Global Military Battery Market Size, Share, and COVID-19 Impact Analysis, By Platform (Ground, Airborne, Marine), By Type (Non-Rechargeable, Rechargeable, Propulsion), By Composition (Rotary Lithium-based, Lead acid, Nickel-based, Thermal, Others), By Installation (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Military Battery Market Insights Forecasts to 2033

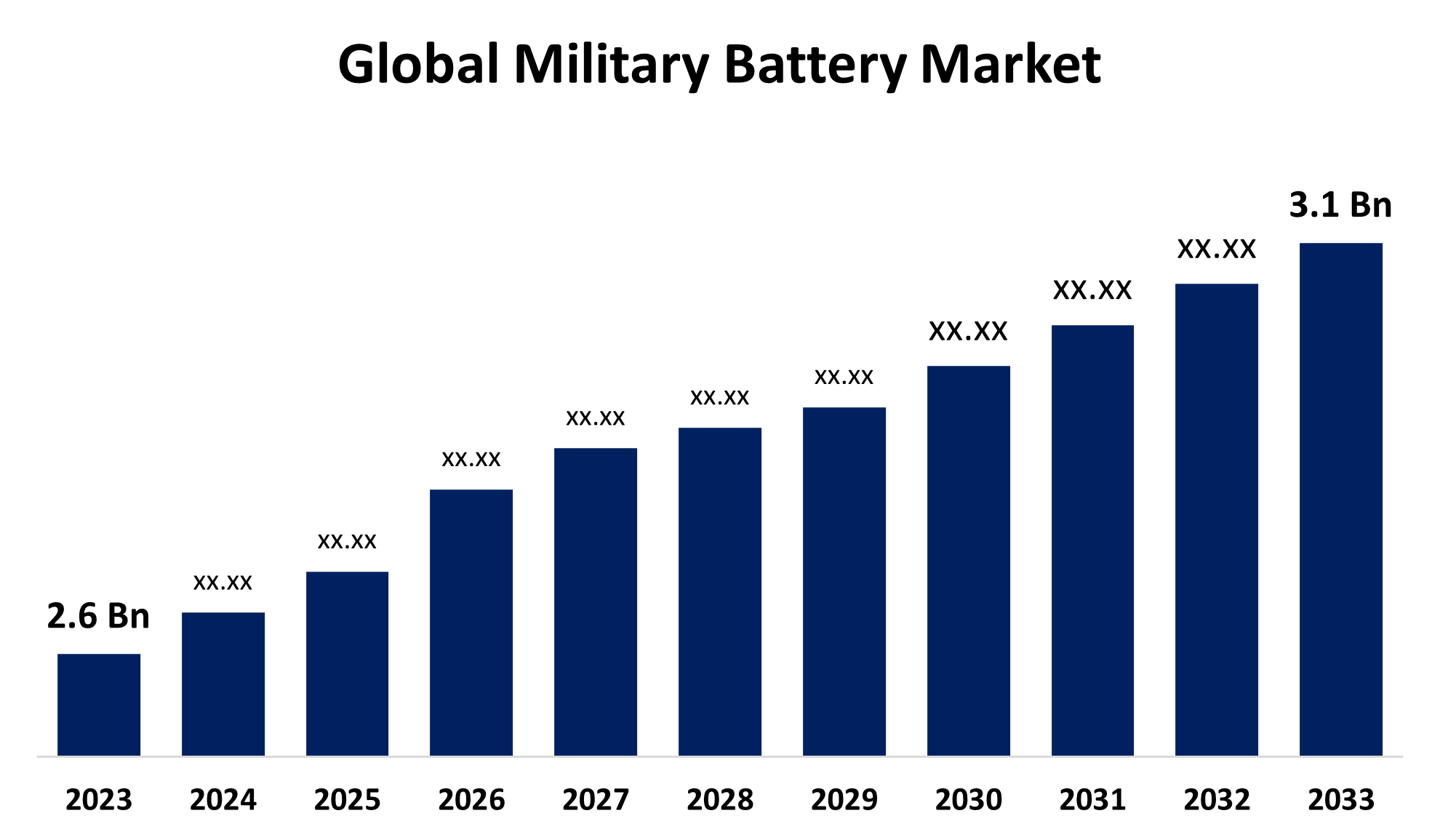

- The Military Battery Market Size was valued at USD 2.6 billion in 2023.

- The market Size is Growing at a CAGR of 1.77% from 2023 to 2033.

- The Worldwide Military Battery Market Size is expected to reach USD 3.1 billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global Military Battery Market Size is expected to reach USD 3.1 billion by 2033, at a CAGR of 1.77% during the forecast period 2023 to 2033.

The military battery market is experiencing significant growth due to rising defense budgets, increasing demand for advanced portable power solutions, and technological advancements. Military forces worldwide rely on high-performance batteries for applications such as communication systems, drones, ground vehicles, submarines, and wearable soldier gear. Lithium-ion batteries dominate the market due to their high energy density and lightweight properties, while alternative chemistries like nickel-metal hydride and solid-state batteries are gaining traction. Governments are investing in energy-efficient and long-lasting battery solutions to enhance operational efficiency. Key players in the industry focus on developing rugged, high-capacity, and fast-charging batteries to meet military standards. The growing adoption of unmanned systems and the need for reliable power sources in harsh environments are further propelling market expansion.

