Global Medical Imaging Services Market Size, Share, and COVID-19 Impact Analysis, By Modality (X-Ray Imaging, MRI, Ultrasound, Computed Tomography, Nuclear Imaging, Mammography), By Application (Cardiology, Neurology, Orthopedics, Gynecology, Oncology, and Others), By End-use (Hospitals, Diagnostic Centers, Clinics, & Ambulatory Surgical Centers), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: HealthcareGlobal Medical Imaging Services Market Insights Forecasts to 2032

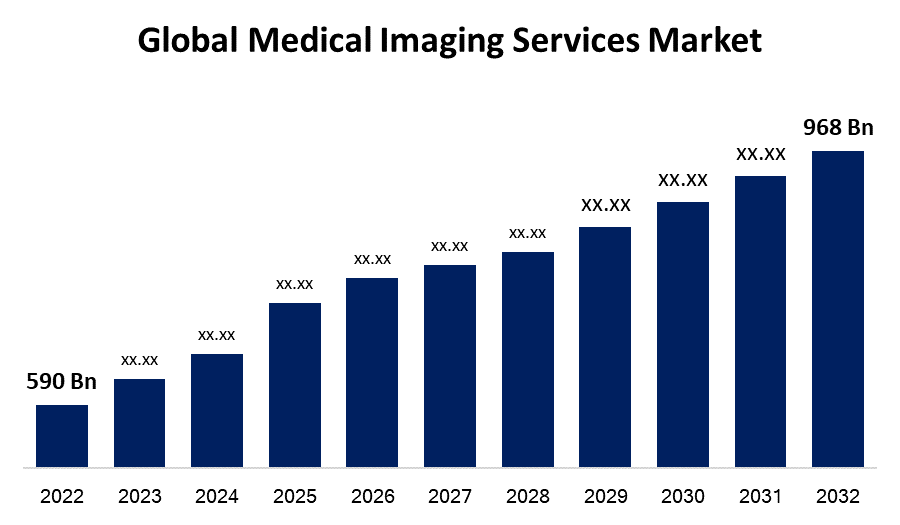

- The Global Medical Imaging Services Market Size was valued at USD 590 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.0% from 2022 to 2032.

- The Worldwide Medical Imaging Services Market size is expected to reach USD 968 Billion by 2032.

- Asia Pacific is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global Medical Imaging Services Market Size is expected to reach USD 968 Billion by 2032, at a CAGR of 5.0% during the forecast period 2022 to 2032.

Market Overview

Medical imaging refers to techniques for creating pictures of the human body (or specific body sections) for different clinical applications such as procedures and diagnosis, as well as medical research, which involves the examination of normal anatomy and function. Radiography, endoscopy, thermography, medical photography, and microscopy are all examples of biological imaging. Medical imaging includes measuring and recording technologies such as electroencephalography (EEG) and magnetoencephalography (MEG), which produce data shown as maps rather than pictures.

Report Coverage

This research report categorizes the global medical imaging services market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global medical imaging services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global medical imaging services market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Medical Imaging Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 590 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.0% |

| 2032 Value Projection: | USD 968 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Modality, By Application, By End-use, By Region, |

| Companies covered:: | GE Healthcare, Koninklijke Philips N.V., Siemens Healthineers, Canon Medical Systems Corporation, Mindray Medical International, Esaote, Hologic, Inc., Samsung Medison Co., Ltd., Koning Corporation, PerkinElmer Inc., FUJIFILM VisualSonics Inc., and Cubresa Inc. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for cutting-edge imaging modalities by teaching hospitals and universities to provide advanced technical training is projected to influence market growth in the future substantially. Further AI usage to automate picture quantification and identification will drive market expansion. For example, Google's AI platform, Deep Mind, cooperated with Moorfields Eye Hospital to analyze all optical CT scanner eye scans to ensure early identification of age-related macular degeneration. Furthermore, the emergence of 3D MRI and CT scans allows radiologists to analyze images more quickly, lowering analysis time and enhancing efficacy. Furthermore, computer vision is being utilized to identify problems that the human eye cannot see. Also, the chance of acquiring illnesses rises proportionally with age. According to the Centers for Disease Control and Prevention (CDC), approximately 80% of the elderly in the United States have at least one chronic illness. According to the American Medical Association (AMA), at least 60% of people aged 65 and over would have more than one chronic illness by 2030. As a result, there is an increase in the older population is predicted to boost demand for enhanced and sophisticated diagnostic treatment choices and diagnostic imaging services.

