Global Lithium Cobalt Oxide Market Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial, Battery), By Application (Consumer electronics, Electric vehicles, Medical Devices, Energy store systems, Telecommunication), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Specialty & Fine ChemicalsGlobal Lithium Cobalt Oxide Market Insights Forecasts to 2033

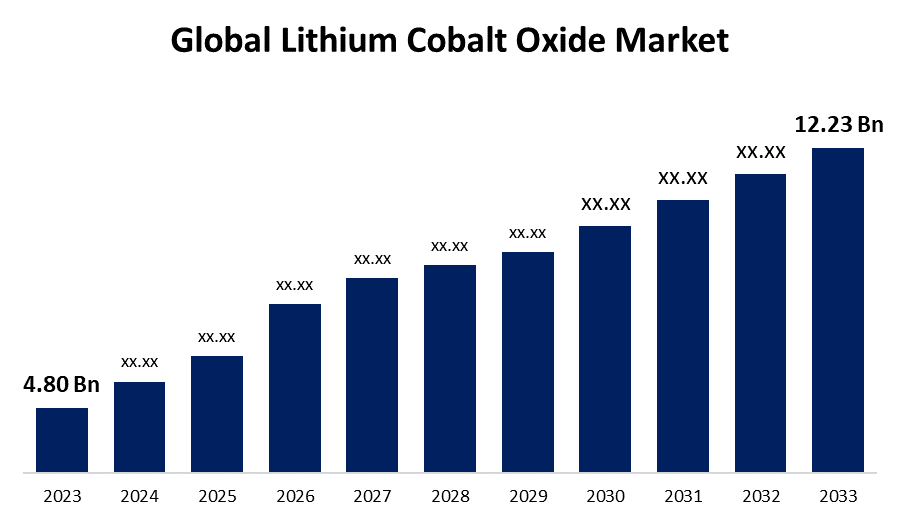

- The Global Lithium Cobalt Oxide Market Size was Valued at USD 4.80 Billion in 2023

- The Market Size is Growing at a CAGR of 9.80% from 2023 to 2033

- The Worldwide Lithium Cobalt Oxide Market Size is Expected to Reach USD 12.23 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Lithium Cobalt Oxide Market Size is Anticipated to Exceed USD 12.23 Billion by 2033, Growing at a CAGR of 9.80% from 2023 to 2033.

Market Overview

Lithium cobalt dioxide has the chemical formula LiCoO2. It is also known as lithium cobalt mixed oxide or lithium cobaltite. This bluish-grey crystalline solid is widely utilized in rechargeable lithium-ion batteries. Cobalt, when used in positive electrodes in lamellar form, improves the stability and power of lithium-ion (Li-Ion) batteries due to its high conductivity. The Lithium Cobalt Oxide (LiCoO2) market refers to the global economic ecosystem surrounding the production, distribution, and consumption of LiCoO2. These batteries are essential power sources for various applications, including consumer electronics like smartphones and laptops, electric vehicles (EVs), and energy storage systems. The market encompasses factors such as technological advancements, regulatory policies, supply chain dynamics, raw material availability, consumer demand trends, and economic conditions, all of which influence the production, pricing, and growth of LiCoO2-based products.

Report Coverage

This research report categorizes the Lithium Cobalt Oxide market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Lithium Cobalt Oxide market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Lithium Cobalt Oxide market.

Global Lithium Cobalt Oxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.80 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.80% |

| 2033 Value Projection: | USD 12.23 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Grade, By Application, By Region |

| Companies covered:: | Elcan Industries Inc., Horiba Scientific, Huayou New Energy Technology Co. Ltd., NIPPON CHEMICAL INDUSTRIAL CO., LTD., Targray, Otto Chemie Pvt. Ltd., Merck, Nicheia Corporation, Stanford Advanced Material, Tokyo Chemical Materials, LG Chem, BYD Company Ltd., Tragray, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The lithium cobalt oxide (LiCoO2) market is primarily driven by its critical position in lithium-ion batteries, which power a wide range of consumer gadgets, electric vehicles (EVs), and energy storage systems. Technological developments and regulatory assistance are driving the lithium cobalt oxide market. Population expansion, urbanization, and shifting consumer tastes all contribute to the increasing demand for lithium cobalt oxide products and services. The need for lithium cobalt is especially noticeable in the portable electronics industry, where lithium cobalt oxide batteries are frequently employed due to their high energy density and long cycle life. Government policies supporting clean energy and electric vehicle adoption further bolster demand, while supply chain dynamics and raw material availability, such as lithium and cobalt, play crucial roles in market stability. Ongoing research and development activities seek to improve battery performance, energy density, and safety. For example, replacing pure lithium cobalt oxide cathode material with a mixture of lithium cobalt and nickel oxide enhanced the stability and performance of lithium cobalt oxide batteries. Furthermore, the development of thin-film lithium cobalt oxide electrodes is critical for the evolution of high-performance thin-film lithium batteries.

