Mexico Luxury Goods Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Luxury Fashion & Accessories, Luxury Watches and Jewelry, Luxury Beauty & Cosmetics, Luxury Travel & Experiences, Luxury Home Goods, and Luxury Automobiles), By Distribution Channel (Online Stores and Offline Stores), and Mexico Luxury Goods Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsMexico Luxury Goods Market Insights Forecasts to 2033

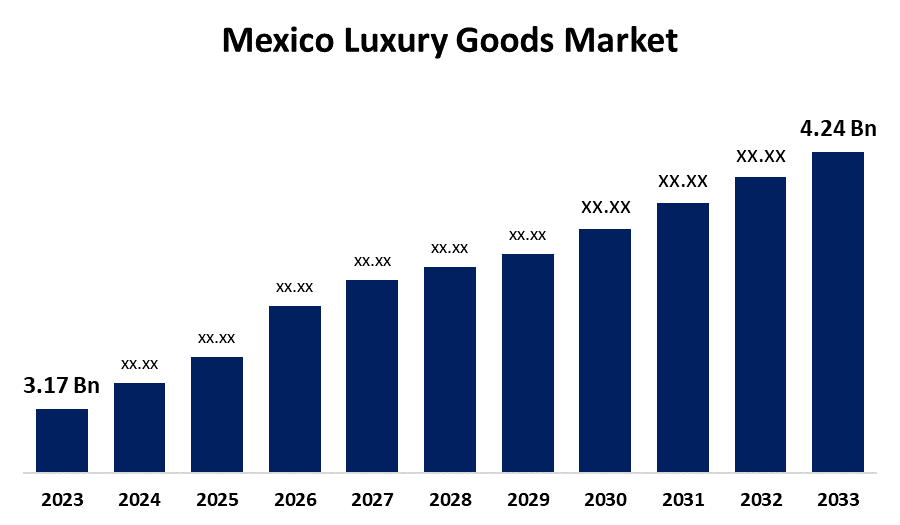

- The Mexico Luxury Goods Market Size was estimated at USD 3.17 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.95% from 2023 to 2033

- The Mexico Luxury Goods Market Size is Expected to Reach USD 4.24 Billion by 2033

Get more details on this report -

The Mexico Luxury Goods Market Size is Expected to Reach USD 4.24 Billion by 2033, growing at a CAGR of 2.95% from 2023 to 2033.

Market Overview

The industry that deals with high-end goods and services that are usually distinguished by their exclusivity, superior quality, and high price points is referred to as the luxury goods market in Mexico. This sector offers a broad variety of goods and experiences that appeal to wealthy customers and are frequently connected to status and prestige. The luxury goods market in Mexico is expanding due to rising disposable incomes, a burgeoning middle class, and an increase in the number of high-net-worth individuals. Additionally, the market's growth is further supported by Mexico's proximity to the United States, as well as its thriving tourism industry and rich cultural legacy. In addition, international luxury brands' existence and their forceful marketing approaches have also been crucial in influencing consumer preferences and increasing sales. Furthermore, the development of e-commerce has made it easy to get product information and prices online at any time. This has contributed to the overall growth of the luxury sector in Mexico.

Report Coverage

This research report categorizes the market for the Mexico luxury goods market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Mexico luxury goods market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Mexico luxury goods market.

Mexico Luxury Goods Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.17 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.95% |

| 2033 Value Projection: | USD 4.24 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Rolex SA, Hermes, Giorgio Armani S.p.A, LVMH Moet Hennessey Louis Vuitton, Kering Group, and Others |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Mexico's luxury goods sector is expanding because of the demand for luxurious goods, which is fueled by Mexican customers' appreciation of uniqueness, superior craftsmanship, and high-quality products. In addition, Mexico's luxury goods market is being driven by digitalization and social media, which is altering how consumers find and buy products. This allows firms to interact with their target audiences, establish exclusivity, and draw in younger consumers. Additionally, the market for sustainable luxury products is growing due to younger generations' growing environmental consciousness, as companies that emphasize ethical sourcing and transparency draw in eco-aware customers.

Restraining Factors

Mexico's luxury goods market faces significant constraints due to income inequality and economic imbalance, which pose problems for Mexico's luxury goods sector, as lower-income inhabitants and wealthy buyers restrict market potential. In addition, the market for luxury goods in Mexico is challenged by shifting government policies, inflation, economic uncertainty, and exchange rate fluctuations, which force luxury manufacturers to localize their products.

Market Segmentation

The Mexico luxury goods market share is classified into the product type and distribution channel.

- The luxury fashion & accessories segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product type, the Mexico luxury goods market is divided into luxury fashion & accessories, luxury watches and jewelry, luxury beauty & cosmetics, luxury travel & experiences, luxury home goods, and luxury automobiles. Among these, the luxury fashion & accessories segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to its rarity, craftsmanship, and reputation, luxury apparel is especially appealing to Mexican consumers. In addition, the demand is strongest among wealthy people, and designer boutiques and flagship locations make it easier to get in. Furthermore, luxury companies and regional designers collaborate to produce culturally appropriate collections.

- The offline stores segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the Mexico luxury goods market is divided into online stores and offline stores. Among these, the offline stores segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing owing to luxury retail establishments, such as department stores, boutiques, and flagship stores, offer upscale shopping experiences with dedicated customer care, unique product selections, and sophisticated settings. In addition, luxury shoppers are drawn to Mexico City and Monterrey's upscale retail areas and upscale malls.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Mexico luxury goods market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rolex SA

- Hermes

- Giorgio Armani S.p.A

- LVMH Moet Hennessey Louis Vuitton

- Kering Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2023, GCAL By Sarine and Naos Jewelry, an established luxury jewelry maker and designer in Mexico, partnered to bring premium cut 8X® certified diamonds to the Mexican market. Naos is the first jewelry company in Mexico to use and introduce jewelry made with both natural and lab-grown diamonds that have earned the GCAL 8X certification.

Market Segment

This study forecasts revenue at Mexico, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Mexico luxury goods market based on the below-mentioned segments:

Mexico Luxury Goods Market, By Product Type

- Luxury Fashion & Accessories

- Luxury Watches and Jewelry

- Luxury Beauty & Cosmetics

- Luxury Travel & Experiences

- Luxury Home Goods

- Luxury Automobiles

Mexico Luxury Goods Market, By Distribution Channel

- Online Stores

- Offline Stores

Need help to buy this report?