Global Metal Fabrication Equipment Market Size, Share, and COVID-19 Impact Analysis, By Equipment Type (Cutting, Machining, Welding, Bending, and Others), By Application (Job Shops, Automotive, Aerospace and Defence, Mechanical Applications, and Others), By Material (Steel, Aluminium, Stainless Steel, Titanium, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Machinery & EquipmentGlobal Metal Fabrication Equipment Market Insights Forecasts to 2033

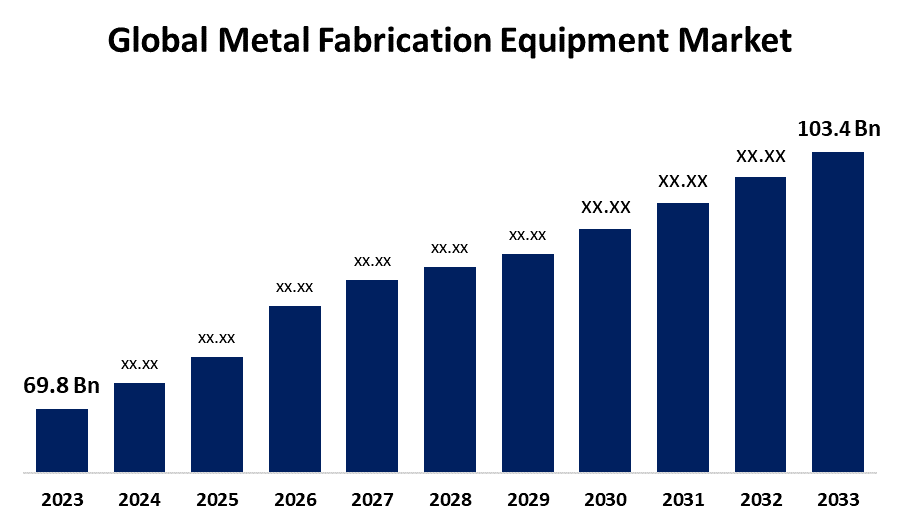

- The Global Metal Fabrication Equipment Market Size Was Valued at USD 69.8 Billion in 2023

- The Market Size is Growing at a CAGR of 4.01% from 2023 to 2033

- The Worldwide Metal Fabrication Equipment Market Size is Expected to Reach USD 103.4 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Metal Fabrication Equipment Market Size is Anticipated to Exceed USD 103.4 Billion by 2033, Growing at a CAGR of 4.01% from 2023 to 2033.

Market Overview

Metal fabrication equipment refers to the machinery, tools, and equipment used in shaping, cutting, joining, and assembling metal components and structures. These tools and machines are crucial in various industries, including manufacturing, construction, architecture, automotive, and aerospace, where they help produce the components and structures necessary for several applications.

This equipment includes cutting tools such as sawing machines, shears, laser cutters, plasma cutters, and water jet cutters. Forming equipment like press brakes, roll forming machines, stamping presses, hydraulic presses, and punching machines are used to bend, shape, or create holes in metal. Welding machines include MIG welders, TIG welders, stick welders, and spot welders for joining metal pieces. Machining tools including lathes, milling machines, and drill presses for precise shaping and drilling. It also includes finishing equipment like grinders, sandblasters, and polishing machines, making metal surfaces smooth and clean.

Additionally, equipment such as riveting machines, metal benders, and conveyors are used for the assembly and movement of metal components in a fabrication shop. These tools and machines are vital in industries such as construction, automotive, aerospace, and manufacturing.

Report Coverage

This research report categorizes the market for the global metal fabrication equipment market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global metal fabrication equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global metal fabrication equipment market.

Global Metal Fabrication Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 69.8 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.01% |

| 023 – 2033 Value Projection: | USD 103.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Equipment Type, By Application, By Material, By Region |

| Companies covered:: | Mayville Engineering Company Inc., Kapco Metal Stamping, Interplex Holdings Pte. Ltd., STANDARD IRON and WIRE WORKS INC., BTD Manufacturing, PA International, R5 Metal Fabricators Inc., Watson Engineering Inc., Matcor-Matsu Group, DMG MORI, Aleris Corporation, LancerFab Tech Pvt. Ltd., O’Neal Manufacturing Services, N.W. Metal Fabricators Inc., Komaspec, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid adoption of automation and robotics within fabrication processes drives the growth of the global metal fabrication equipment market as it enhances productivity, precision, and safety while reducing operational costs. Additionally, the use of the Internet of Things (IoT) and artificial intelligence (AI) in this equipment enables predictive maintenance and real-time monitoring, boosting efficiency and minimizing downtime.

The rising demand from end-use industries, including automotive, aerospace, and construction, fuels the need for high-quality and precision-fabricated metal components. Infrastructure development projects, especially in emerging economies also contribute to market expansion. Moreover, the increasing trend towards lightweight and durable materials in manufacturing has led to the evolution of advanced fabrication methods, bringing in high investments.

