Global Membrane Materials Recycling and Upcycling Market Size, Share, and COVID-19 Impact Analysis, By Type (Polymeric, Metallic, Ceramic), By Method (Chemical Cleaning and Regeneration, Physical Cleaning and Backwashing), By End-User (Water Treatment, Chemical and Metal Processing, Pharmaceutical, Biotechnology, Food and Beverage, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Advanced MaterialsGlobal Membrane Materials Recycling and Upcycling Market Insights Forecasts to 2033

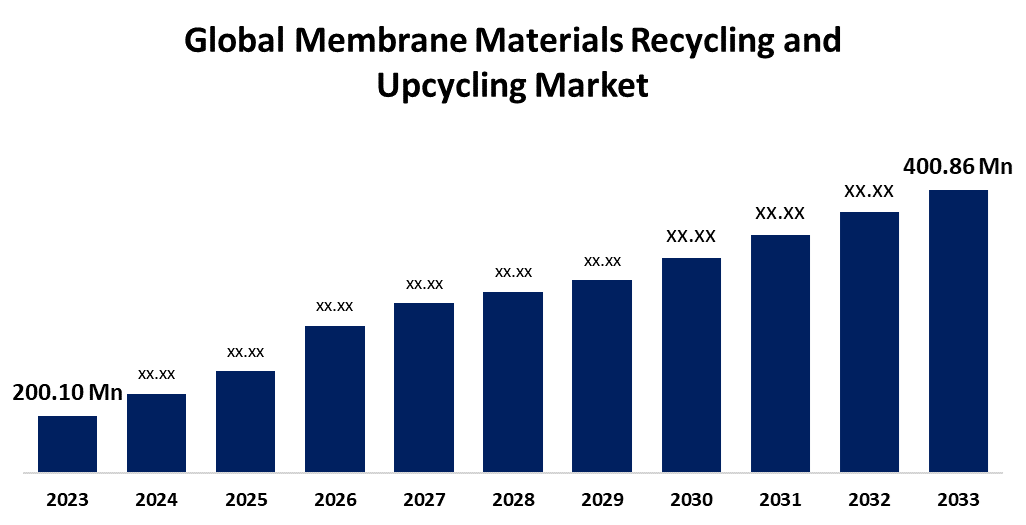

- The Global Membrane Materials Recycling and Upcycling Market Size was Valued at USD 200.10 Million in 2023

- The Market Size is Growing at a CAGR of 7.20% from 2023 to 2033

- The Worldwide Membrane Materials Recycling and Upcycling Market Size is Expected to Reach USD 400.86 Million by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Membrane Materials Recycling and Upcycling Market Size is Anticipated to Exceed USD 400.86 Million by 2033, Growing at a CAGR of 7.20% from 2023 to 2033.

Market Overview

Membrane materials recycling and upcycling refer to the processes involved in handling and reprocessing materials used in membranes, which are thin layers or films used in various applications like filtration, separation, and barriers. Membrane materials recycling and upcycling are processes aimed at managing and repurposing used membrane materials to reduce waste and environmental impact. Recycling involves collecting and processing these materials to recover valuable components or convert them into new products through mechanical, chemical, or energy recovery methods. Upcycling focuses on transforming used membranes into higher-value products or innovative applications, enhancing their utility, and extending their lifecycle.

Membrane materials recycling and upcycling include recycling the components into new membranes or upcycling them into higher-value products like coatings, composites, or fuel cells. The purpose of membrane material recycling and upcycling is to reduce waste, conserve resources, and establish a more sustainable supply chain for membrane materials. Membranes are used in various industries, including water treatment, pharmaceuticals, and food processing. However, their disposal is causing environmental issues, leading to a rise in demand for membrane materials. In the pharmaceutical industry, membranes control drug release, while in food processing, they separate and concentrate liquids and solids. The increasing use of membrane-based products in end-use industries is expected to increase demand for recycled and upcycled membrane materials, reducing waste and conserving resources.

Report Coverage

This research report categorizes the market for membrane materials recycling and upcycling based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the membrane materials recycling and upcycling market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the membrane materials recycling and upcycling market.

Global Membrane Materials Recycling and Upcycling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 200.10 Million |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 7.20% |

| 2033 Value Projection: | USD 400.86 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Method, By End-User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Falcon Water Tech LLC, TAMI Industries, Lenntech BV, Evonik, Memtech International Ltd, aqua plus Wasser- und Recyclingsysteme GmbH, Sterlitech Corporation, Evodos, Danaher Corporation, Porex, Aquatech, Porifera Inc., Aquaporin A/S, and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The membrane materials recycling and upcycling market is driven by a combination of environmental, economic, and technological factors including increasing regulatory pressures and rising waste management costs that are pushing industries toward sustainable practices, while technological advances make recycling more feasible and cost-effective. Resource scarcity and the need for sustainability align with growing consumer demand for eco-friendly solutions, encouraging companies to adopt circular economy practices. Economic incentives and industry collaborations further support these efforts, improving the quality and competitiveness of recycled materials.

Restraining Factors

The growth of the membrane materials recycling and upcycling market faces several challenges including high recycling costs, technical difficulties, and inadequate infrastructure can hinder the effective processing and recovery of membrane materials. Limited market demand for recycled products, coupled with quality and performance issues, might reduce the attractiveness of recycling initiatives. Regulatory barriers and economic uncertainties further complicate market dynamics, while a lack of awareness and the low cost of raw materials can constrain adoption.

