Global Military Communications Market Size, Share, and COVID-19 Impact Analysis, By System (Satcom System, Radio System, Security System, Communication Management System), Platform (Land, Naval, Airborne, Unmanned Vehicles), Application (Military Satcom System, Military Security System, Communication Management System), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Military Communications Market Insights Forecasts to 2033

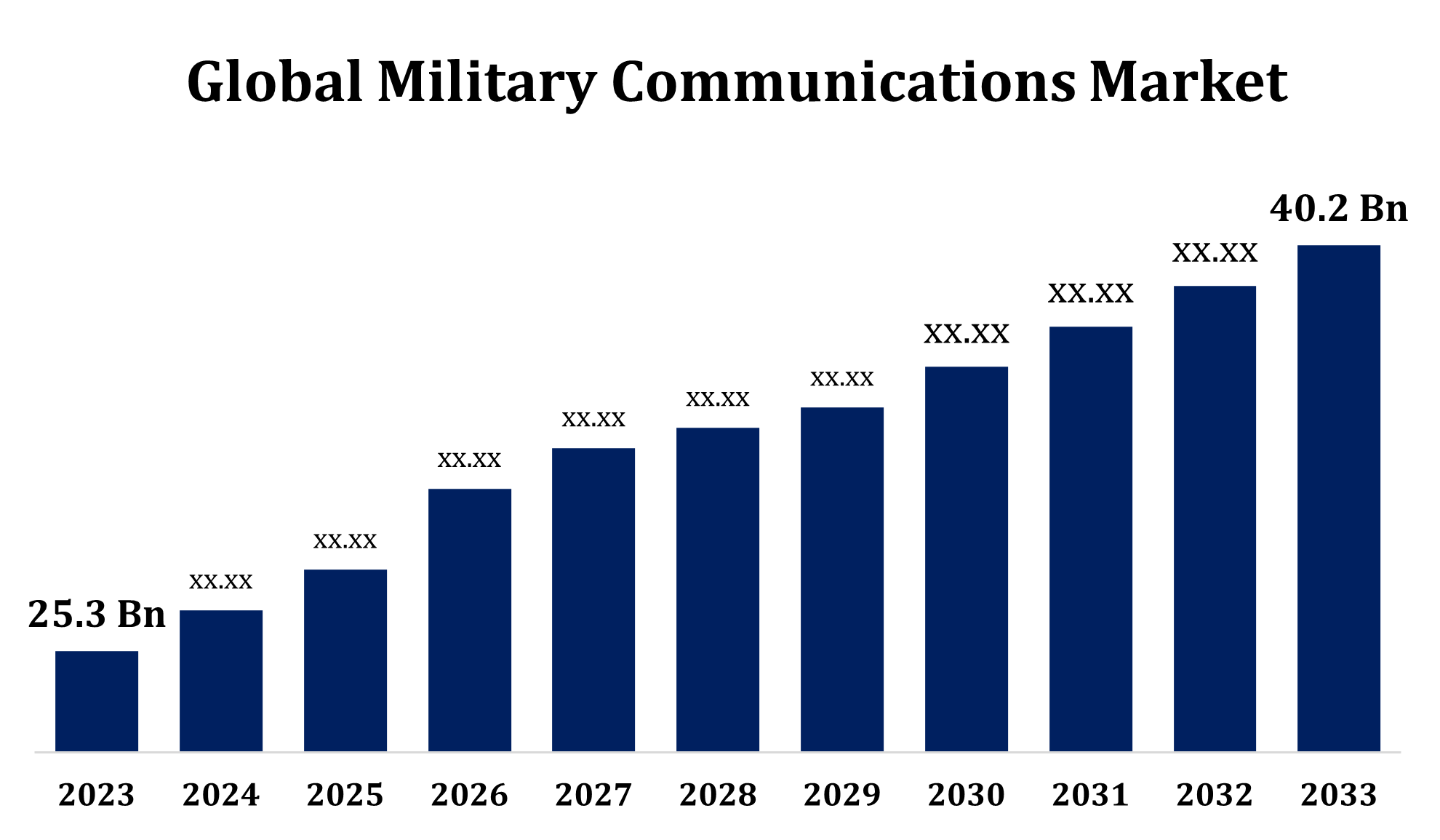

- The Global Military Communications Market Size was valued at USD 25.3 Billion in 2023.

- The Market is Growing at a CAGR of 4.74% from 2023 to 2033.

- The Worldwide Military Communications Market Size is expected to reach USD 40.2 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Military Communications Market is Expected to reach USD 40.2 Billion by 2033, at a CAGR of 4.74% during the forecast period 2023 to 2033.

