Global Military Land Vehicles Market Size By Offering (Platform and Services), By Product Type (Infantry Fighting Vehicles (IFV), Armored Personnel Carriers (APC), Main Battle Tanks (MBT), Light Multirole Vehicles (LMV), and Tactical Trucks), By Application (Defense and Combat, Logistics and Transportation), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Military Land Vehicles Market Insights Forecasts to 2033

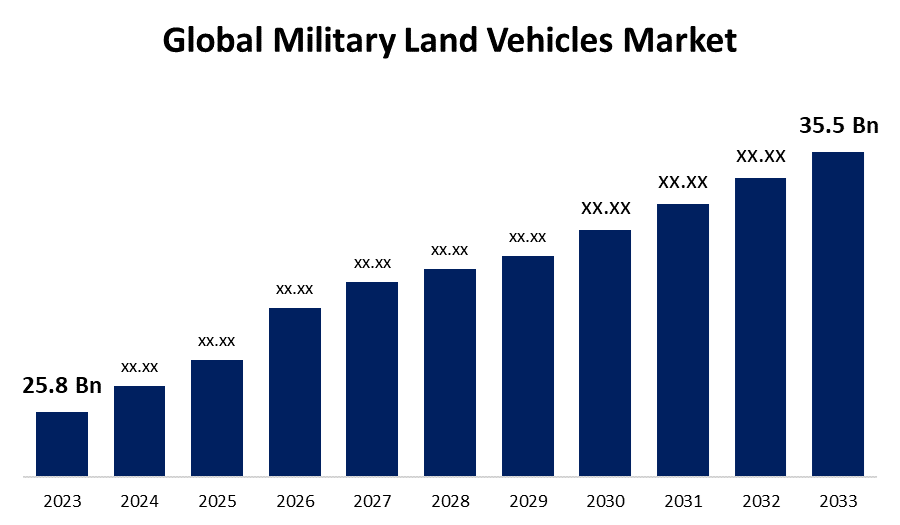

- The Military Land Vehicles Market Size was valued at USD 25.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.24% from 2023 to 2033

- The Worldwide Military Land Vehicles Market Size is expected to reach USD 35.5 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Military Land Vehicles Market Size is expected to reach USD 35.5 Billion by 2033, at a CAGR of 3.24% during the forecast period 2023 to 2033.

The military land vehicles market includes a diverse range of armoured vehicles, tanks, troop carriers, artillery vehicles, and other ground-based military equipment. Many countries are investing in military modernization to maintain a technological advantage and react to changing threats. This covers the design and acquisition of next-generation armoured vehicles with increased mobility, firepower, and survivability. With an increased emphasis on asymmetric warfare and urban battles, there is a greater need for armoured vehicles designed for urban operations. These vehicles frequently have increased manoeuvrability, urban situational awareness systems, and superior protection against improvised explosive devices (IEDs) and small arms fire. Military land vehicles are increasingly developed with modular designs to facilitate upgrades, mission customisation, and the incorporation of new capabilities.

Military Land Vehicles Market Value Chain Analysis

The military land vehicles market value chain encompasses a comprehensive process from research and development through to deployment and disposal. It involves collaboration among research institutions, defense contractors, and government agencies to develop advanced technologies and vehicle designs. Component suppliers provide crucial parts and subsystems, which are then assembled by defense contractors into complete vehicles. Rigorous testing and validation ensure performance and safety standards are met before procurement by government agencies. Post-procurement, ongoing logistics support, maintenance, and upgrades are provided to sustain operational readiness. Ultimately, decommissioning and disposal processes ensure responsible end-of-life management. Throughout this value chain, various stakeholders collaborate to deliver capable and reliable military land vehicles to armed forces worldwide.

