Global Metformin Hydrochloride Market Size, Share, and COVID-19 Impact Analysis, By Dosage Form (Oral Solutions, Tablets, Injectable Solutions, and Extended-Release Tablets), By Route of Administration (Intravenous and Oral), By Indications (Polycystic Ovary Syndrome, Type II Diabetes, and Gestational Diabetes), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Metformin Hydrochloride Market Insights Forecasts to 2033

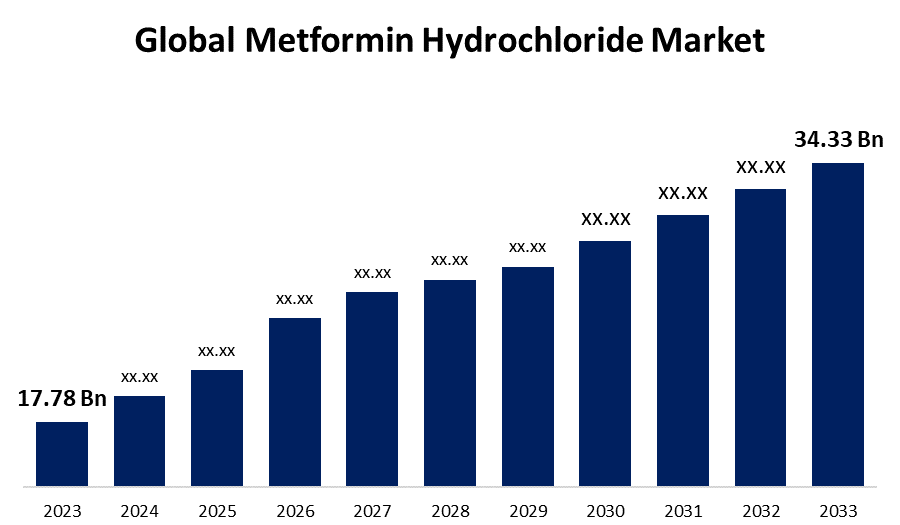

- The Global Metformin Hydrochloride Market Size was Estimated at USD 17.78 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 6.80% from 2023 to 2033

- The Worldwide Metformin Hydrochloride Market Size is Expected to Reach USD 34.33 Billion by 2033

- Asia Pacific is predicted to grow at the fastest CAGR throughout the projection period

Get more details on this report -

The Global Metformin Hydrochloride Market Size is Anticipated to Exceed USD 34.33 Billion by 2033, Growing at a CAGR of 6.80% from 2023 to 2033. The upsurge in the metformin hydrochloride market is owing to rising cases of diabetes, sedentary lifestyles, malnutrition, genetic history of diabetes, an increasing proportion of geriatric populations, and obesity.

Market Overview

The metformin hydrochloride market encompasses the development, manufacturing, and sale of metformin hydrochloride. Metformin hydrochloride is a salt form of metformin, which is a biguanide class of antihyperglycemic agent (antidiabetic). It is a first-line drug used for the management of type II diabetes. Metformin lowers the blood sugar level by increasing peripheral glucose uptake and utilization, which improves insulin sensitivity while reducing intestine absorption and hepatic glucose production. It is available in intravenous and oral dosage forms, and the marketed products of metformin hydrochloride are Glycomet, Radimet, Glymetral-M, etc.

Metformin hydrochloride is extensively used for the management of diabetes owing to its safety concerns and cost-effectiveness. It has been used for 60 years to treat type II diabetes. Along with diabetes, it has a broad range of indications, including cancer, obesity, and cardiovascular and renal diseases.

Diabetes is a chronic metabolic disorder characterized by the raised glucose level in the blood due to impairment in insulin secretion. The rising prevalence of diabetes in society is driving the need for metformin hydrochloride. For instance, the International Diabetes Federation Atlas reported that, in 2021, Diabetes affects 537 million adults, 1 in 10; it is predicted to rise to 643 million by 2030 and 783 million by 2045, and over 3 in 4 live in low- and middle-income countries. Diabetes causes 6.7 million deaths and $966 billion in health expenditure.

Various government initiatives were established to provide financial support to the diabetic population and diabetic medication to poor people. For instance, the Government of India provides technical and financial support to states/Union territories under the National Programme for Prevention and Control of Diabetes and the Free Drugs Service Initiative. They provide free essential medicines, quality generic medicines, and affordable prices under the Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP). The Department of Biotechnology supports research in high disease-burden areas, including diabetes. Therefore, government initiatives reduce the economic burden of patients, giving hope for adequate treatment and the provision of medications cost-effective in middle-income countries, which increases the demand for diabetic medications, resulting in the metformin hydrochloride market expansion.

The U.S. Food and Drug Administration (FDA) has revised labeling changes regarding the recommendations for metformin-containing medicines for diabetes to expand metformin use in certain patients with reduced kidney function. The current FDA revised guideline for metformin labeling changes indicates that metformin can be safely used in patients with impairment in kidney function. Hence, the diversified indications of metformin in the management of numerous diseases escalate the need for metformin hydrochloride and lead to market growth.

