Global Lithium-Ion Battery Separator Market Size, Share, and COVID-19 Impact Analysis, By Thickness (16µm, 20µm, and 25µm), By Material (Polypropylene (PP), Polyethylene (PE), Nylon, and Others), By End-User Industry (Industrial, Consumer Electronics, Automotive, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Lithium-Ion Battery Separator Market Insights Forecasts to 2033

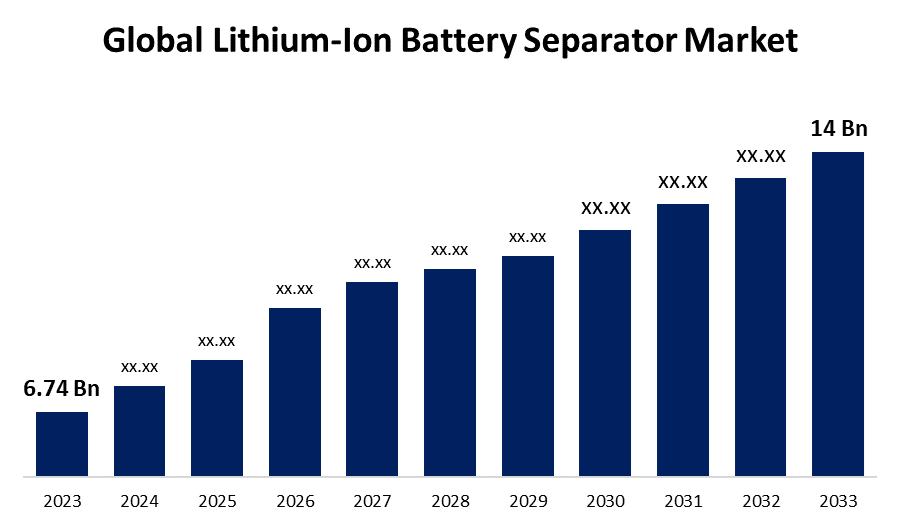

- The Global Lithium-Ion Battery Separator Market Size was Valued at USD 6.74 Billion in 2023

- The Market Size is Growing at a CAGR of 7.58% from 2023 to 2033

- The Worldwide Lithium-Ion Battery Separator Market Size is Expected to Reach USD 14 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Lithium-Ion Battery Separator Market Size is Anticipated to Exceed USD 14 Billion by 2033, Growing at a CAGR of 7.58% from 2023 to 2033.

Market Overview

Lithium-ion battery separators act as barriers between the anode and cathode, preventing direct contact while allowing the ionic transport necessary for battery operation. They are made from polymeric materials like polyethylene (PE) and polypropylene (PP). These separators are preferred for their mechanical strength, chemical stability, and heat resistance.

They improve safety by preventing short circuits. Many modern separators are designed to melt and close their pores when exposed to excessive heat, mitigating the risk of thermal runaway. Additionally, they offer efficient ionic conductivity while blocking electronic conduction, which is crucial for maintaining battery performance during charge and discharge cycles.

Moreover, these separators have excellent mechanical stability and can withstand stresses during battery assembly and operation, which prevents their degradation over time. Their chemical compatibility with electrolytes and electrode materials is vital to avoid adverse reactions. Lean manufacturing processes enable cost-effective production without compromising performance standards, making them suitable for widespread use in consumer electronics and electric vehicles.

There have been several recent developments in the global lithium-ion battery separator market. For instance, in July 2024, ENTEK, a US-owned producer of “wet-process” Li-ion battery separator materials, announced that it received a conditional commitment of up to $1.2bn from the US Department of Energy’s (DOE) Loans Programmes Office.

Report Coverage

This research report categorizes the market for the global lithium-ion battery separator based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global lithium-ion battery separator market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global lithium-ion battery separator market.