Military Land Vehicles Market Opportunity Analysis

Many countries are devoting significant funds for defence, notably for modernising military equipment and vehicles to improve their capabilities in a variety of operating circumstances. Many countries' ageing military fleets need to be replaced or upgraded to meet the needs of contemporary warfare. This opens up a large market for new land vehicles equipped with modern technologies. The growing use of urban warfare and counterinsurgency operations has created a demand for vehicles that are agile, manoeuvrable, and equipped with modern sensors and communication systems to operate effectively in difficult terrain. There is a rising trend towards modular and customisable vehicle platforms that may be tailored to different missions and circumstances. This enables military forces to optimise their vehicle fleets in response to unique operational requirements.

Military Land Vehicles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 25.8 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.24% |

| 2033 Value Projection: | USD 35.5 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Offering, By Product Type, By Application, By Region |

| Companies covered:: | Oshkosh Defense, LLC, General Dynamics Corporation, ST Engineering, BAE Systems plc, Hyundai Rotem, Ashok Leyland, China North Industries Corporation (NORINCO), Rheinmetall AG, Nexter Systems, Uralvagonzavod, Krauss-Maffei Wegmann (KMW), and Iveco S.p.A. |

| Growth Drivers: | Rising geopolitical tensions are fuelling market expansion. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Military Land Vehicles Market Dynamics

Rising geopolitical tensions are fuelling market expansion.

Heightened geopolitical tensions frequently prompt countries to increase defence spending. This additional financing enables armed forces to invest in modern ground vehicles, replacing ageing equipment and improving their ability to respond to possible threats. Geopolitical concerns can push governments to speed up their military modernization efforts. This includes replacing existing land vehicle fleets with more modern ones that incorporate cutting-edge mobility, protection, firepower, and communication technologies. Competition between great countries and strategic adversaries can spark a rush to develop and deploy new military technologies, such as land vehicles. This competition drives innovation, resulting in the production of next-generation cars designed to preserve or acquire a competitive advantage.

Restraints & Challenges

Despite increased defence budgets in many countries, budget restrictions continue to pose a substantial barrier to military procurement programmes. Governments must balance the need for modernization against other competing objectives, which may limit funding for new land vehicle acquisitions. The military land vehicles industry is based on complex worldwide supply chains that are susceptible to disruptions induced by geopolitical tensions, trade disputes, natural disasters, or pandemics. Supply chain interruptions can cause manufacturing delays, cost increases, and essential component or material shortages. The rate of technical progress in the defence sector has the potential to cause military land vehicles to become obsolete quickly. Newer, more powerful technologies may soon outdate older platforms, necessitating constant investment in R&D to remain competitive and relevant.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Military Land Vehicles Market from 2023 to 2033. The United States, as the world's largest defence spender, is a key driver of the North American military land vehicles market. Its defence budget funds the purchase, modernization, and upkeep of a wide range of ground vehicles for several branches of the military. North American defence firms play a significant role in the global arms market, shipping military land vehicles to allies and partners. The US Foreign Military Sales (FMS) programme enables the export of defence equipment, particularly land vehicles, to approved foreign governments, thereby contributing to market expansion. North American defence organisations are increasingly focusing on cybersecurity and information warfare capabilities to safeguard military networks, command systems, and communication platforms built into land vehicles.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region faces a wide range of security problems, including territorial disputes, regional tensions, and the spread of asymmetric threats. As a result, governments in the region are investing in military capabilities, including as land vehicles, to strengthen their defence posture and protect national security interests. The Asia-Pacific area is home to an expanding number of indigenous defence companies that can design, manufacture, and supply military land vehicles. Countries such as South Korea, India, and Singapore have developed indigenous armoured vehicle production capabilities, which contribute to regional self-sufficiency and export opportunities. Economic expansion and infrastructural development in Asia-Pacific open up potential for the deployment of military land vehicles in a variety of operational contexts, including urban areas, isolated regions, and maritime domains.

