Global Military Antenna Market Size, Share, and COVID-19 Impact Analysis, By Frequency (High Frequency, Ultra-High Frequency, Super High Frequency, and Extremely High Frequency), By Type (Dipole Antenna, Aperture Antenna, Traveling Wave Antenna, Loop Antenna, and Array Antenna), By Platform (Airborne, Marine, and Ground), By Application (Communication, Surveillance, SATCOM, Electronic Warfare, and Telemetry), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Military Antenna Market Insights Forecasts to 2033

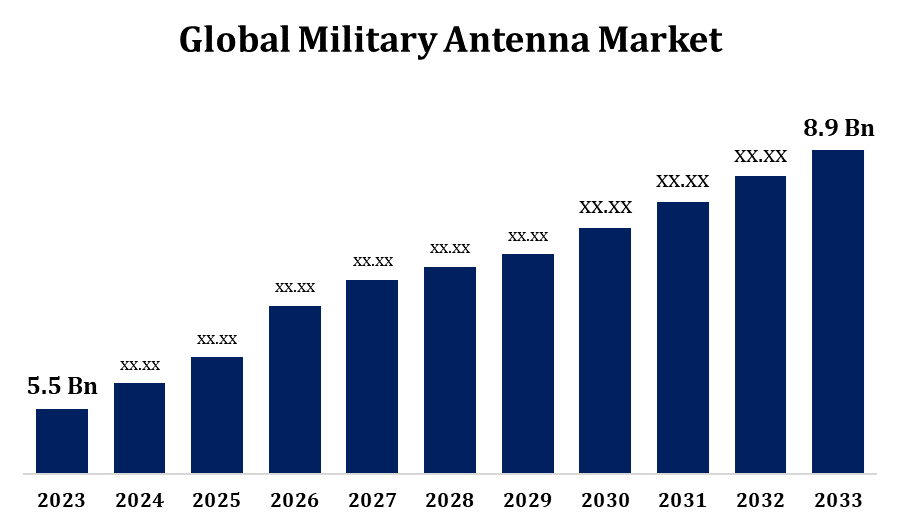

- The Military Antenna Market Size was valued at USD 5.5 Billion in 2023.

- The Market is Growing at a CAGR of 4.93% from 2023 to 2033.

- The Worldwide Military Antenna Market Size is Expected to reach USD 8.9 Billion By 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Military Antenna Market Size is Expected to reach USD 8.9 Billion by 2033, at a CAGR of 4.93% during the forecast period 2023 to 2033.

The military antenna market is a vital component of defense communication systems, enabling secure and reliable data transmission in diverse operational scenarios. These antennas support a wide range of applications, including radar, satellite communication, surveillance, and navigation, critical for modern warfare. Growing defense budgets and advancements in communication technologies, such as 5G integration and software-defined radios, are driving market growth. The rising adoption of unmanned systems and the increasing need for lightweight, compact, and high-performance antennas further enhance market prospects. Geopolitical tensions and the demand for robust battlefield connectivity also fuel investments in this sector. Key challenges include high development costs and the need for specialized manufacturing processes. Nevertheless, innovations in materials and design are expected to sustain growth in the military antenna market.

Military Antenna Market Value Chain Analysis

The military antenna market value chain encompasses several key stages, from raw material sourcing to end-user deployment. It begins with material suppliers providing advanced components, such as composite materials, semiconductors, and precision metals, critical for high-performance antennas. Manufacturers then design and develop antennas tailored to defense requirements, incorporating features like ruggedness, lightweight construction, and high-frequency capabilities. System integrators play a pivotal role, combining antennas with communication systems, radar, and navigation equipment to ensure seamless operation. Testing and validation ensure compliance with stringent military standards, focusing on durability, range, and reliability in harsh environments. Distribution channels include defense contractors and government procurement agencies, which deliver these systems to military forces globally. After-sales services, including maintenance and upgrades, complete the value chain, ensuring long-term operational efficiency.

