Global Military Embedded Systems Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware and Software), By Product Type (Advanced Telecom Computing Architecture (TCA), Compact-PCI (CPCI) Boards, Compact-PCI (CPCI) Serial, VME BUS, OPEN VPX, Motherboard ), By Application (Intelligence Surveillance and Reconnaissance (ISR), Command, Control, Communication Navigation, Radar, Avionics, Vetronics, Cyber, Networking), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Military Embedded Systems Market Insights Forecasts to 2033

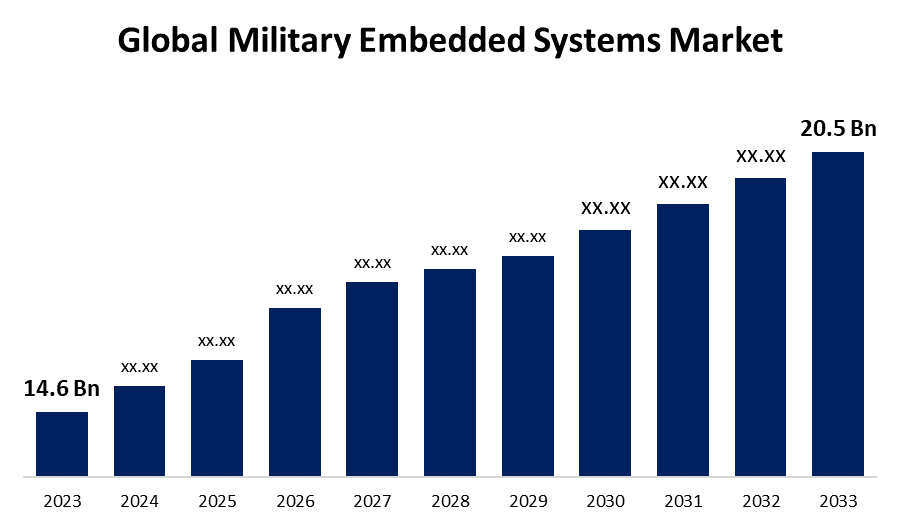

- The Military Embedded Systems Market Size was valued at USD 14.6 Billion in 2023.

- The Market Size is growing at a CAGR of 3.45% from 2023 to 2033.

- The Worldwide Military Embedded Systems Market is expected to reach USD 20.5 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Military Embedded Systems Market Size is expected to reach USD 20.5 Billion by 2033, at a CAGR of 3.45% during the forecast period 2023 to 2033.

The military embedded systems market is experiencing significant growth due to increasing defense spending and advancements in technology. These systems, which are integrated into military platforms for critical applications such as communication, surveillance, navigation, and weapon control, provide reliability and real-time performance. The market is driven by the growing need for more efficient and secure defense solutions, particularly with the rise of cybersecurity threats. Additionally, the shift toward smart and autonomous military systems, like unmanned aerial vehicles (UAVs) and robots, further fuels demand. With the integration of cutting-edge technologies such as AI, IoT, and 5G, military embedded systems are becoming more versatile and capable. Government investments in modernization programs and the ongoing geopolitical tensions contribute to the market's continued expansion.

Military Embedded Systems Market Value Chain Analysis

The military embedded systems market value chain encompasses several key stages, from design and development to deployment and support. Initially, research and development (RandD) play a crucial role in creating advanced embedded systems tailored to military needs. Component manufacturers provide essential hardware such as processors, memory, and sensors, which are integrated into the system by system integrators. These integrators customize the embedded solutions for specific defense applications like communications, navigation, and surveillance. Once developed, the systems are tested for reliability and security in military environments. The systems are then deployed across various platforms, such as aircraft, naval vessels, and ground vehicles. Post-deployment, maintenance, software updates, and system upgrades ensure the continued performance and adaptability of embedded systems. The entire chain involves collaboration among defense contractors, technology providers, and government entities.

Military Embedded Systems Market Opportunity Analysis

The military embedded systems market presents significant opportunities driven by technological advancements and evolving defense needs. Key growth areas include the integration of AI, machine learning, and autonomous technologies, which enhance decision-making and operational efficiency. The increasing demand for secure communication, data encryption, and real-time analytics presents a lucrative market for embedded systems in cybersecurity and defense communications. Additionally, the expansion of unmanned systems, such as drones and autonomous vehicles, creates opportunities for embedded solutions in surveillance, reconnaissance, and weaponry. The rising focus on modernization programs and defense infrastructure upgrades, particularly in emerging economies, further boosts market potential. The growing adoption of 5G and Internet of Things (IoT) in military operations also opens new avenues for embedded systems. Overall, innovation and technological convergence offer diverse opportunities in this rapidly evolving sector.

