Global Lithium Mining Market Size, Share, Growth, and Industry Analysis, By Type (Lithium Chloride, Lithium Hydroxide, Lithium Carbonate, and Concentrate), By Source (Brine, and Hard rock), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Lithium Mining Market Insights Forecasts to 2033

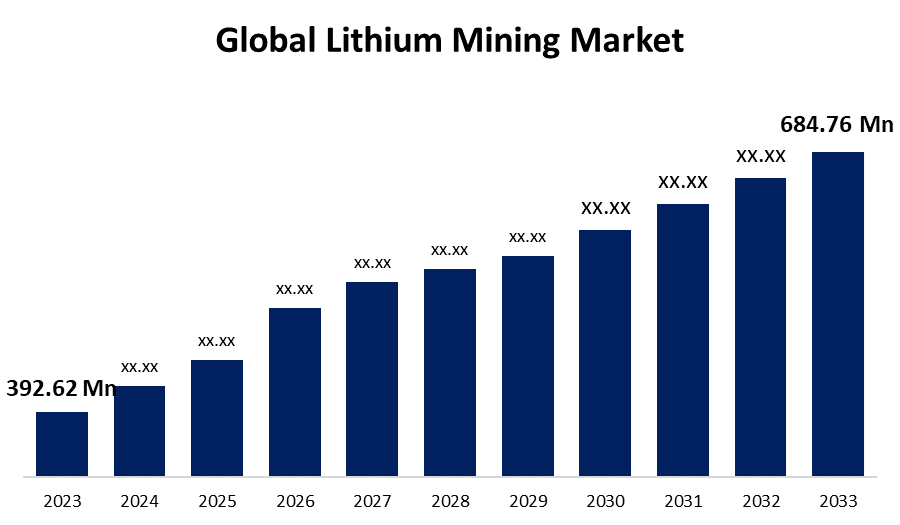

- The Global Lithium Mining Market Size was Valued at USD 392.62 Million in 2023

- The Market Size is Growing at a CAGR of 5.72% from 2023 to 2033

- The Worldwide Lithium Mining Market Size is Expected to Reach USD 684.76 Million by 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Lithium Mining Market Size is Anticipated to Exceed USD 684.76 Million by 2033, Growing at a CAGR of 5.72% from 2023 to 2033.

The lithium mining market is expanding due to its widespread use in medical devices, pharmaceuticals, and electronic vehicles.

LITHIUM MINING MARKET REPORT OVERVIEW

Lithium is a crucial element of energy-saving technology that can used in electrical vehicles and large batteries to store electricity. Lithium is mined from stones and brine. This brine is evaporated and washed in shallow PVC-lined lakes to remove sodium carbonate from it. Lithium compounds are widely used in ceramics and glassware. Ceramics' potential characteristics, such as greater durability, upgraded coating viscosity, raised glaze color, viscosity, strength, and shine of the ceramic bodies, are regarded as major drivers of ceramics, contributing to the overall expansion of the lithium mining sector.

The process of restoring lithium from ore varies depending on the mineral deposit. The procedure involves taking the mineral substance from the earth and subsequently heating and crushing it. The mashed substance is mixed with reactive substances such as sulfuric acid, and the resulting mixture is heated, filtrated, and emphasized using an evaporation method to produce saleable lithium carbonate, whereas the waste product is treated for reuse or elimination. The extraction methods are also growing, resulting in improved and productive mining processes. They are economical and energy-efficient overall. It also uses organic-based sieves, which protect the environment. Such favorable conditions present promising possibilities for the overall expansion of the lithium mining sector.

The Ministry of Mines, Government of India, has reached a significant milestone with the signing of an agreement between Khanij Bidesh India Limited (KABIL) and the Catamarca province of Argentina's state-owned enterprise, CATAMARCA MINERA Y ENERGÉTICA SOCIEDAD DEL ESTADO (CAMYEN SE), in Catamarca. KABIL will begin exploring and development of five lithium brine blocks in Argentina's Catamarca province, namely Cortadera-I, Cortadera-VII, Cortadera-VIII, Cateo-2022-01810132, and Cortadera-VI, which encompass an area of approximately 15,703 Hectare. The cost of project is around 200 crores.

Global Lithium Mining Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 392.62 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.72% |

| 2033 Value Projection: | USD 684.76 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Source, By Region |

| Companies covered:: | Orocobre Limited, Ganfeng Lithium Co. Ltd., Jiangxi Ganfeng Lithium Co. Ltd., Bacanora Lithium PLC, Nemaska Lithium Inc., Altura Mining Limited, Pilbara Minerals Limited, Critical Elements Corporation, Sayona Mining Limited, Advantage Lithium Corp., Wealth Minerals Ltd., Avalon Advanced Materials Inc., Bacanora Minerals Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

DRIVING FACTORS:

The growing use of lithium-ion batteries in the medical sector can boost market growth.

They are mostly used for lithium-ion batteries and play an important role in the worldwide healthcare sector, supplying implantable medical devices like cardiac pacemakers and insulin pumps as well as maintaining accuracy in portable health gadgets. They enhance the device's efficiency, resilience, and security, allowing for better real-time monitoring and management of persistent illnesses. They are extensively used in hearing aids, providing millions of people with hearing loss with reliable and long-lasting hearing.

