Global Metalworking Fluids Market Size, Share, and COVID-19 Impact Analysis, By Product (Mineral, Synthetic, and Bio-Based), By Application (Neat Cutting Oil, Water Cutting Oil, Corrosion Preventive Oil, and Others), By End-use (Metal Fabrication, Transportation Equipment, Machinery, and Others), By Industrial End-use (Construction, Electric & Power, Agriculture, Automobile, Aerospace, Rail, Marine, Telecommunications, and Health Care), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Metalworking Fluids Market Insights Forecasts to 2033

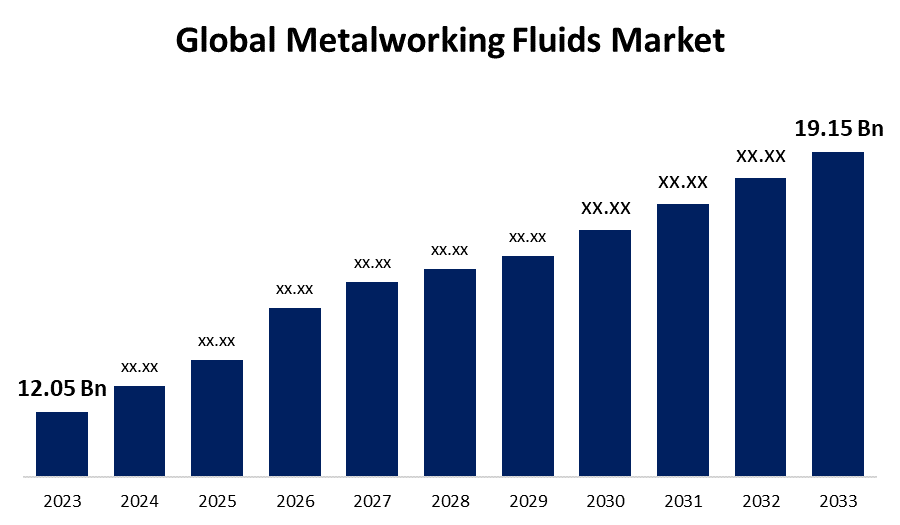

- The Global Metalworking Fluids Market Size was Estimated at USD 12.05 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.74% from 2023 to 2033

- The Worldwide Metalworking Fluids Market Size is Expected to Reach USD 19.15 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Metalworking Fluids Market Size is projected to reach USD 19.14 Billion by 2033, growing at a CAGR of 4.74% from 2023 to 2033. The rising need for automotive and heavy industry machinery is driving the market for metalworking fluids.

Market Overview

The metalworking fluids market refers to the industry that sells liquids for lubricating and cooling metal during manufacturing. Metalworking fluids, also known as coolants, suds, slurry, or soap, are in the form of liquids or oils used during machining, grinding, and other processes. Everyday activities including milling, drilling, cutting, stamping, and grinding require metalworking fluids in a variety of industries. Furthermore, the composition of these products is constantly changing as a result of evolving formulations and rules, as well as pressure from international regulatory agencies. Increased demand for heavy industry and automotive products, together with a growing preference for lightweight components in high-performance applications including construction, heavy machinery, and transportation equipment, are driving the metalworking fluid market trend. By offering comprehensive fluid management solutions, the burden was decreased by offering customers personalized advice for fluid selection, usage optimization, and waste control. By meeting the continuous demand for effective machinery operation and maintenance, this industrial expansion created opportunities for metalworking fluids market.

Report Coverage

This research report categorizes the metalworking fluids market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the metalworking fluids market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the metalworking fluids market.

Global Metalworking Fluids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.05 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.74% |

| 023 – 2033 Value Projection: | USD 19.15 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Product, By Application, By End-use, By Industrial End-use and By Region |

| Companies covered:: | Houghton International, Inc. Chevron Corp. Exxon Mobil Corp. BP plc TotalEnergies Indian Oil Corporation Ltd. Henkel AG & Co. KGaA Hindustan Petroleum Corporation Ltd. Blaser Swisslube AG Total S.A. FUCHS China Petroleum & Chemical Corp. Kuwait Petroleum Corp. Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing need for metalworking fluids in the automotive and transportation industry along with the growing production of vehicles are significantly propelling the metalworking fluids market demand. Further, the market for metalworking fluids (MWFs) is growing due to specific end-use industries such transportation equipment, metal fabrication, and machinery. Increased exports of power, agricultural, automotive, and construction machines, as well as improvements in manufacturing techniques for creating complex end-use products have propelled the metalworking fluids market.

Restraining Factors

The stringent regulations imposed by government agencies for protecting people, environment and workers from hazards, which are closely related to industrial manufacturing are challenging the metalworking fluids market.

Market Segmentation

The global metalworking fluids market share is classified into product, application, end-use, and industrial end-use.

- The mineral segment dominated the market with the largest market share of over 48.06% in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the metalworking fluids market is classified into mineral, synthetic, and bio-based. Among these, the mineral segment dominated the market with the largest market share of over 48.06% in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Mineral based fluids are employed in drilling, milling, broaching, grinding, and turning operations for cooling and lubrication. The increased use of mineral-based fluids owing to increased price consciousness is driving the market in the mineral segment.

- The neat cutting oil segment dominated the market with the largest share of more than 42.0% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the metalworking fluids market is classified into neat cutting oil, water cutting oil, corrosion preventive oil, and others. Among these, the neat cutting oil segment dominated the market with the largest share of more than 42.0% in 2023 and is expected to grow at a significant CAGR during the forecast period. Metalworking fluids are employed in numerous cutting operations and a broad range of machining procedures. The growing use of high-alloy steels in the heavy equipment manufacturing sector is driving the market in the neat cutting oil segment.

