Global Medical Polyoxymethylene Market Size, Share, and COVID-19 Impact Analysis, By Type (Homopolymer POM and Copolymer POM), By Application (Dialysis Machine, Handles for Surgical Instruments, Inhalers, Insulin Pen, Medical Trays, Pharmaceutical Closures, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Chemicals & MaterialsGlobal Medical Polyoxymethylene Market Insights Forecasts to 2032

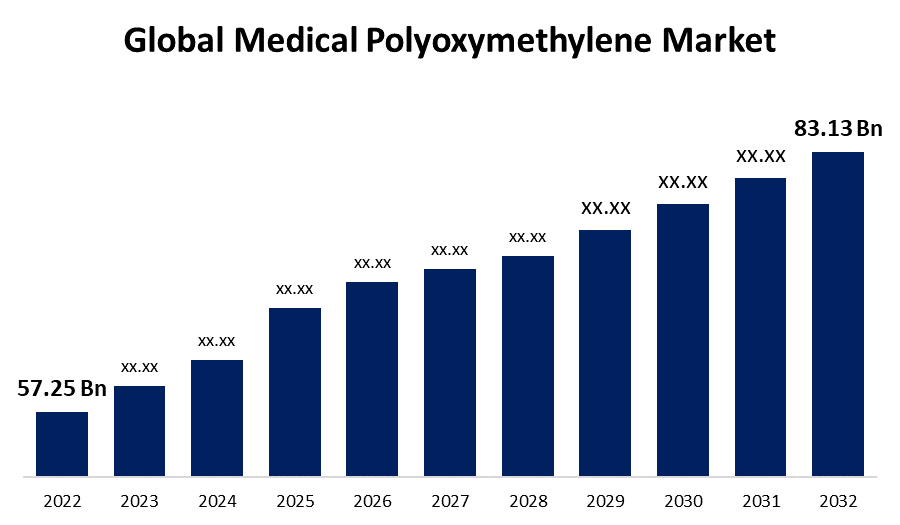

- The Global Medical Polyoxymethylene Market Size was valued at USD 57.25 Billion in 2022.

- The Market Size is Growing at a CAGR of 3.8% from 2022 to 2032

- The Worldwide Medical Polyoxymethylene Market Size is expected to reach USD 83.13 Billion by 2032

- North America is expected to grow higher during the forecast period

Get more details on this report -

The Global Medical Polyoxymethylene Market Size is expected to reach USD 83.13 Billion by 2032, at a CAGR of 3.8% during the forecast period 2022 to 2032.

Market Overview

Medical polyoxymethylene (POM) is a versatile polymer that has gained significant attention in the healthcare industry. Also known as acetal or polyacetal, POM exhibits excellent mechanical properties, biocompatibility, and resistance to chemicals, making it suitable for various medical applications. It is widely used in the production of medical devices, surgical instruments, and implantable components due to its high strength, low friction coefficient, and dimensional stability. Medical POM offers superior resistance to sterilization methods such as steam, ethylene oxide, and gamma irradiation, ensuring the safety and reliability of medical devices. Its biocompatible nature and resistance to body fluids make it an ideal choice for long-term implants. Overall, medical POM stands as a promising material in the healthcare sector, enabling the development of advanced medical technologies and enhancing patient outcomes.

Report Coverage

This research report categorizes the market for medical polyoxymethylene market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the medical polyoxymethylene market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the medical polyoxymethylene market.

Global Medical Polyoxymethylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 57.25 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.8% |

| 2032 Value Projection: | USD 83.13 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Dow, Celanese Corporation, DuPont, Polyplastics Co. Ltd., Asahi Kasei Corporation, Jet-Hot, Inc., Mitsubishi Engineering-Plastics Corporation, SABIC, Avient Corporation, Innovative Plastics LLC, CLARIANT, Korea Engineering Plastics Co. Ltd., SPI Performance Coatings, China National Bluestar (Group) Co. Ltd., ICD High Performance Coatings, EverCoat Industries Sdn Bhd |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The medical polyoxymethylene (POM) market is driven by several factors, due to the increasing demand for medical devices and surgical instruments fuels the growth of the market. POM's exceptional mechanical properties, such as high strength and dimensional stability, make it an ideal choice for these applications. The rising geriatric population and the prevalence of chronic diseases drive the need for advanced medical technologies, which, in turn, increases the demand for POM. Additionally, the biocompatibility and chemical resistance of POM make it suitable for implantable components, further driving market growth. Furthermore, the strict regulations pertaining to the safety and quality of medical devices contribute to the adoption of POM, as it meets the required standards. Overall, these factors collectively contribute to the expansion of the Medical POM market.

