Global Military Exoskeleton Market Size, Share, and COVID-19 Impact Analysis, By Type (Full Body Exoskeleton, Partial Body Exoskeleton), By Power (Active Exoskeleton, Passive Exoskeleton), By Body Part (Upper Body, Lower Body, Full Body), By End-User (Defense, Homeland Security), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Aerospace & DefenseGlobal Military Exoskeleton Market Insights Forecasts to 2033

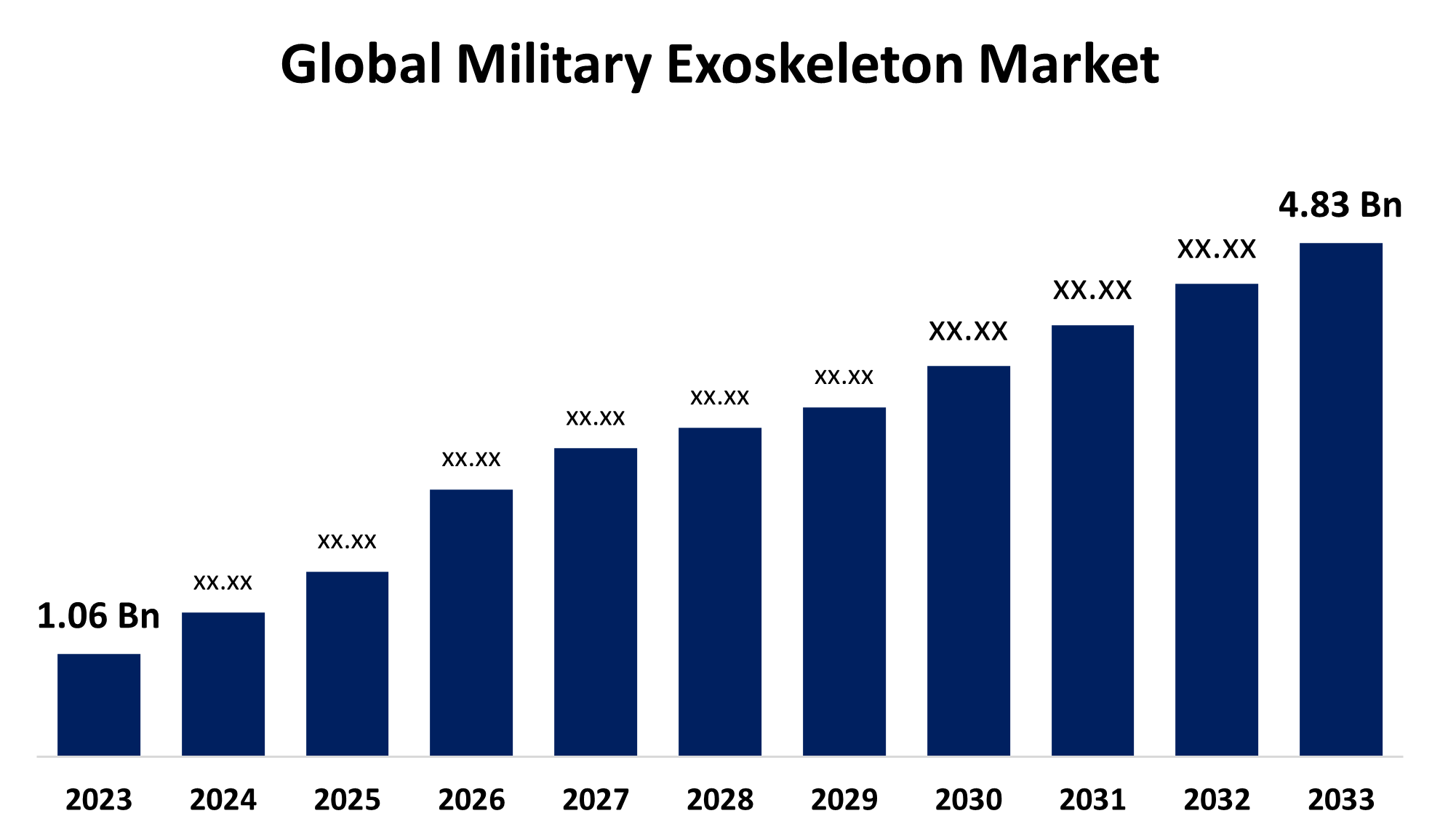

- The Global Military Exoskeleton Market Size Was Estimated at USD 1.06 Billion in 2023

