Global Military Cloud Computing Market Size, Share, and COVID-19 Impact Analysis, By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), By Service Model (Infrastructure as a Service, Platform as a Service, Software as a Service), By Application (Data Storage, Data Backup and Recovery, Big Data Analytics, Disaster Recovery), By End Use (Defense, Aerospace, Intelligence), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Military Cloud Computing Market Insights Forecasts to 2033

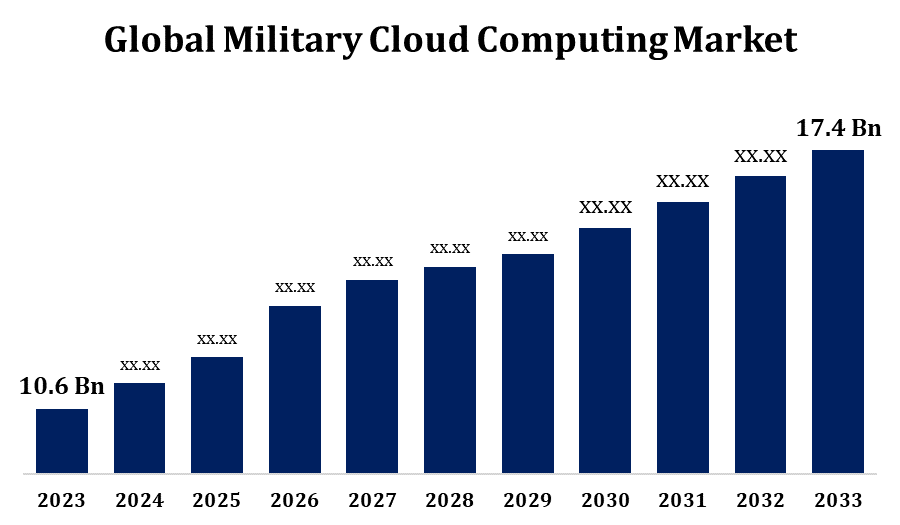

- The Military Cloud Computing Market was valued at USD 10.6 Billion in 2023.

- The Market is growing at a CAGR of 5.08% from 2023 to 2033.

- The Worldwide Military Cloud Computing Market is expected to reach USD 17.4 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Military Cloud Computing Market is expected to reach USD 17.4 billion by 2033, at a CAGR of 5.08% during the forecast period 2023 to 2033.

The military cloud computing market is witnessing significant growth due to the increasing need for secure, scalable, and cost-effective solutions to manage large volumes of data in defense operations. Cloud technologies enable militaries to access real-time information, enhance collaboration, and improve operational efficiency. The rise of advanced technologies like AI, machine learning, and big data analytics within military systems is fueling demand for cloud infrastructure. Additionally, the need for secure communications and rapid data sharing across global defense networks is driving the adoption of private and hybrid cloud models. Key market players are focusing on ensuring robust cybersecurity measures to protect sensitive military data from cyber threats. The market is expected to continue expanding as modernization efforts within defense sectors increase.

- Military Cloud Computing Market Value Chain Analysis

The military cloud computing market value chain involves several key stages, including the development, deployment, and maintenance of cloud-based solutions tailored to defense applications. It begins with cloud service providers offering infrastructure, platform, and software services designed for military use. This is followed by hardware manufacturers supplying servers, storage systems, and networking equipment needed for the cloud infrastructure. Security technology providers play a critical role in ensuring robust cybersecurity measures, protecting sensitive military data. System integrators work to customize and integrate cloud solutions within military networks, ensuring compatibility with existing systems. Finally, end-users, such as defense agencies and contractors, implement and operate these cloud solutions, driving innovation and ensuring operational effectiveness. This value chain highlights the interconnectedness of providers and users in advancing military cloud adoption.

- Military Cloud Computing Market Opportunity Analysis

The military cloud computing market presents substantial growth opportunities, driven by increasing demand for advanced, flexible, and secure IT solutions in defense operations. With the rise of cyber threats, there is a growing need for enhanced security features in cloud systems, creating opportunities for companies specializing in cybersecurity. Additionally, the integration of artificial intelligence, machine learning, and big data analytics in cloud environments offers defense organizations the ability to process and analyze massive datasets in real time, improving decision-making and operational efficiency. The increasing adoption of hybrid and private clouds tailored to military needs is another key opportunity, offering secure, scalable, and cost-effective solutions. Furthermore, partnerships between cloud providers and government defense agencies can drive innovation, ensuring that military cloud computing adapts to evolving technological demands.

