Mexico Nuclear Imaging Market Size, Share, and COVID-19 Impact Analysis, By Product (Equipment and Diagnostic Radioisotope), By Application (SPECT Applications and PET Applications), and Mexico Nuclear Imaging Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareMexico Nuclear Imaging Market Insights Forecasts to 2033

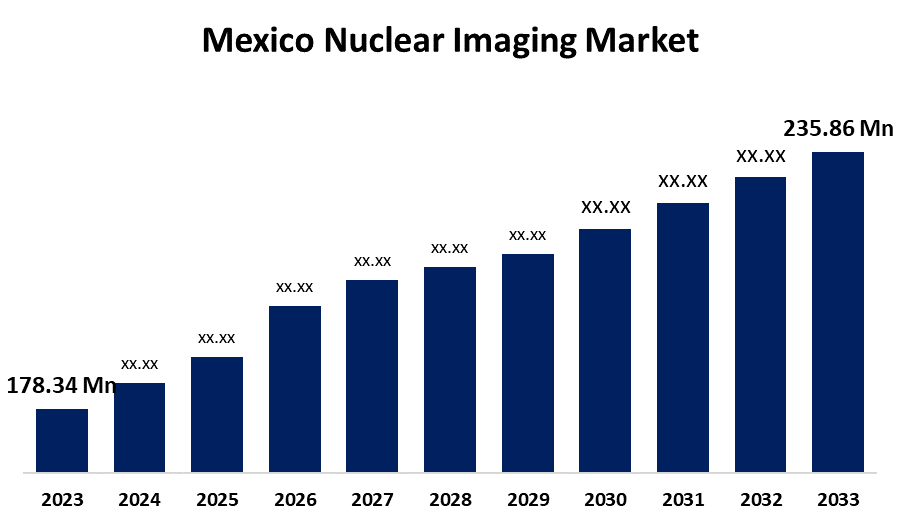

- The Mexico Nuclear Imaging Market Size was estimated at USD 178.34 Million in 2023.

- The Market is Growing at a CAGR of 2.83% from 2023 to 2033

- The Mexico Nuclear Imaging Market Size is Expected to Reach USD 235.86 Million by 2033

Get more details on this report -

The Mexico Nuclear Imaging Market is Expected to Reach USD 235.86 million by 2033, growing at a CAGR of 2.83% from 2023 to 2033.

Market Overview

The market for nuclear imaging in Mexico is the supply and demand for nuclear imaging equipment, services, and associated technologies in the country. The increasing incidence of chronic illnesses and the expanding use of nuclear imaging methods in Mexico are major factors propelling the market's expansion. Mexico's aging population and the rise in diseases including cancer, neurological disorders, and cardiovascular problems are driving rising demand for nuclear imaging operations across the country. Additionally, increased demand for nuclear imaging due to neurological disease research and development in Mexico is expected to propel market expansion. For instance, in May 2024, rapid developments in dementia research throughout Latin America, particularly in Mexico, were emphasized in an article published in the Journal of Alzheimer's Association. The Alzheimer's Association has established 41 active grants totaling more than USD 4 million in 2023, quadrupling its funding for dementia research in Latin America. The market is expected to develop as a result of this research boom and the expected use of nuclear imaging. Furthermore, it is anticipated that favorable initiatives and new product introductions by nuclear imaging industry participants will support market expansion.

Report Coverage

This research report categorizes the market for the Mexico nuclear imaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Mexico nuclear imaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Mexico nuclear imaging market.

Mexico Nuclear Imaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 178.34 million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.83% |

| 2033 Value Projection: | USD 235.86 million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Application, By Product |

| Companies covered:: | Canon Medical Systems Corporation, Fujifilm Holdings Corporation, GE Healthcare, Koninklijke Philips NV, Siemens Healthineers, Curium, Mediso Ltd, Bracco Group, Novartis AG (Advanced Accelerator Applications), Bayer AG, Others, |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The Mexico nuclear imaging market is driven by the expansion of healthcare infrastructure. The shift from standalone to hybrid modalities, advancements in radiotracers, a growing emphasis on personalized medicine, investments through public-private partnerships to modernize diagnostic imaging centers, and the increasing incidence of cardiac conditions and cancer are the primary factors propelling this market's growth. Moreover, increasing incidence rates enhanced diagnostic precision, and technological advancements contribute to the escalating burden of cancer and cardiovascular diseases, which in turn fuels the demand for nuclear imaging diagnostics.

Restraining Factors

The high price of nuclear imaging equipment, limited reimbursement guidelines, complicated regulations, and radiopharmaceutical shortages are some of the issues facing the Mexico nuclear imaging market. Furthermore, widespread adoption is hampered by inadequate infrastructure and a shortage of skilled workers, which slows market expansion even in the face of rising demand.

Market Segmentation

The Mexico nuclear imaging market share is classified into the product and application.

- The equipment segment accounted for the largest share in 2023 and is estimated to grow at a significant CAGR during the projected period.

Based on the product, the Mexico nuclear imaging market is divided into equipment and diagnostic radioisotope. Among these, the equipment segment accounted for the largest share in 2023 and is estimated to grow at a significant CAGR during the projected period. The equipment segment of the nuclear imaging market in Mexico is driven by improved diagnostic accuracy. The demand for state-of-the-art equipment is rising as a result of advanced imaging technologies like SPECT and PET scanners, which offer higher resolution and more accurate sickness identification. The increasing prevalence of chronic conditions like cancer and heart problems is pushing medical practitioners to spend money on top-notch nuclear imaging equipment to guarantee prompt and precise diagnosis.

- The SPECT applications segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the Mexico nuclear imaging market is divided into SPECT applications and PET applications. Among these, the SPECT applications segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The affordability of SPECT techniques and equipment is a major contributing element. SPECT scanners are more widely available in a variety of healthcare settings since they are often less expensive to install and run than PET scanners. This affordability makes SPECT technology available to a greater range of healthcare facilities, including hospitals and smaller clinics with fewer resources.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Mexico nuclear imaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- GE Healthcare

- Koninklijke Philips NV

- Siemens Healthineers

- Curium

- Mediso Ltd

- Bracco Group

- Novartis AG (Advanced Accelerator Applications)

- Bayer AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, Mexico's Instituto Nacional de Pediatría (INP) hosted the unveiling of United Imaging's uMI 550 PET/CT system, a global leader in state-of-the-art medical imaging and radiation solutions.

Market Segment

This study forecasts revenue at Mexico, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Mexico nuclear imaging market based on the below-mentioned segments:

Mexico Nuclear Imaging Market, By Product

- Equipment

- Diagnostic Radioisotope

Mexico Nuclear Imaging Market, By Application

- SPECT Applications

- PET Applications

Need help to buy this report?