Global Main Battle Tank Market Size By Component (Turret System, Internal Combustion Engine, Wheel & Tracks, Situational Awareness, Weaponry Systems, and Others), By Weight (Light Weight, Medium Weight, and Heavy Weight), By Solution (Line Fit and Retro Fit), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Main Battle Tank Market Insights Forecasts to 2033

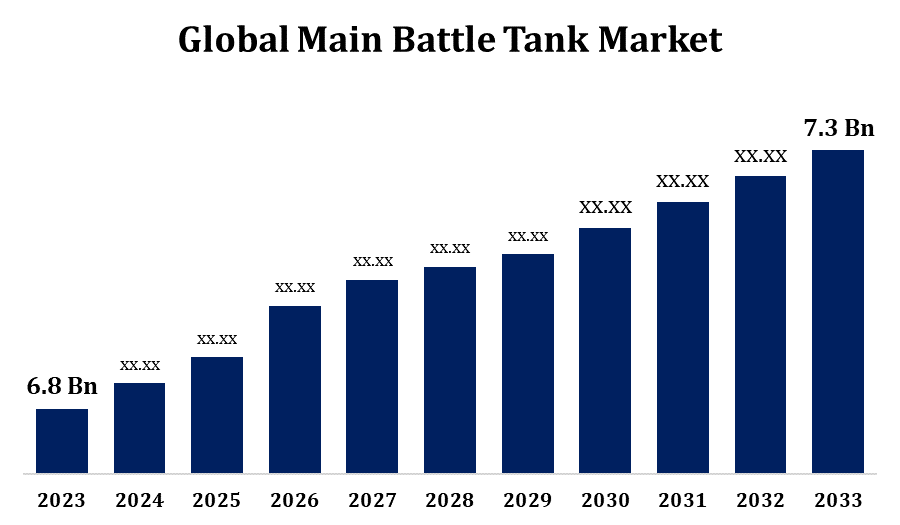

- The Global Main Battle Tank Market Size was valued at USD 6.8 Billion in 2023.

- The Market Size is growing at a CAGR of 0.71% from 2023 to 2033

- The Worldwide Main Battle Tank Market Size is expected to reach USD 7.3 Billion by 2033

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Main Battle Tank Market Size is expected to reach USD 7.3 Billion by 2033, at a CAGR of 0.71% during the forecast period 2023 to 2033.

Many nations are investing in the development and modernization of their fleets of armoured vehicles, making the main battle tank market an important one. Military spending, procurement initiatives, and geopolitical unrest are some of the variables that affect market size. The need to update outdated platforms, replace ageing tank fleets, and improve combat capabilities in response to changing threats is what is driving market growth. The modular designs of modern main battle tanks enable the integration of additional armament systems, subsystems, and technologies to adapt to evolving threats and operating requirements. For military forces looking to minimise lifecycle costs while extending the service life and operational capabilities of their tank fleets, upgradeability is a critical component.

Main Battle Tank Market Value Chain Analysis

In order to satisfy changing military requirements and technology improvements, research and development activities concentrate on enhancing armour protection, firepower, mobility, survivability, and other performance aspects. The different subsystems, parts, and materials needed for Main Battle Tank manufacture are supplied by component suppliers. These include armour plate, engines, transmissions, armament systems, sensors, and electronics. Providers may offer OEMs or subcontractors engaged in Main Battle Tank manufacture their specialised parts or subsystems. Using parts and subsystems purchased from suppliers, OEMs and subcontractors build and assemble Main Battle Tanks. Integration facilities put together Main Battle Tanks and incorporate armament systems, subsystems, and other parts into the finished platform. Throughout their service lives, MRO facilities offer Main Battle Tanks maintenance, repair, and overhaul services. Main Battle Tanks, replacement parts, and consumables are acquired, stored, transported, and distributed as part of supply chain and logistics management.

Main Battle Tank Market Opportunity Analysis

Many nations are updating their armoured vehicle fleets through modernization initiatives, which may involve buying new Main Battle Tanks or equipping older ones with cutting-edge technology. For Main Battle Tank producers, these modernization initiatives offer a great chance to land contracts for Main Battle Tank production, upgrades, or refurbishments. The market for Main Battle Tanks is being driven by rising geopolitical tensions and security risks in different parts of the world as countries look to bolster their defence capabilities and ward off possible adversaries. Increased military investment and procurement programmes targeted at improving military might and power projection provide Main Battle Tank manufacturers prospects to grow their market share and win new contracts. Main Battle Tank requirements are being influenced by the evolving nature of modern warfare, which is marked by urbanisation, asymmetric threats, and non-traditional wars.

Global Main Battle Tank Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 0.71% |

| 2033 Value Projection: | USD 7.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Weight, By Solution, By Region, By Geographic Scope |

| Companies covered:: | BAE Systems plc., Krauss-Maffei Wegmann GmbH & Co. KG, Defence Research And Development Organisation, Hyundai Rotem, Israel Military Industries, Rheinmetall AG, Mitsubishi Heavy Industries, Nexter Systems, BMC, General Dynamics Corporation, and Other Key Vendors. |

| Growth Drivers: | Upgradation of Existing Fleet with Advanced Technological Base Equipment |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Main Battle Tank Market Dynamics

Upgradation of Existing Fleet with Advanced Technological Base Equipment

Modernising current Main Battle Tank fleets with cutting-edge tech upgrades that boost the vehicles' overall performance and combat efficacy includes increased armour protection, firepower, mobility, and electronics. Upgrading Main Battle Tanks increases the value offer for military clients by enabling them to function more effectively in contemporary battlefield settings thanks to advanced technologies. Military forces can maximise return on investment and postpone the need for expensive replacements by upgrading their current Main Battle Tank fleets, which extends the asset's service life. Military customers can delay the purchase of new vehicles while maintaining combat capability and operational readiness by modifying ageing Main Battle Tanks with updated subsystems and components. It is more economical to upgrade current Main Battle Tank fleets rather than buy new ones, particularly for nations with constrained defence budgets or conflicting objectives for defence spending.