Restraining Factors

Diagnostic imaging devices are expensive and need significant upfront investment. Healthcare institutions, mainly outpatient imaging centers, that acquire such expensive systems sometimes rely on third-party payers to recoup the expenses of diagnostics, screening, and treatments conducted with these systems. As a result, factors such as continuous cuts in diagnostic imaging scan reimbursements and the rising cost of diagnostic imaging systems prevent small and medium-sized imaging facilities from investing in technologically advanced diagnostic imaging modalities, stifling the growth of the services market.

Market Segmentation

- In 2022, the X-Ray imaging segment is dominating the market with the largest market share during the forecast period.

Based on modality, the global medical imaging services market is segmented into different segments such as X-Ray imaging, MRI, ultrasound, computed tomography, nuclear imaging, and mammography. Among these segments, the X-Ray imaging segment has the biggest revenue share over the predicted period due to factors such as the increased frequency of lung ailments, dental problems, and bone fractures that have hastened the use of X-ray imaging treatments. Furthermore, the increasing use of digital X-rays and continued technological advances in X-ray imaging are expected to accelerate its acceptance. Moreover, X-ray is one of the most often used major medical imaging modalities for a variety of tests and surgeries. This service provides noninvasive illness diagnosis and monitoring, as well as surgical treatment planning support.

- In 2022, the neurology segment is influencing the largest market share over the forecast period.

Based on application, the global medical imaging services market is segmented into cardiology, neurology, orthopedics, gynecology, oncology, and others. Throughout these segments, the neurology segment is leading the market due to rising senior populations and rising occurrences of brain traumas and neurodegenerative diseases such as Alzheimer's disease (AD) and Parkinson's disease (PD) are expected to boost category growth globally. According to the Alzheimer's Association, an estimated 6.5 million persons aged 65 and older in the United States will have Alzheimer's dementia in 2022, with the figure anticipated to rise to 12.7 million by 2050. Furthermore, an increase in research efforts in the MRI Imaging sector, as well as the approval of novel MRI techniques for the diagnosis of brain illnesses, are projected to add to the segment's growth.

- In 2022, the hospitals segment is dominating the market with the largest market share over the forecast period.

Based on end users, the global medical imaging services market is classified into different segments such as hospitals, diagnostic centers, clinics, & ambulatory surgical centers. Among these segments, the hospital's segment has the biggest revenue share over the forecast period due to rising demand for advanced imaging modalities, as well as the integration of surgical suites with imaging technologies, which are boosting the industry. Some affluent nations have seen a significant increase in demand for these modalities in teaching hospitals as compared to general or specialty hospitals.

Regional Segment Analysis of the medical imaging services market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is dominating the market with the largest market of 32.9% revenue growth during the forecast period

Get more details on this report -

North America is leading the significant market growth of 32.9% during the forecast period due to the existence of a large number of industry participants in the region, as well as the high frequency of new product releases, which are factors contributing to regional market growth. Also, because of advantageous reimbursement scenarios and investment from market participants, the area has seen significant adoption of modern, high-end medical imaging equipment. Moreover, the aforementioned variables, together with the region's aging population, the growth of chronic illnesses, and the growing trend of preventative diagnostic techniques, are likely to fuel the region's medical imaging business.

In Asia Pacific, the market for medical imaging services market is predicted to develop rapidly over the forecast period due to the increasing prevalence of chronic illnesses and the strong need for sophisticated imaging technologies. A growing number of local manufacturing units are projected to produce reasonably priced diagnostic machines, assisting in this price-sensitive, underserved market segment.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global medical imaging services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Canon Medical Systems Corporation

- Mindray Medical International

- Esaote

- Hologic, Inc.

- Samsung Medison Co., Ltd.

- Koning Corporation

- PerkinElmer Inc.

- FUJIFILM VisualSonics Inc.

- Cubresa Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2022, Carlisle Health Pvt Ltd purchased Bundaberg Radiology Group (BR Radiology Group). BR Radiology Group has several sites in Queensland and provides a wide variety of diagnostic and imaging services. This purchase aided the company's entry into the Australian medical imaging sector as well as its industry position.

- In August 2022, Life Healthcare acquired Eugene Marais Radiology's non-clinical imaging activities, which are situated at Life Eugene Marais Hospital in Pretoria. This has enabled the corporation to expand and diversify its portfolio throughout its activities in Southern Africa.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Medical Imaging Services Market based on the below-mentioned segments:

Global Medical Imaging Services Market, By Modality

- X-Ray Imaging

- MRI

- Ultrasound

- Computed Tomography

- Nuclear Imaging

- Mammography

Global Medical Imaging Services Market, By Application

- Cardiology

- Neurology

- Orthopedics

- Gynecology

- Oncology

- Others

Global Medical Imaging Services Market, By End User

- Hospitals

- Diagnostic Centers

- Clinics

- Ambulatory Surgical Centers

Medical Imaging Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?