Global Micro-LED Market Size, Share, and COVID-19 Impact Analysis, By Display Size (Large Display, Small & Medium Display, Micro Display), By Application (Display [Smartwatch, NTE Device, Smartphone & Tablet, Television, Digital Signage, Monitor & Laptop, Others], Lighting [General Lighting, Automotive Lighting]), By End-Use (Consumer Electronics, Entertainment & Advertisement, Retail, Automotive, Aerospace & Defence, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Semiconductors & ElectronicsGlobal Micro-LED Market Insights Forecasts to 2030

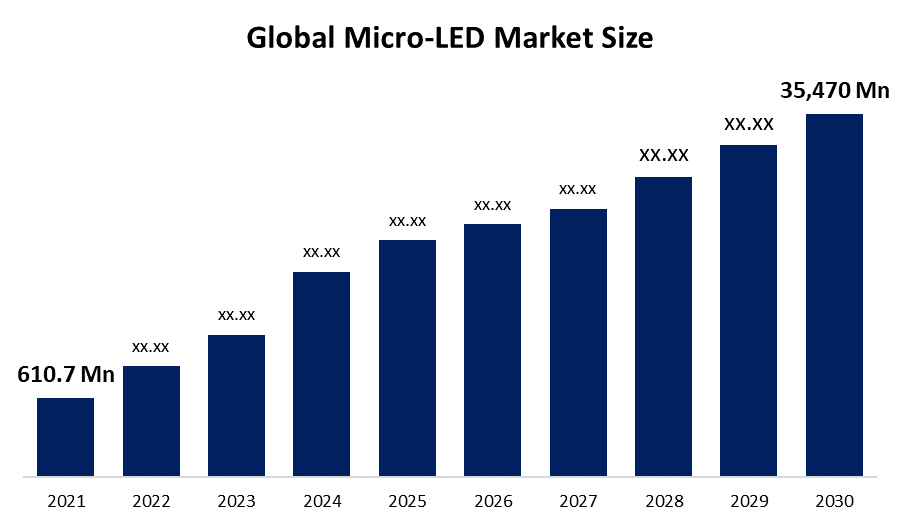

- The Micro-LED Market Size was valued at USD 610.7 million in 2021.

- The market is growing at a CAGR of 80.8% from 2022 to 2030

- The Worldwide Micro-LED Market is expected to reach USD 35,470 million by 2030

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Micro-LED Market Size is expected to reach USD 35,470 million by 2030, at a CAGR of 80.8% during the forecast period 2022 to 2030. One of the primary factors leading the micro-LED market ahead throughout the projected period is the expected proliferation of micro-LED technologies in NTE products and premium smartphones. Additionally, the increasing adoption of wearables devices including such smartwatches and head-mounted displays (HMDs) would likely present appealing opportunities for micro-LED rivals in the market.

Micro-LED, frequently referred to as mLED or LED, is a new flat-panel display technology that employs arrays of microscopic LEDs to generate individual color pixel constituents. Micro-LED displays have the advantage of producing extremely efficient and aesthetically flexible displays that can compete with today's high-end OLED displays. Furthermore, when compared to common LCD technology, micro-LED displays provide higher resolution, lower latency, and energy economy.

Micro-LED displays use far less energy than standard LCD displays while simultaneously providing high-resolution light control and a high contrast ratio. Micro-LEDs have a longer lifespan than OLEDs due to their inorganic composition, allowing devices to exhibit brighter images with less chance of screen fire. Micro-LED displays were not mass-produced as of 2021, despite the fact that Sony, Samsung, and Konka sell micro-LED display walls. It is still in the early stages and is being developed by LG, Tianma, PlayNitride, Jasper Display, Plessey Semiconductors Ltd, and Ostendo Technologies, Inc., Jade Bird Display. The increased demand for this display technology is primarily driven owing to the better eye comfort it provides over other display technologies. This is accomplished by utilizing surface light, which allows for a flat scattering of light rays.

COVID-19 Impact Micro-LED Market

The COVID-19 pandemic has influenced market demand for micro-LED devices, particularly in 2020 and 2021. Continuous lockdowns around the world have halted the manufacturing sector, disrupted logistics and supply chains, and impacted R&D activities, leading to postponed production.

Global Micro-LED Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 610.7 million |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 80.8% |

| 2030 Value Projection: | USD 35,470 million |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Display Size, By Application, By End-Use, By Region |

| Companies covered:: | Aledia SA, Mikro Mesa, Apple Inc., VueReal Inc, Sony Corporation, Samsung Electronics, X-Celeprint, Nanosys, eLux, Inc., Oculus VR, PlayNitride Inc., VueReal, Ostendo Technologies, Inc., MICLEDI, Avicena, Microluce, Epistar Corporation, Innolux Corporation, Jade bird display, Verlase Technologies, Rohinni, Nanosys, Inc., LG Display Co. Ltd, Allos Semiconductors, Plessey Semiconductors Ltd., Nanosys, Lumens.com, Inc., |

Get more details on this report -

Driving Factors

The rising demands for high-end and technologically advanced audio and visual products, as well as energy-saving displays, as well as the expanding popularity of electronic gadgets from key firms such as Apple, Sony, L.G., and Panasonic, are factors contributing to the growth of the micro-LED market. It facilitates manufacturers to excel in conventional display technology manufacturing processes. Prevailing technologies such as OLED and LCD, need huge glass foundations onto which all other materials are deposited sequentially, the broader the foundation employed, the more economical the application.

