Global Military Cable Market Size, Share, and COVID-19 Impact Analysis, By Application (Aerospace, Naval, Ground), By Cable Type (Coaxial Cable, Fiber Optic Cable, Twisted Pair Cable), By Material (Copper, Aluminum, Fiber), By End Use (Defense, Civilian, Commercial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Military Cable Market Insights Forecasts to 2033

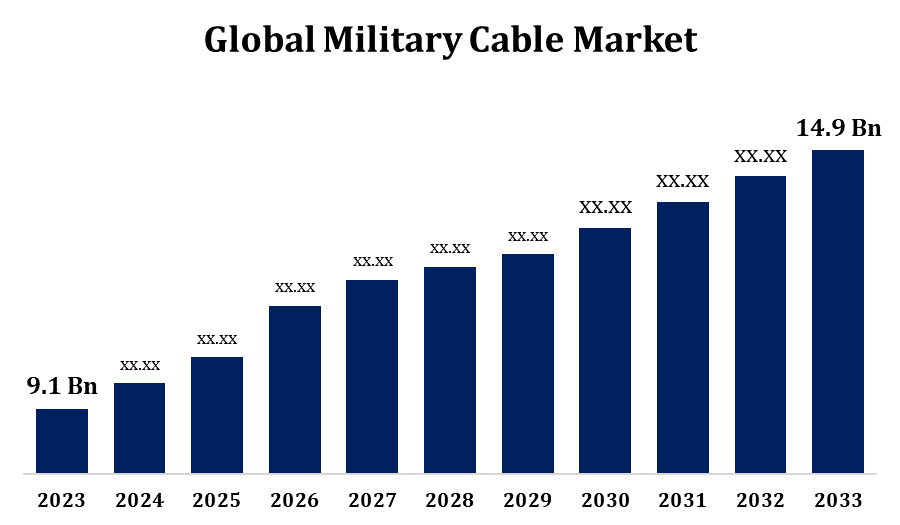

- The Military Cable Market was valued at USD 9.1 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.05% from 2023 to 2033.

- The Worldwide Military Cable Market is Expected to reach USD 14.9 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Military Cable Market Size is Expected to reach USD 14.9 Billion by 2033, at a CAGR of 5.05% during the forecast period 2023 to 2033.

The military cable market is experiencing steady growth due to increasing defense budgets, rising geopolitical tensions, and the need for advanced communication and power distribution systems in military operations. These cables are designed to withstand extreme conditions, offering durability, high performance, and resistance to environmental factors like heat, moisture, and electromagnetic interference. They are widely used in aerospace, naval, ground vehicles, and weapon systems. The demand for lightweight, high-speed data transmission cables is driving innovation in fiber optics and composite materials. Key players in the market focus on R&D to enhance cable efficiency and security. North America dominates due to strong military investments, while Asia-Pacific is growing rapidly with rising defense modernization programs. Stringent military standards and technological advancements further shape the market landscape.

Military Cable Market Value Chain Analysis

The military cable market value chain involves several key stages, from raw material procurement to end-use applications. It begins with sourcing high-performance materials like copper, aluminum, fiber optics, and specialized insulation to ensure durability and resistance to extreme conditions. Manufacturers then design and produce cables tailored to military standards, integrating advanced shielding, coatings, and ruggedization techniques. Suppliers and distributors play a crucial role in ensuring seamless delivery to defense contractors and government agencies. System integrators incorporate these cables into military applications, including communication systems, aerospace, naval, and land-based defense equipment. The final stage involves maintenance, testing, and upgrades to ensure long-term reliability. Technological advancements, stringent defense regulations, and collaborations between governments and private companies drive efficiency and innovation across the value chain.

