Global Marine Battery Market Size, Share, and COVID-19 Impact Analysis, By Battery Type (Lithium-ion, Lead acid, and Others), By Ship Type (Commercial and Defense), By Function (Starting, Deep Cycle, and Dual Purpose), By Nominal Capacity (Less than 150 Ah, and More than 150 Ah), By Sales Channel (OEM and Aftermarket), By Battery Density (<100 WH/KG and More than 100 WH/KG), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022-2032.

Industry: Energy & PowerGlobal Marine Battery Market Insights Forecasts to 2032

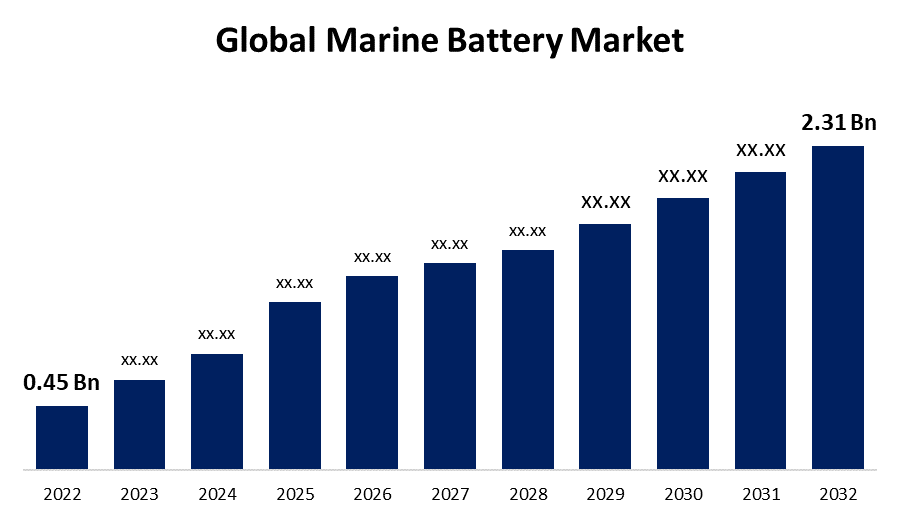

- The Global Marine Battery Market Size was valued at USD 0.45 Billion in 2022.

- The Market is Growing at a CAGR of 17.8% from 2022 to 2032

- The Worldwide Marine Battery Market Size is Expected to reach USD 2.31 Billion By 2032

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Marine Battery Market size is anticipated to exceed USD 2.31 Billion By 2032, Growing at a CAGR of 17.8% from 2022 to 2032. The increasing demand for sustainable marine solutions, advancements in battery technology, and supportive government policies are key factors contributing to market expansion.

Market Overview

The marine battery operates as the vessel's primary or auxiliary power source, utilizing chemical energy to power multiple functions such as a start-stop, a windlass, lighting, depth finders, and fish locators. Marine batteries are made of stronger materials and have heavier plates. These batteries are specifically designed for use on ships or vessels to withstand the vibration and pounding that can occur on any boat. Factors such as increased demand for marine freight transportation vessels, the advantages of lithium-ion batteries over lead-acid batteries, and rising popularity in water sports and leisure activities are projected to fuel the marine battery market's expansion. However, the limited range and capacity of fully electric ships, as well as battery maintenance and protection, limit market growth. The global marine battery market holds promising growth opportunities for market participants, driven by the increasing automation in marine transportation and the adoption of hybrid and electric vessels. Manufacturers and key players can capitalize on the potential of renewable energy for charging marine batteries. In addition, as hybrid propulsion technologies advance, the marine battery market will be provided with more opportunities.

Report Coverage

This research report categorizes the market for the global marine battery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the marine battery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the marine battery market.

Global Marine Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 0.45 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 17.8% |

| 2032 Value Projection: | USD 2.31 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Battery Type, By Ship Type, By Function, By Nominal Capacity, By Sales Channel, By Battery Density, By Region. |

| Companies covered:: | Corvus Energy, Leclanche S.A., Siemens AG, Saft SA, Shift Clean Energy, Echandia Marine AB, EST Floattech, Sensata Technolgies Inc., Powertech Systems, Lifeline Batteries, Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of marine industries is being driven by the rising demand for maritime tourism, along with the necessity for enhanced marine infrastructure and connectivity. This is expected to result in substantial revenue generation for both developed and developing countries, primarily driven by marine and coastal tourism. Improved infrastructure and connectivity are critical factors in driving maritime and coastal tourism. Governments around the world are projected to play a crucial role in driving market growth during the forecast period as they optimize their seaborne economy policies, prioritizing the promotion of environmentally friendly marine tourism and improving connectivity to various ports.

According to the insights provided by a thorough Maritime Supply Chain Optimization analysis, maritime transport is an integral and irreplaceable component of the global trade ecosystem. Approximately 90% of products are traded via sea trade routes. The ongoing COVID-19 pandemic, the trade dispute between the United States and China, and the palpable churning of geoeconomics and geopolitics have all had a significant impact on seaborne trade. During the forecast period, all of these variables will compel governments around the world to evaluate and reconfigure the global supply chain, as well as employ alternative marine power and propulsion systems. An alternative global supply chain is expected to increase the number of vessels operating globally while also modernizing the existing fleet.

Restraining Factors

Electric propulsion systems have more initial expenses than conventional propulsion systems. The installation of proper storage capacity and the size of the battery storage restricts the range of the electric-propelled vessels. Because of the greater range and capacity of conventional marine fuels and propulsion systems, battery technology has a long way to go in the marine market. Furthermore, electronic components are highly susceptible to corrosion failures, necessitating specialized coating and treatment as well as highly trained staff to operate. The cost of electric propulsion technology has limited its widespread adoption.

