Global Medical Elastomers Market Size, Share, and COVID-19 Impact Analysis, By Type (Thermoplastic Elastomer, and Thermoset Elastomer), By Application (Medical Tubes, Medical Bags, Catheters, Syringes, Implants, Gloves, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Medical Elastomers Market Insights Forecasts to 2033

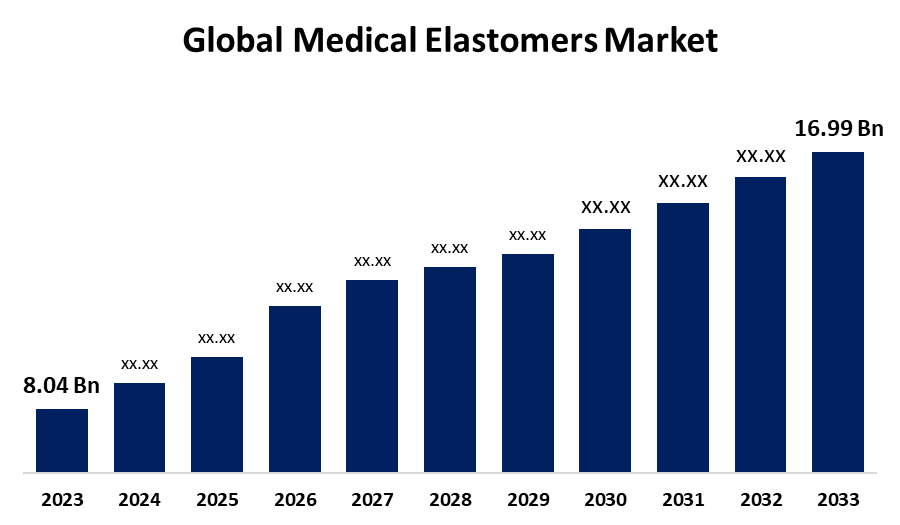

- The Global Medical Elastomers Market Size was Valued at USD 8.04 Billion in 2023

- The Market Size is Growing at a CAGR of 7.77% from 2023 to 2033

- The Worldwide Medical Elastomers Market Size is Expected to Reach USD 16.99 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Medical Elastomers Market Size is anticipated to exceed USD 16.99 billion by 2033, growing at a CAGR of 7.77% from 2023 to 2033. The growing use of medical elastomers in the manufacturing of disposable medical devices such as syringes, tubing, and valves presents a number of opportunities in the medical elastomers market.

Market Overview

A polymer with viscoelasticity, a notably low Young's modulus, and a high yield strain in comparison to other materials is known as a medical elastomer. Fluid channels, blood pressure tubing, wound drainage Penrose tubing, and even drug delivery systems frequently use medical elastomers. Due to their biocompatibility, design flexibility, durability, and advantageous performance and cost ratios, medical elastomers are becoming increasingly common in medical devices. There is a virtually low chance of an allergic reaction with medical elastomers. Medical elastomer production is being driven by the increasing need for vital implants for artificial heart valves and joints. The medical elastomer market is driven by ongoing technological developments for the production of sophisticated materials based on silicone. The technological advancements in thermoplastic elastomer manufacture have led to a significant increase in demand for medical elastomers, which is driving the medical elastomers market.

Report Coverage

This research report categorizes the medical elastomers market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical elastomers market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the medical elastomers market.

Global Medical Elastomers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.04 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.77% |

| 2033 Value Projection: | USD 16.99 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | DuPont, Biomerics, LLC, Kuraray Co., Ltd., Teknor Apex, Celanese Corporation, Momentive, Teknor Apex, Solvay, Trelleborg AB, BASF SE, HEXPOL AB, KRATON CORPORATION, PolyOne Corporation, Foster Corporation, And Other Key Players |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The technological advancements in thermoplastic elastomer manufacture have led to a significant increase in demand for medical elastomers, which in turn is driving the growth in the medical elastomers market. A few of the main factors driving the market include growing demand for single-use medical devices, advancements in medical facilities, and rising demand for medical devices. The market for medical elastomers is being driven by the world's aging population and the increasing prevalence of chronic disorders.

Restraining Factors

The high-quality materials and stringent regulatory compliance needed to manufacture medical-grade elastomers can make the process costly. Their broad adoption can be restricted by the high costs of raw materials, processing, and following safety regulations, particularly in areas where costs are a consideration.

Market Segmentation

The medical elastomers market share is classified into type and application.

- The thermoplastic elastomer segment is estimated to hold the largest market revenue share through the projected period.

