Global Livestock Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Mortality, Revenue, and Other), By Animal Type (Bovine, Swine, Sheep & Goats, Poultry, and Other Animal), By Distribution Channel (Direct, Agency/Broker, Bancassurance, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Livestock Insurance Market Insights Forecasts to 2033

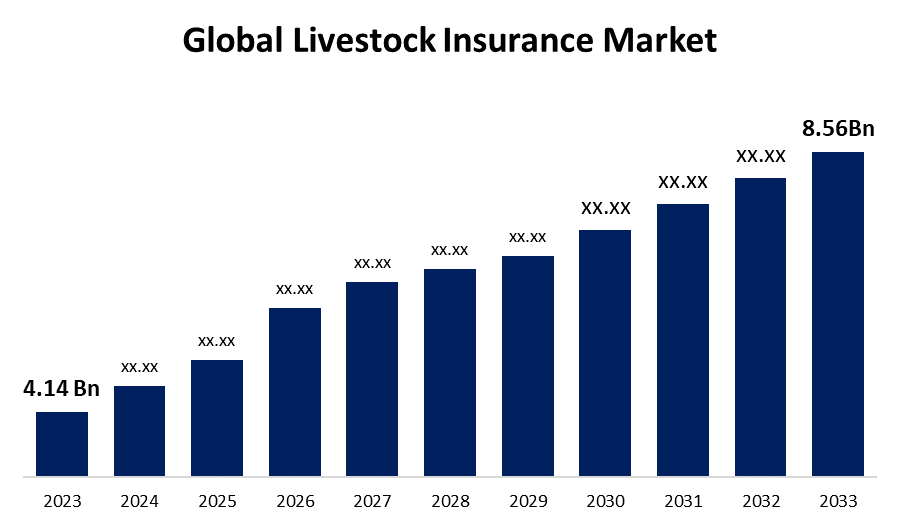

- The Global Livestock Insurance Market Size was Valued at USD 4.14 Billion in 2023

- The Market Size is Growing at a CAGR of 7.53% from 2023 to 2033

- The Worldwide Livestock Insurance Market Size is Expected to Reach USD 8.56 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Livestock Insurance Market Size is Anticipated to Exceed USD 8.56 Billion by 2033, Growing at a CAGR of 7.53% from 2023 to 2033.

Market Overview

An insurance policy expressly originated to protect livestock owners from monetary losses brought on by the theft, accidental harm, or death of their animals is known as livestock insurance. Cattle, sheep, goats, pigs, horses, and poultry are among the various types of animals it covers. It compensates the insurance bearer financially for losses made due to unforeseen circumstances that have an impact on the health or welfare of their cattle. Specialized agricultural and conventional insurance providers that cover farm and ranch activities supply it. Peril insurance should protect livestock against theft, flooding, and earthquakes. This also includes coverage if cattle are struck by a car or perish in a collision with the vehicle carrying them. Coverage of animal fatalities livestock that has perished due to an injury might be compensated through limited animal mortality coverage. Numerous variables, such as the kind and quantity of animals insured, the desired coverage level, and the risk factors about the animals and their surroundings, all affect the cost of livestock insurance. Certain safety precautions, such as immunizations, routine veterinarian exams, or locking enclosures, might be mandated by the insurance provider to lower the chance of loss. The necessity to control risk in the livestock industry and the rising demand for livestock products is likely to fuel the global livestock insurance market's steady growth throughout the forecast period.

Report Coverage

This research report categorizes the market for the global livestock insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global livestock insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global livestock insurance market.

Global Livestock Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.14 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.53% |

| 2033 Value Projection: | USD 8.56 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 280 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Coverage, By Animal Type, By Distribution Channel, By Region |

| Companies covered:: | Allianz SE, Farmers Mutual Hail Insurance Company, XL Catlin, Chubb Limited, American International Group, Zurich Insurance Group Ltd., Tokio Marine Holdings Inc., QBE Insurance Group Ltd., The Hartford Financial Services Group, RSA Insurance Group plc, Sompo Holdings, Fairfax Financial Holdings Limited, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Globally, the need for livestock insurance is primarily driven by the rising value of livestock due to reasons such as changing dietary preferences, increased animal product demand, and an expanding worldwide population. The increased expenditures on cattle have increased the financial risks related to possible losses. As a result, there's an upsurge in the sales of livestock insurance to make sure these precious possessions are safeguarded and covered against theft, death, and other events. The requirement for financial security in the agriculture industry is fulfilled by livestock insurance. Risks that might cause large financial losses for farmers and livestock owners include disease outbreaks, natural disasters, theft, and unintentional animal deaths. A safety net offered by livestock insurance enables farmers to recoup their investment and carry on with their business without suffering catastrophic financial losses. The intention to reduce these risks and protect the monetary stability of livestock enterprises is what drives the need for livestock insurance.