Military Cable Market Opportunity Analysis

The military cable market presents significant growth opportunities driven by rising defense expenditures, increasing military modernization programs, and advancements in communication and electronic warfare systems. The shift toward lightweight, high-speed data transmission solutions, such as fiber optic cables, offers immense potential for innovation. The growing demand for unmanned systems, cyber defense, and next-generation radar and surveillance technologies further boosts market prospects. Expanding defense budgets in emerging economies, particularly in Asia-Pacific and the Middle East, create new business avenues for cable manufacturers. Additionally, collaborations between defense agencies and private companies enhance product development. The adoption of smart and ruggedized cables with enhanced durability and cybersecurity features also presents lucrative opportunities. Companies investing in R&D and strategic partnerships can gain a competitive edge in this evolving market.

Military Cable Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 9.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.05% |

| 2033 Value Projection: | USD 14.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 224 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Cable Type, By Material, By End Use |

| Companies covered:: | Hawke International, Curtis Wright, Raychem, General Cable, Southwire Company, Prysmian Group, Amphenol, Cable Manufacturing Company, Belden, LS Cable and System, Acome, Nexans, Marmon Utility, TE Connectivity, Alcatel-Lucent, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Military Cable Market Dynamics

Increasing Demand for Advanced Communication Systems

The increasing demand for advanced communication systems is a key driver of growth in the military cable market. Modern defense operations rely heavily on secure, high-speed data transmission for battlefield communication, surveillance, and intelligence gathering. Military forces worldwide are investing in cutting-edge communication technologies, including satellite communication, software-defined radios, and encrypted networks, driving the need for high-performance cables. Fiber optic cables, known for their high bandwidth and low latency, are gaining traction in defense applications. Additionally, the integration of 5G and IoT in military operations is further accelerating demand. Governments and defense contractors seek ruggedized, interference-resistant cables to ensure reliable performance in extreme environments. As a result, cable manufacturers are focusing on innovation, cybersecurity enhancements, and compliance with strict military standards to meet evolving defense needs.

Restraints & Challenges

Stringent military standards and regulatory compliance requirements increase manufacturing complexity and costs. The need for high durability, resistance to extreme environmental conditions, and electromagnetic shielding demands advanced materials and technologies, raising production expenses. Supply chain disruptions, geopolitical tensions, and raw material shortages further impact market stability. Additionally, rapid technological advancements require continuous innovation, making it difficult for manufacturers to keep up with evolving military needs. Cybersecurity threats also pose risks, as secure data transmission is crucial for defense operations. Budget constraints in some regions can limit defense spending, affecting procurement rates. Companies must focus on R&D, strategic partnerships, and cost-effective solutions to overcome these challenges and stay competitive in the market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Military Cable Market from 2023 to 2033. The United States, as the largest contributor, invests heavily in modernizing communication, surveillance, and weapon systems, driving demand for high-performance cables. The region’s focus on cybersecurity, space defense, and unmanned systems further boosts the need for secure and durable cables. Stringent military standards, such as those set by the U.S. Department of Defense, ensure high-quality and reliable cable solutions. Additionally, ongoing R&D efforts, collaborations between defense agencies and private companies, and the adoption of next-generation technologies like fiber optics and 5G enhance market growth. With continuous investments in defense infrastructure, North America remains a key driver in the global military cable industry.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, and South Korea are heavily investing in advanced defense technologies, driving demand for high-performance military cables. The expansion of naval fleets, aerospace advancements, and the rising adoption of cyber defense and electronic warfare systems further boost market opportunities. Governments are emphasizing secure communication networks, leading to higher demand for fiber optic and ruggedized cables. Local manufacturers are increasingly collaborating with global defense contractors to enhance technological capabilities. With continued military upgrades and defense infrastructure expansion, Asia-Pacific remains one of the fastest-growing regions in the global military cable market.

Segmentation Analysis

Insights by Application

The aerospace segment accounted for the largest market share over the forecast period 2023 to 2033. Modern military aircraft require high-performance cables for secure communication, avionics, radar systems, and power distribution. The increasing use of unmanned aerial vehicles (UAVs) and next-generation fighter jets further boosts demand for lightweight, durable, and high-speed data transmission cables. Fiber optic cables are gaining traction due to their low latency, high bandwidth, and electromagnetic interference resistance. Additionally, growing space defense programs and satellite communication advancements contribute to market expansion. Stringent military standards for reliability and performance drive continuous innovation in materials and shielding technologies. With ongoing aerospace modernization efforts, this segment remains crucial in shaping the military cable industry's future.