Global Military Cloud Computing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.08% |

| 2033 Value Projection: | USD 17.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | Deployment Model Analysis, Service Model Analysis, Application Analysis, End User Analysis, Regional Analysis |

| Companies covered:: | Amazon (US), Google (US), Microsoft Corporation (US), Oracle (US), Dell Technologies (US), Thales Group (France), IBM (US), Atos (France), DXC Technology (US), Bae Systems (UK), General Dynamics Corporation (US), SAIC (US), Rackspace Technologies Inc. (US), Salesforce (US), Raytheon Technologies Corporation (US), CGI (Canada), Capgemini (France), Soar Technology(US), Sparkcognition (US), Hadean Supercomputing (UK), Peraton (US), Smartonix (US), Windriver (US), Splunk (US). |

| Pitfalls & Challenges: | COVID-19 Impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Military Cloud Computing Market Dynamics

- Rising Demand for Improved Data Security and Storage

The growing need for enhanced data security and storage is a major driver of the military cloud computing market's expansion. As defense organizations increasingly rely on cloud solutions for mission-critical operations, safeguarding sensitive data from cyber threats has become paramount. Military cloud systems require advanced encryption, multi-layered security protocols, and robust access controls to ensure the integrity and confidentiality of classified information. Additionally, the vast amounts of data generated by military operations necessitate scalable and efficient storage solutions. Cloud platforms offer flexible storage options, enabling defense agencies to manage large volumes of data while maintaining high performance. This demand for secure, high-capacity storage solutions is fueling investments in both private and hybrid cloud infrastructures, ensuring that military operations can securely store, access, and analyze data in real time.

Restraints & Challenges

A primary concern is ensuring robust cybersecurity, as military data is a prime target for cyberattacks. Implementing state-of-the-art security protocols and maintaining constant vigilance against evolving threats requires significant investment and expertise. Another challenge is the complexity of integrating cloud solutions with existing legacy systems within military organizations. Ensuring seamless interoperability and compatibility between modern cloud platforms and older technologies can be a resource-intensive task. Additionally, regulatory compliance and data sovereignty issues pose challenges, particularly when data is stored across borders. Privacy concerns related to the storage of sensitive military data in public clouds also limit adoption. Lastly, the high costs associated with cloud infrastructure and ongoing maintenance can be a barrier for some defense agencies.

Regional Forecasts

North America Market Statistics

Get more details on this report -

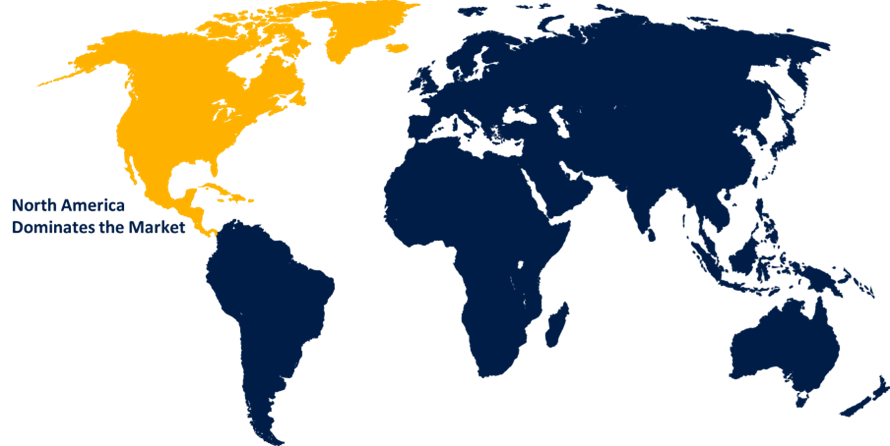

North America is anticipated to dominate the Military Cloud Computing Market from 2023 to 2033. The U.S., with its large defense budget, is focusing on modernizing its military infrastructure through the adoption of cloud computing to enhance operational efficiency, improve data sharing, and bolster cybersecurity. The region’s strong emphasis on innovation, coupled with the rising need for secure, scalable cloud platforms, is fostering the market's growth. Furthermore, collaborations between military agencies and leading cloud service providers, such as Amazon Web Services (AWS) and Microsoft, are accelerating the deployment of tailored cloud solutions. North America is expected to continue leading the market, with ongoing investments in cybersecurity and AI-powered cloud technologies for defense applications.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, and Japan are investing heavily in military cloud infrastructure to enhance operational capabilities, improve data management, and support rapid decision-making processes. The growing focus on cybersecurity in the region is also driving demand for secure cloud platforms, ensuring the protection of sensitive military information. Additionally, the region's expanding defense budgets and the strategic shift towards digitization in military operations are fueling the adoption of cloud computing. Partnerships between defense agencies and leading cloud providers are accelerating cloud deployments, while government policies supporting technological advancements further boost market growth in Asia Pacific.

Segmentation Analysis

Insights by Deployment Model

The private cloud segment accounted for the largest market share over the forecast period 2023 to 2033. Private clouds offer a high level of control, security, and compliance, which are critical for military applications where data confidentiality is paramount. Unlike public clouds, private clouds enable military organizations to host their infrastructure and resources within a dedicated environment, ensuring full control over data access and storage. This has made private clouds the preferred choice for defense agencies concerned about cybersecurity risks and regulatory requirements. Additionally, private clouds are highly customizable, allowing for integration with legacy systems and providing the flexibility to scale as needed. The growing emphasis on secure communication and real-time data analysis is propelling the expansion of the private cloud segment in military cloud computing.