Restraining Factors

Some of the challenges anticipated to restrain the growth of the global metal fabrication equipment market include the high initial investment cost required for acquiring advanced fabrication machinery and the ongoing expenses of maintenance and operations. Additionally, there is a shortage of skilled labor capable of operating this equipment, which might hamper productivity. Economic uncertainties and fluctuations in raw material prices could lead to high market volatility, creating financial constraints for manufacturers.

Market Segmentation

The global metal fabrication equipment market share is classified into equipment type, application, and material.

- The cutting equipment segment is expected to hold the largest share of the global metal fabrication equipment market during the forecast period.

Based on the equipment type, the global metal fabrication equipment market is divided into cutting, machining, welding, bending, and others. Among these, the cutting equipment segment is expected to hold the largest share of the global metal fabrication equipment market during the forecast period. This dominance is primarily expected due to the essential role that cutting plays in the initial stages of metal fabrication, where accurate separation of metal pieces is crucial for consequent processes. Cutting equipment, including laser cutters, plasma cutters, and waterjet cutters, offers high precision, speed, and versatility, making them essential in various industries like automotive, aerospace, and construction. The continuous advancements in cutting technologies, such as fibre lasers boost their efficiency and cost-effectiveness. These benefits, combined with the high demand for accurate and high-quality metal cutting support the cutting equipment segment’s leading position in the market.

- The automotive segment is expected to hold the largest share of the global metal fabrication equipment market during the forecast period.

Based on application, the global metal fabrication equipment market is divided into job shops, automotive, aerospace and defense, mechanical applications, and others. Among these, the automotive segment is expected to hold the largest share of the global metal fabrication equipment market during the forecast period. This is expected due to the use of fabricated metal components in vehicle manufacturing, which requires high accuracy and quality finish. The automotive industry relies heavily on metal fabrication for producing parts such as chassis, engine components, transmission systems, and body panels. The demand for lightweight and durable materials pushes manufacturers to invest in advanced fabrication techniques and equipment. Furthermore, the automotive industry’s drive toward innovation, modernization, and increasing production capacities contributes to the high demand for metal fabrication equipment.

- The aluminum segment is expected to grow at the fastest CAGR in the global metal fabrication equipment market during the forecast period.

Based on material, the global metal fabrication equipment market is divided into steel, aluminum, stainless steel, titanium, and others. Among these, the aluminum segment is expected to grow at the fastest CAGR in the global metal fabrication equipment market during the forecast period. The rise in demand for aluminum is driven by its lightweight, high strength-to-weight ratio, and excellent corrosion resistance properties. It makes aluminum the ideal material for various applications, particularly in the automotive and aerospace industries, which seek to improve fuel efficiency and reduce emissions using lighter materials. Additionally, the construction industry prefers aluminum alloys for its durability and aesthetic appeal. Advancements in aluminum fabrication techniques, its recyclability, and sustainability boost its attractiveness.

Regional Segment Analysis of the Global Metal Fabrication Equipment Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

