Mexico Oilfield Auxiliary Rental Equipment Market Size, Share, and COVID-19 Impact Analysis, By Equipment (Drilling Equipment, Pressure and Flow Control Equipment, and Others), By Application (Onshore and Offshore), and Mexico Oilfield Auxiliary Rental Equipment Market Insights, Industry Trend, Forecasts to 2033

Industry: Energy & PowerMexico Oilfield Auxiliary Rental Equipment Market Insights Forecasts to 2033

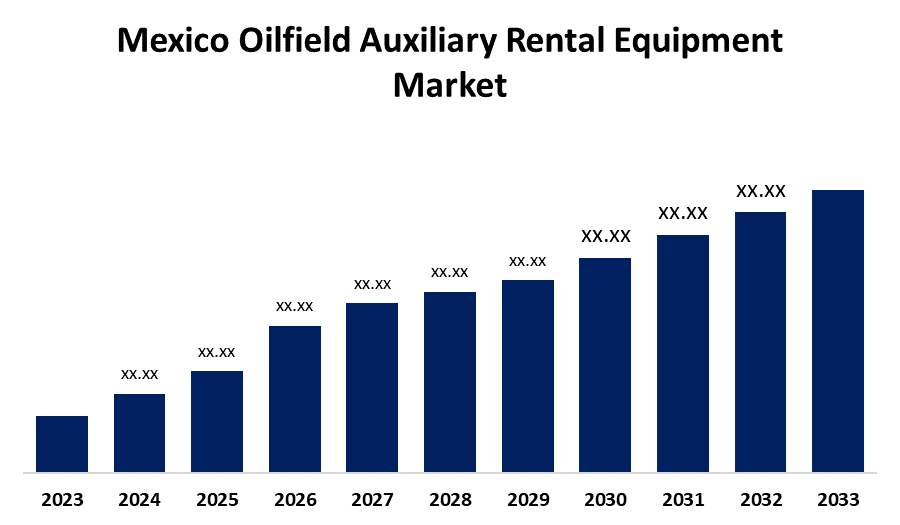

- The Mexico Oilfield Auxiliary Rental Equipment Market Size is Growing at a CAGR of 4.3% from 2023 to 2033

- The Mexico Oilfield Auxiliary Rental Equipment Market Size is Expected to Reach a Significant Share By 2033

Get more details on this report -

The Mexico Oilfield Auxiliary Rental Equipment Market Size is Anticipated to Reach a Significant Share By 2033, Growing at a CAGR of 4.3% from 2023 to 2033.

Market Overview

Mexico oilfield auxiliary rental equipment market is a sector that rents out specialized machinery for oil and gas operations, such as drilling rigs, pumps, generators, and other essential equipment for exploration, production, and maintenance. These rental services are valuable for companies that want to avoid the high costs of purchasing equipment while still accessing top-quality tools for efficient operations. The key benefits of this market include cost savings on capital expenditure, flexibility in terms of equipment availability, and access to the latest technology without long-term commitments. Renting equipment also allows companies to adjust their operations according to project demands, improving flexibility and reducing maintenance burdens. The market is supported by Mexico's expanding oil and gas industry, with government efforts focused on boosting energy infrastructure. These efforts include regulatory changes, incentives for foreign investments, and partnerships between the public and private sectors, all designed to enhance the country's energy production capabilities.

Report Coverage

This research report categorizes the market for the Mexico oilfield auxiliary rental equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Mexico oilfield auxiliary rental equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Mexico oilfield auxiliary rental equipment market.

Mexico Oilfield Auxiliary Rental Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Equipment, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Ensign Energy Services, Inc, Oil States International, Weatherford International, Plc, Key Energy Services, Inc., TechnipFMC, Superior Energy Services, Inc., Schlumberger Limited, Odfjell Drilling, Parker Drilling Company, Halliburton Company and other key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ongoing modernization of Mexico’s energy infrastructure, supported by government initiatives such as regulatory reforms and incentives for foreign investment, has created a favorable environment for the market. The flexibility to scale equipment based on project size and the ability to access advanced, up-to-date technology without long-term commitments further fuel the market's growth. The expansion of exploration activities, both onshore and offshore, also contributes to the rising demand for specialized rental equipment.

Restraining Factors

Fluctuations in global oil prices can lead to uncertainty in the market, as oil and gas companies may scale back their operations or delay projects during periods of price instability.

Market Segmentation

The Mexico oilfield auxiliary rental equipment market share is classified into equipment and application.

- The drilling equipment segment accounted for the largest revenue share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Mexico oilfield auxiliary rental equipment market is segmented by equipment into drilling equipment, pressure and flow control equipment, and others. Among these, the drilling equipment segment accounted for the largest revenue share in 2023 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by the increasing demand for drilling activities in both onshore and offshore oilfields, as companies seek advanced and reliable equipment to enhance their exploration and production capabilities.

- The onshore segment accounted for the highest market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The Mexico oilfield auxiliary rental equipment market is segmented by application into onshore and offshore. Among these, the onshore segment accounted for the highest market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The segment growth is due to the rising number of onshore oil and gas activities in Mexico, which require various types of rental equipment for drilling, production, and maintenance. As companies focus on improving efficiency and cutting costs, the demand for rental equipment in onshore operations will continue to grow.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Mexico oilfield auxiliary rental equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ensign Energy Services, Inc

- Oil States International

- Weatherford International, Plc

- Key Energy Services, Inc.

- TechnipFMC

- Superior Energy Services, Inc.

- Schlumberger Limited

- Odfjell Drilling

- Parker Drilling Company

- Halliburton Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2024, ProPetro Holdings has indeed made a significant move by launching ProPetro Energy Solutions LLC, branded as ProPWR. This subsidiary is focused on delivering mobile natural gas-fueled power generation equipment tailored for oilfield and industrial applications. The initiative marks ProPetro's first organic service line startup in over a decade, showcasing their commitment to innovation and addressing growing power demands.

Market Segment

This study forecasts revenue at Mexico, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Mexico oilfield auxiliary rental equipment market based on the below-mentioned segments:

Mexico Oilfield Auxiliary Rental Equipment Market, By Equipment

- Drilling Equipment

- Pressure and Flow Control Equipment

- Others

Mexico Oilfield Auxiliary Rental Equipment Market, By Application

- Onshore

- Offshore

Need help to buy this report?