Global Meal Replacement Products Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Powder, Ready-to-Drink, Protein Bar), By Distribution Channel (Convenience Stores, Hypermarkets/Supermarkets, Specialty Stores, Online Retailers, Other Distribution Channels), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023-2033

Industry: Food & BeveragesGlobal Meal Replacement Products Market Insights Forecasts to 2033

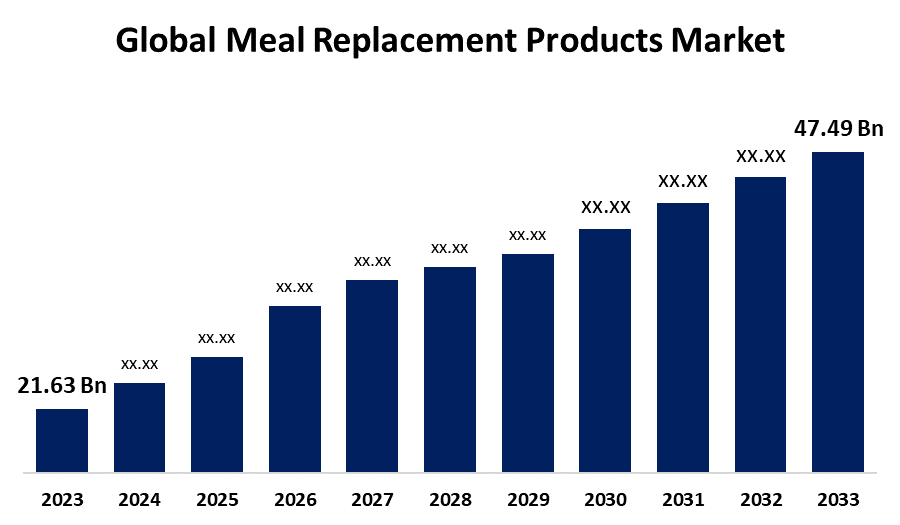

- The Global Meal Replacement Products Market Size was Estimated at USD 21.63 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 8.18% from 2023 to 2033

- The Worldwide Meal Replacement Products Market Size is Expected to Reach USD 47.49 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the Forecast Period.

Get more details on this report -

The Global Meal Replacement Products Market Size was worth around USD 21.63 Billion in 2023 and is Predicted to Grow to around USD 47.49 Billion by 2033 with a compound annual growth rate (CAGR) of 8.18% between 2023 and 2033. The market for meal replacement products is influenced by expanding health awareness, increasing demand for convenient nutrition, growing adoption of weight management programs, and active lifestyles. Also, increasing trends in fitness, growing e-commerce platforms, and the need for personalized and plant-based offerings accelerate market growth.

Market Overview

The meal replacement products industry is the market that involves food and beverage items intended to replace one or more daily meals. These items are generally formulated to deliver necessary nutrients, including protein, vitamins, minerals, and fiber, in a convenient, portable, and often lower-calorie form. The hectic life and time deficit have turned meal replacements into a popular substitute for regular meals, offering a simple and convenient option for having a healthy diet during busy schedules. The increasing disposable incomes and urbanization in regions have also propelled the market upward, as a greater number of people can now afford and purchase these products. The rising trend of fitness and wellness, especially among millennials and Gen Z, is largely driving the demand for meal replacement products. These consumers are more likely to lead a healthy lifestyle and go out of their way to find products that complement their fitness objectives. In addition, the increasing popularity of plant-based meal replacements and ongoing product formulation innovation to improve taste and nutritional content are likely to drive the market.

Report Coverage

This research report categorizes the meal replacement products market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the meal replacement products market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the meal replacement products market.

