Global Medical Equipment Financing Market Size, Share, and COVID-19 Impact Analysis, By Equipment (Diagnostics Equipment, Therapeutic Equipment, Patient Monitoring Equipment, Laboratory Equipment, and Medical Furniture), By Type (New Medical Equipment, Rental Equipment, and Refurbished Equipment), By End User (Hospitals & Clinics, Laboratories & Diagnostic Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Medical Equipment Financing Market Insights Forecasts to 2033

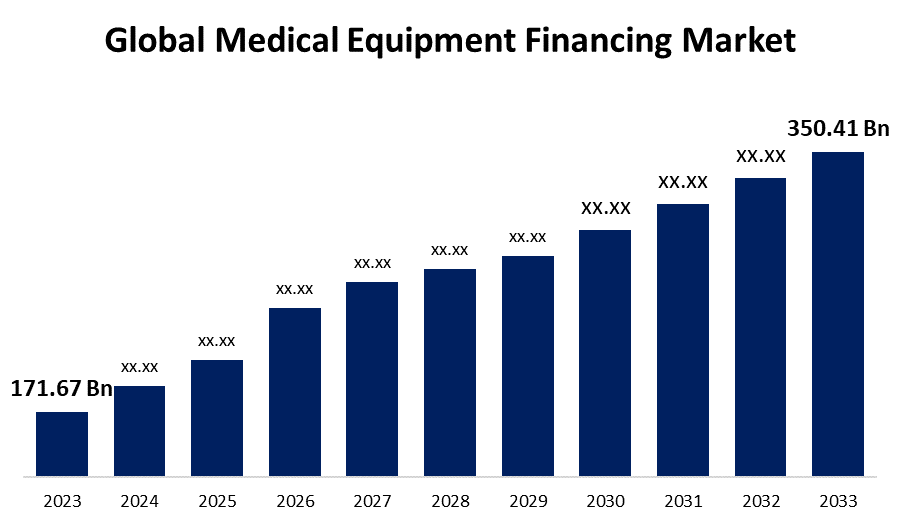

- The Global Medical Equipment Financing Market Size was Valued at USD 171.67 Billion in 2023

- The Market Size is Growing at a CAGR of 7.40% from 2023 to 2033

- The Worldwide Medical Equipment Financing Market Size is Expected to Reach USD 350.41 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Medical Equipment Financing Market Size is Anticipated to Exceed USD 350.41 Billion by 2033, Growing at a CAGR of 7.40% from 2023 to 2033.

Market Overview

Many medical professionals need medical equipment financing to purchase the necessary supplies and equipment. These professionals can improve their cash flow and grow their reserves by getting the required equipment through a loan or lease on medical equipment. They will be able to attract new and returning patients with this equipment. The continuous improvements in medical technology mean that choosing advanced medical equipment is now necessary to receive top-notch healthcare services. The global medical equipment market has grown significantly. AI technology and quick technical advancements have maximized the potential of the medical sector. This is the primary factor driving the demand for equipment financing and bringing in doctors, physicians, and other healthcare professionals. Healthcare facilities and diagnostic centers have opted for funding due to the costly and advanced equipment. Increased patient demand and technological advancements in the market are other drivers of market growth. Like all other industries, healthcare requires technology to meet the changing requirements of its patients. From digital medical records to modern facilities and diagnostic instruments, the technical infrastructure plays a critical role in defining the quality of patient treatment. As hospitals, clinics, and other healthcare facilities strive to obtain a competitive edge, the demand for advanced technology has increased significantly.

Report Coverage

This research report categorizes the market for the global medical equipment financing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global medical equipment financing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global medical equipment financing market.

Global Medical Equipment Financing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 171.67 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.40% |

| 2033 Value Projection: | USD 350.41 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Equipment, By Type, By End User, and By Region |

| Companies covered:: | Bajaj Finserv, Blue Bridge Financial, CMS Funding, First American Healthcare Finance, HDFC Bank, HeroFinCorp, JPMorgan Chase & Co., Kabbage, National Funding, SMC Finance, Societe Generale S.A., TIA Bank, Toronto-Dominion Bank, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for medical equipment has expanded significantly. AI technology along with quick technical development has maximized the potential of the medical sector. This is the main element driving the market for equipment financing and creating demand among physicians and other medical professionals. Due to the high-tech and costly equipment, hospitals and diagnostic centers now choose financing. A few of the drivers driving the global market for financing diagnostic medical equipment include the rising prevalence of diseases, the desire for numerous tests over conventional assays, and the growing use of personalized treatment. The market expansion for funding diagnostic medical equipment is supported by the growing prevalence of infectious diseases and the low cost of living in emerging nations.

Restraining Factors

The medical equipment financing industry is declining due to factors like the high cost of maintaining hospital equipment, which makes investors choose to maintain the equipment they already have rather than purchase new ones. This could be a significant obstacle for the market as a whole. Additionally, end users reevaluate their capital investments as a result of growing equipment costs for services like CT, MRI, and X-ray machines. As such, it is expected that those factors would negatively affect the market during the projected time.

Market Segmentation

The global medical equipment financing market share is segmented into equipment, type, and end-user.