Restraining Factors

The lithium cobalt oxide market faces challenges due to high operational costs associated with maintaining temperature-controlled facilities and complying with stringent regulatory requirements. Complex handling needs for sensitive medications, global supply chain issues, risks of product spoilage, and competitive market dynamics further restrain market growth.

Market Segmentation

The lithium cobalt oxide market share is classified intograde and application.

- The battery segment is estimated to hold the highest market revenue share through the projected period.

Based on the grade, the lithium cobalt oxide market is classified into industrial and battery. Among these, the battery segment is estimated to hold the highest market revenue share through the projected period. The battery-grade segment emerges as the dominant force, with a sizable market share due to its critical role in lithium-ion battery manufacture. Battery-grade lithium cobalt oxide is designed to meet high-quality criteria, ensuring the best electrochemical performance, stability, and safety in batteries. This grade largely addresses the growing demand for high-performance batteries in consumer devices, electric vehicles, and energy storage systems. Manufacturers prioritize the manufacture of battery-grade lithium cobalt oxide to satisfy the increasing requirements of these rapidly developing sectors, driving its dominance and ongoing growth within the market.

- The electric vehicles segment dominates the market with the largest market share through the forecast period.

Based on the application, the lithium cobalt oxide market is categorized into consumer electronics, electric vehicles, medical devices, energy store systems, and telecommunication. Among these, the electric vehicles segment dominates the market with the largest market share through the forecast period. The growing demand for electric vehicles is fueling the lithium cobalt oxide market. Electric vehicles are powered by lithium-ion batteries, which contain lithium cobalt oxide as one of their main components. The growing government measures to encourage the usage of electric vehicles are also driving the growth of the lithium cobalt oxide market.

Regional Segment Analysis of the Lithium Cobalt Oxide Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the lithium cobalt oxide market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the lithium cobalt oxide market over the predicted timeframe. The Asia-Pacific region emerges as the market leader, driven by strong industrial expansion, technological innovation, and rising demand for lithium-ion batteries. China, South Korea, and Japan are global leaders in battery manufacture, owing to their superior manufacturing skills and large supply chains. Furthermore, the rising adoption of electric cars, the expansion of consumer electronics industries, and government efforts promoting renewable energy storage are driving regional demand for lithium cobalt oxide. Asia-Pacific's strategic position as a manufacturing hub and its constant drive for technical improvement make it a vital player in the worldwide market.Top of Form

Bottom of Form

North America is expected to grow at the fastest CAGR growth of the lithium cobalt oxide market during the forecast period. The increasing demand for lithium-ion batteries in the automotive and defense industries has driven market expansion in this region. The United States is the primary market for lithium cobalt oxide in North America. The country is a major producer of lithium-ion batteries and has a significant market for consumer electronics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the lithium cobalt oxide market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Elcan Industries Inc.

- Horiba Scientific

- Huayou New Energy Technology Co. Ltd.

- NIPPON CHEMICAL INDUSTRIAL CO., LTD.

- Targray

- Otto Chemie Pvt. Ltd.

- Merck

- Nicheia Corporation

- Stanford Advanced Material

- Tokyo Chemical Materials

- LG Chem

- BYD Company Ltd.

- Tragray

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Toshiba Corporation made a significant advance in lithium-ion battery technology. They created a new battery with a cobalt-free 5V-class high-potential cathode material that greatly reduces the formation of performance-degrading gasses as a byproduct during battery operation.

- In September 2023, Blue Whale Materials, a Washington-based recycler of lithium-ion batteries, announced the opening of its first processing facility in Bartlesville, Oklahoma.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the lithium cobalt oxide market based on the below-mentioned segments:

Global Lithium Cobalt Oxide Market, By Grade

- Industrial

- Battery

Global Lithium Cobalt Oxide Market, By Application

- Consumer electronics

- Electric vehicles

- Medical Devices

- Energy store systems

- Telecommunication

Global Lithium Cobalt Oxide Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the lithium cobalt oxide market over the forecast period?The lithium cobalt oxide market is projected to expand at a CAGR of 9.80% during the forecast period.

-

2. What is the market size of the lithium cobalt oxide market?The Global Lithium Cobalt Oxide Market Size is Expected to Grow from USD 4.80 Billion in 2023 to USD 12.23 Billion by 2033, at a CAGR of 9.80% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the lithium cobalt oxide market?Asia Pacific is anticipated to hold the largest share of the lithium cobalt oxide market over the predicted timeframe.

Need help to buy this report?