Restraining Factors

The medical polyoxymethylene (POM) market faces certain restraints that impact its growth. One major restraint is the availability of alternative materials with similar properties, such as polyether ether ketone (PEEK) and polypropylene (PP), which can be used in medical applications. These alternatives pose competition to POM and can limit its market share. Additionally, the high cost of POM compared to some other materials can hinder its widespread adoption, particularly in cost-sensitive healthcare settings. Moreover, certain concerns regarding the long-term biocompatibility and potential toxicity of POM have been raised, which may raise caution among healthcare professionals. These restraints, combined, affect the growth potential of the Medical POM market to some extent.

Market Segmentation

- In 2022, the copolymer POM segment accounted for around 56.2% market share

On the basis of the type, the global medical polyoxymethylene market is segmented into homopolymer POM and copolymer POM. The copolymer segment has emerged as the dominant segment in the Medical Polyoxymethylene (POM) market. Copolymers are formed by combining two or more different monomers, resulting in enhanced properties compared to homopolymers. In the case of Medical POM, copolymers offer improved characteristics such as increased flexibility, impact resistance, and lower friction coefficient, making them highly desirable for medical applications. These enhanced properties make copolymers well-suited for the production of medical devices, surgical instruments, and implantable components. They provide better performance and durability in dynamic and high-stress applications. Furthermore, copolymers exhibit excellent chemical resistance and biocompatibility, ensuring their suitability for use in healthcare settings. The dominance of copolymers in the Medical POM market can be attributed to their ability to meet the specific requirements of medical applications and provide enhanced functionality, making them the preferred choice among manufacturers and healthcare professionals.

- In 2022, the insulin pen segment dominated with more than 33.7% market share

Based on the type of application, the global medical polyoxymethylene market is segmented into dialysis machine, handles for surgical instruments, inhalers, insulin pen, medical trays, pharmaceutical closures, and others. The insulin pen has emerged as a dominant product segment in the Medical Polyoxymethylene (POM) market. This can be attributed to increasing prevalence of diabetes worldwide has led to a rise in the demand for insulin delivery devices. Insulin pens, which provide a convenient and user-friendly method for insulin administration, have gained significant popularity among patients and healthcare providers. The mechanical properties of POM, such as its high strength and dimensional stability, make it an ideal material for insulin pen production. POM's biocompatibility and resistance to body fluids ensure the safety and reliability of these devices. Additionally, POM's chemical resistance allows for compatibility with various insulin formulations. Moreover, the ease of customization and production efficiency of POM contribute to the dominance of insulin pens in the Medical POM market. Overall, the insulin pen's superior performance and patient-friendly features position it as a leading product segment in the market.

Regional Segment Analysis of the Medical Polyoxymethylene Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific dominated the market with more than 35.3% revenue share in 2022

Get more details on this report -

Based on region, the Asia-Pacific region is a dominant force in the Medical Polyoxymethylene (POM) market. Several factors contribute to its market dominance, because the region's large population, particularly in countries like China and India, provides a significant customer base and drives demand for medical devices and surgical instruments. The rapid industrialization and economic growth in countries like China, Japan, and South Korea have led to advancements in healthcare infrastructure, creating a favorable environment for the adoption of POM in medical applications. Additionally, the presence of a robust manufacturing sector in Asia-Pacific, coupled with lower production costs, allows for competitive pricing of POM-based medical products. Furthermore, government initiatives promoting domestic production and investments in the healthcare sector further stimulate the market. Overall, these factors contribute to Asia-Pacific's dominant position in the Medical POM market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global medical polyoxymethylene market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. These companies compete based on factors such as product quality, innovation, regulatory compliance, pricing, and customer support. The market is dynamic, with ongoing research and development efforts to introduce advanced polyoxyethylene materials that meet the evolving needs of the medical industry.

List of Companies:

- Dow

- Celanese Corporation

- DuPont

- Polyplastics Co. Ltd.

- Asahi Kasei Corporation

- Jet-Hot, Inc.

- Mitsubishi Engineering-Plastics Corporation

- SABIC

- Avient Corporation

- Innovative Plastics LLC

- CLARIANT

- Korea Engineering Plastics Co. Ltd.

- SPI Performance Coatings

- China National Bluestar (Group) Co. Ltd.

- ICD High Performance Coatings

- EverCoat Industries Sdn Bhd.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Polyplastics Group expanded their portfolio of acetal materials for the medical and healthcare industries at MD&M West in Anaheim, California. The business intends to exhibit its new DURACON POM PM range for pharmaceutical interaction and delivery applications. The expanded portfolio of acetal materials demonstrates the company's commitment to meeting the evolving needs of the medical industry by offering high-quality solutions that ensure safe and efficient pharmaceutical processes. The introduction of these innovative materials signifies Polyplastics' dedication to advancing medical technology and contributing to improved patient care.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global medical polyoxymethylene market based on the below-mentioned segments:

Medical Polyoxymethylene Market, By Type

- Homopolymer POM

- Copolymer POM

Medical Polyoxymethylene Market, By Application

- Dialysis Machine

- Handles for Surgical Instruments

- Inhalers

- Insulin Pen

- Medical Trays

- Pharmaceutical Closures

- Others

Medical Polyoxymethylene Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?