Global Military Aerospace Coatings Market Size, Share, and COVID-19 Impact By Aircraft Type (Narrow-Body Aircraft, Wide-Body Aircraft), By Resin (Epoxy, Polyurethane), By Application (Engine, Interior, and Exterior), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Chemicals & MaterialsGlobal Military Aerospace Coatings Market Size Insights Forecasts to 2032

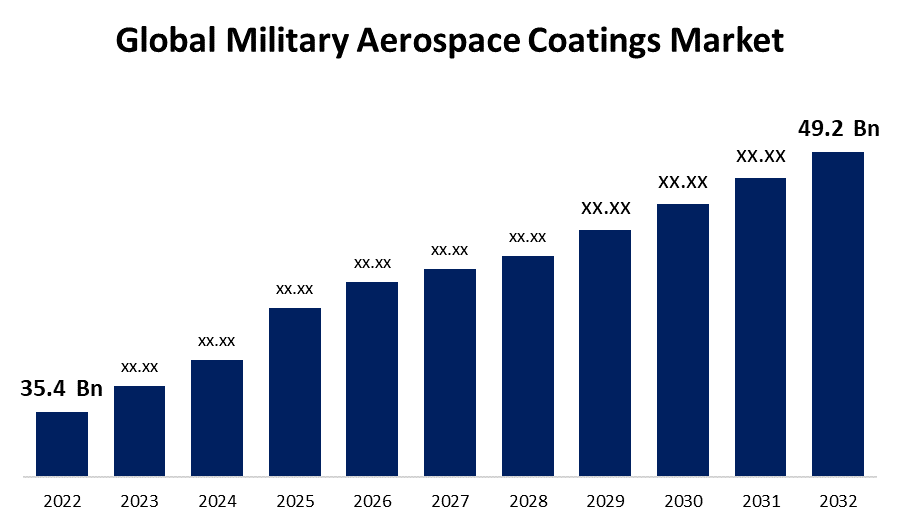

- The Military Aerospace Coatings Market Size was valued at USD 35.4 Billion in 2022.

- The Market is Growing at a CAGR of 5.3% from 2022 to 2032.

- The Worldwide Military Aerospace Coatings Market Size is expected to reach USD 49.2 Billion By 2032.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The global Military Aerospace Coatings Market Size is expected to reach USD 49.2 Billion By 2032, at a CAGR of 5.3% during the forecast period 2022 to 2032.

Military Aerospace Coatings are specialised coatings created to defend and improve the functionality of military aircraft and aerospace equipment. These coatings are essential for preserving the durability and integrity of military vehicles, including aircraft, that operate in challenging situations. Military aircraft must function in a variety of settings, including ones with high humidity, exposure to seawater, and other corrosive elements. Aerospace coatings are designed to offer superior corrosion resistance, guarding against rust and deterioration on the metal surfaces. There is a chance that chemical weapons or dangerous materials will come into contact with military planes. Aerospace coatings are made to withstand chemical attacks and guard against surface damage to aircraft.

Impact of COVID 19 On Global Military Aerospace Coatings Market

Global supply networks were affected by the epidemic, which had an impact on the availability of raw materials and production capacity. As a result, there may have been a shortage of aircraft coatings and production delays. Due to the pandemic's economic effects on many nations, funding was reallocated and budgets were cut. Government actions may have impacted the demand for military aircraft coatings by postponing or reducing defence programmes. Both civilian and military air traffic significantly decreased as a result of the a pandemic As a result, some military planes were put to rest or used less regularly, potentially lowering the need for coatings maintenance or replacement right away. The allocation of funds for aerospace coatings would have been altered if defence authorities' attention had been diverted to other crucial areas, such public health and emergency response during the epidemic. Research and development efforts connected to aircraft coatings may have temporarily slowed down because to the pandemic, delaying the release of novel and cutting-edge technologies.