- The machinery segment dominated the market with the largest revenue share of more than 41.61% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the metalworking fluids market is classified into metal fabrication, transportation equipment, machinery, and others. Among these, the machinery segment dominated the market with the largest revenue share of more than 41.61% in 2023 and is expected to grow at a significant CAGR during the forecast period. Manufacturers use metalworking fluids in machining operations to prolong the sump’s life. Small-scale enterprises have increased the usage of MWFs owing to their limited procurement budgets.

- The construction segment held the largest revenue share of 26.98% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the industrial end-use, the metalworking fluids market is classified into construction, electric & power, agriculture, automobile, aerospace, rail, marine, telecommunications, and health care. Among these, the construction segment held the largest revenue share of 26.98% in 2023 and is expected to grow at a significant CAGR during the forecast period. The metalworking fluids demand is rising due to the increasing building and construction activities. The rising need for construction machinery and related parts required for industrial, residential, and commercial construction is driving the market in the construction segment.

Regional Segment Analysis of the Metalworking Fluids Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

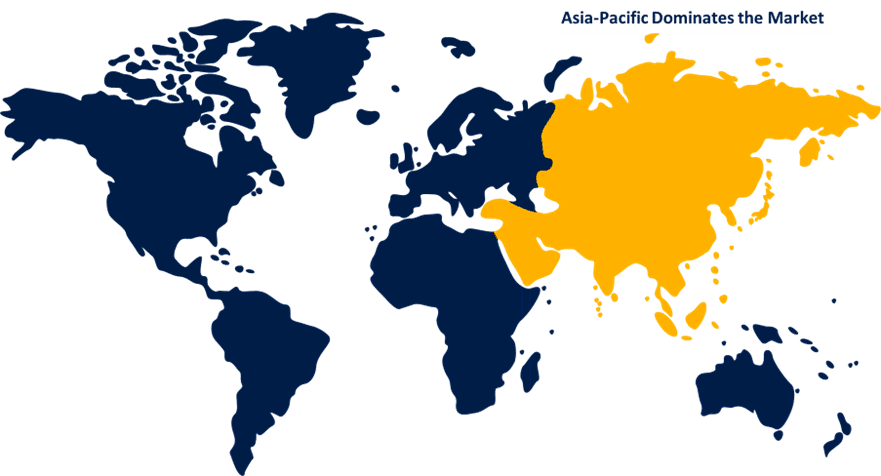

Asia Pacific is anticipated to hold the largest share of the metalworking fluids market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the metalworking fluids market over the predicted timeframe. The increasing need for metalworking fluids in the automotive and transportation industry is driving the market demand. Further, the robust manufacturing base in China and India is driving the market demand for metalworking fluids. The increased need for superior lubrication performance in automotive grinding and machining operations is also propelling the metalworking fluids market demand.

North America is expected to grow at the fastest CAGR growth of the metalworking fluids market during the forecast period. One of the prime users of MWFs in North America, which also complies with stringent environmental regulations enforced by OSHA and EU Ecolabel. MWF manufacturers in North America offer mineral, synthetic, and water-soluble oils that are appropriate for grinding and machining processes on both ferrous and non-ferrous metals, thereby propelling the metalworking fluids market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the metalworking fluids market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Houghton International, Inc.

- Chevron Corp.

- Exxon Mobil Corp.

- BP plc

- TotalEnergies

- Indian Oil Corporation Ltd.

- Henkel AG & Co. KGaA

- Hindustan Petroleum Corporation Ltd.

- Blaser Swisslube AG

- Total S.A.

- FUCHS

- China Petroleum & Chemical Corp.

- Kuwait Petroleum Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Univar Solutions B.V., a subsidiary of Univar Solutions, Inc., a leading global solutions provider to users of specialty ingredients and chemicals, announced the Company has been appointed as distributor for Marott Graphic Services (MGS Chemistry Group) unique rust protection additives for inks, coatings, rust prevention oils, and lubricants and metalworking fluids in Europe.

- In September 2022, Clariant extended support for manufacturers of fully synthetic metalworking fluids. The uniquely comprehensive set of low-foaming, multifunctional additives are available alongside formulation guidance to support mineral oil-free, more bio-resistant water soluble fluids that boost machining efficiency, productivity and protection with fewer ingredients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the metalworking fluids market based on the below-mentioned segments:

Global Metalworking Fluids Market, By Product

- Mineral

- Synthetic

- Bio-Based

Global Metalworking Fluids Market, By Application

- Neat Cutting Oil

- Water Cutting Oil

- Corrosion Preventive Oil

- Others

Global Metalworking Fluids Market, By End-use

- Metal Fabrication

- Transportation Equipment

- Machinery

- Others

Global Metalworking Fluids Market, By Industrial End-use

- Construction

- Electric & Power

- Agriculture

- Automobile

- Aerospace

- Rail

- Marine

- Telecommunications

- Health Care

Global Metalworking Fluids Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the metalworking fluids market over the forecast period?The metalworking fluids market is projected to expand at a CAGR of 4.74% during the forecast period.

-

2. What is the market size of the metalworking fluids market?The Metalworking Fluids Market Size is Expected to Grow from USD 12.05 Billion in 2023 to USD 19.15 Billion by 2033, at a CAGR of 4.74% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the metalworking fluids market?Asia Pacific is anticipated to hold the largest share of the metalworking fluids market over the predicted timeframe.

Need help to buy this report?