Global Mild Hybrid Vehicles Market Size, Share, and COVID-19 Impact Analysis, By Capacity Type (Less Than 48V and Above 48V), By Vehicle Type (Passenger Cars, and Commercial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Mild Hybrid Vehicles Market Insights Forecasts to 2033

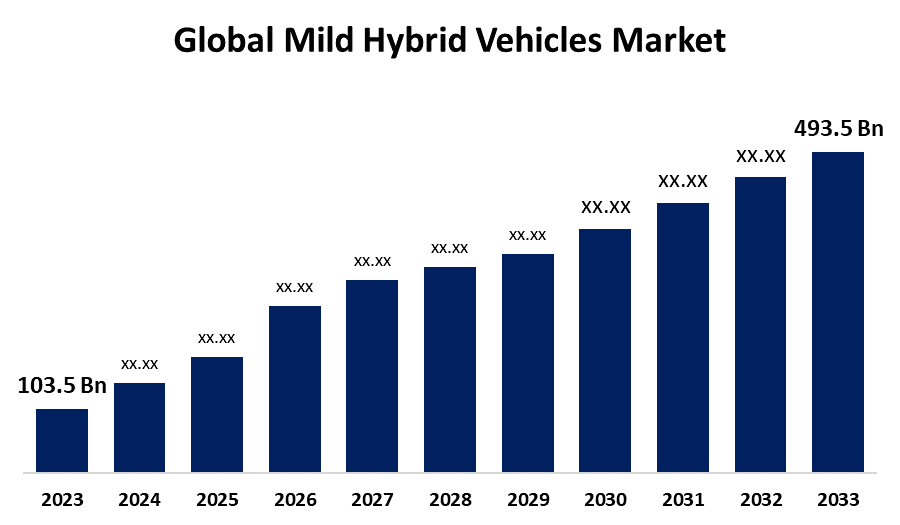

- The Global Mild Hybrid Vehicles Market Size was Valued at USD 103.5 Billion in 2023

- The Market Size is Growing at a CAGR of 16.91% from 2023 to 2033

- The Worldwide Mild Hybrid Vehicles Market Size is Expected to Reach USD 493.5 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Mild Hybrid Vehicles Market Size is Anticipated to Exceed USD 493.5 Billion by 2033, Growing at a CAGR of 16.91% from 2023 to 2033.

Market Overview

Mild hybrids, also called smart hybrids or power-syst hybrids, are vehicles with an internal combustion engine and a small battery paired with an electric motor. This setup allows the engine to stop when the car is coasting or stationary, restarting when more power is needed. Mild hybrids might use regenerative braking and some power assistance to the internal combustion engine. Acting as a bridge technology between traditional combustion engines and electric cars, mild hybrid cars strike a better balance between cost and performance than full hybrids and electric vehicles. Sales of mild hybrid cars continue to grow despite some governments ending incentives for these vehicles. Key factors driving the market growth include increasing demand for eco-friendly vehicles, government efforts to improve mild hybrid vehicles, and a growing need for alternative fuel efficiency. The global mild hybrid vehicle market is witnessing substantial growth due to various factors. A major factor driving this growth is the rapid urbanization taking place worldwide. With a growing urban population, there is a growing need for efficient and environmentally friendly transportation solutions in cities. Growing environmental concerns and the need to reduce greenhouse gas emissions are also driving this demand. Furthermore, stringent government regulations are significantly affecting the market structure. Governments around the world are introducing stricter emission regulations and incentives to encourage the use of eco-friendly vehicles.

Report Coverage

This research report categorizes the market for global mild hybrid vehicles market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global mild hybrid vehicles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global mild hybrid vehicles market.

Global Mild Hybrid Vehicles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 103.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.91% |

| 2033 Value Projection: | USD 493.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Capacity Type, By Vehicle Type, By Region |

| Companies covered:: | Bayerische Motoren Werke AG, China FAW Group Co. Ltd., FCA Italy S.p.A., Ford Motor Co., General Motors Co, Great Wall Motor Co. Ltd., Honda Motor Co. Ltd, Hyundai Motor Group, Mahindra & Mahindra Ltd., Mercedes Benz Group AG, Stellantis NV, Suzuki Motor Corp., Tata Sons Pvt. Ltd., Toyota Motor Corp., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

Governments of many countries around the world have implemented various regulations and incentives to accelerate the use of hybrid vehicles towards a full transition to electric cars as part of their goal of achieving net-zero carbon emissions within a predetermined time frame. The market CAGR for mild hybrid vehicles is driven by the increasing stringency of emission norms. New product launches by various automobile manufacturers have fueled demand for mild hybrid vehicle market revenue over the forecast period. The mild hybrid electric vehicle (MHEV) industry is witnessing significant trends driven by the emergence of advanced parts from auto parts manufacturing companies. Furthermore, advances in regenerative braking systems, aerodynamics, and thermal management solutions are shaping the landscape of MHEV design and engineering. As a result, the market is shifting towards more sophisticated and efficient MHEVs. Collaborations between automakers and auto parts manufacturers drive this trend, paving the way for further advancements in MHEV technology.

Restraining Factors

A key challenge facing the global mild hybrid vehicle market is the high initial cost associated with mild hybrid technology compared to conventional internal combustion engine vehicles. Another challenge facing the global mild hybrid vehicles market is limited infrastructure for advanced 48-volt systems, especially in terms of servicing and maintenance. Battery technology and associated range limitations are a significant challenge for the global mild hybrid vehicle market. The global mild hybrid vehicles market is challenged by market fragmentation and a diverse regulatory landscape. Rapid advancement in full hybrid and electric vehicles poses a challenge to the global mild hybrid vehicles market.

