Middle East Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Type (Anhydrous Ammonia and Aqueous Ammonia), By Application (Refrigeration, Pharmaceuticals, Fertilizers, and Water Purification Chemicals), and by Country (UAE, South Africa, and Rest of MEA), Analysis and Forecast 2021 - 2030

Industry: Chemicals & MaterialsMiddle East Ammonia Market Insights Forecasts to 2030

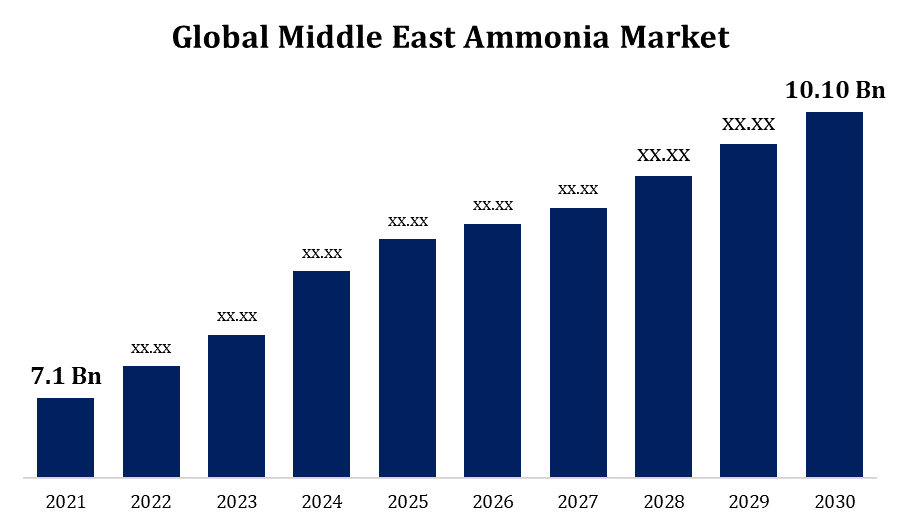

- The Middle East Ammonia Market Size was valued at USD 7.1 Billion in 2021.

- The Market is Growing at a CAGR of 4.0% from 2021 to 2030

- The Middle East Ammonia Market Size is Expected to reach USD 10.10 Billion by 2030

- Saudi Arabia is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Middle East Ammonia Market Size is Expected to reach USD 10.10 Billion by 2030, at a CAGR of 4.0% during the forecast period 2021 to 2030. The Ammonia Market has been growing owing to the positive application outlook in industries such as refrigeration, fertilizer, pharmaceuticals, chemicals, and water purification.

Market Overview:

Ammonia is a colorless gas with a distinct odor that is used as a fundamental chemical in the production of many items that people use daily. It exists in plants, and animals, humans, and the air, soil, and water naturally throughout the environment. The process by which the body converts protein-containing foods into amino acids, ammonia, and urea results in ammonia production. Ammonia produced by industry is used as fertilizer in agriculture to 80%. In addition to these uses, ammonia is made into polymers, explosives, textiles, insecticides, dyes, and other chemicals. It is also used to purify water sources. Numerous commercial and household cleaning products contain it. Ammonia gas and water are combined to create household ammonia cleaning solutions containing between 5 and 10% ammonia. Industrial ammonia solutions can have 25% or more concentrations and are corrosive. Globally expanding agricultural activity is the main factor boosting the ammonia market. To develop healthily, plants continually need the essential minerals potassium, nitrogen, magnesium, calcium, and Sulphur. Depending on the kind, location, and size of the plant, the amount of these nutrients varies from plant to plant. Ammonia is often used as fertilizer because it is considered a notable supplier of these nutrients. The government has greatly regulated the usage of ammonia. Thus, the cost of ammonia products differs from country to country due to the intricate manufacturing process. Additionally, the oversupply of ammonia producers is restricting the market's expansion. As much as the manufacturers can produce, they cannot. This aspect is causing pricing uncertainty and will probably slow the ammonia market's growth during the anticipated time frame.

Middle East Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 7.1 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 4.0% |

| 2030 Value Projection: | USD 10.10 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 197 |

| Tables, Charts & Figures: | 83 |

| Segments covered: | By Type, By Application, by Country |

| Companies covered:: | Yara International ASA, SABIC, Ma’aden, Gulf Petrochemical Industries Company, Pardis Petrochemical Company, OCI N.V., Istanbul Fertilizer Industry Inc. Co. (IGSAS), Petrochemical Industries Company, Qatar Fertiliser Company, Hemmat Petrochemical Company and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report on ammonia categorizes the market for ammonia based on various segments and countries and forecasts revenue growth, and analyzes trends in each of the submarkets. The report analyses the key growth drivers, opportunities, and challenges influencing the ammonia market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the ammonia market.

Segmentation Analysis

- In 2021, the anhydrous ammonia segment dominated the market with the largest market share of 72% and market revenue of 5.1 billion.