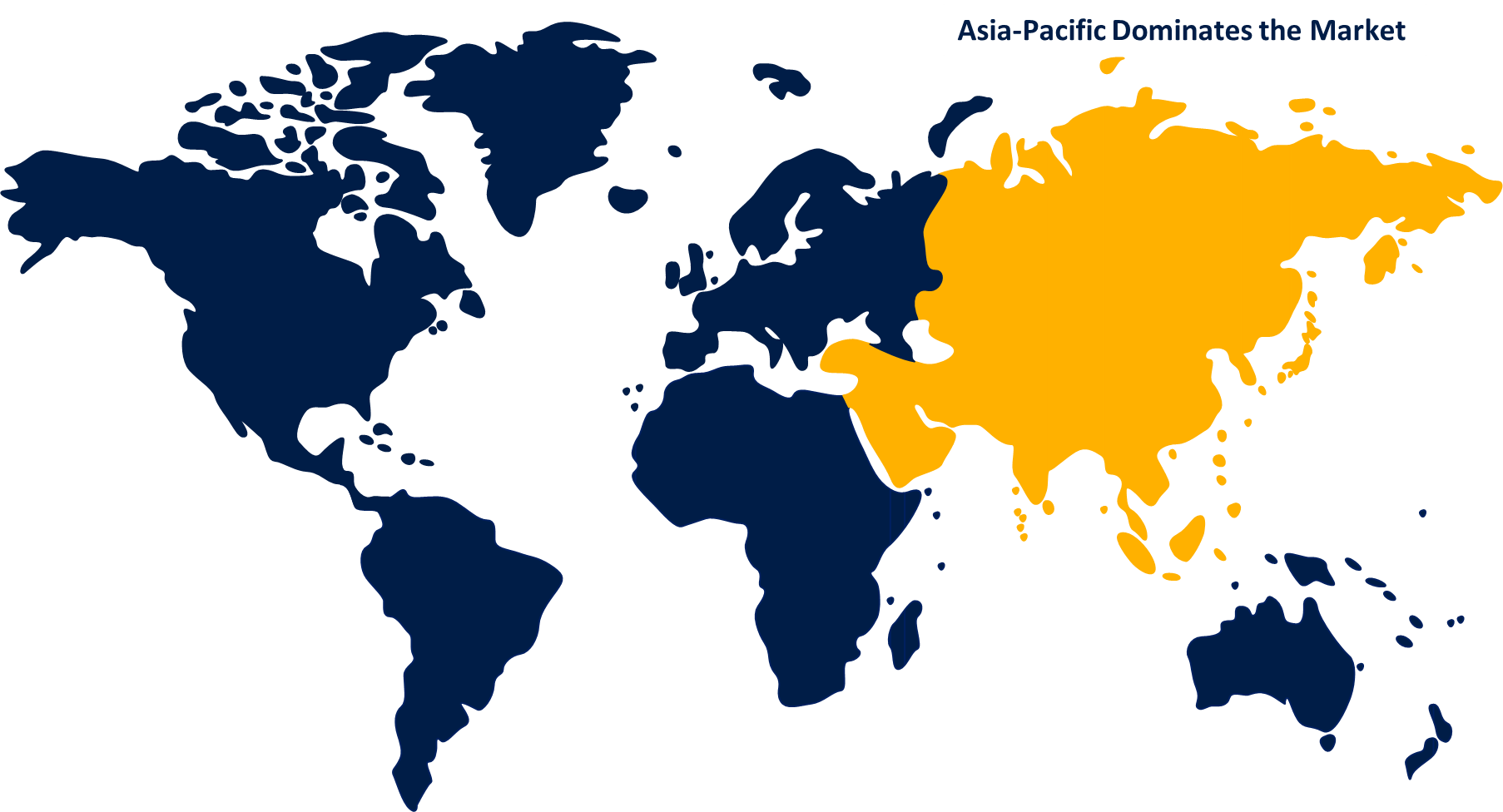

Asia Pacific is anticipated to hold the largest share of the global metal fabrication equipment market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global metal fabrication equipment market over the predicted timeframe. The North American market is driven by the rapid rise of manufacturing industries in countries such as China, India, Japan, and South Korea. The robust manufacturing sector in these nations and investments in infrastructure development fuels the demand for metal fabrication equipment. China is a manufacturing powerhouse and contributes to the market due to its high production capacities and advanced manufacturing technologies.

Additionally, the growing automotive and aerospace industries in the region amplify the need for high-quality metal components. The availability of low-cost labour and raw materials, combined with supportive government policies and tax benefits for industrial growth, also play crucial roles in supporting the region’s leading position in the metal fabrication equipment market.

Europe is Expected to Grow the fastest during the forecast period. The growth is primarily fueled by the emphasis on advanced manufacturing technologies and Industry 4.0 initiatives. Countries including Germany, Italy, and France are at the forefront of adopting automation, robotics, and IoT in metal fabrication, leading to high efficiency and productivity. Additionally, the region’s significant focus on sustainable practices and the transition towards green manufacturing drives investments in state-of-the-art, energy-efficient metal fabrication equipment. The automotive and aerospace sectors are key components of the industrial ecosystem, and demand high-quality fabricated metal parts, boosting market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global metal fabrication equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mayville Engineering Company Inc.

- Kapco Metal Stamping

- Interplex Holdings Pte. Ltd.

- STANDARD IRON and WIRE WORKS INC.

- BTD Manufacturing

- PA International

- R5 Metal Fabricators Inc.

- Watson Engineering Inc.

- Matcor-Matsu Group

- DMG MORI

- Aleris Corporation

- LancerFab Tech Pvt. Ltd.

- O'Neal Manufacturing Services

- N.W. Metal Fabricators Inc.

- Komaspec

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, J&L Machine and Fabrication, a provider of steel fabrication and machining services, created 33 new jobs with a $2.1 million expansion of its production capacity in Stanley, N.C.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global metal fabrication equipment market based on the below-mentioned segments:

Global Metal Fabrication Equipment Market, By Equipment Type

- Cutting

- Machining

- Welding

- Bending

- Others

Global Metal Fabrication Equipment Market, By Application

- Job Shops

- Automotive

- Aerospace and Defence

- Mechanical Applications

- Others

Global Metal Fabrication Equipment Market, By Material

- Steel

- Aluminium

- Stainless Steel

- Titanium

- Others

Global Metal Fabrication Equipment Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Mayville Engineering Company Inc., Kapco Metal Stamping, Interplex Holdings Pte. Ltd., STANDARD IRON and WIRE WORKS INC., BTD Manufacturing, PA International, R5 Metal Fabricators Inc., Watson Engineering Inc., Matcor-Matsu Group, DMG MORI, Aleris Corporation, LancerFab Tech Pvt. Ltd., O'Neal Manufacturing Services, N.W. Metal Fabricators Inc., Komaspec., and others.

-

2.What is the size of the global metal fabrication equipment market?The Global Metal Fabrication Equipment Market is expected to grow from USD 69.8 Billion in 2023 to USD 103.4 Billion by 2033, at a CAGR of 4.01% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global metal fabrication equipment market over the predicted timeframe.

Need help to buy this report?