Global Military Aerospace Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 35.4 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.3% |

| 2032 Value Projection: | USD 49.2 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact, By Aircraft Type, By Resin, By Application, By Region |

| Companies covered:: | Akzo Nobel N.V., CREATIVE COATINGS, Valspar, Klinge Enameling, Inc., CHASE CORPORATION, Mankiewicz Gebr. & Co. (GmbH & Co. KG), Cloverdale Paint Inc., Marpol Private Limited, Hentzen Coatings, Inc., Kansai Paint Co.,Ltd., Evonik Industries AG, Klinge Coatings, Argosy International Inc., BryCoat Inc., Henkel AG & Company KGaA, BASF SE, 3Chem, The Sherwin-Williams Company, PPG Industries, Inc., IHI Ionbond AG. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Key Market Drivers

The modernization and improvement of existing military aircraft fleets was a major global undertaking for many nations. High-performance coatings are required to safeguard and improve these assets as older aircraft are upgraded and new platforms are introduced. Given that military aircraft operate in a variety of hostile situations, corrosion is a major concern. Corrosion-resistant coatings that work well were needed to increase aircraft service life and save maintenance costs. Defence organisations and aerospace suppliers place an increasing emphasis on the value of taking into account a military asset's whole lifecycle costs. Investing in high-quality coatings can help increase an aircraft's service life and lower long-term maintenance costs. Advanced coatings that aid in lowering radar signals and enhancing the stealth characteristics of the aircraft were required due to the development and deployment of stealth aircraft. Increased defence spending in some areas and emerging economies' interest in modernising their defence capabilities both had an impact on the growth of the Military Aerospace Coatings industry.

Key Market Challenges

Continuous innovation in coatings is required due to developments in materials science and aerospace technology. In order to provide better protection and performance, coatings must keep up with the advancements in military aircraft technology. Cost-effectiveness is frequently given top priority by defence organisations, and they search for solutions that maximise their budgets. Offering high-performance coatings while maintaining affordable prices is a delicate balance that coating manufacturers must achieve. To fulfil military and aviation standards, aerospace coatings must go through stringent testing and certification procedures. The introduction of new coatings to the market can be delayed by these processes since they can be time- and resource-intensive. The market for Military Aerospace Coatings is subject to shifts in general economic conditions. The market for aerospace coatings can be impacted by changes in the defence budget, geopolitical unrest, and economic downturns.

Market Segmentation

Aircraft Type Insights

Narrow-body aircraft segment is dominating the market over the forecast period

On the basis of aircraft type, the global Military Aerospace Coatings market is segmented into Narrow-Body Aircraft, Wide-Body Aircraft, Military Aircraft, and Spacecraft. Among these. the Narrow body aircraft segment is dominating the market over the forecast period. The commercial aviation sector's narrow-body aircraft segment has been seeing substantial demand and growth. Single-aisle aircraft with a narrow body is intended for short- to medium-haul passenger travel. They are favoured options for many airlines throughout the world since they are incredibly adaptable and suitable for a variety of activities. Many airlines aimed to improve operational effectiveness and lessen their environmental impact by upgrading their fleets with newer, more fuel-efficient narrow-body models in order to modernise their fleets.

Resin Insights

Polyurethane segment holds the highest market share over the forecast period

Based on resin, the global Military Aerospace Coatings market is segmented into Epoxy, Polyurethane, and Others. Among these, the polyurethane segment holds the highest market share over the forecast period. Due to their exceptional qualities, including great durability, corrosion resistance, and flexibility, polyurethane coatings have been utilised extensively in military and aerospace applications. Military aircraft surfaces, including the exterior, interior, and crucial components, frequently have these coatings applied to them in order to shield them from abrasive elements, chemicals, and wear. Due to the large number of military aircraft fleets that have been in operation for many years, maintenance requirements have increased. Because they offer defence against deterioration and wear, polyurethane coatings are frequently chosen because they can increase the lifespan of aeroplanes.

