Global Medical Polymer Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Resins, Biodegradable Polymers, Medical Elastomers, Fibers and Others) By Application (Tooth Implants, Mobility Aids, Cleanroom Supplies, Wound Care, BioPharma Devices, Medical Components, Dental Implants and Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) Analysis and Forecast 2021 - 2030.

Industry: Chemicals & MaterialsGlobal Medical Polymer Market Insights Forecasts to 2030

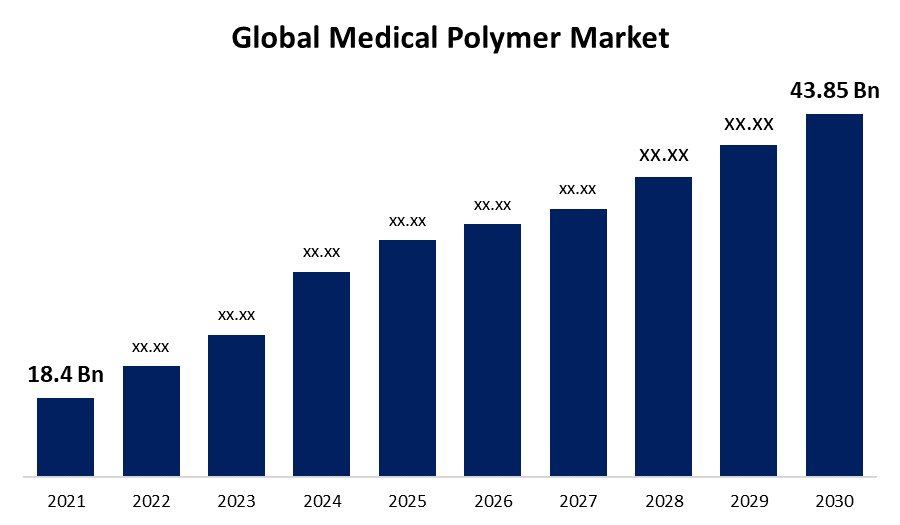

- The Global Medical Polymer Market was valued at USD 18.4 Billion in 2021.

- The Market is Growing at a CAGR of 8.4% from 2021 to 2030

- The Worldwide Medical Polymer Market Size is Expected to reach USD 43.85 Billion by 2030

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Medical Polymer Market Size is Expected to reach USD 43.85 Billion by 2030, at a CAGR of 8.4% during the forecast period 2021 to 2030. Medical-grade polymers are expected to be in high demand due to factors like rising medical sector demand. Based on the raw materials used, polymers are divided into synthetic and natural polymers. Wood, bio-based polymers, and natural rubber are examples of naturally occurring polymers. Conversely, thermoset and thermoplastic resins, elastomers, and fibres are examples of manufactured polymers.

Market Overview

In nature, medical polymers are biocompatible, allowing them to be easily processed by the human body. Medical polymers are referred to as clinical polymers also because these are mainly used in the healthcare sector. A substantial upsurge in medical equipment drives medical polymers' demand in healthcare markets. The outstanding properties of medical polymers are responsible for the increasing demands in the healthcare sector like non-toxic, biodegradable, fluid compatibility etc. Medical polymers are also used in tissue engineering, dental implants and wound healing. Engineered polymers like Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Polystyrene, Polyethylene (PE), and Polypropylene are two of the most important medical polymers used for making devices and equipment. The COVID-19 outbreak had a positive effect on the growth of the medical polymer market. An increase in the production of medical treatments and procedures, combined with a change in awareness and a rise in COVID-19, has created a demand for new medical devices and innovative packaging. It is estimated that the medical polymer market will grow to USD 37.39 billion by 2030 at a CAGR of 8.2%. The government is investing in research and development in order to produce technologically sophisticated equipment to aid in the eradication of deadly diseases throughout the region. Moreover, the use of medical polymers in the packaging sector will boost the growth of medical polymers because of the increasing demand for sustainable packaging. With the increase in the geriatric population, medical polymers have been experiencing strong market growth. In addition, there is a growing need for medical polymers globally in order to aid in the innovation of healthcare devices and ensure their supportability.

Report Coverage

This research report categorizes the market for global medical polymer based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global medical polymer market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global medical polymer market sub-segments.

Global Medical Polymer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 18.4 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 8.2% |

| 2030 Value Projection: | USD 43.85 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Product Type, By Application, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Evonik Industries AG, Huizhou Foryou Medical Devices Co. Ltd., Nature Works LLC, SIBUR, INEOS, LG Chem, Dow Inc., Arkema, Exxon Mobil Corporation, Eastman Chemical Corporation, Lotte Chemical Corporation, Total Plastics, Hyosung Corporation and other key vendors. |

| Pitfalls & Challenges: | Since polymers have a relatively low structural stiffness, heavy structures cannot be created of them. |

Get more details on this report -

Market Dynamics:

- Driver- Rise in Demand

One of the key trends influencing the growth of the market in North America is the rise in per capita healthcare spending in the U.S. in the form of health insurance. The market in North America is projected to be driven by this in the years to come, increasing demand for generic medications and medical equipment. Manufacturing medical components and pharmaceutical packaging are two of this industry's crucial applications. A significant portion of the population now has access to healthcare facilities and services in the United States thanks to the Affordable Care Act (ACA) and Medicaid, two important government programmes.

- Restraint- Some Disadvantages

Cannot resist extremely high temperatures because, in contrast to metals, all plastics melt down relatively quickly. Polymers have a lower strength to size ratio than metals, which is higher. Furthermore, it is difficult to machine and can only be done at a slow speed.