Based on the type, the medical elastomers market is classified into thermoplastic elastomer and thermoset elastomer. Among these, the thermoplastic elastomer segment is estimated to hold the largest market revenue share through the projected period. Rising healthcare and medical facility costs, as well as spending on medical equipment including surgical gloves, plastic syringes, tools, and other plastic products used in consumer and industrial settings, are driving the thermoplastic elastomer market.

- The medical tube segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the medical elastomers market is divided into medical tubes, medical bags, catheters, syringes, implants, gloves, and others. Among these, the medical tube segment is anticipated to hold the largest market share through the forecast period. The need for elastomers in the medical field is increasing due to the growing need for medical tubes to administer drugs and fluids as well as the rise in respiratory conditions such as pulmonary fibrosis, asthma, and lung cancer.

Regional Segment Analysis of the Medical Elastomers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

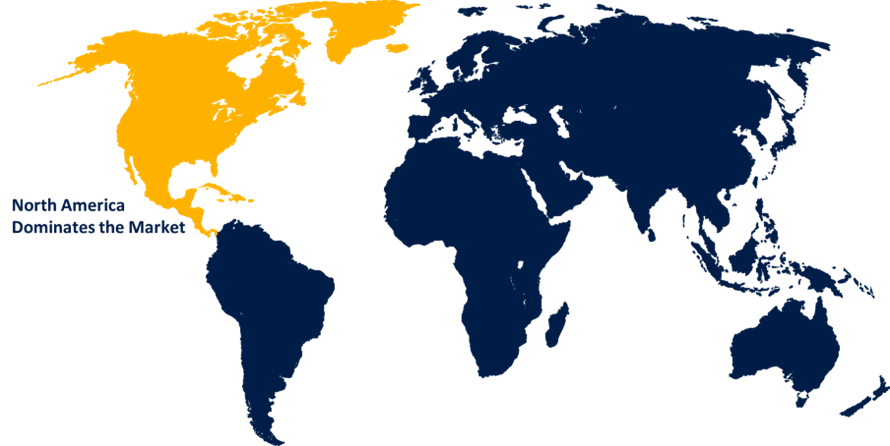

North America is anticipated to hold the largest share of the medical elastomers market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the medical elastomers market over the predicted timeframe. The increasing annual expenditure on healthcare in the United States in the form of health insurance is one of the major trends driving the regional market's growth. The need for generic drugs and medical equipment is expected to drive the North America growth in the market. Syringes, implants, medical bags, and medical tubing are on the market for vital uses.

Asia Pacific is expected to grow at the fastest CAGR growth of the medical elastomers market during the forecast period. Increased spending in the healthcare sector in major nations like China, Australia, and India is driving up demand for high-quality medical devices and components. The market for medical elastomers is also anticipated to be driven by hospitals increased service and safety standards.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the medical elastomers market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DuPont

- Biomerics, LLC

- Kuraray Co., Ltd.

- Teknor Apex

- Celanese Corporation

- Momentive

- Teknor Apex

- Solvay

- Trelleborg AB

- BASF SE

- HEXPOL AB

- KRATON CORPORATION

- PolyOne Corporation

- Foster Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, A reliable supplier of specialty plastic compounds to the healthcare sector, Teknor Apex, announced the addition of new grades of medical-grade thermoplastic elastomer (TPE) to its range that are specially made for use in biopharmaceutical tubing applications.

- In October 2021, at a formal ribbon-cutting ceremony, DuPont officially launched their new medical elastomers mixers at the Healthcare Industries Materials Site (HIMS) in Hemlock, Michigan, in the United States. The purchase of the new mixers is a response to the growing demand for supplies from clients of DuPont Liveo Healthcare Solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the medical elastomers market based on the below-mentioned segments:

Global Medical Elastomers Market, By Type

- Thermoplastic Elastomer

- Thermoset Elastomer

Global Medical Elastomers Market, By Application

- Medical Tubes

- Medical Bags

- Catheters

- Syringes

- Implants

- Gloves

- Others

Global Medical Elastomers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the medical elastomers market over the forecast period?The medical elastomers market is projected to expand at a CAGR of 7.77% during the forecast period.

-

What is the market size of the medical elastomers market?The Global Medical Elastomers Market Size is Expected to Grow from USD 8.04 Billion in 2023 to USD 16.99 Billion by 2033, at a CAGR of 7.77% during the forecast period 2023-2033.

-

Which region holds the largest share of the medical elastomers market?North America is anticipated to hold the largest share of the medical elastomers market over the predicted timeframe

Need help to buy this report?