Global Marine Vessel Energy Efficiency Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hardware System, and Sensors & Software), By Application (Dry Cargo Vessel, Service Vessels, Fishing Vessels, and Yachts), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Marine Vessel Energy Efficiency Market Insights Forecasts to 2033

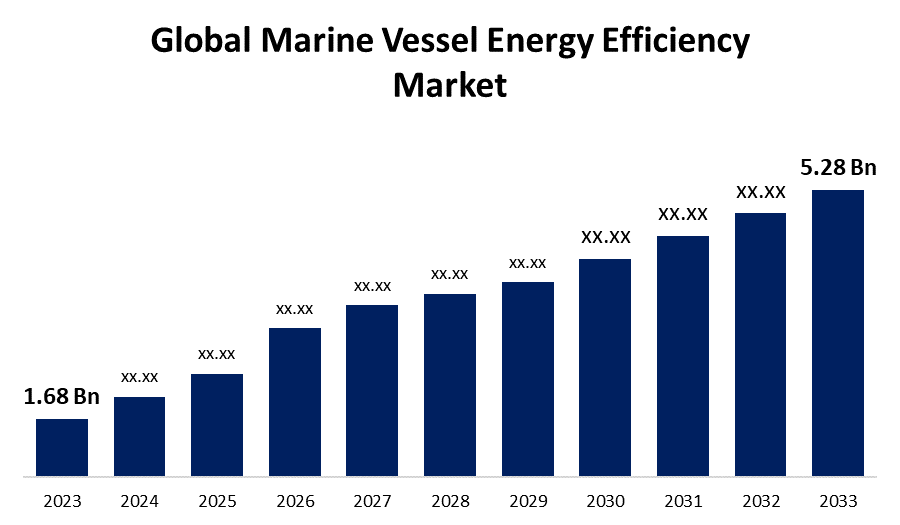

- The Global Marine Vessel Energy Efficiency Market Size was Valued at USD 1.68 Billion in 2023

- The Market Size is Growing at a CAGR of 12.13% from 2023 to 2033

- The Worldwide Marine Vessel Energy Efficiency Market Size is Expected to Reach USD 5.28 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Marine Vessel Energy Efficiency Market Size is Anticipated to Exceed USD 5.28 Billion by 2033, Growing at a CAGR of 12.13% from 2023 to 2033.

Market Overview

The term "energy efficiency" describes the process of utilizing less energy to accomplish a certain action or goal. The term "marine vessel energy efficiency" describes the strategies and tools used in ship construction, maintenance, and operation to lower energy usage and lessen environmental effects. Optimizing the use of fuel and other energy sources, lowering greenhouse gas emissions, and minimizing the shipping industry's environmental impact are the objectives of marine vessel energy efficiency. It is a measurement of the efficiency with which an apparatus, system, or procedure transforms input energy into usable output. Increasing energy efficiency is crucial for a number of reasons, including cutting expenses, lessening environmental effects, and consuming less energy. Increasing marine vessel energy efficiency is essential for lowering fuel usage, running expenses, and environmental effects. In order to maximize operating procedures and lessen the negative environmental effects of maritime activities, the marine vessel energy efficiency sector is crucial. Additionally, there is a greater emphasis on using energy-efficient solutions to cut emissions due to increased awareness of how maritime operations affect the environment.

Ambitious decarbonization goals are being advanced by the U.S. Department of Energy (DOE) for the maritime transportation industry on a national and worldwide scale. In order to promote partnerships and work together on sustainable energy solutions targeted at reaching net zero emissions in the maritime sector by 2050, DOE is partnering with more than 15 government and business partners in Singapore. To improve domestic shipping, the American Bureau of Shipping (ABS) and DOE's Office of Energy Efficiency and Renewable Energy (EERE) are collaborating to establish opportunities for data and information sharing.

For incidence, in May 2024, revolutionizing a hub financed by the US Department of Energy is expected to progress fuel cell technology, expedite the transition to renewable energy, and transform the transportation of products by land and sea.

Report Coverage

This research report categorizes the market for marine vessel energy efficiency based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the marine vessel energy efficiency market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the marine vessel energy efficiency market.

Global Marine Vessel Energy Efficiency Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.68 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 12.13% |

| 023 – 2033 Value Projection: | USD 5.28 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 236 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By Region |

| Companies covered:: | Equinor ASA, Siemens AG, General Electric Company (GE), Schneider Electric SE, Mitsubishi Heavy Industries Ltd. (MHI), ABB Group, Emerson Electric Co., Kawasaki Heavy Industries Ltd., Wartsila Corporation, Bureau Veritas S.A., MAN Energy Solutions SE, KONGSBERG, China Classification Society (CCS), Haldor Topsoe A/S, Gaztransport & Technigaz S.A. (GTT), Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The marine vessel energy efficiency market is driven by a number of reasons, such as the need to save fuel costs, the need for stronger environmental rules, and the increased focus on environmentally friendly transportation methods. The industry has been compelled to embrace more energy-efficient technology and solutions by laws like the EU's monitoring, reporting, and verification (MRV) program and the International Maritime Organization's (IMO) emissions regulations. Ship owners and operators have also been encouraged by the high cost of fuel to invest in technologies that can increase fuel efficiency, such as waste heat recovery systems, air lubrication systems, and cutting-edge hull designs. The market for marine vessel energy efficiency has also expanded as a result of the industry's attempts to lessen its carbon footprint and end customers' growing desire for environmentally friendly shipping solutions.

