Middle East and Africa Power Rental Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (Diesel, Natural Gas, Others), By Equipment Type (Generator, Transformer, Load Bank, Others), By Power Rating (Up to 50 kW, 51 - 500 kW, 501 - 2,500 kW, Above 2,500 kW), By Application (Peak Shaving, Standby Power, Base Load/Continuous Power), By End Use Industry (Utilities, Oil & Gas, Events, Construction, Mining, Data Centers, Others), By Region(UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), and Middle East and Africa Power Rental Market Insights Forecasts 2023 – 2033

Industry: Energy & PowerMiddle East and Africa Power Rental Market Insights Forecasts to 2033

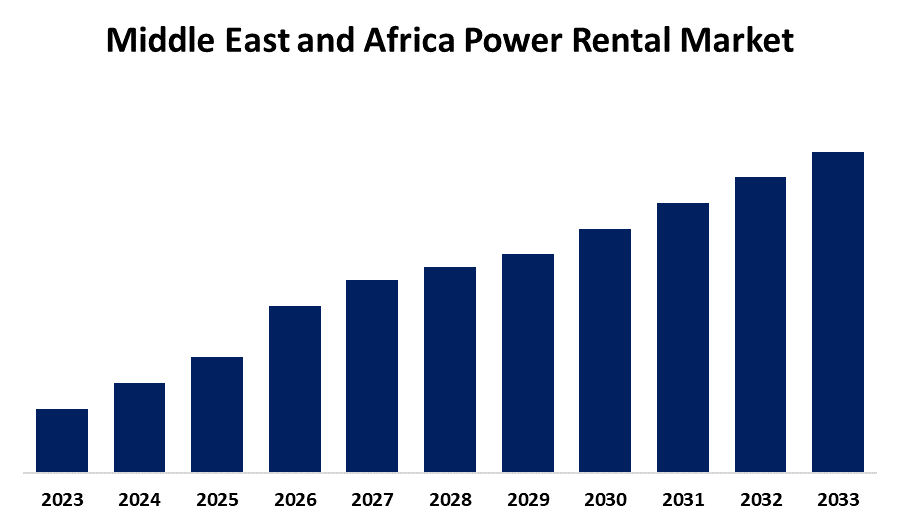

- The Market Size is Growing at a CAGR of 8.86% from 2023 to 2033.

- The Middle East and Africa Power Rental Market Size Expected to Hold a Significant Share by 2033.

Get more details on this report -

The Middle East and Africa Power Rental Market Size is expected to hold a significant Share by 2033, at a CAGR of 8.86% during the forecast period 2023 to 2033.

Market Overview

Power rental is also known as plant hire in some countries. Power rental refers to the temporary rental of power plants or generators to supply energy to industrial facilities. Power rental refers to the rental of gas, diesel, or other fuel-powered generator sets. It provides operational power equipment as well as numerous scalable components for use in power stations. Businesses benefit from its dependability, flexibility, speed, and affordability when dealing with power outages. Power leasing services are intended to help utilities stabilize their power systems while also providing additional energy to businesses and communities. As a consequence, it is widely used in construction, mining, and the oil and gas industries. Power rental is a service industry that rents out machinery, equipment, and tools of all types and sizes (from earthmoving to powered access, power generation to hand-held tools, and so on for a limited time to end users, primarily construction contractors but also industry and individual customers. The Middle Eastern market remains the largest for power rental. Widespread construction and development activities are boosting the power rental market forward. The permanent power producers' inability to meet power demand, particularly during extremely hot weather conditions, is viewed as an opportunity for the Middle East and Africa's power rental market.

Report Coverage

This research report categorizes the market for the Middle East and Africa power rental market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Middle East and Africa power rental market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Middle East and Africa power rental market.