Global Meal Replacement Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 21.63 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.18% |

| 2033 Value Projection: | USD 47.49 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel, and COVID-19 Impact Analysis. |

| Companies covered:: | Soylent, Abbott Nutrition, Unilever, Nestle, Herbalife, SlimFast, Wild Oats Markets, Blue Diamond Growers, General Mills, Glanbia, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Meal replacement foods tend to be low-calorie, high-protein, and high in essential nutrients, thus becoming the go-to food item for individuals looking to achieve better health, lose weight, or simply stay healthy and fit while sacrificing nothing for convenience. This increasing consciousness of well-being propels the need for healthy, easy-to-digest meal items, boosting the market for meal replacements. In addition, ongoing innovation in the meal replacement industry, like the introduction of new flavors, formulations, and more personalized alternatives, keeps consumers interested and rewards them with repeat purchases. The companies are also introducing better-tasting products and improved nutrient profiles.

Restraining Factors

Gourmet meal replacement items, especially those designed for specific diets or incorporating high-end ingredients, tend to be more costly. Budget-friendly consumers might perceive these products as being too costly for conventional, whole-food meals and thus not suitable for a larger market. The expense of some meal replacement products might limit their uptake among low-income consumers or individuals seeking more budget-friendly meals. Price sensitivity, especially in emerging economies, may restrict the reach of the product.

Market Segmentation

The meal replacement products market share is classified into product type and distribution channel.

- The powder segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the meal replacement products market is divided into powder, ready-to-drink, and protein bars. Among these, the powder segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to powdered meal replacements providing consumers with the convenience to regulate serving sizes based on their nutritional requirements. This is particularly useful for individuals with customized diet plans either for weight gain, muscle development, or tailored caloric needs. Being able to dictate how much powder to use enables them to be more customized than with fixed portion ready-to-drink or protein bars.

- The hypermarkets/supermarkets segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the distribution channel, the meal replacement products market is divided into convenience stores, hypermarkets/supermarkets, specialty stores, online retailers, and other distribution channels. Among these, the hypermarkets/supermarkets segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is due to hypermarkets and supermarkets typically providing a lot of meal replacement varieties, such as shakes, bars, and powders, from different brands. This enables the customers to compare and select products depending on their requirements, nutritional values, and price, making the stores the most preferred site for meal replacement buying.

Regional Segment Analysis of the Meal Replacement Products Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the meal replacement products market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the meal replacement products market over the predicted timeframe. North America, and more specifically the United States and Canada, has the largest portion of the meal replacement products market. This is mainly because the region has a developed and mature consumer market for health and wellness products, such as meal replacements. North American consumers are very health-conscious, and the market for meal replacement products corresponds with the increasing interest in fitness, weight control, and easy, healthy solutions. Growing emphasis on lifestyle diseases and personalized nutrition also contributes to demand.

Asia Pacific is expected to grow at a rapid CAGR in the meal replacement products market during the forecast period. The Asia-Pacific (APAC) region is witnessing the highest growth in the meal replacement market due to urbanization, hectic lifestyles, and growing demand for healthy and convenient food options. China, India, Japan, and South Korea are witnessing high adoption of meal replacement products as eating habits change. Consumers in APAC are shifting towards Westernized diets because of globalization and higher exposure to fitness and health culture. This trend has driven the demand for meal replacements that promote weight control, fitness, and nutrition balance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the meal replacement products market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Soylent

- Abbott Nutrition

- Unilever

- Nestle

- Herbalife

- SlimFast

- Wild Oats Markets

- Blue Diamond Growers

- General Mills

- Glanbia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, Arla, the Danish dairy giant, introduced meal-replacement milk-based beverages range in Denmark. The new range will be launched in the Netherlands and England after its domestic roll-out.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the meal replacement products market based on the below-mentioned segments:

Global Meal Replacement Products Market, By Product Type

- Powder

- Ready-to-Drink

- Protein Bar

Global Meal Replacement Products Market, By Distribution Channel

- Convenience Stores

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Retailers

- Other

Global Meal Replacement Products Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the meal replacement products market over the forecast period?The global meal replacement products market is projected to expand at a CAGR of 8.18% during the forecast period.

-

2. What is the market size of the meal replacement products market?The global meal replacement products market size is expected to grow from USD 21.63 Billion in 2023 to USD 47.49 Billion by 2033, at a CAGR of 8.18% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the meal replacement products market?North America is anticipated to hold the largest share of the meal replacement products market over the predicted timeframe.

Need help to buy this report?