The military communications market is a critical component of modern defense strategies, enabling secure, reliable, and efficient information exchange across various platforms. This market encompasses a wide range of technologies, including satellite communication systems, encrypted radio networks, and data transmission solutions, designed to enhance situational awareness and mission effectiveness. Key drivers include advancements in wireless communication, increasing demand for cybersecurity, and rising defense budgets globally. The integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies is transforming military communication, offering real-time data analytics and autonomous decision-making capabilities. Challenges such as interoperability among diverse systems and cyber threats persist, driving continuous innovation. The market is poised for growth, supported by the rising focus on network-centric warfare and modernization of communication infrastructure.

Military Communications Market Value Chain Analysis

The military communications market value chain involves multiple stages, from raw material suppliers to end users. It begins with component manufacturers producing essential parts like semiconductors, antennas, and transceivers. System integrators then assemble these components into communication systems, such as radios, satellite terminals, and encrypted devices. Software developers provide critical applications for secure data transmission, encryption, and network management. Defense contractors and technology firms collaborate with governments and military organizations to deploy these solutions. Distribution channels include direct government contracts and partnerships with defense agencies. Maintenance and upgrade services ensure long-term operational efficiency. Emerging technologies like AI, IoT, and 5G are reshaping the value chain, emphasizing innovation and collaboration. The entire process is driven by defense requirements, technological advancements, and geopolitical considerations.

Military Communications Market Opportunity Analysis

The military communications market offers significant growth opportunities driven by evolving defense needs and technological advancements. Increasing adoption of network-centric warfare emphasizes real-time information sharing, creating demand for advanced communication systems. Emerging technologies like 5G, AI, and IoT present opportunities for innovative solutions, including autonomous systems and enhanced situational awareness. Rising cybersecurity threats highlight the need for secure, encrypted communication networks, fostering growth in cybersecurity and anti-jamming technologies. Expanding defense budgets in developing nations offer potential for market penetration, particularly in Asia-Pacific, the Middle East, and Africa. Additionally, advancements in satellite communication, including low-Earth orbit (LEO) satellites, provide cost-effective, global connectivity solutions. Collaborations between defense contractors, technology firms, and governments will be pivotal in tapping these opportunities and driving future market growth.

Global Military Communications Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 25.3 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.74% |

| 023 – 2033 Value Projection: | USD 40.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 133 |

| Segments covered: | By System, By Platform, By Application, By Regional Analysis |

| Companies covered:: | Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Elbit Systems (Israel), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), BAE Systems(UK), Saab AB (Sweden), Aselsan A.S (Turkey), Viasat Inc (US), Rheinmetall AG (Germany), Leonardo(Italy), Israel Aerospace Industries (Israel), Cobham Limited(UK), Honeywell International Inc (US), and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Military Communications Market Dynamics

Increasing integration of advanced technologies in military communication systems

The military communications market is experiencing significant growth due to the increasing integration of advanced technologies. Cutting-edge innovations like Artificial Intelligence (AI), 5G networks, and the Internet of Things (IoT) are revolutionizing communication systems, enhancing speed, security, and efficiency. AI enables real-time data processing and autonomous decision-making, while IoT connects diverse military assets for seamless operations. The adoption of 5G enhances bandwidth and reduces latency, supporting advanced applications like augmented reality (AR) for battlefield awareness. Additionally, satellite communication advancements, including low-Earth orbit (LEO) satellites, ensure global, uninterrupted connectivity. These technologies address critical challenges such as cyber threats and interoperability, making them indispensable for modern defense strategies. Growing defense budgets and increasing focus on network-centric warfare further fuel this trend, driving market expansion.

Restraints & Challenges

The military communications market faces several challenges that impact its growth and adoption. Interoperability among diverse communication systems remains a significant issue, especially as multinational defense collaborations increase. Ensuring robust cybersecurity is another critical challenge, as communication networks are prime targets for sophisticated cyberattacks. The complexity and cost of deploying advanced technologies like AI, 5G, and IoT can hinder widespread implementation, particularly in developing regions with limited budgets. Additionally, reliance on satellite communication systems faces risks from anti-satellite weapons and space debris, threatening the reliability of these networks. Operational challenges, such as maintaining communication in extreme environments and ensuring minimal latency during high-stakes missions, further complicate the landscape. Addressing these challenges requires innovation, international cooperation, and substantial investment in research and development.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Military Communications Market from 2023 to 2033. The United States, with its advanced defense initiatives, leads the region, emphasizing the adoption of cutting-edge technologies such as Artificial Intelligence (AI), 5G, and satellite communications. These advancements enable real-time data sharing, enhanced situational awareness, and secure, high-speed networks for critical missions. Canada also contributes to the market with investments in modern communication solutions for its defense forces. Key challenges include maintaining cybersecurity and addressing interoperability issues across diverse systems. The region benefits from strong partnerships between government agencies, defense contractors, and technology providers, fostering innovation. Continued emphasis on network-centric warfare and upgrading communication systems ensures sustained market growth in North America.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region’s focus on network-centric warfare, secure communication systems, and real-time data sharing is fueling the adoption of technologies like Artificial Intelligence (AI), 5G, and satellite communications. Additionally, collaborations between governments and private technology firms are fostering innovation and deployment of advanced systems. However, challenges such as cybersecurity threats, interoperability issues, and the high cost of advanced infrastructure persist. With growing regional security concerns and expanding military modernization programs, the Asia-Pacific region is poised to become a key player in the global military communications market.