Restraining Factors

The unpredictable behavior of animals sometimes results in high premium rates for livestock insurance. It is also difficult for the majority of livestock owners, who often make ordinary or low incomes, to afford the expensive premiums required for livestock insurance. The majority of small-scale farmers consequently refrain from getting this insurance coverage. Consequently, this poses a significant barrier to the expansion of the livestock insurance industry.

Market Segmentation

The global livestock insurance market share is segmented into coverage, animal type, and distribution channel.

- The morality segment dominates the market with the largest market share through the forecast period.

Based on the coverage, the global livestock insurance market is segmented into mortality, revenue, and other. Among these, the morality segment dominates the market with the largest market share through the forecast period. The livestock insurance coverage known as mortality provides benefits to the policyholder if an insured animal dies from one of the covered dangers (diseases, illnesses, accidents, natural calamities, theft, etc.). It supports owners in safeguarding their assets and financial security, especially when it comes to expensive pets. According to the terms of the insurance policy, the payout amount is determined by the animal's worth at the time of death.

- The bovine segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the animal type, the global livestock insurance market is segmented into bovine, swine, sheep & goats, poultry, and other animal. Among these, the bovine segment is anticipated to grow at the fastest CAGR growth through the forecast period. This results from increased awareness of the need to reduce production risks and the use of bovine insurance plans. The losses incurred by cattle as a result of bad weather, such as illness, injury, or decreased productivity due to a lack of feed or infrastructure damage, are covered by bovine insurance. A certain level of revenue stability for dairy and beef producers is also ensured by its protection against price risk and market volatility. Due to it pays for treatment costs, livestock mortality, and biosecurity precautions, cow insurance is essential in reducing the financial losses brought on by disease epidemics. Growth in the segment is anticipated as a result of these advantages.

- The direct segment accounted for the largest revenue share through the forecast period.

Based on the distribution channel, the global livestock insurance market is segmented into direct, agency/broker, bancassurance, and others. Among these, the direct segment accounted for the largest revenue share through the forecast period. The direct distribution of livestock insurance policies, which do not include intermediaries, is witnessing a rise in sales at present. The insurance company communicates with farmers and livestock owners directly through a variety of channels, such as call centers, online platforms, and in-person meetings. In addition to handling policy inquiries, collecting premiums, and actively managing claims, the corporation distributes and sells its insurance products. A direct link between the policyholder and the insurer is made possible by this distribution channel, providing parties with ease and control.

Regional Segment Analysis of the Global Livestock Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global livestock insurance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global livestock insurance market over the predicted timeframe. Livestock farmers in North America have embraced livestock insurance to the extent that the market is well-established with reputable insurance companies. Due to the significant cattle sector in the region, the cow insurance market in North America is the largest one. A variety of cattle insurance policies are available from insurance companies, such as policies covering fodder, range, and pasture as well as death, injury, and illness insurance. To enhance risk assessment, boost productivity, and cut expenses, the livestock insurance business in North America is implementing precision agriculture technology including drones, artificial intelligence, and satellite imagery. Risks associated with climate change, like drought and severe weather, are significant concerns for the North American livestock business. To assist farmers in managing their risks, insurance companies are providing coverage for these hazards.

Asia Pacific is expected to grow at the fastest CAGR growth of the global livestock insurance market during the forecast period. Due to the region's rapidly urbanizing population, rising animal product demand, and growing population. In addition, livestock farmers typically suffer hazards to their animals, infrastructure, and feed availability due to Asia Pacific's tendency for a variety of natural disasters, such as typhoons, floods, earthquakes, and droughts. Consequently, livestock insurance acts as a vital safety net for farmers, enabling them to weather natural disaster losses, adjust to changing weather patterns, and continue running their livestock businesses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global livestock insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allianz SE

- Farmers Mutual Hail Insurance Company

- XL Catlin

- Chubb Limited

- American International Group

- Zurich Insurance Group Ltd.

- Tokio Marine Holdings Inc.

- QBE Insurance Group Ltd.

- The Hartford Financial Services Group

- RSA Insurance Group plc

- Sompo Holdings

- Fairfax Financial Holdings Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2022, The HDFC ERGO General Insurance Company introduced multiple online insurance platforms and digitalized the process of purchasing insurance products.

- In February 2021, A new livestock insurance product that covers disease outbreaks including avian influenza and African swine fever has been introduced, according to XL Catlin.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global livestock insurance market based on the below-mentioned segments:

Global Livestock Insurance Market, By Coverage

- Mortality

- Revenue

- Other

Global Livestock Insurance Market, By Animal Type

- Bovine

- Swine

- Sheep & Goats

- Poultry

- Other Animal

Global Livestock Insurance Market, By Distribution Channel

- Direct

- Agency/Broker

- Bancassurance

- Others

Global Livestock Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?