Mexico Hospital Supplies Market Size, Share, and COVID-19 Impact Analysis, By Product (Patient Examination Devices, Operating Room Equipment, Mobility Aids and Transportation Equipment, Sterilization and Disinfectant Equipment, Disposable Hospital Supplies, Syringes and Needles, and Others), and Mexico Hospital Supplies Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareMexico Hospital Supplies Market Insights Forecasts to 2033

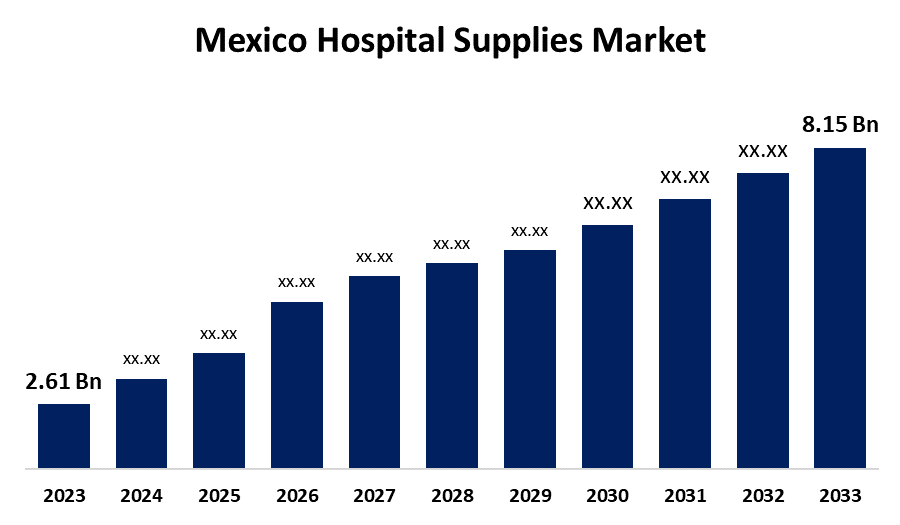

- The Mexico Hospital Supplies Market Size was estimated at USD 2.61 Billion in 2023.

- The Market is Growing at a CAGR of 12.06% from 2023 to 2033

- The Mexico Hospital Supplies Market Size is Expected to Reach USD 8.15 Billion by 2033

Get more details on this report -

The Mexico Hospital Supplies Market is Expected to Reach USD 8.15 billion by 2033, growing at a CAGR of 12.06% from 2023 to 2033

Market Overview

The market for medical supplies in Mexico is the area of the Mexican healthcare sector that focuses on necessary medical supplies and equipment for use in clinics, hospitals, and other healthcare institutions. The rise in the prevalence of chronic illnesses, rising healthcare costs, increased focus on hospital-acquired infection (HAI) control measures, and technological advancements in hospital equipment are some of the factors predicted to propel the hospital equipment and supplies market's expansion over the projected timeframe. Additionally, the demand for personal protection equipment, mobility aids, patient monitoring devices, and other hospital-use products surged as a result of the large number of patients admitted to hospitals. In addition, more people are seeking medical assistance without fear of financial burden as a result of rising health insurance coverage. The industry that supplies hospitals around the country benefits from this favorable increase in healthcare accessibility and affordability. Furthermore, government initiatives aid in market expansion. For instance, in October 2024, the 130 billion peso New Consolidated Procurement Model for Medicines and Medical Supplies for the 2025–2026 period was proposed by President Claudia Sheinbaum.

Report Coverage

This research report categorizes the market for the Mexico hospital supplies market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Mexico hospital supplies market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Mexico hospital supplies market.

Driving Factors

The Mexico hospital supplies market is growing due to the expansion of healthcare infrastructure. The primary drivers of the overall growth of the hospital supplies market in Mexico are factors like rising rates of infectious and chronic diseases, rising public awareness of hospital-acquired infections, an aging population, and an increase in hospital inpatient admissions. In addition, in Mexico, the prevalence of infectious and communicable diseases is continuously increasing. The need for disease detection and treatment is growing in Mexico due to the high incidence and prevalence of several diseases, including the human papillomavirus (HPV).

Restraining Factors

The Mexico hospital supplies market faces challenges such as the rise of home care services and strict regulatory frameworks are other factors that are anticipated to impede market expansion over the forecast period.

Market Segmentation

The Mexico hospital supplies market share is classified into the product.

- The sterilization and disinfectant equipment segment accounted for the largest share in 2023 and is estimated to grow at a significant CAGR during the projected period.

Based on the product, the Mexico hospital supplies market is divided into patient examination devices, operating room equipment, mobility aids and transportation equipment, sterilization and disinfectant equipment, disposable hospital supplies, syringes and needles, and others. Among these, the sterilization and disinfectant equipment segment accounted for the largest share in 2023 and is estimated to grow at a significant CAGR during the projected period. This segment is expanding because in hospital settings, sterilization and disinfection are crucial. The cost of hospital supplies to keep equipment clean, including surgical instruments, staff hygiene, and the prevention of illnesses associated with healthcare, is considerable. Sterilization and disinfection products are frequently sought after by end users to prevent infections in hospital settings and in-home care.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Mexico hospital supplies market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic PLC

- 3M

- Baxter

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health

- Koninklijke Philips NV

- Abbott

- Fisher & Paykel Healthcare Limited

- Medline Industries LP

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, Mexico's distribution of essential medical supplies improved because of BIRMEX. In order to enhance the timely delivery of essential commodities like COVID-19 vaccines and cancer medications across the nation, BIRMEX works with labs and medical facilities.

Market Segment

This study forecasts revenue at Mexico, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Mexico hospital supplies market based on the below-mentioned segments

Mexico Hospital Supplies Market, By Product

- Patient Examination Devices

- Operating Room Equipment

- Mobility Aids and Transportation Equipment

- Sterilization and Disinfectant Equipment

- Disposable Hospital Supplies

- Syringes and Needles

- Others

Need help to buy this report?