Market Segmentation

The membrane materials recycling and upcycling market share is classified into type, method, and end-user.

- The polymeric segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the membrane materials recycling and upcycling market is classified into polymeric, metallic, and ceramic. Among these, the polymeric segment is estimated to hold the highest market revenue share through the projected period. Polymeric is the most often utilized membrane material because of its diversity and ease of production. They are utilized in a variety of applications, including water treatment, gas separation, and food processing. Polymeric membranes are commonly constructed of polyamide, polyethersulfone, and polyvinylidene fluoride. Polyvinylidene difluoride (PVDF) and polyethersulfone (PES) are the primary materials for polymeric membranes, which account for approximately 75% of total market products, including 9 of the 11 most commercially important items in the wastewater treatment industry. Polymeric membranes are often less expensive, making recycling and upcycling economically viable for businesses. Environmental limitations are also driving demand for polymeric membrane recycling and upcycling, as industries adopt more sustainable waste management approaches.

- The chemical cleaning and regeneration segment is anticipated to hold the largest market share through the forecast period.

Based on the method, the membrane materials recycling and upcycling market is divided into chemical cleaning and regeneration, physical cleaning and backwashing. Among these, the chemical cleaning and regeneration segment is anticipated to hold the largest market share through the forecast period. This dominance is due to the effectiveness and efficiency of chemical cleaning processes in restoring membrane performance. Chemical cleaning can address a wide range of contaminants, including organic fouling, scaling, and biological fouling, which makes it a preferred choice for extending the operational life of membrane systems. Regeneration techniques further enhance the viability of membranes for reuse, aligning with sustainability goals and reducing overall costs. The ability of chemical cleaning and regeneration to significantly improve membrane longevity and performance often gives it a leading edge over physical cleaning and backwashing methods in the market.

- The water treatment segment dominates the market with the largest market share through the forecast period.

Based on the end-user, the membrane materials recycling and upcycling market is categorized into water treatment, chemical and metal processing, pharmaceutical, biotechnology, food and beverage, and others. Among these, the water treatment segment dominates the market with the largest market share through the forecast period. This is largely due to the extensive use of membranes in water purification and wastewater treatment processes, driven by stringent regulatory requirements and economic considerations. The high cost of membrane replacement and the sector’s commitment to sustainability further amplify the need for effective recycling and upcycling materials.

Regional Segment Analysis of the Membrane Materials Recycling and Upcycling Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the membrane materials recycling and upcycling market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the membrane materials recycling and upcycling market over the predicted timeframe. Europe region is dominated in the market due to stringent environmental regulations, strong emphasis on sustainability, and technological innovation. The region's commitment to circular economy principles, combined with a robust industrial base in sectors like water treatment and chemical processing, drives high demand for advanced recycling solutions. Additionally, government incentives and support for sustainable practices further bolster the market in the region. Top of Form

Bottom of Form

North America is expected to grow at the fastest CAGR growth of the membrane materials recycling and upcycling market during the forecast period. This growth is driven by increasing environmental regulations, rising industrial demand for membranes, and technological advancements in recycling processes. The region's strong focus on sustainability, coupled with substantial investments in research and infrastructure, further accelerates market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the membrane materials recycling and upcycling market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Falcon Water Tech LLC

- TAMI Industries

- Lenntech BV

- Evonik

- Memtech International Ltd

- aqua plus Wasser- und Recyclingsysteme GmbH

- Sterlitech Corporation

- Evodos

- Danaher Corporation

- Porex

- Aquatech

- Porifera Inc.

- Aquaporin A/S

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Dow announced REVOLOO Recycled Plastics Resins in June 2024. This launch is a significant step forward in Dow's efforts to advance circularity and transform waste.

- In April 2024, BASF accelerated its plastics journey with a spectrum of recycled grades and circular solutions.

- In April 2024, CARBIOS a pioneer in the development and industrialization of biological technologies to reinvent the life cycle of plastic and textiles, celebrated the groundbreaking ceremony for the world's first PET bio-recycling plant in the presence of representatives of local authorities, partner brands, and industrial partners who all make up CARBIOS’ ecosystem.

- In August 2023, Mitsui Chemicals Tohcello and Mitsui announced the launch of pilot testing for horizontally recycling printed BOPP film into new flexible packaging film.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the membrane materials recycling and upcycling market based on the below-mentioned segments:

Global Membrane Materials Recycling and Upcycling Market, By Type

- Polymeric

- Metallic

- Ceramic

Global Membrane Materials Recycling and Upcycling Market, By Method

- Chemical Cleaning and Regeneration

- Physical Cleaning and Backwashing

Global Membrane Materials Recycling and Upcycling Market, By End-User

- Water Treatment

- Chemical and Metal Processing

- Pharmaceutical

- Biotechnology

- Food and Beverage

- Others

Global Membrane Materials Recycling and Upcycling Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the membrane materials recycling and upcycling market over the forecast period?The membrane materials recycling and upcycling market is projected to expand at a CAGR of 7.20% during the forecast period.

-

2. What is the market size of the membrane materials recycling and upcycling market?The Global Membrane Materials Recycling and Upcycling Market Size is Expected to Grow from USD 200.10 Million in 2023 to USD 400.86 Million by 2033, at a CAGR of 7.20% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the membrane materials recycling and upcycling market?Europe is anticipated to hold the largest share of the membrane materials recycling and upcycling market over the predicted timeframe.

Need help to buy this report?