- The Market Size is expected to grow at a CAGR of around 16.38% from 2023 to 2033

- The Worldwide Military Exoskeleton Market Size is Expected to Reach USD 4.83 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The global military exoskeleton market size was valued at USD 1.06 billion in 2023 and is expected to reach USD 4.83 billion by 2033, growing at a CAGR of 16.38% from 2023 to 2033. The global market of

the military exoskeleton is propelled by the rising need for exoskeletons in orthopedic settings, the growing incidence of disabilities related to strokes, and heightened investment in exoskeletons by the defense and military sectors. Additionally, the rising use of human enhancement technology in the manufacturing sector and other areas is driving the demand for exoskeletons and contributing to their market expansion.

Market Overview

The military exoskeleton sector focuses on creating and utilizing computer-operated equipment that improves soldiers' strength, agility, and stamina. These tools can help soldiers to carry heavy weights, reduce fatigue, and offer safety. This military exoskeleton is a wearable suit that can enhance a soldier’s physical prowess, and endurance, providing additional strength, and support. Typically, these suits are integrated with advanced technologies such as advanced robotics, engineering, and materials science to enhance the wearer's natural movements to reduce exhaustion and enhance mobility during demanding tasks or combat situations.

Increasing fund investment by the defense ministry for exoskeleton projects, to enhance soldiers' capabilities. Exoskeletons augment soldiers' strength and endurance, reduce fatigue, and minimize the risk of injuries, especially in challenging terrains and extreme weather conditions. For instance, the U.S. Army Natick Soldier Research, Development, and Engineering Center (NSRDEC) awarded a $6.9 million contract to Lockheed Martin for the development of the ONYX exoskeleton. This investment aims to improve operational efficiency and ensure the safety and effectiveness of military personnel. Moreover, they encourage advancements in defense technology as major research and development contracts are awarded. Numerous exoskeleton initiatives progress to the production stage more swiftly when backed by assured financial support. In the past, these were confined to small initial procurement batches for testing purposes. Top military forces are now incorporating specific models for wider operational deployments after extensive field evaluations.

Report Coverage

This research report categorizes the global military exoskeleton market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global military exoskeleton market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global military exoskeleton market.

Global Military Exoskeleton Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.06 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.38% |

| 2033 Value Projection: | USD 4.83 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Type, By Power, By Body Part, By End-User, By Region |

| Companies covered:: | BAE Systems plc, Hyundai Robotics, General Dynamics Corporation, Northrop Grumman Corporation, Honeywell International Inc., Bionic Power Inc., Parker Hannifin Corporation, Cyberdyne Inc., ReWalk Robotics Ltd., Ottobock SE & Co. KGaA, SuitX (US Bionics, Inc.), and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand for military exoskeletons is significantly affected by the increasing focus on ensuring soldier safety and survival. Modern soldiers in combat are required to operate under more difficult and risky circumstances, which can greatly strain both their physical and mental well-being. Military exoskeletons offer a solution that boosts soldiers' physical capabilities, allowing them to move more quickly, lift heavier items, and remain active for extended periods without experiencing fatigue. Along with enhancing operational efficiency, this reduces the chances of physical strain injuries, thereby boosting mission success and the well-being of soldiers.

Moreover, the increase in the number of people with physical disabilities, especially the geriatric population across the world, particularly in USA geriatric population is growing rapidly According to The U.S. Census Bureau, approximately 18% of the total population falls into this age group, which translates to around 62 million people and 43.9% of individuals aged 65 and older live with a disability. This number is expected to continue and create opportunities to the healthcare industry to reduce this age group's disabilities by making easy availability of exoskeleton technology to many users, also there are many governments and prominent industry leaders around the world are increasing their investments in the exoskeleton sector. This increase in financing enhances research and development, speeding up innovation and manufacturing. The objective is to improve human abilities in healthcare, industry, and military sectors, guaranteeing wider access and elevating the quality of life for various groups.

