Global Microfinance Market Size, Share, and COVID-19 Impact Analysis, By Provider Type (Banks, Microfinance Institutes (MFI), Non-Banking Financial Institutions (NBFCs), and Others), By Service Type (Group and Individual Micro-Credit, Leasing, Micro-Investment Funds, Insurance, and Savings & Checking Accounts), By Purpose (Agriculture, Manufacturing/Production, Trade & Services, Household, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Microfinance Market Insights Forecasts to 2033

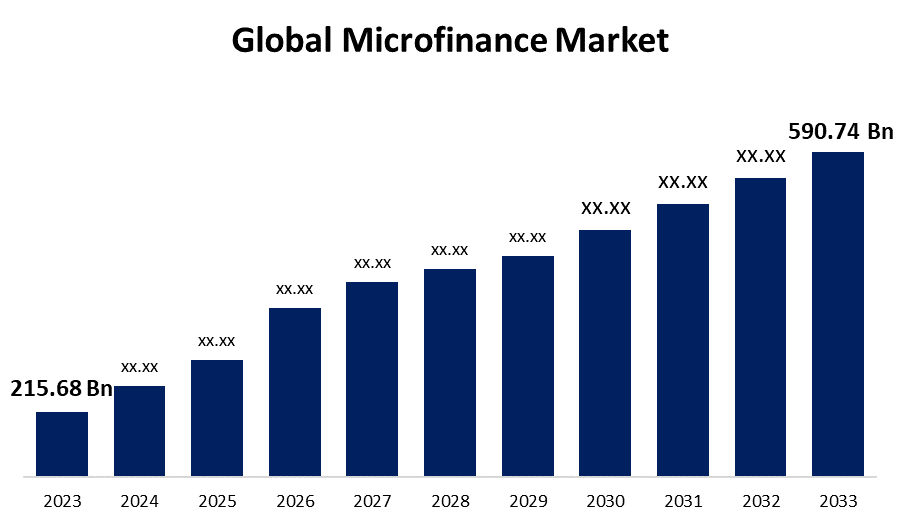

- The Global Microfinance Market Size was Valued at USD 215.68 Billion in 2023

- The Market Size is Growing at a CAGR of 10.60% from 2023 to 2033

- The Worldwide Microfinance Market Size is Expected to Reach USD 590.74 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Microfinance Market Size is Anticipated to Exceed USD 590.74 Billion by 2033, Growing at a CAGR of 10.60% from 2023 to 2033.

Market Overview

Microfinance is a kind of banking service offered to low-income people or organizations who would not be able to obtain financial services. These organizations' basic goal is to provide microloans for savings, insurance, and payment products to unbanked people across the globe. The market's services are made to be accessible to low-income and socially disadvantaged clients, providing them with a large range of superior financial products and services, and assisting them in achieving financial independence. Initiatives promoting financial inclusion are driving the demand for microfinance as more people become aware of the benefits of formal financial products. Unbanked individuals are becoming more accessible, especially in rural regions, owing to technological advancements like the increasing usage of mobile banking and financial technology (fintech). Mobile technology expands reach and reduces costs by automating loan processing, repayments, and other financial operations. The major participants in the microfinance industry are microfinance institutions (MFIs). These institutions can be banks, cooperatives, non-profit organizations, or specialist financial institutions, among other types. Serving as an interface between the formal financial system and those forced out due to their low income, lack of collateral, or remote location, they operate as mediators, by giving them the tools to create money and raise their standard of living. Microfinance helps people and communities overcome financial obstacles and end the cycle of poverty by providing modest loans and financial services.

Report Coverage

This research report categorizes the market for the global microfinance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global microfinance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global microfinance market.

Global Microfinance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 215.68 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 10.60% |

| 2033 Value Projection: | USD 590.74 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Provider Type, By Service Type, By Purpose, By Region and COVID-19 Impact Analysis |

| Companies covered:: | SKS Microfinance (BFIL), Compartamos Banco, ASA International, BRAC, Bandhan Bank, Opportunity International, FINCA International, Accion International, Kiva, Oikocredit, Ujjivan Financial Services, Fonkoze, PRASAC, and othetrs Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The microfinance market is driven by the positive effects it has on people's lives and communities. Microloans enable people to make investments in housing, healthcare, education, and income-generating ventures, resulting in higher living standards and more economic stability. Small enterprises that get microfinance help have the potential to grow, generate employment, and boost regional economies. The demand for microfinance has surged due to technological improvements. Microfinance services are now more efficient, affordable, and scalable owing to the delivery of these services being eased by mobile banking, digital payments, and novel financial technologies. MFIs might now reach rural locations with limited traditional banking infrastructure owing to these digital technologies, and they can now offer financial services to groups that were previously unreached.