Application Insights

Exterior segment dominates the market over the forecast period

On the basis of application, the global Military Aerospace Coatings market is segmented into Engine, Interior, and Exterior. Among these, exterior segment dominates the market with the largest market share over the forecast period. There has been a rise in defence spending across the world as a result of escalating geopolitical tensions. As a result, there has been an increase in demand for military aircraft, both for brand-new purchases and for fleet modifications. These aircraft's outside surfaces require coatings that offer defence against abrasive environmental factors like UV radiation, freezing temperatures, and weathering. Modern military aircraft are built to function in a variety of difficult conditions. Extreme temperatures, high-speed flying, exposure to harsh chemicals, and other situations all call for the external coatings to perform to a high standard.

Regional Insights

North America is dominating the market with the largest market share.

Get more details on this report -

Among all other regions, North America is dominating the market with the largest market share over the forecast period. The two largest nations in North America, the United States and Canada, both have considerable defence expenditures to fund their military forces. The demand for innovative aerospace coatings to safeguard and improve the performance of their military aircraft fleets is driven by continuing modernization activities. Major aerospace firms and coating producers have their corporate headquarters or a sizable presence in North America. These businesses help the market expand by providing domestic and foreign customers with coatings and solutions for military aircraft.

Asia Pacific is witnessing the fastest market growth over the forecast period. To modernise their armed forces and improve their aerospace capabilities, many Asia-Pacific nations have been raising their defence budgets. The need for military aircraft and, subsequently, aerospace coatings to preserve and improve these aircraft, both expand as a result of this increase in defence spending. With nations like China, India, and South Korea growing to be key players in the global aerospace sector, the Asia Pacific region has become a centre for aerospace manufacturing. The need for coatings used in the manufacture and maintenance of military aircraft is further fueled by the expansion of the aerospace industry in these nations.

Recent Market Developments

- In July 2022, in order to provide airline clients with good service by merging paint supply with livery design, PPG worked with the UK airline brand and formed the consultancy Aerobrand.

- In July 2022, a total of EUR 15 million was invested by Akzo Nobel in their Pamiers aerospace coatings division, which Mapaero purchased in 2019.

List of Key Companies

- Akzo Nobel N.V.

- CREATIVE COATINGS

- Valspar

- Klinge Enameling, Inc.

- CHASE CORPORATION

- Mankiewicz Gebr. & Co. (GmbH & Co. KG)

- Cloverdale Paint Inc.

- Marpol Private Limited

- Hentzen Coatings, Inc.

- Kansai Paint Co.,Ltd.

- Evonik Industries AG

- Klinge Coatings

- Argosy International Inc.

- BryCoat Inc.

- Henkel AG & Company KGaA

- BASF SE

- 3Chem

- The Sherwin-Williams Company

- PPG Industries, Inc.

- IHI Ionbond AG

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Military Aerospace Coatings Market based on the below-mentioned segments:

Military Aerospace Coatings Market, Aircraft Type Analysis

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Military Aircraft

- Spacecraft

Military Aerospace Coatings Market, Resin Analysis

- Epoxy

- Polyurethane

- Others

Military Aerospace Coatings Market, Application Analysis

- Engine

- Interior

- Exterior

Military Aerospace Coatings Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of Military Aerospace Coatings Market?The global Military Aerospace Coatings Market is expected to grow from USD 35.4 Billion in 2022 to USD 49.2 Billion by 2032, at a CAGR of 5.3% during the forecast period 2022-2032.

-

2. Who are the key market players of Military Aerospace Coatings Market?Some of the key market players of Akzo Nobel N.V., CREATIVE COATINGS, Valspar, Klinge Enameling, Inc., CHASE CORPORATION, Mankiewicz Gebr. & Co. (GmbH & Co. KG), Cloverdale Paint Inc., Marpol Private Limited, Hentzen Coatings, Inc., Kansai Paint Co.,Ltd., Evonik Industries AG, Klinge Coatings, Argosy International Inc., BryCoat Inc., Henkel AG & Company KGaA, BASF SE, 3Chem, The Sherwin-Williams Company, PPG Industries, Inc., and IHI Ionbond AG.

-

3. Which segment hold the largest market share?Polyurethane segment holds the largest market share is going to continue its dominance.

-

4. Which region is dominating the Military Aerospace Coatings Market?North America is dominating the Military Aerospace Coatings Market with the highest market share.

Need help to buy this report?