Market Segmentation

The Global Marine Battery Market share is classified into battery type, ship type, and sales channel.

- lithium-ion segment is expected to grow at the fastest pace in the global marine battery market during the forecast period.

The global marine battery market is categorized by battery type into lithium-ion, lead acid, and others. Among these, the lithium-ion segment is expected to grow at the fastest pace in the global marine battery market during the forecast period. Lithium-ion batteries are gaining popularity in the marine industry due to their high energy density, lightweight design, longer cycle life, and faster charging capabilities when compared to traditional lead-acid batteries. These lithium-ion batteries are well-suited for a variety of marine applications, including recreational boats, commercial vessels, offshore support vessels, and hybrid/electric propulsion systems.

- The commercial segment is expected to hold the largest share of the global marine battery market during the forecast period.

Based on the ship type, the global marine battery market is divided into commercial and defense. Among these, the commercial segment is expected to hold the largest share of the global marine battery market during the forecast period. Increased global tourism is one of the primary factors driving this segment. The segmental growth is driven by the need to design safe battery systems with high energy capacity, small volume, high performance, and long life.

- The OEM segment is expected to hold the largest share of the global marine battery market during the forecast period.

Based on the sales channel, the global marine battery market is divided into OEM and aftermarket. Among these, the OEM segment is expected to hold the largest share of the global marine battery market during the forecast period. The OEM segment of the market is driven by the ongoing fleet expansion programs of several end users, such as cargo and freight operators and the global naval force. Several inland and sea-going vessel operators are implementing hybrid and fully-electric propulsion systems, which reduce operational costs while also causing less environmental degradation.

Regional Segment Analysis of the Global Marine Battery Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

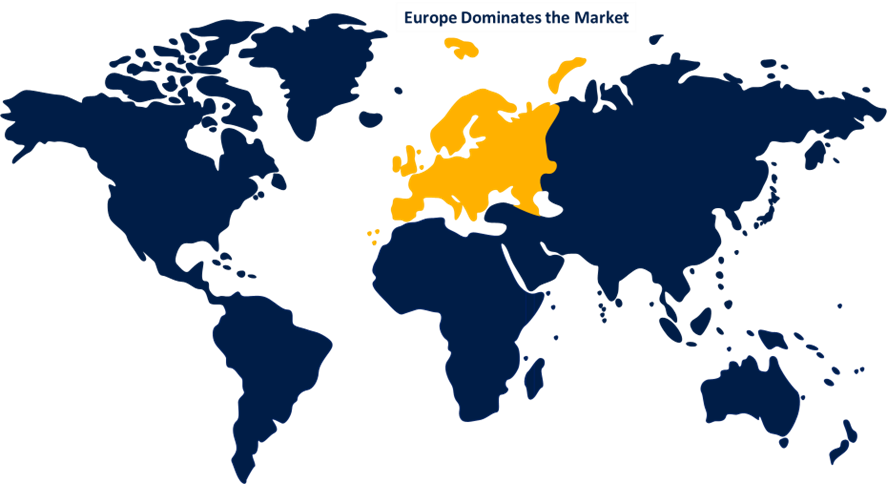

Europe dominated the largest share of the global marine battery market in 2022.

Get more details on this report -

Europe holds the largest share of the global marine battery market. Due to strict environmental regulations, government initiatives to promote sustainable transportation, and the presence of major shipbuilding and maritime industries, Europe has the largest market for marine batteries. Germany, Norway, the Netherlands, and the United Kingdom are all major players in the European marine battery market. Applications in ferries, cruise ships, yachts, and other commercial vessels drive demand for marine batteries in Europe.

Asia Pacific is expected to grow at the fastest pace in the global marine battery market during the forecast period. The Asia Pacific region is experiencing rapid growth in the marine battery market, owing to increased shipbuilding activity, rising maritime trade, and a focus on reducing emissions from marine vessels. China, Japan, South Korea, and Singapore are major contributors to this region's market. Commercial ships, fishing vessels, and offshore support vessels drive demand for marine batteries in Asia Pacific.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global marine battery along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Corvus Energy

- Leclanché S.A.

- Siemens AG

- Saft SA

- Shift Clean Energy

- Echandia Marine AB

- EST Floattech

- Sensata Technolgies Inc.

- Powertech Systems

- Lifeline Batteries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2022, Corvus Energy has received a contract from Ulstein Power & Control to supply energy storage systems for two Construction Service Operation Vessels (CSOVs) being built for Norwegian shipowner Olympic.

- In January 2023, Leclanché SA has been picked as the provider of battery technology for two hybrid vessels for Stena RoRo and Brittany Ferries. Each battery system can store 11.3 MWh. RoPax (roll-on/roll-off passenger) ferries will be the world's largest hybrid vessels.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Marine Battery Market based on the below-mentioned segments:

Global Marine Battery Market, By Battery Type

- Lithium-ion

- Lead acid

- Others

Global Marine Battery Market, By Ship Type

- Commercial

- Defense

Global Marine Battery Market, By Function

- Starting

- Deep Cycle

- Dual Purpose

Global Marine Battery Market, By Nominal Capacity

- Less than 150 Ah

- More than 150 Ah

Global Marine Battery Market, By Sales Channel

- OEM

- Aftermarket

Global Marine Battery Market, By Battery Density

- <100 WH/KG

- More than 100 WH/KG

Global Marine Battery Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?