sustainable solutions, including recycling technologies, influence the sector. Competitive pressures from alternative cathode materials and advancements in manufacturing processes also impact the demand and development of LCO cathodes.

Restraining Factors

The lithium cobalt oxide (LCO) cathode materials market faces several restraining factors including high costs and supply issues related to cobalt, significant environmental and ethical concerns, and limited energy density compared to newer materials that hinder the market. Additionally, LCO batteries face safety concerns due to thermal instability, and competition from alternative cathode materials with better performance and lower costs further affects their market share. High manufacturing expenses and challenges in recycling also contribute to the constraints on the LCO cathode materials market.

Market Segmentation

The lithium cobalt oxide cathode materials market share is classified into type and application.

- The 4.35v licoo2 material segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the lithium cobalt oxide cathode materials market is classified into 4.35v licoo2 material, and 4.40v licoo2 material. Among these, the 4.35v licoo2 material segment is estimated to hold the highest market revenue share through the projected period. This segment's dominance is attributed to its established market presence, optimal balance between energy density and stability, and cost-effectiveness compared to the 4.40V variant. The 4.35V licoo2 material's widespread use in consumer electronics and portable devices, coupled with its proven performance and competitive pricing, reinforces its leading position in the market.

- The smartphones segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the lithium cobalt oxide cathode materials market is divided into laptops tablets, and smartphones. Among these, the smartphones segment is anticipated to hold the largest market share through the forecast period. The smartphone segment is attributed to the high global demand for smartphones, which drives significant use of LCO cathodes due to their high energy density and compact size. The frequent and reliable performance required for smartphone batteries further boosts the segment's prominence. Additionally, the sheer volume of smartphone sales surpasses that of laptops and tablets, reinforcing the leading market share of LCO materials used in smartphones.

Regional Segment Analysis of the Lithium Cobalt Oxide Cathode Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the lithium cobalt oxide cathode materials market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the lithium cobalt oxide cathode materials market over the predicted timeframe. The region's strong focus on technological innovation and research, coupled with high demand for consumer electronics and a growing electric vehicle market, fuels significant consumption of LCO materials. Government policies and investments promoting green technologies and EV adoption further bolster market growth. Additionally, established supply chains and a strong presence of major battery manufacturers enhance the availability and utilization of LCO cathodes in North America.

Asia Pacific is expected to grow at the fastest CAGR growth of the lithium cobalt oxide cathode materials market during the forecast period. This rapid growth is driven by the region's industrialization, rising demand for consumer electronics, and significant growth in the electric vehicle sector. Key factors include the presence of major battery manufacturers, ongoing technological advancements, and supportive government policies and incentives for green technologies driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the lithium cobalt oxide cathode materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- XTC New Energy Materials (Xiamen) Co., Ltd.

- Ningbo Shanshan Co., Ltd.

- Greatpower Technology Co., Ltd.

- Golden Dragon Capital Limited

- Zhejiang Huayou Cobalt

- Beijing Easpring Material Technology

- Hunan Changyuan Lico Co Ltd.

- Pulead Technology Industry Co., Ltd.

- BTR New Material Group Co., Ltd.

- Umicore

- Advanced Lithium Electrochemistry

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Forge Battery's "Gen. 1.1 Supercell," the company's first commercial product, has achieved both UN 38.3 and UL 1642 certifications that prove the cells exceed the most demanding safety requirements, allowing shipping to client locations.

- In April 2024, LANXESS, a leading specialty chemicals company, and IBU-tec Advanced Materials launched a groundbreaking research cooperation. The collaboration intends to create high-performance iron oxides for lithium iron phosphate (LFP) cathode materials, which could improve the capacities of batteries used in electric vehicles and stationary energy storage devices.

- In April 2024, Our Next Energy Inc. (ONE), a Michigan-based energy storage technology company, and L&F, a South Korean cathode active materials (CAM) producer, entered into a Memorandum of Understanding (MOU) to collaborate on the validation, qualification, and production of a mid to long-term supply of lithium iron phosphate (LFP) CAM.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the lithium cobalt oxide cathode materials market based on the below-mentioned segments:

Global Lithium Cobalt Oxide Cathode Materials Market, By Type

- 4.35V LiCoO2 Material

- 4.40V LiCoO2 Material

Global Lithium Cobalt Oxide Cathode Materials Market, By Application

- Laptops and Tablets

- Smartphone

Global Lithium Cobalt Oxide Cathode Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the lithium cobalt oxide cathode materials market over the forecast period?The lithium cobalt oxide cathode materials market is projected to expand at a CAGR of 9.10% during the forecast period.

-

2. What is the market size of the lithium cobalt oxide cathode materials market?The Global Lithium Cobalt Oxide Cathode Materials Market Size is Expected to Grow from USD 14.8 Billion in 2023 to USD 35.35 Billion by 2033, at a CAGR of 9.10% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the lithium cobalt oxide cathode materials market?North America is anticipated to hold the largest share of the lithium cobalt oxide cathode materials market over the predicted timeframe.

Need help to buy this report?