Global Long Fiber Thermoplastics Market Size, Share, and COVID-19 Impact By Resin Type (Polypropylene, Polyamide), By Fiber Type (Carbon, Glass), By End-User (Automotive, Building and Construction), By Manufacturing Process (Pultrusion, D-LFT), by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032)

Industry: Chemicals & MaterialsGlobal Long Fiber Thermoplastics Market Insights Forecasts to 2032

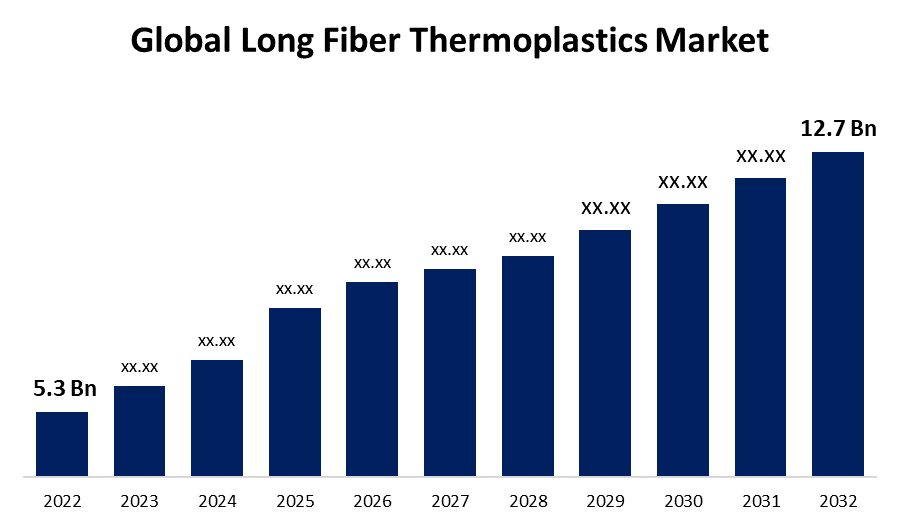

- The Long Fiber Thermoplastics Market was valued at USD 5.3 Billion in 2022.

- The market is growing at a CAGR of 11.8% from 2022 to 2032

- The global Long Fiber Thermoplastics Market is expected to reach USD 12.7 Billion by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The global Long Fiber Thermoplastics Market is expected to reach USD 12.7 Billion by 2032, at a CAGR of 11.8% during the forecast period 2022 to 2032.

Long Fiber Thermoplastics (LFT) are a kind of composite material made of long reinforcing fibers and a thermoplastic matrix. In comparison to conventional short-fiber composites, the material produced by this combination has improved mechanical properties. Strength, stiffness, impact resistance, and design flexibility are all attributes of LFT materials. In the automotive sector, LFT materials are frequently utilized for lightweight structural parts like underbody shields, front-end modules, interior panels, and more. They contribute to lighter vehicles and greater fuel efficiency.

Impact of COVID 19 On the Global Long Fiber Thermoplastics Market

The pandemic caused global supply chains to break down, which impacted the supply of raw materials and components. This might have had an effect on the creation of LFT materials if producers had trouble finding the fibers and thermoplastic resins they needed. Production slowdowns may have occurred in sectors that significantly rely on composite materials, such as automotive and aerospace, as a result of lockdowns and decreased customer demand. This might have affected these sectors' need for LFT. Due to the epidemic, production priorities changed, with some sectors turning their attention to necessities. This might have had an impact on the manufacture of LFT-using non-essential goods.

Global Long Fiber Thermoplastics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 5.3 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 11.8% |

| 2032 Value Projection: | USD 12.7 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Resin Type, By Fiber Type, By End-User, By Manufacturing Process, by Region and COVID-19 Impact |

| Companies covered:: | LANXESS, Solvay, PolyOne Corporation, RTP Company, Celanese Corporation, Avient Corporation, Daicel Corporation, Sumitomo Bakelite Co., Ltd., Mitsubishi Chemical Corporation, PPG Industries, Inc., Asahi Kasei Corporation, SABIC, Owens Corning, TORAY INDUSTRIES, INC., BASF SE’, Polymer Group Ltd, SGL Carbon, SKYi Composites Pvt. Ltd., Great Eastern Resins Industrial Co. Ltd., JNC Corporation, and other. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Key Market Drivers

The need for lightweight materials in a variety of sectors, including the automotive and aerospace industries, was a major factor in the market's expansion. LFT composites are appealing for applications where weight reduction is essential for fuel efficiency, emissions reduction, and overall performance because they have high strength-to-weight ratios. LFT materials have been extensively used in the automotive industry. LFT composites are being used more frequently for structural elements, interior panels, and underbody shields in automobiles as a result of the push for lighter, more fuel-efficient vehicles as well as the demand for robust, impact-resistant components. LFT materials offer design versatility, enabling producers to build intricate shapes and improve component performance. Due to their adaptability, they can be used in a variety of applications across many sectors, which helps the market develop. Due to the advantages these materials provide, their use is becoming more widespread outside of conventional industries (such automotive and aerospace) and into areas like building, consumer goods, and industrial machinery.

