Global Microprocessor Market Size, Share, and COVID-19 Impact Analysis, By Technology (CISC, RISC, ASIC, Superscalar, DSP), By Substrate (Rigid, Flexible, Rigid-flex), By Application (Automotive & Transportation, Consumer Electronics & Home Appliances, Industrial, Medical & Healthcare, Aerospace & Défense, IT & Telecom), By Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America) - Market Size & Forecasting To 2030

Industry: Semiconductors & ElectronicsThe Global Microprocessor Market Insights Forecasts to 2030

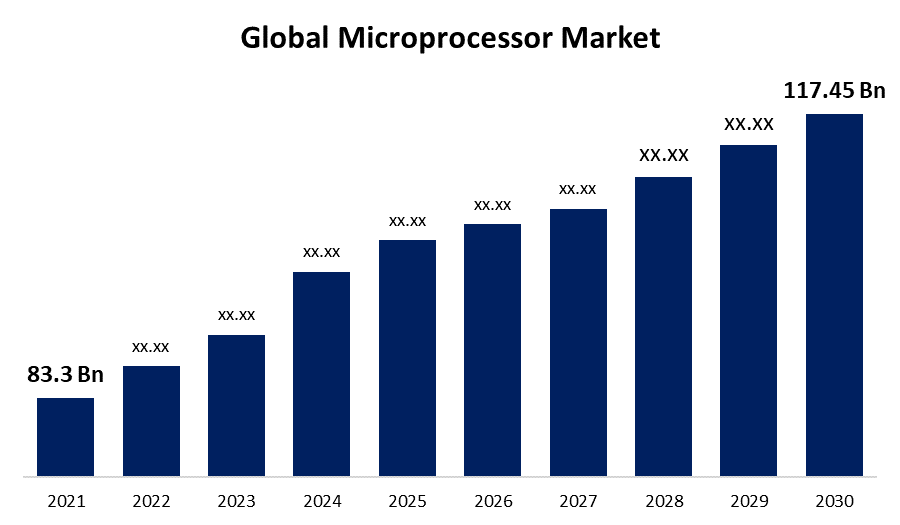

- The global microprocessor market size was valued at $83.3 billion in 2021

- The market growing at a CAGR of 4.1% from 2022 to 2030.

- The rapid global commercialization of 5G communication technology is attributed for the market expansion.

Get more details on this report -

Market Overview

A microprocessor is an electronic device made up of millions of tiny components, such as diodes, transistors, and resistors, all of which are combined onto a single integrated circuit (IC). This chip performs a variety of tasks, including timing, data storage, and communication with peripheral devices. These ICs are utilised in a wide range of electronic products, including embedded devices, servers, tablets, and smartphones.

Over the projected period, a rapidly expanding consumer demand for smartphones and tablets is anticipated to drive market expansion. By 2025, roughly 75% of all mobile phone owners worldwide will have smartphones, according to GVR study. Because a microprocessor is utilised to increase a smartphone's speed and efficiency, it improves the performance of the device. Any smartphone's performance speed is directly correlated with the microprocessor's performance. Additionally, with the rise of "smart" gadgets, electronic items like televisions, digital cameras, laptops, and wearable devices now provide a variety of advanced technologies including flat screens, touch screen monitors and displays, and Bluetooth, which call for more integrated circuits (ICs).

Global Microprocessor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 83.3 billion |

| Forecast Period: | 2020-2030 |

| Forecast Period CAGR 2020-2030 : | 4.1% |

| 2030 Value Projection: | USD 117.45 billion |

| Historical Data for: | 2019 - 2021 |

| No. of Pages: | 145 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Technology, By Substrate, By Application, By Region |

| Companies covered:: | Intel Corporation, Advanced Micro Devices (AMD), Inc., Qualcomm Technologies, Inc., Toshiba Electronic Devices and Storage Corporation, Samsung |

| Growth Drivers: | Personal computers and servers were the original applications for which microprocessors were created. To provide better connectivity and high-speed to vehicle systems, these ICs are currently being employed in automotive applications including infotainment systems and Advanced Driver-Assistance Systems (ADAS). |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

Personal computers and servers were the original applications for which microprocessors were created. To provide better connectivity and high-speed to vehicle systems, these ICs are currently being employed in automotive applications including infotainment systems and Advanced Driver-Assistance Systems (ADAS). In addition, microprocessors control servers, personal computers, and massive mainframes. They are also employed for embedded processing in a wide range of systems, including networking hardware, wearable technology, computer peripherals, set-top boxes, medical devices, televisions, industrial machinery, video game consoles, and Internet of Things (IoT) applications. Most RISC (Reduced Instruction Set Computer) architectures or a generic x86 processor are utilised in microprocessors for digital consumer applications, PCs, and communications.