Global Lithium-Ion Battery Separator Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.74 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.58% |

| 2033 Value Projection: | USD 14 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 253 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Thickness, By Material, By End-User Industry, By Region |

| Companies covered:: | SEMCORP, Celgard LLC, QuantumScape, Porous Power Technologies LLC, ENTEK, Targray Technology International Inc., TEIJIN Limited, Sumitomo Chemical Company Limited, SK Innovation Co Ltd, Natrion, Gellec, Entek International LLC, Asahi Kasei Group, Mitsubishi Plastics Inc., Daramic, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

The increasing sales of electric vehicles (EVs) is the primary catalyst, as it relies heavily on high-performance lithium-ion batteries, which require efficient separators to ensure safety and performance. Governments are implementing supportive policies and incentives to promote the adoption of EVs, fueling the need for efficient and durable battery components. Additionally, the declining prices of lithium-ion batteries have made them more accessible, boosting their usage across various sectors, especially consumer electronics and renewable energy storage systems.

Moreover, advancements in battery technology are necessitating improvements in separator design to meet higher stability, lifespan, and performance. This innovation creates opportunities for manufacturers to develop next-gen separators that enhance battery efficiency and safety.

Restraining Factors

The global lithium-ion battery separator market faces restraining factors, including the demand-supply mismatch of raw materials, which might lead to increased production costs and delays in manufacturing. This mismatch is worsened by the rising demand for lithium-ion batteries across various sectors, including electric vehicles and consumer electronics. Additionally, the current separator technologies struggle to meet the evolving performance standards required for enhanced stability and lifespan. This gap in technology limits the efficiency and reliability of lithium-ion batteries. Furthermore, intense competition among large manufacturers necessitates continuous innovation, which could strain resources, impact profitability, and create a barrier to entry for small and medium-sized enterprises (SMEs).

Market Segmentation

The global lithium-ion battery separator market share is classified into thickness, material, and end-user industry.

- The 16µm segment is expected to hold the largest share of the global lithium-ion battery separator market during the forecast period.

Based on the thickness, the global lithium-ion battery separator market is divided into 16µm, 20µm, and 25µm. Among these, the 16µm segment is expected to hold the largest share of the global lithium-ion battery separator market during the forecast period. This thickness is preferred due to its balance between performance and cost-effectiveness. At 16 microns, the separator provides sufficient porosity for efficient ion transport while maintaining mechanical strength and thermal stability. The thin profile also contributes to higher energy density by allowing more active material to be packed into the battery. Additionally, the manufacturing process for 16µm separators is well-established, enabling large-scale production and consistent quality.

- The polyethylene (PE) segment is expected to hold the largest share of the global lithium-ion battery separator market during the forecast period.

Based on material, the global lithium-ion battery separator market is divided into polypropylene (PP), polyethylene (PE), nylon, and others. Among these, the polyethylene (PE) segment is expected to hold the largest share of the global lithium-ion battery separator market during the forecast period. PE separators have excellent mechanical properties, including high tensile strength and tear resistance, which enhance the structural integrity of the battery and prevent short circuits during operation. The chemical stability and compatibility of polyethylene with other battery components ensure long-term reliability and performance. Furthermore, PE separators feature a shutdown function that improves battery safety by closing pores and halting ion flow when exposed to excessive heat, mitigating the risk of thermal runaway.

- The consumer electronics segment is expected to grow at the fastest CAGR in the global lithium-ion battery separator market during the forecast period.

Based on the end-user industry, the global lithium-ion battery separator market is divided into industrial, consumer electronics, automotive, and others. Among these, the consumer electronics segment is expected to grow at the fastest CAGR in the global lithium-ion battery separator market during the forecast period. This growth is driven by the surging demand for portable electronic devices, such as smartphones, laptops, and tablets, which require efficient and reliable power sources. As consumer expectations for longer battery life and faster charging capabilities continue to rise, manufacturers focus more on enhancing battery performance through advanced separator technologies. Additionally, the rapid innovation in consumer electronics fuels the need for high-performance lithium-ion batteries, increasing the demand for effective separators. Furthermore, the use of lithium-ion batteries in emerging technologies like wearable devices and smart home products contributes to the growth.