Global Military Embedded Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.6 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 3.45% |

| 023 – 2033 Value Projection: | USD 20.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Component, By Product Type, By Application, By Region |

| Companies covered:: | Curtiss-Wright Corporation (U.S.) Kontron (Germany) Xilinx (U.S.) Mercury Systems Inc (U.S.) EUROTECH (Italy) General Dynamics Corporation (U.S.) General Micro Systems, Inc (U.S.) Advantech Co., Ltd (Taiwan) Thales Group (France) SMART Embedded Computing (Netherlands) NXP Semiconductors (Netherlands) Renesas Electronics Corporation (Japan) Microsemi (U.S.) Advanced Micro Peripherals (U.K.) Elma Electronic (Switzerland) Texas Instruments Incorporated (U.S.) Teledyne (U.S.) Intel Corporation (U.S.) Radisys (U.S.) Aitech (U.S.) |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Military Embedded Systems Market Dynamics

The increasing government expenditure on defense is fueling the growth of the market

The rise in government defense spending is a major driver of growth in the military embedded systems market. As nations prioritize national security and military modernization, they invest in advanced technologies to enhance the capabilities of their armed forces. This includes upgrading existing platforms and deploying new systems that require sophisticated embedded solutions for real-time data processing, secure communications, and autonomous operations. Governments are increasingly focused on integrating cutting-edge technologies such as AI, machine learning, and 5G to improve operational efficiency and decision-making. Additionally, geopolitical tensions and the need for enhanced defense capabilities further contribute to increased military budgets. As defense spending grows globally, there is a greater demand for high-performance embedded systems, fueling market expansion and innovation in this sector.

Restraints and Challenges

The military embedded systems market faces several challenges that hinder its growth. One of the primary issues is the rapid pace of technological advancements, requiring constant innovation and updates to maintain system relevance and effectiveness. The high complexity of developing secure, reliable, and real-time embedded systems also presents significant technical challenges. Additionally, cybersecurity threats are a growing concern, as military systems become increasingly interconnected and vulnerable to cyberattacks. Budget constraints and lengthy procurement processes can delay the adoption of new technologies, while geopolitical tensions and defense regulations complicate international collaboration. Another challenge is the need for interoperability between different military platforms and legacy systems, which requires significant effort in system integration. Overcoming these challenges is essential to ensuring the continued growth and adoption of embedded systems in defense applications.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Military Embedded Systems Market from 2023 to 2033. The United States, as a global leader in defense spending, drives the region's growth by investing heavily in military modernization, incorporating embedded systems in various platforms like aircraft, naval vessels, ground vehicles, and drones. The demand for secure communications, surveillance, and autonomous systems is propelling the adoption of cutting-edge technologies such as AI, IoT, and 5G within military applications. Additionally, ongoing defense contracts, research, and development initiatives by the U.S. Department of Defense (DoD) and Canadian Armed Forces further boost the market. North America's strong focus on innovation, coupled with increasing security concerns and military upgrades, positions the region as a key player in the global military embedded systems market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, and South Korea are ramping up their defense budgets, leading to greater demand for advanced military solutions. Embedded systems are crucial in enhancing communication, surveillance, navigation, and autonomous capabilities in defense platforms. The rapid modernization of military infrastructure, including the integration of AI, 5G, and IoT technologies, is accelerating market growth. Additionally, ongoing geopolitical tensions and territorial disputes in the region fuel the need for advanced defense systems. The growing adoption of unmanned systems, drones, and advanced robotics further boosts the demand for embedded technologies. As a result, the Asia-Pacific region is poised to become a key player in the global military embedded systems market.

Segmentation Analysis

Insights by Component

The software segment accounted for the largest market share over the forecast period 2023 to 2033. The software segment of the military embedded systems market is experiencing rapid growth due to the increasing reliance on advanced software solutions for system performance, security, and functionality. As military platforms become more sophisticated, the demand for software that enables real-time data processing, secure communications, and autonomous operations is rising. Key trends driving this growth include the integration of AI, machine learning, and cybersecurity technologies into embedded software, which enhances operational efficiency and protects against cyber threats. The software also supports the development of unmanned systems, drones, and advanced navigation and targeting systems, fueling demand across the defense sector. Moreover, the need for software upgrades, maintenance, and customization ensures a steady demand for software solutions. As defense systems evolve, software innovation remains crucial to enhancing embedded system capabilities in military applications.