Military Battery Market Value Chain Analysis

The military battery market value chain involves multiple stages, from raw material sourcing to end-user deployment. It begins with suppliers providing key materials like lithium, nickel, and advanced electrolytes. Battery manufacturers then design and produce specialized military-grade batteries, ensuring durability, high energy density, and compliance with defense standards. Component suppliers contribute essential parts such as battery management systems (BMS), thermal insulation, and protective casings. System integrators assemble these batteries into military equipment, including vehicles, communication devices, and unmanned systems. Defense contractors and original equipment manufacturers (OEMs) integrate batteries into final applications. Finally, military organizations procure and deploy these batteries in field operations. Maintenance, recycling, and disposal services complete the chain, with a growing focus on sustainable energy solutions and battery life-cycle management.

Military Battery Market Opportunity Analysis

The military battery market presents significant opportunities driven by technological advancements, increasing defense budgets, and the growing need for reliable power solutions in modern warfare. The rising adoption of unmanned aerial vehicles (UAVs), electric military vehicles, and wearable soldier systems is fueling demand for high-performance, lightweight, and long-lasting batteries. Innovations in solid-state and lithium-sulfur batteries offer enhanced energy density and safety, opening new growth avenues. Additionally, the push for renewable energy integration in defense operations creates opportunities for hybrid and rechargeable battery solutions. Governments worldwide are investing in energy-efficient and sustainable power sources, driving R&D in advanced military batteries. Companies focusing on rugged, fast-charging, and temperature-resistant battery technologies will gain a competitive edge, positioning themselves to meet evolving military energy needs.

Global Military Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.77% |

| 2033 Value Projection: | USD 3.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Platform, By Type, By Composition, By Installation, By Region |

| Companies covered:: | EnerSys, GS Yuasa International Ltd., Saft, Exide Industries, EaglePicher Technologies, Bren-Tronics, Kokam Co., Ltd., Ultralife Corporation, Arotech Corporation, CBAK Energy Technology, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Military Battery Market Dynamics

The increasing demand for more advanced and efficient battery management systems

The military battery market is witnessing significant growth due to the increasing demand for more advanced and efficient battery management systems (BMS). As modern defense operations rely heavily on high-performance batteries for vehicles, drones, and communication equipment, the need for intelligent BMS has intensified. These systems optimize battery performance, enhance safety, and extend lifespan by preventing overcharging, overheating, and deep discharge. With the growing adoption of lithium-ion and next-generation batteries, robust BMS solutions are essential to ensure reliability in extreme military environments. Additionally, the push for energy-efficient and rechargeable power sources further accelerates BMS advancements. Defense agencies and battery manufacturers are investing in smart monitoring and predictive maintenance technologies, driving innovation and expanding market opportunities for sophisticated military battery management systems.

Restraints & Challenges

One major issue is the high cost of advanced battery technologies, particularly lithium-ion and solid-state batteries, which can strain defense budgets. Additionally, ensuring battery durability and reliability in extreme conditions such as high temperatures, humidity, and shock remains a significant hurdle. Safety concerns, including overheating, leakage, and potential explosions, also necessitate stringent testing and protective measures. Limited battery life and the need for frequent recharging can affect mission efficiency, driving demand for longer-lasting solutions. Supply chain disruptions, particularly for critical raw materials like lithium and nickel, further impact production. Lastly, integrating new battery technologies into existing military infrastructure requires significant investment and adaptation, posing another challenge for widespread adoption.