Further, rapid advances in high-speed communication and miniature mobile computing platforms escalated a strong demand for deeper human-digital interactions beyond traditional flat panel displays. AR and VR technologies are driving the growth of next-generation interactive displays with increased applications across various industries. Such trends are expected to boost micro-LED adoption for AR and VR applications. GaN Micro-LED is mostly anticipated to become a popular product in the long run because of the fast speed of technological breakthroughs and shifts in customer demand. Also, growth from new consumer demands is projected to affect the global GaN Micro-LED market's development over the forecast period.

Restraining Factors

However, the cost of micro-LED displays is substantially greater than that of existing display devices such as OLEDs and LEDs, which is expected to hamper market expansion. Additionally, energy dissipation generated by the miniaturization of micro-LED displays leads to increased electricity costs, restricting the market growth.

Market Segmentation

Display Size Insights

The micro display segment accounted the largest market share over the forecast period.

On the basis of display size, the global micro-LED market is segmented into large display, small & medium displays, and micro display. Among these, the micro display segment is dominating the market and is going to continue its dominance over the forecast period owing to its widespread use in applications such as smartwatches, smartphones, and near-to-eye gadgets. Micro-LED devices are significantly smaller in size, enabling them to be applied to small gadgets such as smartphones and tablets. It has a fast response time of a few milliseconds and also is excellent for usage in wearables and AR/VR technologies. Furthermore, the rising popularity of smart display systems is a major driver boosting this segment's revenue growth. Moreover, the displays have enhanced clarity and contrast so that users can immerse themselves in the content on screen.

Application Type Insights

The NTE device segment is dominating the market with the largest revenue share over the forecast period.

On the basis of protocol type, the global micro-LED market is segmented into the display – smartwatch, NTE device, smartphone & tablet, television, digital signage, monitor & laptop, and others, as well as lighting – general lighting and automotive lighting. Among these, the NTE device segment is dominating the market with the largest revenue share of 31.5% over the forecast period, owing to increased applications in near-to-eye devices which include AR and VR headsets. As AR/VR technologies become more broadly utilized in video games, healthcare, and multimedia technologies, modular and comparatively tiny displays with high brightness and affordable costs are growing increasingly desirable. AR and VR products depend on having modules with precise weight and dimension limits in order to provide user delight. Such electronics additionally offer the optimum image quality and wide dynamic range for near-to-eye devices.

End-Use Type Insights

The consumer electronics segment accounted the largest revenue share of more than 65% over the forecast period.

On the basis of end-use, the global micro-LED market is segmented into consumer electronics, entertainment & advertisement, retail, automotive, aerospace & defense, and others. Among these, the consumer electronics is dominating the market with the largest revenue share of 65% over the forecast period. Rising policy measures in various nations are a major element supporting revenue growth in the micro-LED market. Micro-LEDs are rapidly being recognized by technical experts in the consumer electronics market due to a variety of benefits. Electronic items including smart phones and tablets and flat screens are incorporating the technology to increase pixel density and provide customers with an increasingly realistic experience. In the consumer electronics industry, a large number of start-ups with significant Investments in r&d have recently emerged, which is projected to increase market demand for micro-LEDs over the projection period. The primary benefits of micro-LED are the resulting upward trend in demand for power-efficient electronics. Furthermore, the growth of automated and user-friendly household appliances has accelerated the global expansion of consumer electronics. The micro-LED industry is predicted to grow rapidly as a consequence of such advancements.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 58.3% market share over the forecast period. Continuously increasing smartphone adoption and significant technological breakthroughs in the technology industry are important factors fueling this region's commercial growth in the market. Additionally, the existence of several manufacturers throughout the area facilitates for a cost-effective revolution from normal screens to micro-LED screens. Consumer electronics manufacturers such as Panasonic, LG, and Samsung are growing their presence in the area, putting pressure on panel manufacturers to invest in the construction of these facilities. Because of the increased concentration of a significant proportion of screen manufacturers including such Konka, Refond, and others, the Chinese market accounted for the highest market volume. Most such businesses are making investments together and proposing to create micro-LED display solutions in order to provide potential customers with an additional authentic viewing experience. The rising interest in micro-LED technology among Asia Pacific electronic giants is expected to generate the highest development in the Asia Pacific micro-LED market.