Military Antenna Market Opportunity Analysis

The military antenna market presents significant growth opportunities driven by evolving defense strategies and advancements in communication technologies. Increasing demand for secure, high-speed data transmission in real-time battlefield scenarios propels innovation in antenna design and performance. The rise of unmanned aerial vehicles (UAVs), autonomous systems, and satellite-based communication further amplifies market potential, requiring specialized antennas for enhanced connectivity and precision. Emerging technologies, such as phased array antennas and 5G integration, open avenues for advanced applications, including electronic warfare and intelligence gathering. Additionally, rising defense budgets in developing nations and escalating geopolitical tensions create new market prospects. Manufacturers focusing on lightweight, compact, and multi-functional antennas stand to gain competitive advantages. Furthermore, collaborations with defense agencies and advancements in material science drive the adoption of next-generation military antenna solutions.

Global Military Antenna Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.5 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.93% |

| 2033 Value Projection: | USD 8.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 243 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Frequency, By Type, By Platform, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Harris Corporation (U.S.), Cobham plc (U.K.), Comrod Communications AS (Norway), Terma A/S (Denmark), MTI Wireless Edge (Israel), Eylex Pty Ltd. (Australia), Cojot Oy (Finland), Raytheon Company (U.S.), Lockheed Martin Corporation (U.S.), Rohde & Schwarz (Germany), Barker and Williamson (U.S.), RAMI (U.S.), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Military Antenna Market Dynamics

Increasing Demand for Satellite Communication Equipment Driven by Expanding Space Exploration Programs

The military antenna market is experiencing significant growth due to the rising demand for satellite communication equipment fueled by expanding space exploration programs. Military forces increasingly rely on satellite communication for secure, long-range, and real-time connectivity, critical for mission success in remote and hostile environments. Space exploration initiatives are driving technological advancements in satellite systems, boosting the development of high-performance antennas capable of supporting advanced communication networks. These antennas are essential for applications such as intelligence gathering, surveillance, and precision targeting. The growing integration of low-earth orbit (LEO) satellites into military communication systems further accelerates demand. Additionally, collaborative efforts between defense agencies and private space technology firms are fostering innovation, paving the way for lightweight, compact, and energy-efficient antennas, thereby enhancing the overall growth of the military antenna market.

Restraints & Challenges

High development and production costs, driven by the need for advanced materials and cutting-edge technologies, pose significant barriers for manufacturers. Stringent regulatory and compliance standards for military-grade equipment demand rigorous testing and certification processes, increasing time-to-market. The complexity of designing antennas that meet diverse operational requirements, such as durability in harsh environments and compactness for modern platforms, adds to the difficulty. Additionally, the reliance on global supply chains exposes the market to disruptions due to geopolitical tensions and material shortages. Evolving technological demands, including 5G and satellite integration, require continuous innovation, which can strain resources. Lastly, budget constraints in some regions may limit investments in new military communication infrastructure, affecting overall market growth.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Military Antenna Market from 2023 to 2033. The region's strong focus on modernizing military communication systems fuels demand for high-performance antennas. The United States, being the largest contributor, invests heavily in advanced radar, satellite communication, and electronic warfare systems, requiring cutting-edge antenna solutions. Increasing adoption of unmanned aerial vehicles (UAVs) and autonomous systems further bolsters the need for specialized antennas. The presence of leading defense manufacturers and R&D facilities fosters continuous innovation in antenna technology. Additionally, initiatives like the U.S. Space Force and collaborations with private aerospace companies accelerate the integration of next-generation communication technologies. Geopolitical factors and the emphasis on maintaining strategic superiority also drive steady growth in North America's military antenna market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, and South Korea are enhancing their military communication infrastructure to address rising geopolitical tensions and regional security concerns. The adoption of advanced technologies, such as satellite communication, radar systems, and electronic warfare, is driving demand for high-performance antennas. Additionally, the growing use of unmanned systems and the expansion of space programs in countries like China and India further fuel market opportunities. Indigenous manufacturing capabilities and government support for defense modernization initiatives, such as "Make in India," contribute to regional development.

Segmentation Analysis

Insights by Frequency

The high frequency segment accounted for the largest market share over the forecast period 2023 to 2033. High-frequency (HF) antennas support long-range communication, even in challenging terrains, making them indispensable for military operations. The growing emphasis on real-time data exchange, secure communication, and seamless connectivity in remote locations drives demand for HF antennas. These systems are essential for applications like ground-to-air communication, surveillance, and naval operations. Technological advancements, such as software-defined radios and adaptive antenna systems, are enhancing HF antenna performance, boosting their adoption. Moreover, the increasing reliance on unmanned systems and the integration of advanced radar and navigation technologies contribute to the segment's growth. As defense agencies prioritize robust and reliable communication, the high-frequency segment is expected to maintain its upward trajectory.