Segmentation Analysis

Insights by Platform

The unmanned vehicles segment accounted for the largest market share over the forecast period 2023 to 2033. The unmanned vehicles segment is experiencing significant growth in the military communications market, driven by the rising deployment of unmanned aerial vehicles (UAVs), ground vehicles (UGVs), and maritime systems (UMVs) for defense operations. These vehicles rely on advanced communication networks for remote control, real-time data transmission, and mission-critical operations. Integration of technologies like Artificial Intelligence (AI), 5G, and satellite communications enhances their capabilities, enabling autonomous decision-making and secure, high-speed communication. The growing adoption of network-centric warfare and the need for enhanced surveillance, reconnaissance, and combat support drive demand for efficient communication systems in unmanned vehicles. Despite challenges such as cybersecurity risks and interoperability, ongoing investments in R&D and advancements in communication technologies are expected to propel this segment’s growth in the coming years.

Insights by Application

The ISR segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing need for real-time data collection, analysis, and dissemination during defense operations. Advanced communication technologies, such as 5G networks, Artificial Intelligence (AI), and satellite systems, are enhancing ISR capabilities by enabling faster and more secure data transmission across platforms. Modern ISR systems provide critical insights for situational awareness, target identification, and mission planning, making them essential in network-centric warfare. Rising geopolitical tensions and cross-border conflicts further boost investments in ISR technologies, particularly in regions like Asia-Pacific and the Middle East. Despite challenges like cybersecurity threats and integration complexities, ongoing advancements in communication systems and growing defense budgets are expected to drive the segment’s sustained growth.

Insights by System

The Military Satcom System segment accounted for the largest market share over the forecast period 2023 to 2033. Satcom systems provide essential support for real-time communication, navigation, and intelligence sharing, enabling military forces to operate in remote or hostile environments. With the rising adoption of low-Earth orbit (LEO) satellites and advancements in satellite technology, military Satcom systems offer enhanced bandwidth, reduced latency, and greater operational flexibility. The growing focus on network-centric warfare and the need for uninterrupted communication during global missions are key factors fueling this growth. Additionally, rising investments in defense modernization and satellite infrastructure are expected to further drive the expansion of the military Satcom systems segment, despite challenges like space debris and cybersecurity threats.

Recent Market Developments

- In August 2023, Ukraine has announced that Rheinmetall will supply its new Luna NG (Next Generation) reconnaissance unmanned aircraft systems (UASs) as part of a USD 765 million military aid package from the German government. This provision was revealed during the NATO summit in Vilnius, Lithuania.

Competitive Landscape

Major players in the market

- Raytheon Technologies Corporation (US)

- Northrop Grumman Corporation (US)

- Thales Group (France)

- Elbit Systems (Israel)

- L3Harris Technologies Inc. (US)

- Lockheed Martin Corporation (US)

- BAE Systems(UK)

- Saab AB (Sweden)

- Aselsan A.S (Turkey)

- Viasat Inc (US)

- Rheinmetall AG (Germany)

- Leonardo(Italy)

- Israel Aerospace Industries (Israel)

- Cobham Limited(UK)

- Honeywell International Inc (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Communications Market, System Analysis

- Satcom System

- Radio System

- Security System

- Communication Management System

Military Communications Market, Platform Analysis

- Land

- Naval

- Airborne

- Unmanned Vehicles

Military Communications Market, Application Analysis

- Military Satcom System

- Military Security System

- Communication Management System

Military Communications Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Military Communications Market?The global Military Communications Market is expected to grow from USD 25.3 billion in 2023 to USD 40.2 billion by 2033, at a CAGR of 4.74% during the forecast period 2023-2033.

-

2. Who are the key market players of the Military Communications Market?Some of the key market players of the market are Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Elbit Systems (Israel), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), BAE Systems (UK), Saab AB (Sweden), Aselsan A.S (Turkey), Viasat Inc (US), Rheinmetall AG (Germany), Leonardo(Italy), Israel Aerospace Industries (Israel), Cobham Limited(UK), Honeywell International Inc (US).

-

3. Which segment holds the largest market share?The ISR segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Military Communications Market?North America dominates the Military Communications Market and has the highest market share.

Need help to buy this report?