Global Micro Server IC Market Size, Share, and COVID-19 Impact Analysis, By Component (Software, Hardware), By Processer Type (x86, ARM), By Application (Analytics & Cloud Computing, Web Hosting & Enterprise Applications, Edge Computing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Semiconductors & ElectronicsGlobal Micro Server IC Market Insights Forecasts to 2033

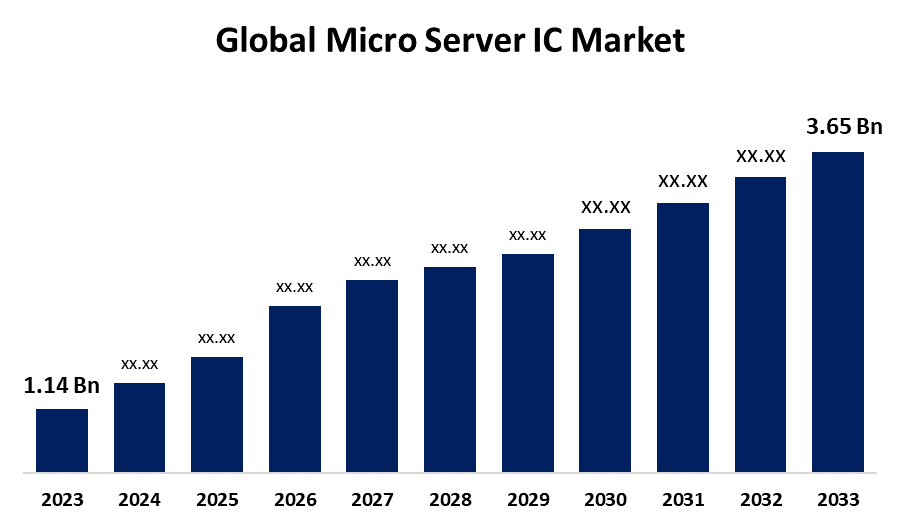

- The Global Micro Server IC Market Size was Valued at USD 1.14 Billion in 2023.

- The Market Size is Growing at a CAGR of 12.34% from 2023 to 2033.

- The Worldwide Micro Server IC Market Size is Expected to Reach USD 3.65 Billion by 2033.

- Asia Pacific Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Micro Server IC Market Size is Anticipated to Exceed USD 3.65 Billion by 2033, Growing at a CAGR of 12.34% from 2023 to 2033.

Market Overview

Micro servers are small, energy-efficient servers designed to handle lightweight tasks, such as serving web pages or streaming videos. These servers typically use low-power processors and are optimized for scale-out workloads, where many small servers work together to accomplish a task rather than relying on a few powerful servers. Except for DRAM, boot FLASH, and power circuits, the majority of server motherboard capabilities are located on a single microprocessor. Furthermore, a micro server integrated circuit (IC) is made up of hundreds or Billions of semiconductor components such as resistors, transistors, and capacitors. The transistors of micro server ICs are incredibly small, calculating in nanometers. IBM is working on 5 nm transistor-based micro server integrated circuits. Micro server ICs with small transistor sizes are significantly more energy-effective and generate less heat than micro server ICs with larger transistor sizes. Moreover, transistors on micro server ICs are utilized to execute calculations; therefore, micro server ICs that have additional transistors can perform more calculations per second than micro server ICs with fewer transistors. Micro servers are significantly smaller than standard full-fledged enterprise servers. Micro server integrated circuits are becoming more common in data center applications because they are less expensive, require less power, and take up less physical space than enterprise-class rack servers.

Report Coverage

This research report categorizes the market for the global micro server IC market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global micro server IC market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global micro server IC market.

