Global Loan Servicing Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Software, and Solution), By Deployment (On-premise, and Cloud), By Enterprise Size (Large Enterprises, and Small and Medium-sized Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Loan Servicing Software Market Insights Forecasts to 2033

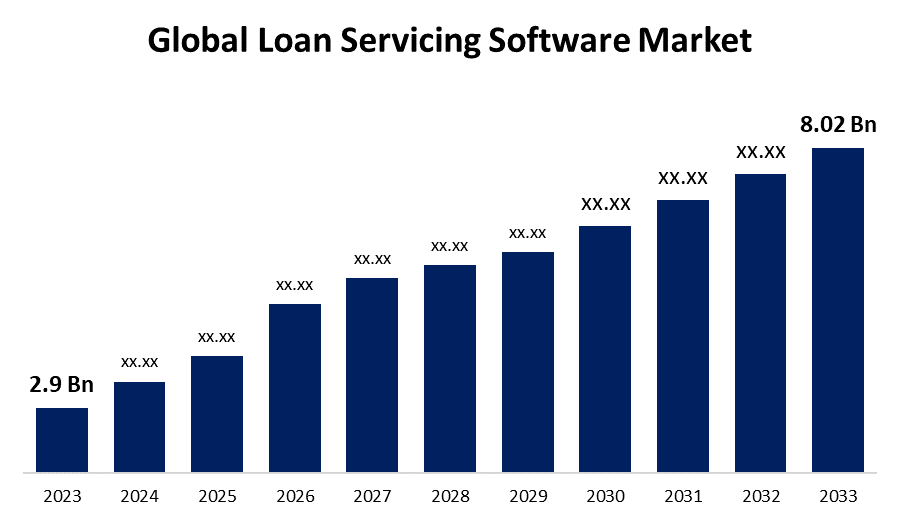

- The Global Loan Servicing Software Market Size was Valued at USD 2.9 Billion in 2023

- The Market Size is Growing at a CAGR of 10.71% from 2023 to 2033

- The Worldwide Loan Servicing Software Market Size is Expected to Reach USD 8.02 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Loan Servicing Software Market Size is Anticipated to Exceed USD 8.02 Billion by 2033, Growing at a CAGR of 10.71% from 2023 to 2033.

Market Overview

Loan servicing software is operating in the banking, financial services, and insurance (BFSI) industry to rationalize banking procedures and enhance the customer experience by offering debtors easy access to their loan information and payment options. Loan servicing software aims to increase revenue for investors, optimize customer satisfaction, simplify portfolio management, and reduce operating costs. It helps mortgage lenders, banks, and credit unions with real-time and accurate data analysis related to pricing and monitoring the credit profile of potential clients. It helps automate and manage the loan lifecycle, from origination, credit decision, payment and collection, accounting, and reporting. It also improves workflow efficiency, controls internal service loans, manages customer service operations, and reduces errors and effort when tracking and reconciling loans. It offers mortgages, home equity, consumer and business loans. As debt servicing software is integrated with payment gateways and accounting software to offer an inclusive solution for debtors and lenders, its demand is increasing worldwide. Furthermore, the increasing adoption of loan servicing software among small and medium enterprises (SMEs) to deliver real-time data on loan performance and detect and manage potential risks is contributing to market growth. In addition, the advent of mobile applications that help borrowers manage their loans and make payments through smartphones and increase convenience and ease is driving the growth of the market. Moreover, loan servicing software is increasingly integrating artificial intelligence (AI), machine learning (ML), cloud computing, and blockchain technology to improve efficiency and enhance the user experience. These advanced technologies are also used to automate various tasks, such as identifying and classifying documents and analyzing data to identify trends and patterns that can aid decision-making.

Report Coverage

This research report categorizes the market for the global loan servicing software market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global loan servicing software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global loan servicing software market.

Global Loan Servicing Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.71% |

| 2033 Value Projection: | USD 8.02 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Deployment, By Enterprise Size, By Region |

| Companies covered:: | Black Knight Inc, C Loans Inc., DownHome Solutions, Fiserv Inc., LOAN SERVICING SOFT Inc, Nucleus Software Exports Ltd, Oracle Corp., Cyrus Technoedge Solutions Pvt. Ltd., Financial Industry Computer Systems Inc, Graveco Software Inc., Applied Business Software Inc, Constellation Software Inc., Fidelity National Information Services Inc., Nortridge Software LLC, and other key companies. |

| Pitfalls & Challenges: | Changing Market Dynamics, Operational Risks, Customer Expectations, Data Security and Privacy Concerns and Experience, |

Get more details on this report -

Driving Factors

The financial sector is subject to regulatory changes and compliance standards, which require sophisticated software solutions that can guarantee compliance with laws such as CCPA, GDPR, and many banking regulations. For financial institutions, sophisticated compliance capabilities in loan servicing software become essential. As loan servicing processes become more sophisticated, there is a growing need for software programs that can handle repetitive duties such as processing payments, monitoring loans, and managing compliance. Lending companies and financial institutions are always looking for ways to improve operational efficiency and streamline the loan management process. Software for loan servicing simplifies loan management, reduces manual error rates, and increases overall productivity. Developments in AI, machine learning, blockchain, and cloud computing are changing the loan servicing industry. Using this technology, software applications can provide enhanced features such as risk assessment, predictive analytics, and customized customer experience. Due to the increase in NPLs in many industries, more focus is now being placed on efficient debt servicing and collection techniques. For effective NPL management, debt servicing software with sophisticated collection and recovery features is critical. Due to advantages such as scalability, flexibility, affordability, and remote accessibility, cloud-based loan servicing software is becoming increasingly popular. To simplify operations and reduce the cost of IT infrastructure, financial institutions are increasingly implementing cloud solutions.