Restraining Factors

Numerous reasons could impede the growth of the marine vessel energy efficiency market. Energy-efficient technology implementation comes with a lot of upfront expenses, which might be prohibitive for smaller ship operators with tighter budgets. This is one of the main issues. Furthermore, even when there are more effective alternatives, it may be difficult to justify replacing outdated systems due to the lengthy lifespan of marine vessels. The marine industry's adoption of energy-efficient solutions may also be slowed down by reservations about the performance and dependability of new technology as well as a shortage of qualified staff to maintain and run these systems. Collaboration between technology providers, legislators, and industry stakeholders is necessary to overcome these limitations.

Market Segmentation

The marine vessel energy efficiency market share is classified into type and application.

- The hardware systems segment is estimated to hold the highest market revenue share through the projected period.

Based on the product type, the marine vessel energy efficiency market is classified into hardware systems, and software & sensors. Among these, the hardware system is estimated to hold the highest market revenue share through the projected period. Due to the rising need for cutting-edge hardware parts that may immediately increase a ship's energy efficiency. Fuel consumption and pollutants can be significantly decreased by implementing hardware solutions like waste heat recovery, propulsion, and energy-efficient engines. Ship owners and operators are more likely to invest in these hardware-based solutions to maximize the energy performance of their vessels as laws become stricter and the emphasis on sustainability grows. In addition, hardware systems are favored in the marine industry over software-based solutions due to their durability and dependability, which will support the segment's leading market share throughout the projection period.

- The service vessels segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the marine vessel energy efficiency market is divided into dry cargo vessel, service vessels, fishing vessels, and yachts. Among these, the service vessels segment is anticipated to hold the largest market share through the forecast period. This is due to the increasing need in the service vessel sector which encompasses a broad spectrum of vessels like dredgers, tugboats, and offshore supply ships for energy-efficient solutions. Because these vessels must adhere to strict laws and frequently operate in environmentally sensitive areas, there is a growing need for increased energy efficiency. Furthermore, compared to larger commercial boats, service vessels often have shorter operating cycles and higher utilization rates, which increases the economic viability of investing in energy-efficient equipment. The service vessel category is expected to hold a significant market position over the projection period because of its focus on reducing emissions and fuel costs, which is in line with the industry trend towards sustainable, shipping practices.

Regional Segment Analysis of the Marine Vessel Energy Efficiency Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is anticipated to hold the largest share of the marine vessel energy efficiency market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the marine vessel energy efficiency market over the predicted timeframe. The substantial marine traffic in the area, the existence of important shipbuilding and ship repair centers, and the enforcement of strict environmental standards are the main drivers of this. To support their booming maritime industries, nations like China, Japan, and South Korea have been making significant investments in the development of energy-efficient technology and infrastructure. The adoption of energy-efficient solutions in Asia-Pacific has also been fueled by the region's growing middle class's demand for greener shipping options. In addition, the rapid economic growth and expansion of seaborne trade in the region, along with government initiatives to promote sustainable maritime practices, are anticipated to sustain demand for marine vessel energy efficiency technologies in the Asia-Pacific market throughout the forecast period.

Europe is expected to grow the fastest during the forecast period. This is because of the area's strict environmental laws and dedication to lowering carbon emissions from the marine industry. Regulations like the Emissions Trading System (ETS) and the Monitoring, Reporting, and Verification (MRV) program have been put into place as a result of the European Union's aggressive climate targets, such as the 'Fit for 55' package and the European Green Deal. In order to comply with the increasingly stringent emissions regulations, these laws have forced ship owners and operators in Europe to invest in energy-efficient technologies and solutions. Moreover, the region's robust R&D capacities and the presence of significant shipping and shipbuilding hubs have fueled the quick adoption of cutting-edge energy efficiency solutions in the European marine industry, supporting the region's rapid market expansion during forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the marine vessel energy efficiency market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Equinor ASA

- Siemens AG

- General Electric Company (GE)

- Schneider Electric SE

- Mitsubishi Heavy Industries Ltd. (MHI)

- ABB Group

- Emerson Electric Co.

- Kawasaki Heavy Industries Ltd.

- Wartsila Corporation

- Bureau Veritas S.A.

- MAN Energy Solutions SE

- KONGSBERG

- China Classification Society (CCS)

- Haldor Topsoe A/S

- Gaztransport & Technigaz S.A. (GTT)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, leading the way in providing shipowners and operators with verified real-time fuel savings and pollution reductions is Manta Marine Technologies (MMT), whose propulsion optimization solution FuelOptTM is soon to be implemented on 400 vessels globally.

- In March 2024, as part of its sustainability goals and effort to adhere to new rules and emission reduction targets, Norwegian seismic business PGS is replacing the lights on eight of its seismic vessels with more energy-efficient options.

- In February 2024, the first in a series of 10 new 2,000 TEU LNG-powered container ships, the French containership operator CMA CGM welcomed CMA CGM Mermaid into its fleet.

- In January 2024, HMM opened the HD Hyundai Heavy Industries headquarters in Ulsan to its 13,000 TEU LNG-ready container ship, HMM Garnet. With energy-saving technologies to improve fuel economy and lower pollutant emissions, the boats are built to be LNG-ready.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the marine vessel energy efficiency market based on the below-mentioned segments:

Global Marine Vessel Energy Efficiency Market, By Product Type

- Hardware Systems

- Software & Sensors

Global Marine Vessel Energy Efficiency Market, By Application

- Dry Cargo Vessel

- Service Vessels

- Fishing Vessels

- Yachts

Global Marine Vessel Energy Efficiency Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?