Global Micro Server IC Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.14 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.34% |

| 2033 Value Projection: | USD 3.65 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Processer Type, By Application, By Region |

| Companies covered:: | Hewlett Packard Enterprise Development L.P., Advanced Micro Devices, Inc., NVIDIA Corporation, Ambedded Technology Co., Ltd., Marvell, Intel Corporation, Quanta Computer Inc., Fujitsu, Dell Technologies, Fujitsu Limited, Huawei Technologies Co. Ltd., NXP Semiconductors, STMicroelectronics, Super Micro Computer Inc., and Others Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The demand for web hosting and cloud computing has increased as the expense of online web hosting and cloud storage has dropped in recent years. Cloud computing needs more data processing, storage, and security from cloud service providers. Several cloud computing service providers compete to offer cloud computing services at an affordable price. Since micro server integrated circuits demand minimal initial funds, numerous small and medium-sized businesses are more likely to prefer them than standard full-fledged enterprise-class servers. The growing demand for data centers across both developed and developing countries is a key driver of the globally micro server IC market. Multiple micro server ICs, as well as micro server IC software, are required in data centers. The size of various application software and multimedia files has grown greatly during the previous few years. The overall number of internet users has grown in recent years. More data centers are needed as internet traffic increases. Increased need for data centers is projected to drive the global micro server IC market in a few years.

Restraining Factors

One significant restriction of the micro server IC industry is its limited ability to store data. Large organizations with large amounts of data may find micro server ICs inadequate for such loads due to their limited storage capacities. Existing software and applications that have not been optimized for microserver systems may cause performance constraints and compatibility issues. Businesses may be anxious to shift their workloads to microservers due to concerns about migration costs and software compatibility.

Market Segmentation

The global micro server IC market share is classified into component, processor type, and application.

- The hardware segment is expected to grow at the fastest pace in the global micro server IC market during the forecast period.

Based on component, the global micro server IC market is divided into software and hardware. Among these, the hardware segment is expected to grow at the fastest pace in the global micro server IC market during the forecast period. Processors, memory, and storage solutions are examples of hardware components that are crucial to the functionality of micro servers. The growing demand for versatile and energy-effective technology solutions, particularly in data centres and edge computing applications, is propelling the hardware segment forward.

- The ARM segment is expected to hold the largest share of the global micro server IC market during the forecast period.

Based on processor type, the global micro server IC market is divided into x86 and ARM. Among these, the ARM segment is expected to hold the largest share of the global micro server IC market during the forecast period. ARM-based micro server integrated circuits use substantially less power than x86-based micro server ICs. This is because ARM-based microserver integrated circuits are intended to be more energy efficient. Micro server integrated circuits based on ARM are also smaller than those based on x86. The ARM-based microserver integrated circuits are meant to be smaller. In addition, ARM-based micro server ICs are cheaper than x86-based micro server ICs. This is because ARM-based microserver integrated circuits are fabricated making use of a simpler technique.

- The edge computing segment is expected to grow at the fastest pace in the global micro server IC market during the forecast period.

Based on the application, the global micro server IC market is divided into analytics & cloud computing, web hosting & enterprise applications, and edge computing. Among these, the edge computing segment is expected to grow at the fastest pace in the global micro server IC market during the forecast period. With increased IoT investments and the introduction of the hyper-scale cloud, edge computing has received even more attention. Edge computing can accelerate consumer insights and loyalty as businesses seek to remain competitive in the digital corporate age, particularly in the aftermath of a pandemic. Independent software vendors, device integrators, and enterprises will all work to build cloud-independent solutions that enable edge computing applications.

Regional Segment Analysis of the Global Micro Server IC Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global micro server IC market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global micro server IC market over the predicted timeframe. The region's growth is being driven by increased R&D developments in miniature integrated circuits (ICs), which are expected to dramatically enhance demand for micro server IC systems. The increased emphasis on R&D efforts demonstrates an attention to technological developments and innovation, notably in the field of small and efficient ICs. This rise in demand is consistent with the larger trend of reduction in size in electronics, in which microserver ICs play a critical role in offering excellent performance in limited places.

Asia Pacific is expected to grow at the fastest pace in the global micro server IC market during the forecast period. The increased use of internet services, combined with the introduction of smart gadgets, has fueled data generation. This helps to drive the growth of data centers in the APAC region. Micro servers are becoming increasingly important due to their low power consumption and cost-effectiveness for light load applications within data centers, which is driving global micro server IC market growth. In recent years, data centers have emerged as a hotspot for China's IT business.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global micro server IC along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hewlett Packard Enterprise Development L.P.