Restraining Factors

High interest rates and shortened payback terms are imposed by microfinance organizations. The costs associated with microloans make it challenging for small enterprises and low-income people to pay back the money borrowed. The goal of financial inclusion might be hampered by the high cost, which could restrict the number of people who can use these services. For people who need credit but cannot pay the substantial borrowing costs, it puts up a barrier.

Market Segmentation

The global microfinance market share is segmented into provider type, service type, and purpose.

- The banks segment dominates the market with the largest market share through the forecast period.

Based on the provider type, the global microfinance market is segmented into banks, microfinance institutes (MFI), non-banking financial institutions (NBFCs), and others. Among these, the banks segment dominates the market with the largest market share through the forecast period. This might be attributed to the higher acquisition costs and increased security linked to the banking system features that are typically in line with the needs of microloan customers. However, it is important to note that the industry is expected to expand significantly in the future due to the projected development in demand for non-bank microfinancing services. Due to their established consumers, infrastructure, and regulatory environment, banks are well-positioned to provide microfinance services in addition to their core banking functions. They frequently have the means and ability to serve a broad consumer and offer a variety of financial products and services.

- The group and individual micro-credit segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the service type, the global microfinance market is segmented into group and individual micro-credit, leasing, micro-investment funds, insurance, and savings & checking accounts. Among these, the group and individual micro-credit segment is anticipated to grow at the fastest CAGR growth through the forecast period. By granting loans, microcredit breaks the cycle of poverty and dependency on expensive informal lenders for low-income people and microenterprises. Access to microloans makes saving money easier, encourages financial discipline, and facilitates future financial endeavors. Microloans encourage microbusiness expansion, which boosts employment, income, and regional economic development. Additionally, the expansion of microenterprises boosts consumer demand for products and services, which supports the expansion of the economy as a whole. With the help of microloans, people can invest in successful businesses and increase the well-being of their households while also improving their standard of living.

- The agriculture segment accounted for the largest revenue share through the forecast period.

Based on the purpose, the global microfinance market is segmented into agriculture, manufacturing/production, trade & services, household, and others. Among these, the agriculture segment accounted for the largest revenue share through the forecast period. Offering financial services and support to farmers, agricultural businesses, and rural communities involved in agricultural operations is the main objective of the agriculture segment. Many developing nations depend heavily on agriculture, and for smallholder farmers and agricultural enterprises to invest in the machinery, seeds, fertilizer, and other inputs required for production, they must have access to financing. To assist the entire agricultural ecosystem, microfinance institutions that focus on the agriculture sector provide customized financial products such crop loans, animal loans, financing for agricultural equipment, and value chain financing.

Regional Segment Analysis of the Global Microfinance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global microfinance market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global microfinance market over the predicted timeframe. This expansion can be attributed to the increase in government initiatives targeted at raising the general public's standard of living and reducing poverty, which has become a major trend in the microfinance industry. The majority of the population also lives in rural areas, where access to conventional financial services is restricted. Therefore, to provide financial services to this underprivileged group, microfinance is essential.

Europe is expected to grow at the fastest CAGR growth of the global microfinance market during the forecast period. This is a result of the growing significance of microfinance in supporting financial inclusion and assisting with entrepreneurship, which has led to the creation of regulatory frameworks and microfinance institutions. Financial services are offered to individuals and small businesses by a variety of institutions with an emphasis on sustainable development and social impact, such as microfinance banks, non-governmental organizations, cooperatives, and social enterprises.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global microfinance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SKS Microfinance (BFIL)

- Compartamos Banco

- ASA International

- BRAC

- Bandhan Bank

- Opportunity International

- FINCA International

- Accion International

- Kiva

- Oikocredit

- Ujjivan Financial Services

- Fonkoze

- PRASAC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, RBI directed credit information companies to prepare an index for commercial, microfinance segments.

- In October 2022, IPO-bound Fusion Microfinance executed and secured a loan arm for SMEs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global microfinance market based on the below-mentioned segments:

Global Microfinance Market, By Provider Type

- Banks Microfinance Institutes (MFI)

- Non-Banking Financial Institutions (NBFCs)

- Others

Global Microfinance Market, By Service Type

- Group And Individual Micro-Credit

- Leasing

- Micro-Investment Funds

- Insurance

- Savings & Checking Accounts

Global Microfinance Market, By Purpose

- Agriculture

- Manufacturing/Production

- Trade & Services

- Household

- Others

Global Microfinance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?SKS Microfinance (BFIL), Compartamos Banco, ASA International, BRAC, Bandhan Bank, Opportunity International, FINCA International, Accion International, Kiva, Oikocredit, Ujjivan Financial Services, Equitas Small Finance Bank, Fonkoze, PRASAC, and Others.

-

2. What is the size of the global microfinance market?The Global Microfinance Market Size is Expected to Grow from USD 215.68 Billion in 2023 to USD 590.74 Billion by 2033, at a CAGR of 10.60% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global microfinance market over the predicted timeframe.

Need help to buy this report?