The server processor with an embedded IoT and AI microprocessor assists in lowering the unit cost for microprocessors, which is positively affecting market growth globally. These microprocessors are widely utilised in linked devices, data centre infrastructure, and public clouds, enabling the speedier movement of corporate data throughout the IT network. In order to enable the operation of cutting-edge technology in devices and reduce operational costs, enterprises are adopting these ICs.

An ageing population, growing per capita disposable income, and improved quality of life are all closely correlated with healthcare spending. Compared to the 15–30 age group, medical spending per person is much higher for those aged 60 and over. Longer life expectancies are a result of the world's old population, which is expanding at an unprecedented rate, but they come with a host of comorbidities. To enhance patient quality of life and lower medical expenses, embedded microprocessors are used in a range of healthcare electronic systems, including real-time patient monitoring systems, wireless patient body monitoring systems, and distant health monitoring systems. For instance, electromyographic (EMG) impulses are translated into audible and visual signals by embedded microprocessors in nerve integrity monitors during a number of procedures.

Restraining Factors

Over the upcoming years, it's expected that factors like high raw material prices, declining shipments of individual computers, rising sales of low-cost mobile devices, high manufacturing costs for microprocessor integrated circuits, and growing sales of low-priced mobile devices will impede market growth. Nevertheless, depending on the applications, server processors are chosen above standard desktop processors due to many improvements in these processors, including Internet of Things (IoT) and Artificial Intelligence (AI).

Covid 19 Impact

The COVID-19 pandemic is expected to have an effect on the world microprocessor market. Due to a shortage of parts during the first quarter of 2020, the entire supply chain was disrupted. China, South Korea, Taiwan, Malaysia, Singapore, the Philippines, Thailand, and Vietnam are just a few of the East Asian economies that significantly rely on the electronics manufacturing sector as a source of manufactured exports. Additionally, there is a strong economic interdependence in the electronics supply chain, with China playing a significant role as a supplier of intermediate electronics components to several Southeast Asian electronics sectors. The complete shutdown of Chinese industrial output for a prolonged period in February and March of 2019 resulted in significant supply chain disruptions in the electronics manufacturing industry in numerous Southeast Asian locations. The microprocessors market will develop at a large rate during the projection period despite a slight downward curve in the market in 2020 and low global case numbers.

Segmentation

The global microprocessor market is segmented into Technology, Application, and Region.

Global Microprocessor Market, By Technology

The Complex Instruction Set Computer (CISC) market is expected to increase at a 4.5% annual pace through 2028, with a 2021 market value of USD 30 billion. The CISC-based processor's attributes, including its low power consumption, low memory storage demand, and low-cost advantages over competing CPUs, are credited with the industry's expansion. The market acceptance of this product is increased by these features in a variety of industries, including gaming hardware, automotive electronics, and IT & telecom infrastructure.

The market value will be boosted by the expanding use of CISC-based CPUs in gaming gear such gaming consoles, VR/AR, and digital PCs. The Association for UK Interactive Entertainment (UKIE), in a news release from March 2021, stated that the UK video games market had an FY2020 valuation of USD 9.3 billion. In comparison to 2019, the market has seen a robust growth rate of over 39%. Due to its ability to execute complicated instruction sets, CISC-based processors are widely used in gaming hardware such as video games, consoles, and VR devices. In the upcoming years, the industry size will be boosted by the spread of CISC-based gaming devices.

Global Microprocessor Market, By Application

The PC segment held the biggest market share in 2019 (more than 40.0%), according to data. The growing use of microprocessor chips in personal computers around the world supports the substantial commercial potential the personal computer segment presents to the major market participants. Microprocessors are increasingly being used in personal computer applications due to their many benefits, which include expanded storage, enhanced volatile memory, logical operations, additional operating system tasks, and reduced power consumption.

Additionally, in order to offer consumers high-tech goods, personal computer makers are working with technology suppliers. For instance, Samsung announced a collaboration with system on chip and ASIC solutions supplier Avnet, Inc. in 2018. The goal of the agreement was to involve both businesses in developing and producing ASIC that will enable consumers to benefit from the most recent and enhanced ASIC design solutions implemented with silicon integrated circuits and cutting-edge process technologies.