- Advanced Micro Devices, Inc.

- NVIDIA Corporation

- Ambedded Technology Co., Ltd.

- Marvell

- Intel Corporation

- Quanta Computer Inc.

- Fujitsu

- Dell Technologies

- Fujitsu Limited

- Huawei Technologies Co. Ltd.

- NXP Semiconductors

- STMicroelectronics

- Super Micro Computer Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Intel has announced the official start of its contract chip manufacturing division to rival TSMC and Samsung, branding it the "world's first systems foundry" for the AI era and revealing the upcoming Intel 14A process node expected in 2026.

- In March 2022, Medtronic plc entered into a strategic partnership with Vizient, a leading healthcare performance improvement organization in the U.S. As part of the agreement, Touch Surgery Enterprise will be added to Vizient's wide range of offerings for more than half of the country's healthcare providers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global micro server IC market based on the below-mentioned segments:

Global Micro Server IC Market, By Component

- Software

- Hardware

Global Micro Server IC Market, By Processor Type

- x86

- ARM

Global Micro Server IC Market, By Application

- Analytics & Cloud Computing

- Web Hosting & Enterprise Applications

- Edge Computing

Global Micro Server IC Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

Frequently Asked Questions (FAQ)

-

1. Which region holds the largest share of the global micro server IC market?North America is anticipated to hold the largest share of the global micro server IC market over the predicted timeframe.

-

2. What is the projected market size & growth rate of the global micro server IC market?The global micro server IC market was valued at USD 1.14 Billion in 2023 and is projected to reach USD 3.65 Billion by 2033, growing at a CAGR of 12.34% from 2023 to 2033.

-

3. Which are the key companies that are currently operating within global micro server IC market?Hewlett Packard Enterprise Development L.P., Advanced Micro Devices, Inc., NVIDIA Corporation, Ambedded Technology Co., Ltd., Marvell, Intel Corporation, Quanta Computer Inc., Fujitsu, Dell Technologies, Fujitsu Limited, Huawei Technologies Co. Ltd., NXP Semiconductors, STMicroelectronics, Super Micro Computer Inc., and Others

-

1. Which region holds the largest share of the global micro server IC market?North America is anticipated to hold the largest share of the global micro server IC market over the predicted timeframe.

-

2. What is the projected market size & growth rate of the global micro server IC market?The global micro server IC market was valued at USD 1.14 Billion in 2023 and is projected to reach USD 3.65 Billion by 2033, growing at a CAGR of 12.34% from 2023 to 2033.

-

3. Which are the key companies that are currently operating within global micro server IC market?Hewlett Packard Enterprise Development L.P., Advanced Micro Devices, Inc., NVIDIA Corporation, Ambedded Technology Co., Ltd., Marvell, Intel Corporation, Quanta Computer Inc., Fujitsu, Dell Technologies, Fujitsu Limited, Huawei Technologies Co. Ltd., NXP Semiconductors, STMicroelectronics, Super Micro Computer Inc., and Others

-

1. Which region holds the largest share of the global micro server IC market?North America is anticipated to hold the largest share of the global micro server IC market over the predicted timeframe.

-

2. What is the projected market size & growth rate of the global micro server IC market?The global micro server IC market was valued at USD 1.14 Billion in 2023 and is projected to reach USD 3.65 Billion by 2033, growing at a CAGR of 12.34% from 2023 to 2033.

-

3. Which are the key companies that are currently operating within global micro server IC market?Hewlett Packard Enterprise Development L.P., Advanced Micro Devices, Inc., NVIDIA Corporation, Ambedded Technology Co., Ltd., Marvell, Intel Corporation, Quanta Computer Inc., Fujitsu, Dell Technologies, Fujitsu Limited, Huawei Technologies Co. Ltd., NXP Semiconductors, STMicroelectronics, Super Micro Computer Inc., and Others

Need help to buy this report?