Insights by Cable Type

The Coaxial cable segment accounted for the largest market share over the forecast period 2023 to 2033. These cables are widely used in military communication systems, radar, electronic warfare, and surveillance applications, where reliable data transmission is essential. The increasing demand for advanced radar and satellite communication systems is driving the adoption of high-performance coaxial cables with enhanced shielding and durability. Military modernization programs across the U.S., Europe, and Asia-Pacific are further fueling demand. Additionally, technological advancements in materials and design are improving signal integrity and resistance to harsh environmental conditions. With rising defense budgets and growing investments in electronic warfare and secure communication networks, the coaxial cable segment remains a vital component of the military cable industry.

Insights by Material

The copper segment accounted for the largest market share over the forecast period 2023 to 2033. Copper cables are widely used in military vehicles, naval ships, radar systems, and ground communication networks, where secure and stable connections are critical. The rising demand for high-performance power cables in defense infrastructure, along with ongoing military modernization programs, is driving market expansion. Additionally, advancements in insulation and shielding technologies are enhancing copper cable efficiency, making them more resistant to electromagnetic interference and harsh environmental conditions. While fiber optics is gaining traction, copper cables remain essential due to their robustness and cost-effectiveness. With increasing global defense investments, the copper segment continues to play a crucial role in military cable applications.

Insights by End Use

The defence segment accounted for the largest market share over the forecast period 2023 to 2033. Military forces worldwide require high-performance cables for secure communication, power distribution, radar systems, and electronic warfare. The increasing adoption of advanced technologies, including unmanned systems, cybersecurity solutions, and next-generation combat vehicles, is boosting demand for ruggedized and interference-resistant cables. Fiber optic cables are gaining prominence due to their high-speed data transmission capabilities, while coaxial and copper cables remain essential for power and signal integrity. North America and Asia-Pacific lead the market with continuous defense infrastructure upgrades. Stringent military standards and the need for enhanced battlefield connectivity further drive innovation. As military operations become more technology-driven, the defense segment will continue expanding within the military cable market.

Recent Market Developments

- In January 2021, Carlisle Interconnect Technologies, a renowned leader in military cables, introduced the UTiPHASE microwave cable assembly series an advanced solution offering exceptional electrical phase stability across varying temperatures without sacrificing microwave performance. Designed for defense, space, and testing applications, UTiPHASE ensures reliable and high-performance connectivity in demanding environments.

Competitive Landscape

Major players in the market

- Hawke International

- Curtis Wright

- Raychem

- General Cable

- Southwire Company

- Prysmian Group

- Amphenol

- Cable Manufacturing Company

- Belden

- LS Cable and System

- Acome

- Nexans

- Marmon Utility

- TE Connectivity

- Alcatel-Lucent

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Cable Market, Application Analysis

- Aerospace

- Naval

- Ground

Military Cable Market, Cable Type Analysis

- Coaxial Cable

- Fiber Optic Cable

- Twisted Pair Cable

Military Cable Market, Material Analysis

- Copper

- Aluminum

- Fiber

Military Cable Market, End Use Analysis

- Defense

- Civilian

- Commercial

Military Cable Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Military Cable Market?The global Military Cable Market is expected to grow from USD 9.1 billion in 2023 to USD 14.9 billion by 2033, at a CAGR of 5.05% during the forecast period 2023-2033.

-

2. Who are the key market players of the Military Cable Market?Some of the key market players of the market are the Hawke International, Curtis Wright, Raychem, General Cable, Southwire Company, Prysmian Group, Amphenol, Cable Manufacturing Company, Belden, LS Cable and System, Acome, Nexans, Marmon Utility, TE Connectivity, Alcatel-Lucent.

-

3. Which segment holds the largest market share?The defence segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?