Considering all the above-defined factors, including the rising prevalence of diabetes and government initiatives thriving the metformin hydrochloride market growth.

Report Coverage

This research report categorizes the market for the global metformin hydrochloride market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global metformin hydrochloride market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global metformin hydrochloride market.

Global Metformin Hydrochloride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 17.78 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.80% |

| 023 – 2033 Value Projection: | USD 34.33 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 258 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Dosage Form, By Route of Administration, By Indications, By Distribution Channel, By Region |

| Companies covered:: | Sandoz Sun Pharmaceuticals Lupin Cadila Healthcare Myla Laboratories Sanofi Hetero Labs Reddy’s Laboratories Torrent Pharmaceuticals Aurobindo Pharma Teva Pharmaceuticals Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising percentage of people with diabetes, sedentary lifestyles, bad eating habits, and the world's aging population are all contributing to the market's growth. A frequently prescribed oral antihyperglycemic medication, metformin HCL persists as an essential medication in the management of type 2 diabetes mellitus owing to its ability to effectively reduce blood glucose levels and enhance insulin sensitivity. Furthermore, through enhanced therapeutic results and patient compliance, developments in pharmaceutical formulations, including extended-release formulations, fuel market growth. Treatment initiation is additionally increasing due to rising awareness of the illness and the significance of early diagnosis. The demand for metformin hydrochloride is anticipated to continue to grow as the worldwide diabetes epidemic continues to show no signs of decreasing, emphasizing the vital role of metformin hydrochloride in diabetes treatment.

In an attempt to improve patient tolerance and treatment adherence, extended-release (ER) formulations of metformin have been introduced to address prevalent gastrointestinal side effects. Improved glycemic control and fewer problems are associated with this invention. Metformin hydrochloride is more desirable for long-term maintenance owing to its once-daily dosing simplicity. Additionally, the pharmacokinetic profile of extended-release formulations is stable. For example, Mascot Health Series Pvt Ltd has received the Drug Controller General of India (DCGI) approval for its triple combination diabetes treatment. Mascot claims to be the first CDMO to launch Dapagliflozin + Glimepride + Metformin ER tablets for commercial consumption. The development of this formulation aims to reduce the necessity of multiple drugs and prolong the therapeutic effect.

Restraining Factors

The global metformin hydrochloride market faces challenges in adhering to strict regulatory standards, including Good Manufacturing Practices (GMP) guidelines and frequent updates in policies. Non-compliance can lead to penalties, recalls, or bans on distribution, impacting revenue and brand reputation.

Market Segmentation

The global metformin hydrochloride market share is classified into dosage form, route of administration, indications, and distribution channel.

- The tablet segment dominated the market with 45.89% of the share in 2023 and is anticipated to grow at a significant CAGR throughout the projected timeframe.

Based on the dosage form, the global metformin hydrochloride market is categorized into oral solutions, tablets, injectable solutions, and extended-release tablets. Among these, the tablet segment dominated the market with 45.89% of the share in 2023 and is anticipated to grow at a significant CAGR throughout the projected timeframe. The sector growth is ascribed to ease of use, patient compliance, longer shelf life, availability of the tablets, growing trend of the controlled release formulations, greater stability, patient compliance, accurate and precise dosing, cost-effective than injectables, advanced blister packaging of tablets avoids the moisture absorption from the environment, sugar-coated masking prevents from unpleasant taste, and longer shelf life.

- The oral segment accounted for the largest share in 2023 and is predicted to grow at a CAGR Of 4.78% throughout the predicted timeframe.

Based on the route of administration, the global metformin hydrochloride market is categorized into intravenous and oral. Among these, the oral segment accounted for the largest share in 2023 and is predicted to grow at a CAGR Of 4.78% throughout the predicted timeframe. The segmental expansion is attributed to safety concerns, better bioavailability, lower prices, greater tolerability, flexibility in dosing, stable dosage form, lesser incompatibilities, patient compliance, pain avoidance, ease of ingestion, faster metabolism of the drug, and convenience for repeated and prolonged usage.

- The type II diabetes segment held a significant share in 2023 and is predicted to grow at a remarkable CAGR throughout the predicted timeframe.

Based on the indications, the global metformin hydrochloride market is categorized into polycystic ovary syndrome, type II diabetes, and gestational diabetes. Among these, the type II diabetes segment held a significant share in 2023 and is predicted to grow at a remarkable CAGR throughout the predicted timeframe. The segment growth is owing to the most prevalent type of diabetes, rising cases of obesity, low intake of fiber, high intake of saturated fatty acids, family history of diabetes, hyperlipidemic condition, and increasing prevalence of gestational diabetes.

- The retail pharmacies segment accounted for the largest market share of 52.14% in 2023 and is predicted to grow at a significant CAGR throughout the predicted timeframe.