Global Microprocessor Market, By Region

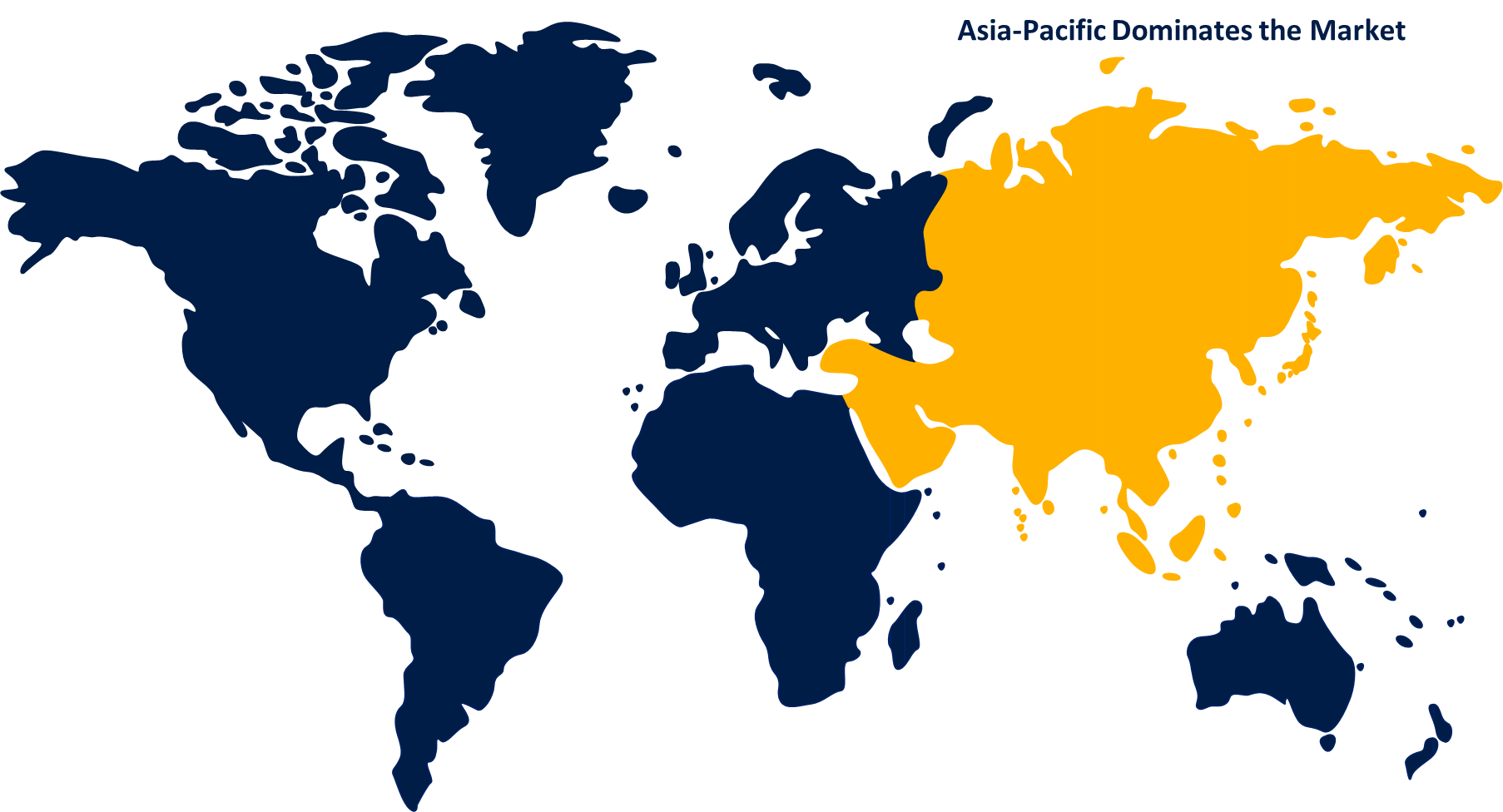

In terms of market share, the Asia Pacific region held the highest position in 2019 with 56.5%, and it is anticipated that over the forecast period, it would grow at the fastest rate. The increase in use of smartphones and other electronics in the area, including laptops, mobile devices, desktop computers, and tablets, is credited with the expansion. As a result of a number of factors, including the market's rapid digitalization, the increasing use of high-tech devices, and the development of automotive electronics, developing nations like China and India are also assisting in the market's expansion. Over the course of the projection period, the regional market is also expected to be driven by increased Internet of Things (IoT) adoption, significant government IT spending, and rising demand for cloud-based services.

Get more details on this report -

Recent Developments in Global Microprocessor Market

- March 2022: By 2022, a new semiconductor foundry will be built in China thanks to a 2.35 billion USD investment by SMIC and the Chinese government. The new facility will concentrate on producing chipsets using process technologies as advanced as 28 nm.

List of Key Market Players

- Intel Corporation

- Advanced Micro Devices (AMD), Inc.

- Qualcomm Technologies, Inc.

- Toshiba Electronic Devices and Storage Corporation

- Samsung

Segmentation

By Technology

- CISC

- RISC

- ASIC

- Superscalar

- DSP

By Application

- Automotive & Transportation

- Consumer Electronics & Home Appliances

- Industrial

- Medical & Healthcare

- Aerospace & Defense

- IT & Telecom

By Region:

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, by Technology

- North America, by Application

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, by Technology

- Europe, by Application

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, by Technology

- Asia Pacific, by Application

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Technology

- Middle East & Africa, by Application

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Technology

South America, by Application

Need help to buy this report?