Insights by Type

The array antenna segment accounted for the largest market share over the forecast period 2023 to 2033. Array antennas, including phased array systems, offer superior performance in beam steering, high gain, and multi-target tracking, making them ideal for applications like radar, electronic warfare, and satellite communication. The increasing adoption of unmanned aerial vehicles (UAVs) and missile defense systems drives demand for compact, lightweight, and high-efficiency array antennas. Advances in electronic scanning and adaptive technologies further enhance the effectiveness of these systems, boosting their integration into modern defense platforms. Additionally, rising geopolitical tensions and the need for enhanced situational awareness fuel investments in array antennas. As militaries prioritize network-centric warfare and precision targeting, the array antenna segment is poised for sustained growth.

Insights by Platform

The airborne segment accounted for the largest market share over the forecast period 2023 to 2033. Airborne antennas, integrated into fighter jets, unmanned aerial vehicles (UAVs), and reconnaissance aircraft, provide crucial support for secure, high-speed data transmission, GPS navigation, and real-time intelligence sharing. The growing use of advanced radar, satellite communication, and electronic warfare systems in airborne platforms boosts the need for specialized antennas that ensure reliable performance in challenging environments. Technological advancements in lightweight, compact, and high-efficiency antenna designs further fuel market growth.

Insights by Application

The electronic warfare segment accounted for the largest market share over the forecast period 2023 to 2033. EW antennas play a crucial role in detecting, disrupting, and neutralizing adversarial communication and radar systems. As militaries invest in next-generation technologies for signal intelligence, radar systems, and countermeasures, the demand for highly specialized antennas with wide bandwidth, high sensitivity, and low susceptibility to interference has surged. Technological advancements, such as adaptive antennas and phased array systems, enhance the effectiveness of EW operations. The growing geopolitical tensions, evolving cyber threats, and the integration of EW systems into airborne, naval, and land platforms further propel the segment's growth. This trend underscores the importance of electronic warfare in modern defense strategies.

Recent Market Developments

- In January 2023, CAES, a prominent provider of mission-critical advanced RF technology, announced that Northrop Grumman has secured a contract exceeding USD 24 million to supply M-Code GPS antennas for the support of Precision Guidance Instruments (PGK).

Competitive Landscape

Major players in the market

- Harris Corporation (U.S.)

- Cobham plc (U.K.)

- Comrod Communications AS (Norway)

- Terma A/S (Denmark)

- MTI Wireless Edge (Israel)

- Eylex Pty Ltd. (Australia)

- Cojot Oy (Finland)

- Raytheon Company (U.S.)

- Lockheed Martin Corporation (U.S.)

- Rohde & Schwarz (Germany)

- Barker and Williamson (U.S.)

- RAMI (U.S.)

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Antenna Market, Frequency Analysis

- High Frequency

- Ultra-High Frequency

- Super High Frequency

- Extremely High Frequency

Military Antenna Market, Type Analysis

- Dipole Antenna

- Aperture Antenna

- Traveling Wave Antenna

- Loop Antenna

- Array Antenna

Military Antenna Market, Platform Analysis

- Airborne

- Marine

- Ground

Military Antenna Market, Application Analysis

- Communication

- Surveillance

- SATCOM

- Electronic Warfare

- Telemetry

Military Antenna Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Military Antenna Market?The global Military Antenna Market is expected to grow from USD 5.5 billion in 2023 to USD 8.9 billion by 2033, at a CAGR of 4.93% during the forecast period 2023-2033.

-

2. Who are the key market players of the Military Antenna Market?Some of the key market players of the market are Harris Corporation (U.S.), Cobham plc (U.K.), Comrod Communications AS (Norway), Terma A/S (Denmark), MTI Wireless Edge (Israel), Eylex Pty Ltd. (Australia), Cojot Oy (Finland), Raytheon Company (U.S.), Lockheed Martin Corporation (U.S.), Rohde & Schwarz (Germany), Barker and Williamson (U.S.), RAMI (U.S.).

-

3. Which segment holds the largest market share?The airborne segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Military Antenna Market?North America dominates the Military Antenna Market and has the highest market share.

Need help to buy this report?