Insights by Service Model

The Platform as a Service (PaaS) segment accounted for the largest market share over the forecast period 2023 to 2033. PaaS solutions offer military organizations the ability to rapidly develop, test, and deploy mission-critical applications without the need to manage underlying infrastructure. This reduces costs and enhances operational efficiency, as defense agencies can focus on core tasks rather than hardware management. PaaS also supports integration with existing military systems and provides robust security features to protect sensitive data. The increasing use of advanced technologies like artificial intelligence, machine learning, and big data analytics in military operations is further driving the demand for PaaS, as it allows for seamless development of innovative defense applications. This trend is expected to continue as defense agencies prioritize agility and flexibility in their cloud strategies.

Insights by Application

The Data Backup and Recovery segment accounted for the largest market share over the forecast period 2023 to 2033. Military organizations generate vast amounts of critical data, which must be securely stored and readily accessible in case of system failures or cyberattacks. Cloud-based backup and recovery solutions offer scalable and cost-effective ways to protect this data, ensuring quick recovery times and minimal operational disruption. The rise in cyber threats, including ransomware attacks targeting military infrastructure, has made robust backup and recovery strategies essential for maintaining operational readiness. Additionally, cloud platforms allow for geographically distributed backups, enhancing disaster recovery capabilities. As the need for secure, reliable, and fast data recovery grows, the Data Backup and Recovery segment is expected to continue expanding within the military cloud computing market.

Insights by End User

The defence segment accounted for the largest market share over the forecast period 2023 to 2033. With growing demand for real-time data analysis, mission-critical applications, and secure communication platforms, cloud computing offers the flexibility and scalability required for modern defense operations. The defense sector is leveraging cloud services to streamline logistics, maintain situational awareness, and optimize decision-making processes. Moreover, advancements in AI, machine learning, and big data analytics integrated into cloud platforms enable defense agencies to process large volumes of data and gain actionable insights. As defense budgets rise and modernization efforts intensify, the adoption of military cloud solutions is set to expand further, making the defense segment a key contributor to market growth.

Recent Market Developments

- In December 2022, the U.S. Department of Defense (DoD) has awarded a USD 9 billion contract as part of its Joint Warfighter Cloud Capability initiative to four companies: Amazon (US), Microsoft Corporation (US), Oracle (US), and Google (US). The contract, which spans six years, aims to enhance the DoD's cloud computing capabilities.

Competitive Landscape

Major players in the market

- Amazon (US)

- Google (US)

- Microsoft Corporation (US)

- Oracle (US)

- Dell Technologies (US)

- Thales Group (France)

- IBM (US)

- Atos (France)

- DXC Technology (US)

- Bae Systems (UK)

- General Dynamics Corporation (US)

- SAIC (US)

- Rackspace Technologies Inc. (US)

- Salesforce (US)

- Raytheon Technologies Corporation (US)

- CGI (Canada)

- Capgemini (France)

- Soar Technology(US)

- Sparkcognition (US)

- Hadean Supercomputing (UK)

- Peraton (US)

- Smartonix (US)

- Windriver (US)

- Splunk (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Cloud Computing Market, Deployment Model Analysis

- Public Cloud

- Private Cloud

- Hybrid Cloud

Military Cloud Computing Market, Service Model Analysis

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

Military Cloud Computing Market, Application Analysis

- Data Storage

- Data Backup and Recovery

- Big Data Analytics

- Disaster Recovery

Military Cloud Computing Market, End User Analysis

- Defense

- Aerospace

- Intelligence

Military Cloud Computing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Military Cloud Computing Market?The global Military Cloud Computing Market is expected to grow from USD 10.6 billion in 2023 to USD 17.4 billion by 2033, at a CAGR of 5.08% during the forecast period 2023-2033.

-

2. Who are the key market players of the Military Cloud Computing Market?Some of the key market players of the market are Amazon (US), Google (US), Microsoft Corporation (US), Oracle (US), Dell Technologies (US), Thales Group (France), IBM (US), Atos (France), DXC Technology (US), Bae Systems (UK), General Dynamics Corporation (US), SAIC (US), Rackspace Technologies Inc. (US), Salesforce (US), Raytheon Technologies Corporation (US), CGI (Canada), Capgemini (France), Soar Technology(US), Sparkcognition (US), Hadean Supercomputing (UK), Peraton (US), Smartonix (US), Windriver (US), Splunk (US).

-

3. Which segment holds the largest market share?The defence segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Military Cloud Computing Market?North America dominates the Military Cloud Computing Market and has the highest market share.

Need help to buy this report?