RESTRAINING FACTORS

The ecological effects of the mining process can Limit the growth of the market.

Extended contact with Li-dust can lead to serious breathing disorders. There is also a scarcity of recycling setups for Li-ion batteries, ensuring recycling is an expensive process. The mined metal is processed by evaporating salt water and cleaning it with sodium carbonate in small lakes lined with PVC, which causes water pollution.

Market Segmentation

The lithium mining market share is classified into type and source.

Lithium carbonate segment accounts for the largest share of the market over the forecast period due to its widespread production via brine and solid rock mining.

Based on type, the lithium mining market is classified into lithium chloride, lithium hydroxide, lithium carbonate, and concentrate. The lithium carbonate segment accounts for the largest share of the market over the forecast period. It contributes to the majority of metal production because it is easy to produce. It is commonly used to address mental health issues in the glass and ceramic industries, as well as in medicine. The concentrate market is also expected to grow indirectly as the global hard rock mining industry expands. New technological developments in the brine manufacturing process are expected to result in a rapid increase in chloride output. The lithium carbonate is widely applied for making of lithium-ion batteries, and lithium stearate in lubricants.

The hard rock segment is the most dominating in the lithium mining market during the forecast period.

Based on the source, the lithium mining market is classified into brine and hard rock. The greatest number of lithium-containing elements are found in hard rock granular pegmatites. Spodumene is regarded as the most economically feasible source of lithium, with usual lithium assessments ranging from 0.5 to 2.5% lithium oxide. Hard rock lithium mineral mines are anticipated to play an important role in lithium availability as they are less capital intensive, and China has an important surplus of spodumene conversion capacity. Subsequently, the spodumene ore has been cleaned out of the hard rock, it is transported to a chemical converter where it is converted into carbonate or hydroxide via acidic, alkaline, or chlorination processes. This excess supply of the substance conversion capacity provides immediate opportunities for spodumene concentrate growth without requiring downstream investment.

Regional Segment Analysis of the Global Lithium Mining Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America has the biggest share of the lithium mining market throughout the forecast period.

Get more details on this report -

The continuous technological improvements are enhancing battery performance, lowering costs, and expanding their applications across consumer electronics, grid storage, and industrial purposes, propelling the sector forward. Additionally, there is a push for domestic production and supply chain resilience, which has resulted in investments in lithium-ion battery manufacturing plants around North America. Partnerships between automakers, technology businesses, and battery producers are stimulating innovation and driving market growth. These factors cumulatively point to a vibrant and dynamic market poised for continuing growth in the coming years, with potential for both existing players and newcomers to the industry.

The Asia-Pacific is the fastest-growing region during the projected timeframe.

The use of lithium-ion batteries in electronic products and medical applications is expanding, creating attractive potential for the general expansion of the lithium mining industry. India is considering incentives to encourage private companies to develop lithium processing plants in order to boost its lithium mining sector and electric vehicle (EV) battery metal supplies. Under a proposed essential minerals policy, the government plans to incentivize corporations to establish processing facilities that include beneficiation and refining phases. While the exact nature of incentives is unknown, the government draws inspiration from countries such as Australia and Canada.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global lithium mining market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Orocobre Limited

- Ganfeng Lithium Co. Ltd.

- Jiangxi Ganfeng Lithium Co. Ltd.

- Bacanora Lithium PLC

- Nemaska Lithium Inc.

- Altura Mining Limited

- Pilbara Minerals Limited

- Critical Elements Corporation

- Sayona Mining Limited

- Advantage Lithium Corp.

- Wealth Minerals Ltd.

- Avalon Advanced Materials Inc.

- Bacanora Minerals Ltd.

- Others

Key Market Developments

- In January 2023, loneer An Australian business is scheduled to receive a $700 million conditional loan from the United States Department of Energy to pursue a lithium mining project in Nevada, USA.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global lithium mining market based on the below-mentioned segments:

Global Lithium Mining Market, By Type

- Lithium Chloride

- Lithium Hydroxide

- Lithium Carbonate

- Concentrate

Global Lithium Mining Market, By Source

- Brine

- Hard rock

Global Lithium Mining Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global lithium mining market over the forecast period?The global lithium mining market size is expected to grow from USD 392.62 Million in 2023 to USD 684.76 Million by 2033, at a CAGR of 5.72% during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the global lithium mining market?North America is projected to hold the largest share of the global lithium mining market over the forecast period.

-

3.Who are the top key players in the lithium mining market?Orocobre Limited, Ganfeng Lithium Co. Ltd., Jiangxi Ganfeng Lithium Co. Ltd., Bacanora Lithium PLC, Nemaska Lithium Inc., Altura Mining Limited, Pilbara Minerals Limited, Critical Elements Corporation, Sayona Mining Limited, Advantage Lithium Corp, Wealth Minerals Ltd., Avalon Advanced Materials Inc., Bacanora Minerals Ltd., and Others.

Need help to buy this report?