Middle East and Africa Power Rental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.86% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Fuel Type, By Equipment Type, By Power Rating, By Application, By End Use Industry, By Region |

| Companies covered:: | Aggreko Middle East Ltd, Byrne Equipment Rental LLC, Rental Solutions & Services LLC, SES SMART Energy Solutions FZCO, KPS Power Generation, Peax Equipment Rental, Jozi Power Limited, Jubaili Bros. LLC, Eaton Corporation PLC, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Middle East and Africa region is experiencing rapid infrastructure development, with the construction of residential complexes, commercial buildings, industrial facilities, and transportation networks. This necessitates the availability of temporary power solutions during the construction phase, and the region's growing events and entertainment industry, which includes music festivals, sporting events, exhibitions, and conferences, requires dependable and uninterrupted power supply, driving demand for power rental services. Some remote areas in the Middle East and Africa lack reliable power infrastructure. Power rental services help to bridge this gap by providing temporary power solutions to meet these regions' energy needs. Rapid technological advancements are creating numerous opportunities in the market. Technological innovations have ushered in a new era of efficiency, sustainability, and reliability in power rental solutions, making them more appealing to diverse industries. Furthermore, the growing emphasis on emergency preparedness is driving the market. In an era of increased climate-related uncertainties and the possibility of grid failures, industries, and communities understand the critical importance of reliable backup power solutions.

Restraining Factors

The use of diesel generators in power rental services can lead to increased air pollution and carbon emissions. This has resulted in stricter environmental regulations and a shift toward cleaner, more sustainable power solutions, which may pose challenges for traditional diesel-powered power rental companies. Starting a power rental business requires a significant initial investment in power generation equipment, maintenance, transportation, and storage facilities. This can be a barrier for new entrants into the market.

Market Segment

- In 2023, the diesel segment accounted for the largest revenue share over the forecast period.

Based on fuel type, the Middle East and Africa power rental market is segmented into diesel, natural gas, and others. Among these, the diesel segment has the largest revenue share over the forecast period. Diesel-powered generators provide a dependable and adaptable source of temporary power, especially when grid power is unavailable or inadequate. Their durability and ability to produce a high-power output make them ideal for industrial operations, construction sites, events, and emergencies. They are well-known for their speed and efficiency, allowing them to respond quickly to unexpected power demands. Furthermore, the diesel segment's market dominance is further boosted by its widespread use in various regions and industries. In remote areas or areas with unreliable power infrastructure, diesel generators are essential for ensuring a continuous and stable power supply. Furthermore, advances in diesel generator technology have resulted in increased fuel efficiency and lower emissions, which aligns with the growing emphasis on sustainability.

- In 2023, the generator segment is witnessing significant growth over the forecast period.

Based on equipment type, the Middle East and Africa power rental market is segmented into generators, transformer, load banks, and others. Among these, the generator segment is witnessing significant growth over the forecast period. Generators are an essential component of the power rental market, serving as a linchpin for meeting temporary or supplemental power requirements in a variety of industries. Their widespread use and versatility make them a driving force in market growth. Several industries, including construction, events, manufacturing, and utilities, rely heavily on rental generators to maintain power during planned or unplanned outages. Portable and stationary generators provide flexibility in deployment, catering to a wide range of power requirements, from small-scale events to large industrial operations. The generator's adaptability to various applications, in addition to its critical role in ensuring business continuity, makes it a key market growth catalyst. As industries look for scalable, dependable, and cost-effective power solutions, the generator segment remains at the forefront, meeting the changing energy needs of a dynamic and growing market.

- In 2023, the 51 - 500 kw segment accounted for the largest revenue share over the forecast period.

Based on power rating, the Middle East and Africa power rental market are segmented into up to 50 kw, 51 - 500 kw, 501 - 2,500 kw, and above 2,500 kw. Among these, the events segment has the largest revenue share over the forecast period. The 51 - 500 kW power rating segment boost the market forward, demonstrating its critical role in meeting diverse energy requirements across industries. This power range strikes a balance between portability and high-power output, making it appropriate for a wide range of applications, including construction sites, events, and industrial operations. The 51 - 500 kW power rating meets mid-range power requirements, providing an ideal solution for situations requiring a moderate but dependable power supply. Advances in generator technology, which improve fuel efficiency and emission control within this power range, are accelerating the growth of the 51 - 500 kW power rating segment. As businesses seek more scalable and efficient power solutions, the 51 - 500 kW range stands out as a key contributor to the growing market, meeting the evolving and diverse energy demands of various applications and industries.