Restraints and challenges

A major limitation of the expansion of the military exoskeleton market is the major expense associated with its development and implementation. The technology that powers exoskeletons demands cutting-edge engineering, top-quality materials, and complex actuators or energy systems, due to this huge investment requirement at the starting phase, it is hesitant to consumers and businesses that may hamper the market growth.

Market Segmentation

The global military exoskeleton market share is classified into type, power, body part, and end-user.

- The partial body exoskeleton segment secured a dominant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the type, the global military exoskeleton market is classified into full-body exoskeleton and partial-body exoskeleton. Among these, the partial body exoskeleton segment secured a dominant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance is due to the rising demand from the defense sector, driven by exoskeletons' capability to enhance soldiers' physical abilities, especially in the lower body, where the strain occurs due to carrying heavy equipment is most significant. Also, a partial body is created to aid particular areas of the body, like the legs and arms. These exoskeletons are frequently employed in logistics and support functions, where soldiers may not need complete body aid but still require improved strength and stamina for particular tasks.

- The active exoskeleton segment dominates the market in 2023 and is expected to grow at a notable CAGR during the forecast period.

Based on the power, the global military exoskeleton market is categorized into active exoskeleton and passive exoskeleton. Among these, the active exoskeleton segment dominates the market in 2023 and is expected to grow at a notable CAGR during the forecast period. This is due to, advanced powered assistance ability, which significantly enhances soldier performance in demanding military environments. Additionally, Active exoskeletons help reduce fatigue and risk of physical injuries as well as the ability to adapt critical movements and tasks. Which makes them the preferred choice for military forces worldwide, and driving segmental growth.

- The lower body segment accounted for the highest share in 2023 and is anticipated to grow at a prominent CAGR during the forecast period.

Based on the body part, the global military exoskeleton market is divided into upper body, lower body, and full body. Among these, the lower body segment accounted for the highest share in 2023 and is anticipated to grow at a prominent CAGR during the forecast period. This segmental growth is driven by the crucial role of lower body strength in soldiers and their performance, especially in difficult conditions or prolonged conflict. Additionally, they must transport heavy armor, pistols, and bulky equipment or supplies, which can significantly impact the lower body. The growing emphasis on flexibility and endurance in contemporary military operations has made lower-body exoskeletons the favored option. This growing inclination is propelling the segment's dominance.

- The defense segment secured a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the end-user, the global military exoskeleton market is separated into defense and homeland security. Among these, the defense segment secured a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. This significance is attributed to, the uses of exoskeletons by various branches of forces such as the army, navy, air force, and special forces to improve the physical activities and stamina of soldiers during the war period and internal conflict management support. Also, the use of exoskeletons in armed forces may importantly boost the efficiency and performance of soldiers during the operations.

Regional Segment Analysis of the Global Military Exoskeleton Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

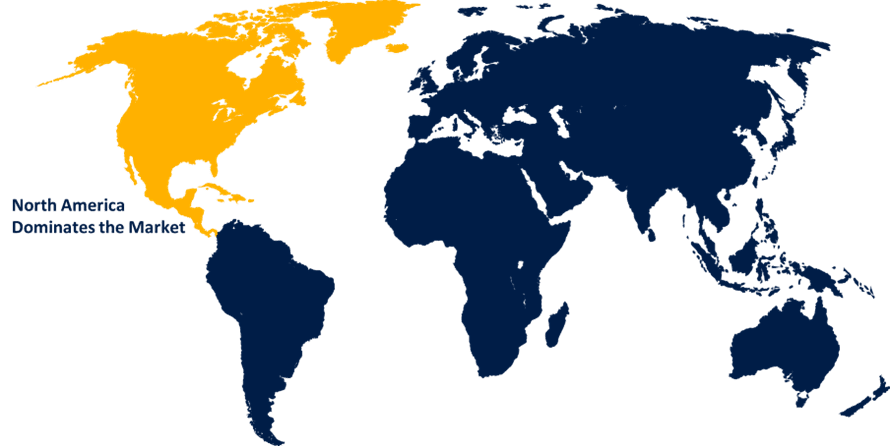

North America is expected to hold the dominant share of the global military exoskeleton market over the predicted timeframe.