Regional Forecasts

Get more details on this report -

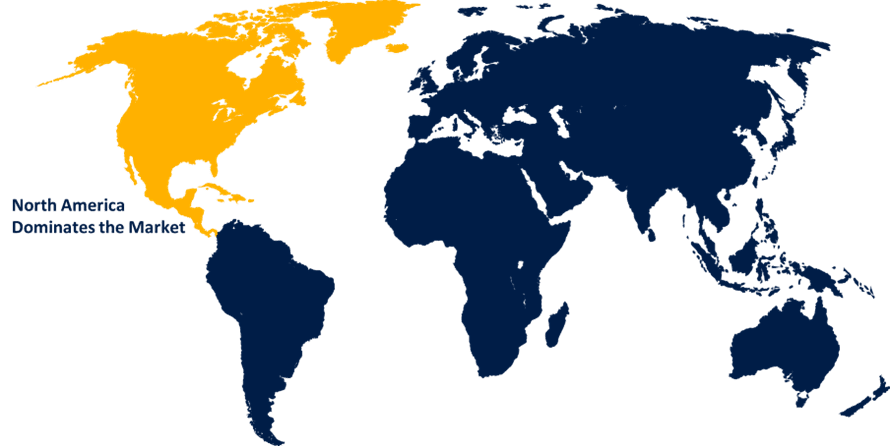

North America Market Statistics

North America is anticipated to dominate the Military Battery Market from 2023 to 2033. The United States, in particular, leads the region due to its focus on modernizing military equipment, including electric vehicles, drones, and advanced soldier systems. The demand for high-energy-density batteries, such as lithium-ion and solid-state variants, is increasing to enhance mission efficiency and reduce dependency on traditional power sources. Additionally, government initiatives to develop next-generation energy storage solutions and improve battery management systems (BMS) are fueling market growth. The region also benefits from a strong supply chain, R&D investments, and collaborations between defense agencies and private companies.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, and South Korea are heavily investing in advanced battery technologies to power military vehicles, UAVs, submarines, and soldier equipment. The demand for lightweight, high-energy-density batteries, particularly lithium-ion and solid-state variants, is growing as armed forces seek improved operational efficiency. Additionally, government initiatives supporting domestic battery production and research are strengthening regional capabilities. However, challenges such as supply chain constraints, dependence on raw material imports, and strict military regulations may impact growth. Despite these hurdles, the region presents significant opportunities for battery manufacturers focusing on durable, long-lasting, and energy-efficient power solutions tailored for harsh military environments.

Segmentation Analysis

Insights by Platform

The ground segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is due to the increasing adoption of electric and hybrid military vehicles, portable power units, and advanced soldier systems. Modern warfare requires high-performance batteries to power communication equipment, radar systems, surveillance devices, and unmanned ground vehicles (UGVs). Lithium-ion batteries dominate the segment due to their high energy density, lightweight design, and fast-charging capabilities. Additionally, advancements in battery management systems (BMS) are improving efficiency, reliability, and safety. Governments worldwide are investing in next-generation energy storage solutions to enhance battlefield readiness and reduce reliance on fossil fuels.

Insights by Type

The non-rechargeable segment accounted for the largest market share over the forecast period 2023 to 2033. These batteries are widely used in equipment such as sensors, radios, night vision devices, and emergency backup systems, where recharging is not feasible. Lithium-based chemistries, particularly lithium-thionyl chloride and lithium-manganese dioxide dominate this segment due to their long shelf life, lightweight properties, and high energy output. The rising focus on soldier modernization programs and the need for durable, maintenance-free power solutions are further driving demand. However, environmental concerns related to battery disposal and limitations in energy capacity pose challenges. Despite these issues, continued advancements in non-rechargeable battery technology are expected to sustain market growth.

Insights by Composition

The Rotary lithium-based segment accounted for the largest market share over the forecast period 2023 to 2033. These batteries are widely used in torpedoes, missiles, and other high-power military applications where consistent energy output is crucial. Their ability to deliver instant power with minimal self-discharge makes them ideal for mission-critical operations. Advancements in lithium-thionyl chloride and lithium-sulfur dioxide chemistries are enhancing performance, improving safety, and extending shelf life. Additionally, increasing defense budgets and military modernization programs worldwide are fueling demand for high-performance rotary lithium-based batteries.

Insights by Installation

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. OEMs play a crucial role in integrating high-performance batteries into military vehicles, drones, communication systems, and soldier-worn equipment. The shift toward lightweight, high-energy-density lithium-based batteries, along with innovations in battery management systems (BMS), is driving market expansion. Governments and defense agencies are collaborating with OEMs to develop next-generation power solutions that enhance operational efficiency and reliability. Additionally, the growing need for customized, rugged, and mission-specific battery solutions is boosting OEM investments in R&D.

Recent Market Developments

- In January 2024, the U.S. Army deployed its second Typhon battery at Joint Base Lewis-McChord in Washington, U.S., to support operations of the ground-based Typhon missile system.

Competitive Landscape

Major players in the market

- EnerSys

- GS Yuasa International Ltd.

- Saft

- Exide Industries

- EaglePicher Technologies

- Bren-Tronics

- Kokam Co., Ltd.

- Ultralife Corporation

- Arotech Corporation

- CBAK Energy Technology

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Battery Market, Platform Analysis

- Ground

- Airborne

- Marine

Military Battery Market, Type Analysis

- Non-Rechargeable

- Rechargeable

- Propulsion

Military Battery Market, Composition Analysis

- Rotary Lithium-based

- Lead acid

- Nickel-based

- Thermal

- Others

Military Battery Market, Installation Analysis

- OEM

- Aftermarket

Military Battery Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Military Battery Market?The global Military Battery Market is expected to grow from USD 2.6 billion in 2023 to USD 3.1 billion by 2033, at a CAGR of 1.77% during the forecast period 2023-2033.

-

Who are the key market players of the Military Battery Market?Some of the key market players of the market are the EnerSys; GS Yuasa International Ltd.; Saft; Exide Industries; EaglePicher Technologies; Bren-Tronics; Kokam Co., Ltd.; Ultralife Corporation; Arotech Corporation; CBAK Energy Technology

-

Which segment holds the largest market share?The ground segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?