Key Market Challenges

LFT materials can be more expensive than conventional short-fiber composites or other materials like metals, despite having considerable performance advantages. Widespread adoption may be hampered by the increased production and material costs, particularly in price-sensitive businesses. To achieve the necessary performance characteristics, the ideal thermoplastic matrix and reinforcing fiber mix must be chosen. To optimize the material for particular purposes, this calls for expertise and testing. For producers, the complexity of material selection might be difficult. Other lightweight materials, such metals and continuous fiber-reinforced composites (CFRPs), which each have advantages for particular applications, compete with LFT materials. For LFT to effectively compete, it must showcase its distinctive value proposition.

Market Segmentation

Resin Type Insights

Polypropylene segment is dominating the market over the forecast period

On the basis of resin type, the global Long Fiber Thermoplastics Market is segmented into polypropylene, polyamide, polyether ether ketone, and others. Among these, the polypropylene segment is dominating the market with the largest market share over the forecast period. LFT composites based on polypropylene are increasingly used in the automotive industry, a significant user of LFT materials, for a variety of components. For non-structural vehicle parts, PP-LFT materials offered a mix of lightweight design, superior impact resistance, and affordability. Beyond the automobile industry, PP-LFT materials were being used more often. Consumer products, industrial equipment, and the construction industries were investigating the advantages of polypropylene-based LFT composites for lightweight, strong, and affordable components. Injection molding, a typical processing technique in the plastics industry, is a good fit for polypropylene. PP-LFT materials are adaptable for a variety of applications because they can be effectively molded into complex shapes.

Fiber Type Insights

Glass fiber segment holds the highest market share over the forecast period

Based on the fiber type, the global long fiber thermoplastics market is segmented into carbon, glass, and others. Among these glass fiber segment holds the highest market share over the forecast period. Glass fibers are more affordable than other reinforcing materials like carbon fibers. Glass fiber-reinforced LFT composites are appealing for a variety of applications, including those where cost concerns are important, due to this cost benefit. Glass fibers are easily included into the LFT production process since they are widely accessible in a variety of forms, including rovings, chopped strands, and textiles. Scalability of production is influenced by the accessibility of glass fibers. Beyond the automobile industry, the use of glass fiber-reinforced LFT materials was growing. Other industries were investigating the advantages of glass fiber-reinforced LFT composites for their mechanical performance and design flexibility, including aircraft, consumer goods, and industrial equipment.

End User Insights

The automotive segment dominates the market with the largest market share

On the basis of end user, the global long fiber thermoplastics market is segmented into automotive, building and construction, electrical and electronics, sporting goods, and others. Among these, the automotive segment is dominating the market over the forecast period. The emphasis on lightweighting in the automotive sector is one of the main forces behind the adoption of LFT materials. LFT composites, especially those made with glass or carbon fibers, provide an attractive balance of high strength and low weight. This is essential for raising total vehicle performance, cutting emissions, and improving fuel economy. LFT materials are increasingly being used in structural and non-structural exterior and interior sections as well as underbody shields in the automotive industry. The advantages of LFT are now more widely used throughout the vehicle.

Manufacturing Process Insights

Injection Molding segment holds the highest market share over the forecast period

Based on the manufacturing process, the global long fiber thermoplastics market is segmented into Pultrusion, D-LFT, injection molding, and others. Among these, the injection molding segment holds the highest market share over the forecast period. Injection molding is favored for producing parts with distinctive shapes, multi-functional features, and complex geometries because it permits detailed and sophisticated part designs. LFT materials can be utilized in injection molding to increase the variety of component design options. It is very efficient and repeatable to use injection molding. Compared to some other manufacturing methods, it offers cost benefits in terms of production efficiency, material usage, and reduced manpower. LFT materials, especially those made using economical thermoplastic matrices like polypropylene (PP), can raise the injection molding process' overall cost effectiveness. In the automotive and aerospace industries, injection-molded LFT materials are frequently utilized for a variety of components, including interior panels, structural elements, underbody shields, and more.