Segmentation Analysis

Insights by Offering

The services segment accounted for the largest market share over the forecast period 2023 to 2033. As military land vehicles develop in technology, the complexity of maintenance and repair tasks grows. Military forces frequently lack the specialised expertise and infrastructure required to undertake MRO activities in-house, necessitating the outsourcing of these services to outside suppliers. Logistics and support services are critical for keeping military land vehicles operational throughout their lifecycle. This comprises supply chain management, spare parts inventory, technical support, and field service operations. Logistics and support services are critical for keeping military land vehicles operational throughout their lifecycle. This comprises supply chain management, spare parts inventory, technical support, and field service operations. With the rising digitization and connection of military land vehicles, cybersecurity has become a major problem.

Insights by Product Type

The infantry fighting vehicles segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Many countries are undertaking military modernization initiatives to replace ageing armoured vehicles with next-generation IFVs equipped with enhanced capabilities. Modern IFVs have improved mobility, firepower, protection, and situational awareness systems, making them valuable assets in mechanised infantry units. The prominence of urban warfare and asymmetric threats in contemporary combat scenarios has boosted the demand for IFVs designed for urban operations. Modern infantry fighting vehicles are designed to manoeuvre through congested urban terrain, offer close fire support to dismounted personnel, and engage enemy forces in densely populated areas while minimising collateral damage.

Insights by Application

The defence and combat segment accounted for the largest market share over the forecast period 2023 to 2033. Evolving security challenges, such as conventional and asymmetric warfare, terrorism, and hybrid threats, are increasing demand for better defence and combat capabilities in military land vehicles. As enemies develop more sophisticated weaponry and tactics, military forces need vehicles that provide superior protection, firepower, mobility, and situational awareness to sustain combat superiority. Many countries are launching military modernization programmes to upgrade their armoured vehicle fleets with cutting-edge platforms outfitted with superior defence and combat systems. Military ground vehicles are becoming more integrated into multi-domain operations, which encompass coordinated actions on land, sea, air, space, and cyberspace. Modern combat vehicles are designed to operate in complicated, contested areas while also supporting joint and coalition operations by supplying ground personnel with firepower, protection, and mobility.

Recent Market Developments

- In January 2021, Oshkosh Corporation, an American industrial business that designs and manufactures military vehicles and specialist trucks, acquired Pratt Miller.

Competitive Landscape

Major players in the market

- Oshkosh Defense, LLC

- General Dynamics Corporation

- ST Engineering

- BAE Systems plc

- Hyundai Rotem

- Ashok Leyland

- China North Industries Corporation (NORINCO)

- Rheinmetall AG

- Nexter Systems

- Uralvagonzavod

- Krauss-Maffei Wegmann (KMW)

- Iveco S.p.A.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Land Vehicles Market, Offering Analysis

- Platform

- Services

Military Land Vehicles Market, Product Type Analysis

- Infantry Fighting Vehicles (IFV)

- Armored Personnel Carriers (APC)

- Main Battle Tanks (MBT)

- Light Multirole Vehicles (LMV)

- Tactical Trucks

Military Land Vehicles Market, Application Analysis

- Defense and Combat

- Logistics and Transportation

Military Land Vehicles Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Military Land Vehicles Market?The global Military Land Vehicles Market is expected to grow from USD 25.8 billion in 2023 to USD 35.5 billion by 2033, at a CAGR of 3.24% during the forecast period 2023-2033.

-

2.Who are the key market players of the Military Land Vehicles Market?Some of the key market players of the market are Oshkosh Defense, LLC, General Dynamics Corporation, ST Engineering, BAE Systems plc, Hyundai Rotem, Ashok Leyland, China North Industries Corporation (NORINCO), Rheinmetall AG, Nexter Systems, Uralvagonzavod, Krauss-Maffei Wegmann (KMW), and Iveco S.p.A.

-

3.Which segment holds the largest market share?The defence and combat segment holds the largest market share and is going to continue its dominance.

-

4.Which region is dominating the Military Land Vehicles Market?North America is dominating the Military Land Vehicles Market with the highest market share.

Need help to buy this report?