- In 2023, the base load/continuous power segment accounted for the largest revenue share over the forecast period.

Based on application, the Middle East and Africa Power Rental market is segmented into peak shaving, standby power, and base load/continuous power. Among these, the events segment has the largest revenue share over the forecast period. The base load/continuous power provides a constant and uninterrupted power supply, making it an essential solution for industries and operations that require continuous energy. Baseload or continuous power is used in a variety of industries, including manufacturing, data centers, utilities, and critical infrastructure, to ensure that equipment, processes, and services run smoothly. Their adaptability and scalability are driving the increased use of base load/continuous power solutions. Businesses can modify their power infrastructure to meet changing energy requirements without investing in permanent installations. This adaptability is consistent with the changing dynamics of industries where continuous power is essential for maintaining productivity and operational efficiency. As industries strive for energy resilience and cost-effectiveness, the base load/continuous power segment emerges as a key market driver, catering to the diverse and demanding energy needs of sectors that require consistent and uninterrupted power supply.

- In 2023, the utilities segment is witnessing significant growth over the forecast period.

Based on the end-use industry, the Middle East and Africa power rental market is segmented into utilities, oil & gas, events, construction, mining, data centers, and others. Among these, the utilities segment is witnessing significant growth over the forecast period. Utilities provide a wide range of services, including electricity, water, and gas, and they frequently face challenges such as grid constraints, maintenance outages, and responding to unexpected increases in demand. In such cases, power rental services are critical to ensuring a consistent and uninterrupted power supply. Furthermore, utility companies frequently use rental power solutions to bridge gaps during planned infrastructure maintenance or in emergencies, such as severe weather events that could disrupt the grid. Temporary power solutions allow utilities to maintain operational continuity while quickly restoring services, reducing downtime and potential financial losses. The demand for power rental solutions in the utilities industry demonstrates the sector's recognition of the strategic importance of temporary power in maintaining a strong and dependable energy infrastructure.

- The is Middle East projected to have the largest share of Middle East and Africa power rental market over the forecast period.

Based on region, the Middle East is projected to have the largest share of the Middle East and Africa power rental market over the forecast period. The Middle East makes a major contribution to the market, indicating a strong demand for temporary and scalable power solutions across a variety of industries. The country's diverse economic landscape, which includes manufacturing, construction, events, and utilities, increases the demand for dependable and flexible power sources. In the construction industry, temporary power is critical for project sites in remote areas with no immediate grid access. Events ranging from festivals to corporate functions frequently rely on power rental services for temporary and mobile power solutions to ensure smooth operations and power-diverse equipment. Furthermore, industries that require critical power, such as utilities and data centers, use power rental services to ensure operational continuity during planned maintenance or unplanned outages. Furthermore, the country's regulatory environment, which encourages businesses to implement efficient and resilient energy solutions, promotes market expansion. As businesses seek cost-effective and flexible power options, the country's power rental industry evolves, offering tailored solutions to meet the changing energy needs of a wide range of industries and applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Middle East and Africa power rental market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aggreko Middle East Ltd

- Byrne Equipment Rental LLC

- Rental Solutions & Services LLC

- SES SMART Energy Solutions FZCO

- KPS Power Generation

- Peax Equipment Rental

- Jozi Power Limited

- Jubaili Bros. LLC

- Eaton Corporation PLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Middle East and Africa Power Rental market based on the below-mentioned segments:

Middle East and Africa Power Rental Market, By Fuel Type

- Diesel

- Natural Gas

- Others

Middle East and Africa Power Rental Market, By Equipment Type

- Generator

- Transformer

- Load Bank

- Others

Middle East and Africa Power Rental Market, By Power Rating

- Up to 50 kW

- 51 - 500 kW

- 501 - 2,500 kW

- Above 2,500 kW

Middle East and Africa Power Rental Market, By Application

- Peak Shaving

- Standby Power

- Base Load/Continuous Power

Middle East and Africa Power Rental Market, By End Use Industry

- Utilities

- Oil & Gas

- Events

- Construction

- Mining

- Data Centers

- Others

Middle East and Africa Power Rental Market, By Region

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?