Insights by Application

The communication navigation segment accounted for the largest market share over the forecast period 2023 to 2033. Military platforms such as aircraft, naval vessels, ground vehicles, and unmanned systems rely heavily on embedded navigation systems to ensure accuracy in real-time operations, including mission-critical tasks like target tracking, route planning, and autonomous movement. The integration of advanced technologies, such as GPS, inertial navigation systems (INS), and augmented reality (AR), is driving this segment’s growth. Additionally, the growing focus on enhancing defense capabilities with advanced navigation solutions for missile systems, drones, and reconnaissance missions is further contributing to market expansion. As military operations demand higher accuracy and efficiency, the navigation segment is expected to continue its upward trajectory in the military embedded systems market.

Insights by Product Type

The OPEN VPX segment accounted for the largest market share over the forecast period 2023 to 2033. OPEN VPX, an open-standard architecture, enables the integration of modular systems that offer flexibility, reliability, and reduced development time, making it ideal for military platforms such as aircraft, naval vessels, and ground vehicles. The demand for faster data processing, real-time communication, and secure operations in complex environments is driving the adoption of OPEN VPX systems. Furthermore, the increasing need for interoperability between diverse military systems and the shift toward software-defined architectures are key factors contributing to the segment's growth. As military applications become more advanced, OPEN VPX offers a cost-effective, future-proof solution to meet evolving defense requirements.

Recent Market Developments

- In June 2021, Norway acquired five Thales Ground Master 200 Multi-Mission Compact radars (GM200 MM/C) through a government-to-government deal with the Netherlands. This procurement provided the Norwegian Armed Forces with a new mobile artillery locating radar system, suitable for both national and international operations.

Competitive Landscape

Major players in the market

- Curtiss-Wright Corporation (U.S.)

- Kontron (Germany)

- Xilinx (U.S.)

- Mercury Systems Inc (U.S.)

- EUROTECH (Italy)

- General Dynamics Corporation (U.S.)

- General Micro Systems, Inc (U.S.)

- Advantech Co., Ltd (Taiwan)

- Thales Group (France)

- SMART Embedded Computing (Netherlands)

- NXP Semiconductors (Netherlands)

- Renesas Electronics Corporation (Japan)

- Microsemi (U.S.)

- Advanced Micro Peripherals (U.K.)

- Elma Electronic (Switzerland)

- Texas Instruments Incorporated (U.S.)

- Teledyne (U.S.)

- Intel Corporation (U.S.)

- Radisys (U.S.)

- Aitech (U.S.)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Embedded Systems Market, Component Analysis

- Hardware

- Software

Military Embedded Systems Market, Product Type Analysis

- Advanced Telecom Computing Architecture (TCA)

- Compact-PCI (CPCI) Boards

- Compact-PCI (CPCI) Serial

- VME BUS

- OPEN VPX

- Motherboard

Military Embedded Systems Market, Application Analysis

- Intelligence Surveillance and Reconnaissance (ISR)

- Command

- Control

- Communication Navigation

- Radar

- Avionics

- Vetronics

- Cyber

- Networking

Military Embedded Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East and Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Military Embedded Systems Market?The global Military Embedded Systems Market is expected to grow from USD 14.6 billion in 2023 to USD 20.5 billion by 2033, at a CAGR of 3.45% during the forecast period 2023-2033.

-

2. Who are the key market players of the Military Embedded Systems Market?Some of the key market players of the market are Curtiss-Wright Corporation (U.S.), Kontron (Germany), Xilinx (U.S.), Mercury Systems Inc (U.S.), EUROTECH (Italy), General Dynamics Corporation (U.S.), General Micro Systems, Inc (U.S.), Advantech Co., Ltd (Taiwan), Thales Group (France), SMART Embedded Computing (Netherlands), NXP Semiconductors (Netherlands), Renesas Electronics Corporation (Japan), Microsemi (U.S.), Advanced Micro Peripherals (U.K.), Elma Electronic (Switzerland), Texas Instruments Incorporated (U.S.), Teledyne (U.S.), Intel Corporation (U.S.), Radisys (U.S.), Aitech (U.S.).

-

3. Which segment holds the largest market share?The communication navigation segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Military Embedded Systems Market?North America dominates the Military Embedded Systems Market and has the highest market share.

Need help to buy this report?