Based on the distribution channel, the global metformin hydrochloride market is categorized into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the retail pharmacies segment accounted for the largest market share of 52.14% in 2023 and is predicted to grow at a significant CAGR throughout the predicted timeframe. The segment expansion is driven by the rising prevalence of chronic diseases such as diabetes, cardiovascular disease, and cancer, growing demand for convenient healthcare services, self-medicating adoption, technological advancements, saturation in the retail pharmacies, increasing proportion of the geriatric population, implementing healthcare programs for the patients, and increasing demand of the personalized care and medication.

Regional Segment Analysis of the Global Metformin Hydrochloride Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

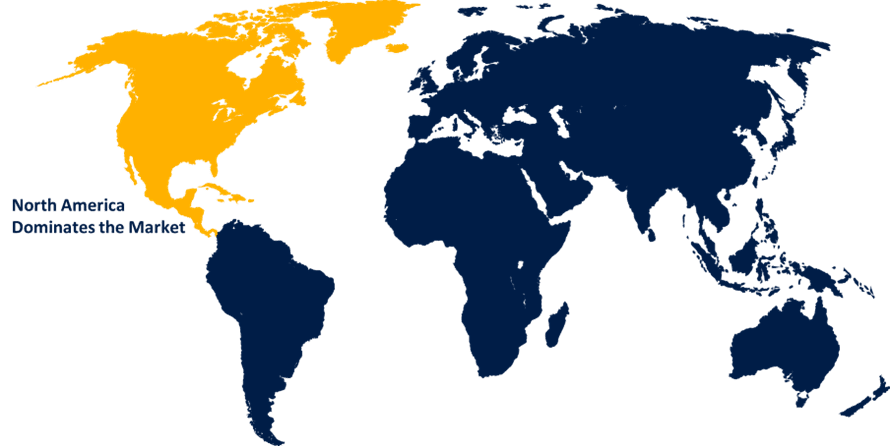

North America is anticipated to hold the largest share of the global metformin hydrochloride market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global metformin hydrochloride market over the predicted timeframe. This is driven by the well-established healthcare system and the high incidence of type II diabetes. The United States is a significant market owing to its sophisticated healthcare system and high level of diabetes control knowledge. In this area, the market is expanding owing to primarily availability of combination therapies and extended-release formulations. Furthermore, the market for metformin hydrochloride in North America is anticipated to be further supported by continuing research into new therapeutic applications.

Asia Pacific is anticipated to grow at the fastest CAGR throughout the projected timeframe. This is fueled by the constantly growing number of people with diabetes and the advancement of healthcare facilities. Diabetes is growing more common in countries like China and India, requiring efficient management strategies. Metformin hydrochloride's accessibility and cost are further fueled by the region's sizable generic medication manufacturing base, which propels market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global metformin hydrochloride market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sandoz

- Sun Pharmaceuticals

- Lupin

- Cadila Healthcare

- Myla Laboratories

- Sanofi

- Hetero Labs

- Reddy’s Laboratories

- Torrent Pharmaceuticals

- Aurobindo Pharma

- Teva Pharmaceuticals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2025, the Central Drug Standard Control Organization (CDSCO) approved the prescribing information for Metformin Sustained Release (SR) tablets (500mg/1000mg). The approval describes the Metformin SR tablets that can be used for managing gestational diabetes during pregnancy and in the periconceptional phase.

- In November 2024, Lupin received tentative approval from the US FDA for its Abbreviated New Drug Application for Sitagliptin and Metformin Hydrochloride Tablets, 50 mg/500 mg and 50 mg/1000 mg, to market as a generic equivalent of Janumet Tablets, manufactured at its Pithampur facility. This combination medication improves glycemic control in adults with type II diabetes mellitus.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global metformin hydrochloride market based on the below-mentioned segments:

Global Metformin Hydrochloride Market, By Dosage Form

- Oral Solutions

- Tablets

- Injectable Solutions

Global Metformin Hydrochloride Market, By Route of Administration

- Intravenous

- Oral

Global Metformin Hydrochloride Market, By Indications

- Polycystic Ovary Syndrome

- Type II Diabetes

- Gestational Diabetes

Global Metformin Hydrochloride Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Global Metformin Hydrochloride Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global metformin hydrochloride market?The global metformin hydrochloride market is projected to expand at 6.80% during the forecast period.

-

2. Who are the top key players in the global metformin hydrochloride market?The key players in the global metformin hydrochloride market are Sandoz, Sun Pharmaceuticals, Lupin, Cadila Healthcare, Myla Laboratories, Sanofi, Hetero Labs, Reddy’s Laboratories, Torrent Pharmaceuticals, Aurobindo Pharma, Teva Pharmaceuticals, and others.

-

3. Which region holds the largest share of the market?North America is anticipated to hold the largest share of the global metformin hydrochloride market over the predicted timeframe.

Need help to buy this report?