Market Segmentation

The global mild hybrid vehicles market share is classified into capacity type and vehicle type.

- The above 48V segment is expected to hold the largest share of the global mild hybrid vehicles market during the forecast period.

Based on the capacity type, the global mild hybrid vehicles market is divided into less than 48V and above 48V. Among these, the above 48V segment is expected to hold the largest share of the global mild hybrid vehicles market during the forecast period. The need for electricity to supply electronic components such as compressors, heaters, power steering, and electric pumps has increased, leading to the introduction of 48V batteries. Over the past years, many automakers have offered 48V mild hybrids as standard equipment in their new vehicle models. For instance, the new XT4 compact crossover SUV was introduced in December 2021 by the Cadillac division of General Motors Corporation Limited (SAIC-GM). The new XT4 features enhanced configuration and power. It has a 48V mild-hybrid powertrain with a 48V motor, 48V power battery, power management module, hybrid control unit, and a 2.0L variable-cylinder turbocharged engine with a maximum power output of 174kW and a peak torque of 350Nm.

- The passenger cars segment is expected to hold the largest share of the global mild hybrid vehicles market during the forecast period.

Based on the vehicle type, the global mild hybrid vehicles market is divided into passenger cars and commercial vehicles. Among these, the passenger cars segment is expected to hold the largest share of the global mild hybrid vehicles market during the forecast period. Passenger cars with mild hybrid drivetrains are growing in popularity. Mild-hybrid technology has advanced in recent years due to the rise in new vehicle debuts by several automakers. For instance, in March 2021, the well-known automaker Hyundai unveiled the brand-new crossover SUV Bayon. This car was created especially for the European Union. The automobile has a 1.0-liter engine and a 48-volt mild hybrid system. In November 2020, Mercedes-Benz unveiled the brand-new Maybach S-Class. The car is powered by a 4.0-liter twin-turbo with mild hybrid EQ-Boost technology. It is anticipated that the car, which will take the place of the Maybach 650 and 560, will launch in India in 2022.

Regional Segment Analysis of the Global Mild Hybrid Vehicles Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global mild hybrid vehicles market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global mild hybrid vehicles market over the predicted timeframe. The APAC automobile industry derived most of its revenue from China, India, South Korea, and Japan. When it comes to automotive production and sales, these nations rule the globe. The Asian Pacific region has witnessed a surge in demand for electric vehicles (EVs) due to notable advancements in infrastructure and industrialization. In the upcoming years, the countries with the biggest shares of new car purchases worldwide will be China, Japan, and India. As economies in nations like China and Japan have improved, people's disposable income has increased. Car sales have surged in several countries as a result. China is a significant automobile market in Asia-Pacific and worldwide, selling a lot of EVs and passenger cars. Rising disposable incomes are one of the factors contributing to China's increased demand for mild hybrid cars.

North America is expected to grow at the fastest pace in the global mild hybrid vehicles market during the forecast period. Automakers are being compelled by government incentives and stringent environmental restrictions in the US to incorporate a mild hybrid system that might potentially replace the current gasoline/diesel engine. On the other hand, mild hybrid cars are unable to supply the motors needed to complete hybrid vehicles on their own. The more substantial increase would impede the possible ascent of mild hybrid cars in pure electric or fully hybrid cars in the US.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global mild hybrid vehicles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayerische Motoren Werke AG

- China FAW Group Co. Ltd.

- FCA Italy S.p.A.

- Ford Motor Co.

- General Motors Co

- Great Wall Motor Co. Ltd.

- Honda Motor Co. Ltd

- Hyundai Motor Group

- Mahindra & Mahindra Ltd.

- Mercedes Benz Group AG

- Stellantis NV

- Suzuki Motor Corp.

- Tata Sons Pvt. Ltd.

- Toyota Motor Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Toyota debuted a mild hybrid version of its famous SUV, the Fortuner, in South Africa. The new Toyota Fortuner mild hybrid SUV gets its powerplant from the Hilux hybrid, which is offered in global markets. This comes in the shape of a 2.8-liter diesel engine mated to a 48V mild hybrid system. The diesel-hybrid powerplant produces 201 BHP and 500 Nm and is combined with a 6-speed automated transmission.

- In May 2023, The GAC hybrid MPV, made in China, is the Trumpchi E9. There are three available trim levels. It costs CNY 329,800 (USD 45,170) for the base Pro trim. Max trim, mid-spec, costs CNY 369,800 (about USD 50,648).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global mild hybrid vehicles market based on the below-mentioned segments:

Global Mild Hybrid Vehicles Market, By Capacity Type

- Less Than 48V

- Above 48V

Global Mild Hybrid Vehicles Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Global Mild Hybrid Vehicles Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Bayerische Motoren Werke AG, China FAW Group Co. Ltd., FCA Italy S.p.A., Ford Motor Co., General Motors Co, Great Wall Motor Co. Ltd., Honda Motor Co. Ltd, Hyundai Motor Group, Mahindra & Mahindra Ltd., Mercedes Benz Group AG, Stellantis NV, Suzuki Motor Corp., Tata Sons Pvt. Ltd., Toyota Motor Corp., and others.

-

2. What is the size of the global mild hybrid vehicles market?The Global Mild Hybrid Vehicles Market is expected to grow from USD 103.5 Billion in 2023 to USD 493.5 Billion by 2033, at a CAGR of 16.91% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global mild hybrid vehicles market over the predicted timeframe.

Need help to buy this report?