- Opportunity- Government Initiavtives

Both the public and commercial sectors are making large investments in the Canadian healthcare system. The Canadian Institute for Health Information (CIHI) estimates that in 2021, the government will invest USD 308 billion in the healthcare industry. The nation has a high level of health consciousness and a long life expectancy—85 years for women and 79 years for men—which presents attractive growth potential for Canadian manufacturers of medical polymers.

- Challenges- Polymer Issues

Polymers cannot be used in heat applications because of their extremely low heat capacity. Since polymers have a relatively low structural stiffness, heavy structures cannot be created of them. Because some polymers can't be recycled while all metals can, disposal becomes a problem.

Segmentation Analysis:

- In 2021, the resins segment accounted for the largest share of the market, with 25% and a market revenue of 4.6 billion.

Based on product type, the medical polymer market is categorized into resins, biodegradable polymers, medical elastomers, fibers and others. In 2021, the resins segment accounted for the largest share of the market, with 25% and a market revenue of 4.6 billion. The increased demand for resins is due to their toughness, strength, optical clarity etc. Due to its outstanding properties, the resin segment can replace the metal and glass devices used in the medical field.

- In 2021, the wound care segment accounted for the largest share of the market, with 18.5% and market revenue of 3.4 billion.

Based on application, the medical polymer market is categorized into tooth implants, mobility aids, cleanroom supplies, wound care, biopharma devices, medical components, dental implants and others. In 2021, the wound care segment accounted for the largest share of the market, with 18.5% and market revenue of 3.4 billion. The demand for wound care segments is increasing because chronic wounds are becoming more prevalent with age, diabetes is becoming more prevalent, and the geriatric population is growing which is triggering the growth of the wound care sector and ultimately contributing a large share in the growth of the medical polymer market.

Regional Segment Analysis of the Medical Polymer Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, the U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

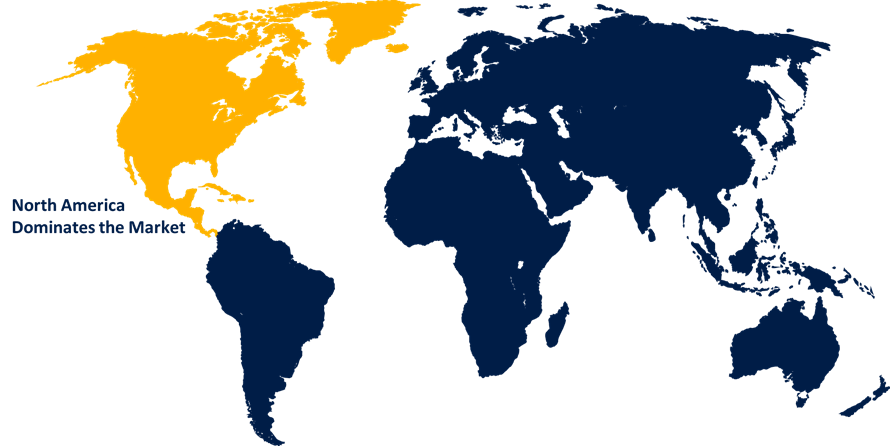

North America emerged as the largest market for the global medical polymer market, with a market share of around 38.20% and 2.7 billion of the market revenue in 2021.

- In 2021, North America emerged as the largest market for the global medical polymer market, with a market share of around 38.20% and 2.7 billion of the market revenue. North America is expected to be the largest market. The increasing demand for packaging in the pharmaceutical sector is responsible for the abrupt growth of the medical polymer market.

- Asia Pacific market is expected to grow at the fastest CAGR between 2021 and 2030. The increased demand for medical devices and instruments in the region will boost the growth of the market.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global medical polymer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Evonik Industries AG

- Huizhou Foryou Medical Devices Co. Ltd.

- Nature Works LLC

- SIBUR

- INEOS

- LG Chem

- Dow Inc.

- Arkema

- Exxon Mobil Corporation

- Eastman Chemical Corporation

- Lotte Chemical Corporation

- Total Plastics

- Hyosung Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In March 2021, BASF plans to spend $29.56 million on superabsorbent polymers to deal with consumers' increasing demand for medical polymers.

- In May 2022, Clariant developed a new polymeric material. Polymeric is resistant to humidity and temperature which is an important development in the field of medical polymer.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global medical polymer market based on the below-mentioned segments:

Global Medical Polymer Market, By Product Type

- Resins

- Biodegradable Polymers

- Medical Elastomers

- Fibers

- Others

Global Medical Polymer Market, By Application

- Tooth Implants

- Mobility Aids

- Cleanroom Supplies

- Wound Care

- BioPharma Devices

- Medical Components

- Dental Implants

- Others

Global Medical Polymer Market, Regional Analysis

- North America

- THE US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- The Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Medical Polymer market?As per Spherical Insights, the size of the Medical Polymer market was valued at USD 18.4 billion in 2022 to USD 43.85 billion by 2030.

-

What is the market growth rate of the Medical Polymer market?The Medical Polymer market is growing at a CAGR of 8.2% from 2022 to 2030.

-

Which country dominates the Medical Polymer market?North America emerged as the largest market for Medical Polymer.

-

Who are the key players in the Medical Polymer market?Key players in the Medical Polymer market are Evonik Industries AG, Huizhou Foryou Medical Devices Co. Ltd., Nature Works LLC, SIBUR, INEOS, LG Chem, Dow Inc., Arkema, Exxon Mobil Corporation, Eastman Chemical Corporation, Lotte Chemical Corporation, Total Plastics, and Hyosung Corporation.

-

Which factor drives the growth of the Medical Polymer market?Factors, such as increasing demand from the medical industry are anticipated to fuel the market's growth over the forecast period.

Need help to buy this report?