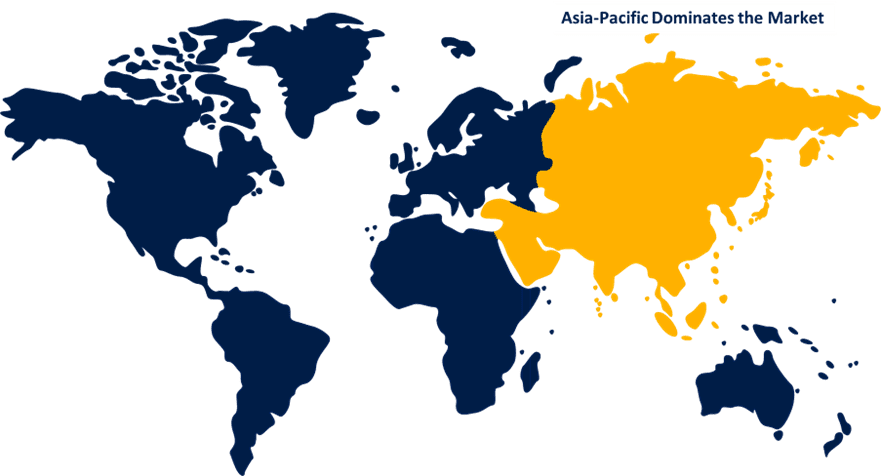

Regional Insights

Asia Pacific is dominating the market over the forecast period

Get more details on this report -

Asia Pacific is dominating the market with the largest market share over the forecast period. Asia-Pacific is a key producer of consumer electronics, industrial equipment, automobile parts, and more, and it has served as a manufacturing hub for a number of different industries. Fuel economy and performance criteria in these industries have increased the demand for lightweight materials, which has helped the LFT market expand. The rise of the middle class in many Asia-Pacific nations has raised demand for consumer goods, durable goods, and automobiles. This has in turn increased demand for lightweight and robust materials like LFT composites.

North America is witnessing the fastest market growth over the forecast period. An important market for the automobile sector is North America, particularly the United States. The development of LFT composites for various automotive components has been prompted by the desire for lightweighting in the automobile industry to meet fuel efficiency criteria and improve vehicle performance. Because of the region's robust consumer goods sector, producers there frequently look for lightweight, long-lasting materials for everything from electronics to sporting goods. LFT composites provide a response to satisfy these requirements.

Recent Market Developments

- In January 2020, Solvay's polyamide division was purchased by BASF SE. With new products like Technyl added as a result of this acquisition, BASF's engineering plastics division has expanded.

List of Key Companies

- LANXESS

- Solvay

- PolyOne Corporation

- RTP Company

- Celanese Corporation

- Avient Corporation

- Daicel Corporation

- Sumitomo Bakelite Co., Ltd.

- Mitsubishi Chemical Corporation

- PPG Industries, Inc.

- Asahi Kasei Corporation

- SABIC

- Owens Corning

- TORAY INDUSTRIES, INC.

- BASF SE’

- Polymer Group Ltd

- SGL Carbon

- SKYi Composites Pvt. Ltd.

- Great Eastern Resins Industrial Co. Ltd.

- JNC Corporation

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Long Fiber Thermoplastics Market based on the below-mentioned segments:

Long Fiber Thermoplastics Market, Resin Type Analysis

- Polypropylene

- Polyamide

- Polyether ether ketone

- Others

Long Fiber Thermoplastics Market, Fiber Type Analysis

- Carbon

- Glass

- Others

Long Fiber Thermoplastics Market, End User Analysis

- Automotive

- Building and construction

- Electrical and electronics

- Sporting goods

- Others

Long Fiber Thermoplastics Market, Manufacturing Process Analysis

- Pultrusion

- D-LFT, injection molding

- Others

Long Fiber Thermoplastics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of Long Fiber Thermoplastics Market?The global Long Fiber Thermoplastics Market is expected to grow from USD 5.3 Billion in 2022 to USD 12.7 Billion by 2032, at a CAGR of 11.8% during the forecast period 2022-2032.

-

2.Who are the key market players of Long Fiber Thermoplastics Market?Some of the key market players of LANXESS, Solvay, PolyOne Corporation, RTP Company, Celanese Corporation, Avient Corporation, Daicel Corporation, Sumitomo Bakelite Co., Ltd., Mitsubishi Chemical Corporation, PPG Industries, Inc., Asahi Kasei Corporation, SABIC, Owens Corning, TORAY INDUSTRIES, INC., BASF SE, Polymer Group Ltd, SGL Carbon, SKYi Composites Pvt. Ltd., Great Eastern Resins Industrial Co. Ltd. and JNC Corporation.

-

3.Which segment hold the largest market share?Automotive segment holds the largest market share is going to continue its dominance.

-

4.Which region is dominating the Long Fiber Thermoplastics Market?Asia Pacific is dominating the Long Fiber Thermoplastics Market with the highest market share.

Need help to buy this report?