Mexico Mining Market Size, Share, and COVID-19 Impact Analysis, By Sector (Non-Metallic Minerals, Non-Ferrous, Precious Metals, and Others), By End-use Industries (Automotive, Construction, Electrical & Electronics, and Others), and Mexico Mining Market Insights, Industry Trend, Forecasts to 2033.

Industry: Advanced MaterialsMexico Mining Market Insights Forecasts to 2033

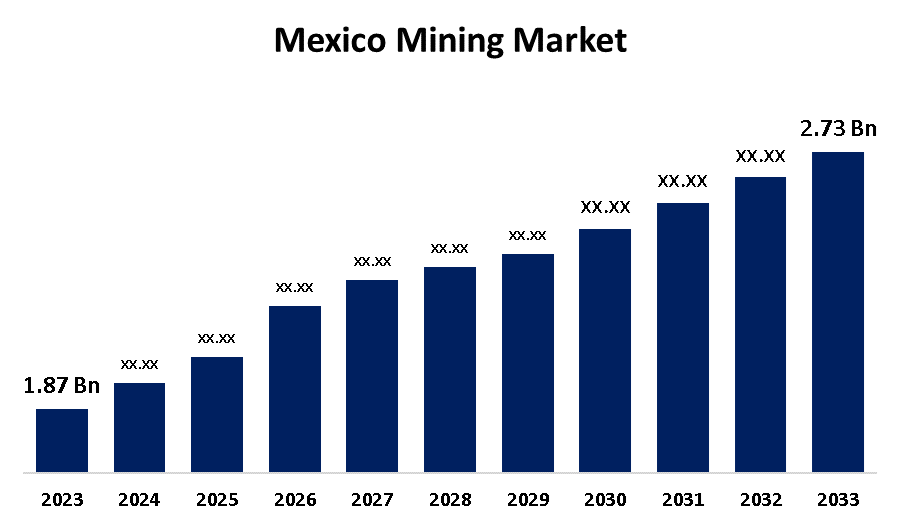

- The Mexico Mining Market Size was estimated at USD 1.87 billion in 2023.

- The Market is Growing at a CAGR of 3.86% from 2023 to 2033

- The Mexico Mining Market Size is Expected to Reach USD 2.73 billion by 2033

Get more details on this report -

The Mexico Mining Market is Expected to Reach USD 2.73 billion by 2033, growing at a CAGR of 3.86% from 2023 to 2033

Market Overview

The Mexico mining market refers to the industries involved in the extraction, exploration, and processing of minerals inside Mexico. This market is diverse and encompasses various minerals, such as basic metals, industrial minerals, and precious metals. Mexico’s mining industry makes a significant contribution to economic development, employment opportunities, and export earnings. In the market, both domestic and international businesses are involved in mining activities, including production, exploration, and mineral processing. The growing demand for non-ferrous, non-metallic, and precious metals products in industries including automotive, construction, aerospace & defense, and electrical & electronics, is anticipated to drive market expansion. In addition, the market is growing due to metals such as lead, copper, and zinc, which are used in a variety of electrical and electronic applications, as a result of the growing demand for electronics, is driving its production in Mexico.

Report Coverage

This research report categorizes the market for the Mexico mining market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Mexico mining market.

Driving Factors

The market expansion in Mexico is mostly driven by the strong government support for mineral extraction and more foreign investment, particularly in areas with significant mining potential such as Sonora and Chihuahua. In addition, Mexico's availability of copper, silver, and lithium reserves make it an important supplier as the world's need for vital minerals for use in electric vehicles and renewable energy sources increases. Additionally, Mexico's mining competitiveness is increased globally by recent mining infrastructure expansions and advantageous trade policies.

Mexico Mining Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.87 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.86% |

| 2033 Value Projection: | USD 2.73 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By End-use Industries, By Sector |

| Companies covered:: | AHMSA, ArcelorMittal, Coeur Mining Inc., Industrias Peñoles, Newmont Corporation, Pan American Silver Corp, FIRST MAJESTIC, Fortuna Silver Mines Inc., Frestnillo plc, Others, |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Restraining Factors

Mexico's mining market faces significant constraints due to environmental and social concerns, with local communities and environmental groups frequently opposing mining activities due to land rights and ecological impact. In addition, operational uncertainty for mining firms may result from regulatory obstacles related to environmental compliance and changing government policy about resource management.

Market Segmentation

The Mexico mining market share is classified into sector and end-use industries.

- The precious metals segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the sector, the Mexico mining market is divided into non-metallic minerals, non-ferrous, precious metals, and others. Among these, the precious metals segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to the increasing consumer preferences for luxurious and fashionable products, which is driving the demand for precious metals. Additionally, due to their increased consumption, major players are investing a lot of money in the investigation and advancement of existing green field projects.

- The electrical & electronics segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use industries, the Mexico mining market is divided into automotive, construction, electrical & electronics, and others. Among these, the electrical & electronics segment accounted for a significant share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is expanding due to metals like copper, zinc, and lead, which are essential for the manufacturing of electronic devices, and their rising demand is fueling the expansion of the electronics industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Mexico mining market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AHMSA

- ArcelorMittal

- Coeur Mining Inc.

- Industrias Peñoles

- Newmont Corporation

- Pan American Silver Corp

- FIRST MAJESTIC

- Fortuna Silver Mines Inc.

- Frestnillo plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, in Nuevo León, Arzyz Metals, a prominent aluminum manufacturer in Mexico, announced a USD 650 million facility expansion. By boosting manufacturing capacity to satisfy growing aluminum demand across multiple industries, this investment hopes to boost the state's industrial development and create new jobs. The project reflects continued growth and investment patterns in Mexico's mining and metals industries and is in line with regional development goals. It also has strong support from local authorities.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Mexico mining market based on the below-mentioned segments:

Mexico Mining Market, By Sector

- Non-Metallic Minerals

- Non-Ferrous

- Precious Metals

- Others

Mexico Mining Market, By End-use Industries

- Automotive

- Construction

- Electrical & Electronics

- Others

Need help to buy this report?