Restraining Factors

Financial institutions frequently need loan servicing software to interface with various further systems, with core banking, accounting, and customer relationship management (CRM) software. Compatibility issues and data migration difficulties are examples of integration barriers that can hinder the adoption and functionality of debt-servicing software. Software utilized for loan servicing handles private and sensitive fiscal information. Any data breach can have serious consequences for financial institutions operating in the program as well as software suppliers. Developing and maintaining such software becomes more difficult and expensive when strong data security measures are in place. Because the financial sector is highly regulated, debt servicing software has to comply with many legal requirements. Complying with these rules makes the creation and implementation of such software more complex and expensive.

Market Segmentation

The global loan servicing software market share is classified into component, deployment, and enterprise size.

- The software segment is expected to hold the largest share of the global loan servicing software market during the forecast period.

Based on the component, the global loan servicing software market is divided into software and solutions. Among these, the software segment is expected to hold the largest share of the global loan servicing software market during the forecast period. This is attributed to the manual methods of loan processing being extremely time-consuming and prone to paperwork and other administrative errors. Older debt management methods are not only more prone to errors, but they can also be incredibly redundant. Hence, one of the primary advantages of loan servicing software is that it eliminates the need for these manual methods. It reduces errors, saves time, and increases data accuracy. Hence, it is a major factor in the growth of the debt-servicing software market.

- The cloud segment is expected to hold the largest share of the global loan servicing software market during the forecast period.

Based on the deployment, the global loan servicing software market is divided into on-premise and cloud. Among these, the cloud segment is expected to hold the largest share of the global loan servicing software market during the forecast period. The cloud-based segment dominated the market, accounting for maximum market revenue due to customer satisfaction and experience, efficient document management, fast process execution, increased reliability and accessibility from any location, quick deployment, and scalability. The market growth is largely due to the increase in the adoption of cloud-based debt management software among large and medium-sized enterprises. Cloud-based software is presented on remote servers and accessed over the Internet, offering scalability, flexibility, and cost-effectiveness.

- The large enterprises segment is expected to hold the largest share of the global loan servicing software market during the forecast period.

Based on the enterprise size, the global loan servicing software market is divided into large enterprises and small and medium-sized enterprises. Among these, the large enterprises segment is expected to hold the largest share of the global loan servicing software market during the forecast period. This is attributed to the fact that customers from large institutions are given a flowchart where they can track the loan process. Also, the dashboard notifies them with real-time updates. It improves customer visibility. Moreover, it speeds up the time spent serving customers. Customers will be satisfied when they are served in a short period and the data is maintained accurately. Satisfaction creates loyalty and thus increases their trust in the company.

Regional Segment Analysis of the Global Loan Servicing Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global loan servicing software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global loan servicing software market over the predicted timeframe. Growing banking sector and growing fintech start-up culture, increasing adoption of loan servicing software across multiple industries and growing demand for cost-effective solutions and services drive market expansion. Additionally, the region benefited from increased focus on the introduction of debt servicing software solutions and services. Furthermore, in the US, personal and home loans are on the rise, and consumers are demanding a robust debt settlement process. Most lending companies in the U.S. are adopting digital services to provide loans to consumers. Hence the use of loan servicing software by companies to serve their customers is increasing. Hence, companies in this region are embracing the loan-servicing software industry.

Asia Pacific is expected to grow at the fastest pace in the global loan servicing software market during the forecast period. Due to the increasing adoption of digital loan services and innovations. Furthermore, China's loan servicing software market had the largest market share and the Indian loan servicing software market was the fastest-growing market in the Asia-Pacific region. Factors of increasing economic activity such as increasing access to credit and modernization of financial services. Developing countries in Asia Pacific are more inclined to get loans for housing finance and the demand for debt management software market has increased in recent years. Growth in mortgage lending in countries such as China, India, and South Korea has fueled the demand for convenient loan processing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global loan servicing software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Black Knight Inc

- C Loans Inc.

- DownHome Solutions

- Fiserv Inc.

- LOAN SERVICING SOFT Inc

- Nucleus Software Exports Ltd

- Oracle Corp.

- Cyrus Technoedge Solutions Pvt. Ltd.

- Financial Industry Computer Systems Inc

- Graveco Software Inc.

- Applied Business Software Inc

- Constellation Software Inc.

- Fidelity National Information Services Inc.

- Nortridge Software LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Bain Capital Tech Opportunities, a worldwide software investor announced that it has agreed to invest in and acquire Finova, a servicing software and savings, and mortgage origination software business. Bain Capital intends to continue its investment in both platforms through the combination of these two investments to offer a wider range of products to existing and potential customers.

- In February 2024, Sagent, a fintech-software-backed company that upgrades mortgage servicing for lenders and banks, launched Dara, a mortgage software platform. The move was intended to consolidate all data and user experience for homeowners and services throughout the servicing lifecycle.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global loan servicing software market based on the below-mentioned segments:

Global Loan Servicing Software Market, By Component

- Software

- Solution

Global Loan Servicing Software Market, By Deployment

- On-premise

- Cloud

Global Loan Servicing Software Market, By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises

Global Loan Servicing Software Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?