- The diagnostics equipment segment dominates the market with the largest market share through the forecast period.

Based on the equipment, the global medical equipment financing market is segmented into diagnostics equipment, therapeutic equipment, patient monitoring equipment, laboratory equipment, and medical furniture. Among these, the diagnostics equipment segment dominates the market with the largest market share through the forecast period. The need for upscale, superior, and modern facilities healthcare facilities is growing in developing nations as a result of improved healthcare infrastructure and a growing healthcare sector. The growing need for technologically advanced medical care has led to the development of new and creative products and services, all of which are slightly costly to acquire, for these treatments. As infectious diseases become more common and diagnostic technology advances, there is a growing trend towards the opening of additional diagnostic centers.

- The refurbished equipment segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the type, the global medical equipment financing market is segmented into new medical equipment, rental equipment, and refurbished equipment. Among these, the refurbished equipment segment is anticipated to grow at the fastest CAGR growth through the forecast period. Refurbished medical equipment is defined as equipment that has been reconditioned or restored to a functional state without compromising its original specifications or main purpose. This equipment is used only after it has been thoroughly cleaned, and disinfected, and all worn or broken parts have been replaced. The need for reconditioned medical equipment is especially high in developing countries owing to budgetary constraints.

- The hospitals & clinics segment accounted for the largest revenue share through the forecast period.

Based on the end-user, the global medical equipment financing market is segmented into hospitals & clinics, laboratories & diagnostic centers, and others. Among these, the hospitals & clinics segment accounted for the largest revenue share through the forecast period. Higher investments in infrastructure management and an increase in the number of patients requiring surgical operations at hospitals and clinics are some of the causes contributing to this dominance. The well-established medical infrastructure and growing patient desire are driving the substantial growth of the hospitals and clinics market. Due to the availability of sufficient funding from finance businesses, hospitals, and clinics quickly adapt and install newly announced medical systems.

Regional Segment Analysis of the Global Medical Equipment Financing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global medical equipment financing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global medical equipment financing market over the predicted timeframe. The primary reason for this dominance is the area's highest financing rate for medical equipment. Investments in the medical infrastructure and continuous advancements in medical devices have contributed to this region's dominance. Additionally, the company's growth will benefit from the presence of multiple market participants focused on developing innovative medical systems or products for improved patient care, as a result of the growing adoption of artificial intelligence technology-based medical equipment finance and expanding expenditures in healthcare infrastructure. In a similar vein, growing numbers of senior citizens, an increase in chronic sickness situations, and supportive government initiatives will drive regional market growth.

Asia Pacific is expected to grow at the fastest CAGR growth of the global medical equipment financing market during the forecast period. Asia Pacific is expected to grow faster than other regions due to the region's finance sector's expansion and the emerging countries' building of hospitals, advanced labs, and diagnostic facilities. Commitments from the government to provide funds to the medical industry would also help this market grow. The principal objective of the money was to develop additional hospitals throughout the country. Due to these investments, the market is expected to develop throughout the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global medical equipment financing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bajaj Finserv

- Blue Bridge Financial

- CMS Funding

- First American Healthcare Finance

- HDFC Bank

- HeroFinCorp

- JPMorgan Chase & Co.

- Kabbage

- National Funding

- SMC Finance

- Societe Generale S.A.

- TIA Bank

- Toronto-Dominion Bank

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, The Spanish Santander Group's fully owned subsidiary, Santander Bank, revealed that it is growing its operations in vehicle and commercial equipment financing. By making this change, the business will be able to provide financing for healthcare institutions to buy commercial equipment. It is a national program that includes funding for cutting-edge medical technology and equipment.

- In August 2022, Poonawalla Fincorp announced that its product suite and offerings would be remodeled. A retail-based strategy is anticipated to be implemented. Following the most recent modifications, the company's portfolio now comprises loans for machinery, medical equipment, personal usage, enterprises, and supply chain financing. This is anticipated to open up new growth opportunities for the business.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global medical equipment financing market based on the below-mentioned segments:

Global Medical Equipment Financing Market, By Equipment

- Diagnostics Equipment

- Therapeutic Equipment

- Patient Monitoring Equipment

- Laboratory Equipment

- Medical Furniture

Global Medical Equipment Financing Market, By Type

- New Medical Equipment

- Rental Equipment

- Refurbished Equipment

- Cardiovascular Disease

Global Medical Equipment Financing Market, By End User

- Hospitals & Clinics

- Laboratories & Diagnostic Centers

- Others

Global Medical Equipment Financing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Bajaj Finserv, Blue Bridge Financial, CMS Funding, First American Healthcare Finance, HDFC Bank, HeroFinCorp, JPMorgan Chase & Co., Kabbage, National Funding, SMC Finance, Societe Generale S.A., TIA Bank, Toronto-Dominion Bank, and Others.

-

2. What is the size of the global medical equipment financing market?The Global Medical Equipment Financing Market Size is Expected to Grow from USD 171.67 Billion in 2023 to USD 350.41 Billion by 2033, at a CAGR of 7.40% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global medical equipment financing market.

Need help to buy this report?