North America, on the contrary, is expected to grow the fastest during the forecast period. In the region the U.S. has a robust manufacturing industry demand that makes extensive use of Micro-LED for electronic devices such as smartphones, tablets, and smartwatches. The U.S. accounts for the majority of overall regional demand due to the presence of major companies and the rapid adoption of smart home appliances among consumers in the country.

In 2021, the Europe market is estimated for the third-largest market growth. The growing demand from the automotive market is a major source of market revenue growth. This region's market growth is also likely due to the widespread adoption of IoT-enabled technologies across all verticals. As a result of rising demand from the automobile industry, the German market accounted for the leading revenue market capitalization. Leading automakers such as BMW as well as others are heavily investing in acquiring micro-LED displays to embed into their new vehicles.

List of Key Market Players

- Aledia SA

- Mikro Mesa

- Apple Inc.

- VueReal Inc

- Sony Corporation

- Samsung Electronics

- X-Celeprint

- Nanosys

- eLux, Inc.

- Oculus VR

- PlayNitride Inc.

- VueReal

- Ostendo Technologies, Inc.

- MICLEDI

- Avicena

- Microluce

- Epistar Corporation

- Innolux Corporation

- Jade bird display

- Verlase Technologies

- Rohinni

- Nanosys, Inc.

- LG Display Co. Ltd

- Allos Semiconductors

- Plessey Semiconductors Ltd.

- Nanosys

- Lumens.com, Inc.

Key Market Developments

- On October 2022, Avicena, the leading company in high-performance microLED-based chip-to-chip interconnects, announced the completion of its acquisition of Nanosys micro-LED fabrication facility and associated engineering team. This purchase expands Avicena's expertise in the research and manufacturing of high-speed GaN micro-LEDs designed for parallel multi-Tbps interconnects.

- On June 2022, Jade Bird Display, a China-based MicroLED micro-display company, revealed the development of a new red micro-LED emitter with up to 500,000 units of brightness at 2 micron diameters. JBD can now mass produce this new red micro-LED, which is available in its 0.13" VGA monochromatic red micro-display. JBD's new red micro-LED is constructed of AlGaInP components. JBD is expected to be able to generate roughly 120 million panels in this fab.

- On April 2022, the Ennostar group showcased the newest products and R&D achievements in the Mini LED, Micro-LED, sensing, automotive, metaverse, and III-V semiconductor industries at Touch Taiwan, Taiwan's largest tech and electronics event. In addition to Mini LED applications, Ennostar demonstrated Micro-LED applications and technology for the first time, claiming its capacity to expedite Micro-LED to mass production.

- On February 2022, Nanosys, Inc., a pioneer in developing and delivering quantum dot and micro-LED technology, and SmartKem, Inc., announced a collaboration to create a new generation of low-cost solution printed micro-LED and quantum dot materials for advanced displays. SmartKem will provide OTFT backplanes to enable the fabrication of micro-LED displays using Nanosys micro-LED and electroluminescent quantum dot Nano-LED technologies, according to the cooperative development agreement.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Global Micro-LED Market based on the below-mentioned segments:

Micro-LED Market, Display Size Analysis

- Large Display

- Small & Medium Display

- Micro Display

Micro-LED Market, Application Analysis

- Display

- Smartwatch

- NTE Device

- Smartphone & Tablet

- Television

- Digital Signage

- Monitor & Laptop

- Other

- Lighting

- General Lighting

- Automotive Lighting

Micro-LED Market, End-Use Analysis

- Consumer Electronics

- Entertainment & Advertisement

- Retail

- Automotive

- Aerospace & Defense

- Others

Micro-LED Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Micro-LED market ?The Global Micro-LED Market is expected to grow from USD 610.7 million in 2021 to USD 35,470 million by 2030, at a CAGR of 80.8% during the forecast period 2021-2030.

-

Which are the key companies in the market ?Aledia SA, Mikro Mesa, Apple In.c, VueReal Inc, Sony Corporation, Samsung Electronics, X-Celeprint, Nanosys, eLux, Inc., Oculus VR, PlayNitride Inc., VueReal, Ostendo Technologies, Inc., MICLEDI, Avicena, Microluce, Epistar Corporation, Innolux Corporation

-

Which segment dominated the Micro-LED market share ?The consumer electronics segment in end-use dominated the Micro-LED market in 2021 and accounted for a revenue share of over 65%.

-

What are the elements driving the growth of the Micro-LED market ?The global micro-LED display market is growing due to increased demand for brilliant and power-efficient display panels, as well as the preference for electronic behemoths such as Sony and Apple for micro-LED displays.

-

Which region is dominating the Micro-LED market ?Asia Pacific is dominating the Micro-LED market with more than 58.3% market share.

-

Which segment holds the largest market share of the Micro-LED market ?The micro display segment based on display size type holds the maximum market share of the Micro-LED market.

Need help to buy this report?