Regional Segment Analysis of the Global Lithium-Ion Battery Separator Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is anticipated to hold the largest share of the global lithium-ion battery separator market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the global lithium-ion battery separator market over the predicted timeframe. Asia-Pacific is home to major leading market players, particularly countries like China, Japan, and South Korea, which are the major hubs for electric vehicle (EV) manufacturing. Also, the Indian government is trying hard to invite manufacturers by offering them lower taxes and other incentives. Additionally, the electric vehicles sector in this region is critical, as it relies heavily on efficient lithium-ion batteries. Government initiatives promoting clean energy and sustainable technologies further fuel the market.

The presence of leading battery manufacturers such as Panasonic, LG Chem, and BYD fuels the market, driven by their significant investments in research and development to enhance battery technology. Additionally, the region benefits from a well-established supply chain for lithium-ion batteries, including mining, material extraction, and end-product manufacturing. Strong government support aimed at reducing carbon emissions also plays a crucial role.

North America is expected to grow at the fastest pace in the global lithium-ion battery separator market during the predicted timeframe. This growth can be attributed to several factors, including the increasing demand for electric vehicles (EVs) and the rapid expansion of the consumer electronics sector. Governments in the region are implementing supportive policies and incentives for promoting EV adoption, which directly drives the need for high-performance lithium-ion batteries and their separators.

Additionally, North America has a well-developed infrastructure for battery manufacturing and innovation, facilitating advancements in separator technologies. The presence of leading battery manufacturers in the United States and Canada enhances market dynamics by creating competition and encouraging research and development. As consumer awareness regarding sustainability and energy efficiency rises, the demand for lithium-ion batteries and separators is anticipated to grow significantly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global lithium-ion battery separator market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SEMCORP

- Celgard LLC

- QuantumScape

- Porous Power Technologies LLC

- ENTEK

- Targray Technology International Inc.

- TEIJIN Limited

- Sumitomo Chemical Company Limited

- SK Innovation Co Ltd

- Natrion

- Gellec

- Entek International LLC

- Asahi Kasei Group

- Mitsubishi Plastics Inc.

- Daramic

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Asahi Kasei announced that it construct an integrated plant in Ontario, Canada for the base film manufacturing and coating of Hipore wet-process lithium-ion battery (LIB) separator.

- In April 2024, Shenzhen Senior Technology Material, one of China’s major manufacturers of separators for lithium-ion batteries, secured a six-year supply deal from South Korean electric car battery maker Samsung SDI in the firm’s latest tie-up with an overseas client.

- In January 2024, 24M unveiled a transformative new battery separator — 24M Impervio — that promised to redefine battery safety for electric vehicles (EV), energy storage systems (ESS), and consumer applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global lithium-ion battery separator market based on the below-mentioned segments:

Global Lithium-ion Battery Separator Market, By Thickness

- 16µm

- 20µm

- 25µm

Global Lithium-ion Battery Separator Market, By Material

- Polypropylene (PP)

- Polyethylene (PE)

- Nylon

- Others

Global Lithium-ion Battery Separator Market, By End-User Industry

- Industrial

- Consumer Electronics

- Automotive

- Others

Global Lithium-Ion Battery Separator Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?SEMCORP, Celgard LLC, QuantumScape, Porous Power Technologies LLC, ENTEK, Targray Technology International Inc., TEIJIN Limited, Sumitomo Chemical Company Limited, SK Innovation Co Ltd, Natrion, Gellec, Entek International LLC, Asahi Kasei Group, Mitsubishi Plastics Inc., Daramic, and Others.

-

2.What is the size of the global lithium-ion battery separator market?The Global Lithium-Ion Battery Separator Market is expected to grow from USD 6.74 Billion in 2023 to USD 14 Billion by 2033, at a CAGR of 7.58% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?Asia-Pacific is anticipated to hold the largest share of the global lithium-ion battery separator market over the predicted timeframe.

Need help to buy this report?