Based on the type, the ammonia market is bifurcated into anhydrous ammonia and aqueous ammonia. In 2021, the anhydrous ammonia segment dominated the market with the largest market share of 72% and market revenue of 5.1 billion. Chemical fertilizers like urea, ammonium nitrate and ammonium phosphate are all produced using anhydrous ammonia. Enhanced well-being and health awareness brought on by the pandemic have increased people's desire for cleanliness and sanitation, which in turn has boosted demand for household and industrial cleaners and accelerated market figures. For crops like wheat and corn, it is the most effective and widely utilized source of nitrogen fertilizer. Anhydrous ammonia will be used more frequently as a result of its therapeutic and cleaning benefits as well as its affordability, which will boost demand for the product over the anticipated time period.

- In 2021, the fertilizer segment accounted for the largest share of the market, with 30% and market revenue of 2.13 billion.

Based on application, the ammonia market is categorized into refrigeration, pharmaceuticals, fertilizers, and water purification chemicals. In 2021, the fertilizer segment dominated the market with the largest market share of 30% and market revenue of 2.13 billion. The agricultural industry's increasing emphasis on fertilizers and their variations to improve soil quality and produce better crops will contribute to market expansion. Given the various climatic challenges faced by farmers and agronomists, fertilizer use is crucial and expanding, which boosts market demand overall. The demand for the product is increasing due to several government programs to raise knowledge about the usage of fertilizers and their beneficial effects on crops. Additionally, a small amount of arable land in the area and lower soil nutrient levels because of the heavy use of pesticides and other chemicals are anticipated to increase product uptake.

Country’s Segment Analysis of the ammonia Market

- UAE

- South Africa

- Rest of MEA

Get more details on this report -

Saudi Arabia emerged as the largest market for the Middle East Ammonia market, with a market share of around 39% and 2.76 billion of the market revenue in 2021.

- In 2021, Saudi Arabia emerged as the largest market for the Middle East Ammonia market, with a market share of around 39% and 2.76 billion of the market revenue. High crop output from scarce arable land is driving the demand for fertilizers, which will increase ammonia production and drive the market. The country's ammonia market is also predicted to develop as a result of the country's water deficit and decreased rainfall, which has boosted the demand for fertilizers to promote agricultural crop productivity. Ammonia and its derivatives are one of the main exports from Saudi Arabia. The nation holds a prominent position on the list of the world's ammonia exporters thanks to the export of a sizeable portion of its production to Asia and Brazil.

- The UAE market is expected to grow at the fastest CAGR over the forecast period. One of the primary components of dyes, ammonia has grown in demand in the manufacturing sector, fostering corporate development. The rising textile and other chemical industries have greatly boosted their use of ammonia, which has increased the product demand in the nation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Middle East Ammonia market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Yara International ASA

- SABIC

- Ma’aden

- Gulf Petrochemical Industries Company

- Pardis Petrochemical Company

- OCI N.V.

- Istanbul Fertilizer Industry Inc. Co. (IGSAS)

- Petrochemical Industries Company

- Qatar Fertiliser Company

- Hemmat Petrochemical Company

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Recent Development

- In September 2021, Around USD 30 million was given to Yara International ASA by Enova for the production of green ammonia. With this, Yara formally completes the first phase of the ammonia plant at Herya in Porsgrunn's full decarbonization.

- In February 2022, As part of the Phase 3 projects to increase its market share, Ma'aden has finished building and pre-commissioning the third ammonia plant.

Market Segment

This study forecasts revenue at country, and country levels from 2021 to 2030. Spherical Insights has segmented the Middle East Ammonia market based on the below-mentioned segments:

Ammonia Market, By Type

- Anhydrous Ammonia

- Aqueous Ammonia

Ammonia Market, By Application

- Refrigeration

- Pharmaceuticals

- Fertilizers

- Water Purification Chemicals

Ammonia Market, Country’s Analysis

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Middle East Ammonia market?As per Spherical Insights, the size of the Middle East Ammonia market was valued at USD 7.1 billion in 2021 to USD 10.10 billion by 2030.

-

What is the market growth rate of the Middle East Ammonia market?The Middle East Ammonia market is growing at a CAGR of 4.0% during the forecast period 2021-2030.

-

Which country dominates the Middle East Ammonia market?The Saudi Arabia emerged as the largest market for Middle East Ammonia.

-

Who are the key players in the Middle East Ammonia market?Key players in the Middle East Ammonia market are Yara International ASA, SABIC, Ma’aden, Gulf Petrochemical Industries Company, Pardis Petrochemical Company, OCI N.V., Istanbul Fertilizer Industry Inc. Co. (IGSAS), Petrochemical Industries Company, Qatar Fertiliser Company, and Hemmat Petrochemical Company.

-

Which is the leading type for Middle East Ammonia Market?The anhydrous ammonia segment is the leading product type for the Middle East Ammonia market.

Need help to buy this report?