Restraints & Challenges

For Main Battle Tank systems to continue to be effective in the battlefield, they must be continuously innovated and modernised because to the rapid improvements in military technology. Outdated features and antiquated technology can make Main Battle Tanks less competitive and restrict their operational capabilities, making it difficult for military users and producers to stay up to date with changing threats. Significant expenditures are associated with the development, production, and acquisition of Main Battle Tanks. These costs include those associated with manufacturing, lifecycle maintenance, and research and development. The expansion of the market and the profitability of the sector may be impacted by budgetary restrictions and competing priorities for defence spending, which may limit investment in new Main Battle Tank programmes, postpone procurement decisions, or result in project cancellations. Navigating complicated regulatory frameworks, export controls, and compliance requirements imposed by national governments and international organisations are frequently necessary when exporting Main Battle Tanks to foreign markets.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Main Battle Tank Market from 2023 to 2033. Much of the demand for Main Battle Tanks in North America is driven by the United States, which is the country that spends the most on defence in the world. With ongoing upgrading programmes and possible future procurements, the U.S. Army's Abrams Main Battle Tank programme is a major market driver. Contributing to the regional Main Battle Tank market are investments made by other North American nations, including Canada, on armoured vehicle upgrading projects. Although the United States is the main market for Main Battle Tanks in North America, American-made Main Battle Tanks can also be exported to allies and other clients. Government-to-government agreements, foreign procurement initiatives, and foreign military sales (FMS) programmes enable the export of U.S.-built Main Battle Tanks to nations looking to acquire modern armoured vehicle capabilities.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Large-scale military modernization initiatives are being carried out by several Asia-Pacific nations in an effort to strengthen their defence capacities. Several nations are investing in the development, modernization, and acquisition of Main Battle Tanks as part of these programmes in order to bolster their armoured forces and uphold strategic deterrence. Some Asia-Pacific nations, especially those with well-established defence industries and cutting-edge Main Battle Tank capabilities, look for ways to export the armoured vehicles they manufacture at home. Exporting Main Battle Tanks to other markets offers chances for generating income, transferring technology, and fostering diplomatic relations with partner nations.

Segmentation Analysis

Insights by Component

The turret system segment accounted for the largest market share over the forecast period 2023 to 2033. Turret system growth is driven by the need for main battle tanks with more firepower. Main Battle Tanks can efficiently engage a variety of targets, including armoured vehicles, fortifications, and infantry positions, thanks to their turret systems' advanced gun systems, which include smoothbore cannons or autoloaders, as well as secondary weaponry, such as machine guns or anti-tank missiles. Target acquisition, tracking, and engagement capabilities are improved by turret systems' integration of sensors, electronics, and fire control systems. Lethality and operational effectiveness are increased by Main Battle Tanks' ability to detect and engage targets with great precision and accuracy thanks to turret-mounted sensors such thermal imagers, laser rangefinders, and day/night cameras.

Insights by Weight

The heavy weight segment accounted for the largest market share over the forecast period 2023 to 2033. Against a variety of threats, including as anti-tank guided missiles, improvised explosive devices (IEDs), and armor-piercing projectiles, heavy weight Main Battle Tanks are built to offer superior protection. To survive on the contemporary battlefield and withstand high-caliber projectiles, these vehicles have strengthened hulls, heavier armour plating, and sophisticated composite materials. Advanced heavy-weight multirole combat tanks (Main Battle Tanks) offer export prospects for defence suppliers and manufacturers who want to reach out to global markets. Purchasing high weight Main Battle Tanks with the newest features and technology may be the goal of nations with growing defence budgets, new security risks, and needs for armoured vehicle upgrading.

Insights by Solution

The retro fit segment accounted for the largest market share over the forecast period 2023 to 2033. Purchasing new vehicles is frequently more expensive than retrofitting an existing fleet of Main Battle Tanks, especially for nations with small defence budgets or a big stock of outdated Main Battle Tanks. Through retrofit programmes, armed forces can improve performance and combat effectiveness by utilising advanced technologies and features while utilising pre-existing platforms and infrastructure. Defence contractors and manufacturers looking to offer modernization options to foreign military customers should consider marketing retrofitting their current Main Battle Tank fleets as an export opportunity. Countries with ageing Main Battle Tank fleets or little money for new purchases can look for refit packages to modernise their current armoured vehicle assets, opening up new markets and avenues for export sales.

Recent Market Developments

- In March 2022, an initiative was started by the Indian army to acquire 350 light tanks. The contract is worth USD 1932.5 million in total.

Competitive Landscape

Major players in the market

- BAE Systems plc.

- Krauss-Maffei Wegmann GmbH & Co. KG

- Defence Research And Development Organisation

- Hyundai Rotem

- Israel Military Industries

- Rheinmetall AG

- Mitsubishi Heavy Industries

- Nexter Systems

- BMC

- General Dynamics Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Main Battle Tank Market, Component Analysis

- Turret System

- Internal Combustion Engine

- Wheel & Tracks

- Situational Awareness

- Weaponry Systems

- Others

Main Battle Tank Market, Weight Analysis

- Light Weight

- Medium Weight

- Heavy Weight

Main Battle Tank Market, Solution Analysis

- Line Fit

- Retro Fit

Main Battle Tank Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?