Get more details on this report -

North America is expected to hold the dominant share of the global military exoskeleton market over the predicted timeframe. This regional dominance is attributed to the significant funding for defense advancements and the existence of major market contributors. Especially, The United States has led in the use of military exoskeletons, with substantial funding from the Department of Defense in diverse exoskeleton initiatives focused on improving soldier abilities and effectiveness. For instance, In May 2024, the Henry M. Jackson Foundation for the Advancement of Military Medicine Inc. was awarded a $9.38 million contract by the U.S. Department of Defense for exoskeleton research. This two-year project, starting May 13, 2025, is funded by fiscal 2024 and 2025 funds and is based in Frederick, Maryland. These technological innovations and funding investment for the exoskeleton advancement are making technological solutions for the soldier during difficult situations and limitless conflict period. This kind of investment in innovation is making regional dominance in North America.

The Asia-Pacific military exoskeleton market is expected to grow with the fastest CAGR during the forecasting period. This regional growth is significantly influenced by rising defense spending and the heightened emphasis on advancing military capabilities in countries such as Japan, China, and India. These nations are making substantial investments in the research and implementation of cutting-edge military technologies, such as exoskeletons, to improve their combat preparedness and operational effectiveness. This regional growth throughout the forecast period is driven by the increasing need for improved soldier capabilities and ongoing developments in exoskeleton technologies in the area.

The European military exoskeleton industry represents significant growth opportunities throughout the forecast period, fueled by the rising need for improved soldier abilities and the ongoing progress in exoskeleton technology. Additionally, there is a necessity to improve security and defense systems along with the increasing number of elderly individuals with disabilities in these areas. Which is anticipated to rise and foster regional development.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global military exoskeleton market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BAE Systems plc

- Hyundai Robotics

- General Dynamics Corporation

- Northrop Grumman Corporation

- Honeywell International Inc.

- Bionic Power Inc.

- Parker Hannifin Corporation

- Cyberdyne Inc.

- ReWalk Robotics Ltd.

- Ottobock SE & Co. KGaA

- SuitX (US Bionics, Inc.)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, German Bionic unveiled its comprehensive 360° Human Augmentation Exoskeleton Platform at VivaTech. This innovative platform aims to enhance everyday life, providing individuals with increased safety, ease, and comfort.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global military exoskeleton market based on the below-mentioned segments:

Global Military Exoskeleton Market, By Type

- Full Body Exoskeleton

- Partial Body Exoskeleton

Global Military Exoskeleton Market, By Power

- Active Exoskeleton

- Passive Exoskeleton

Global Military Exoskeleton Market, By Body Part

- Upper Body

- Lower Body

- Full Body

Global Military Exoskeleton Market, By End-User

- Defense

- Homeland Security

Global Military Exoskeleton Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the global military exoskeleton market over the forecast period?The global military exoskeleton market size was valued at USD 1.06 billion in 2023 and is expected to reach USD 6.21 billion by 2033, growing at a CAGR of 19.34% from 2023 to 2033

-

Which region holds the largest share of the global military exoskeleton market?North America is estimated to hold the largest share of the global military exoskeleton market over the predicted timeframe.

-

Who are the top key players in the global military exoskeleton market?BAE Systems plc,Hyundai Robotics, General Dynamics Corporation, Northrop Grumman Corporation, Honeywell International Inc., Bionic Power Inc., Parker Hannifin Corporation, Cyberdyne Inc., ReWalk Robotics Ltd., Ottobock SE & Co. KGaA, SuitX (US Bionics, Inc.), and Others.

Need help to buy this report?